The major altcoin Ethereum (ETH) has fallen 15% over the past 7 days. However, according to on-chain data, this price decline merely reflects the broader cryptocurrency market's selling pressure, as the bullish bias towards altcoins remains strong.

This analysis highlights two key on-chain indicators that suggest potential upside towards the $4,000 price level in the near term.

Ethereum Maintains Bullish Momentum Despite Price Decline

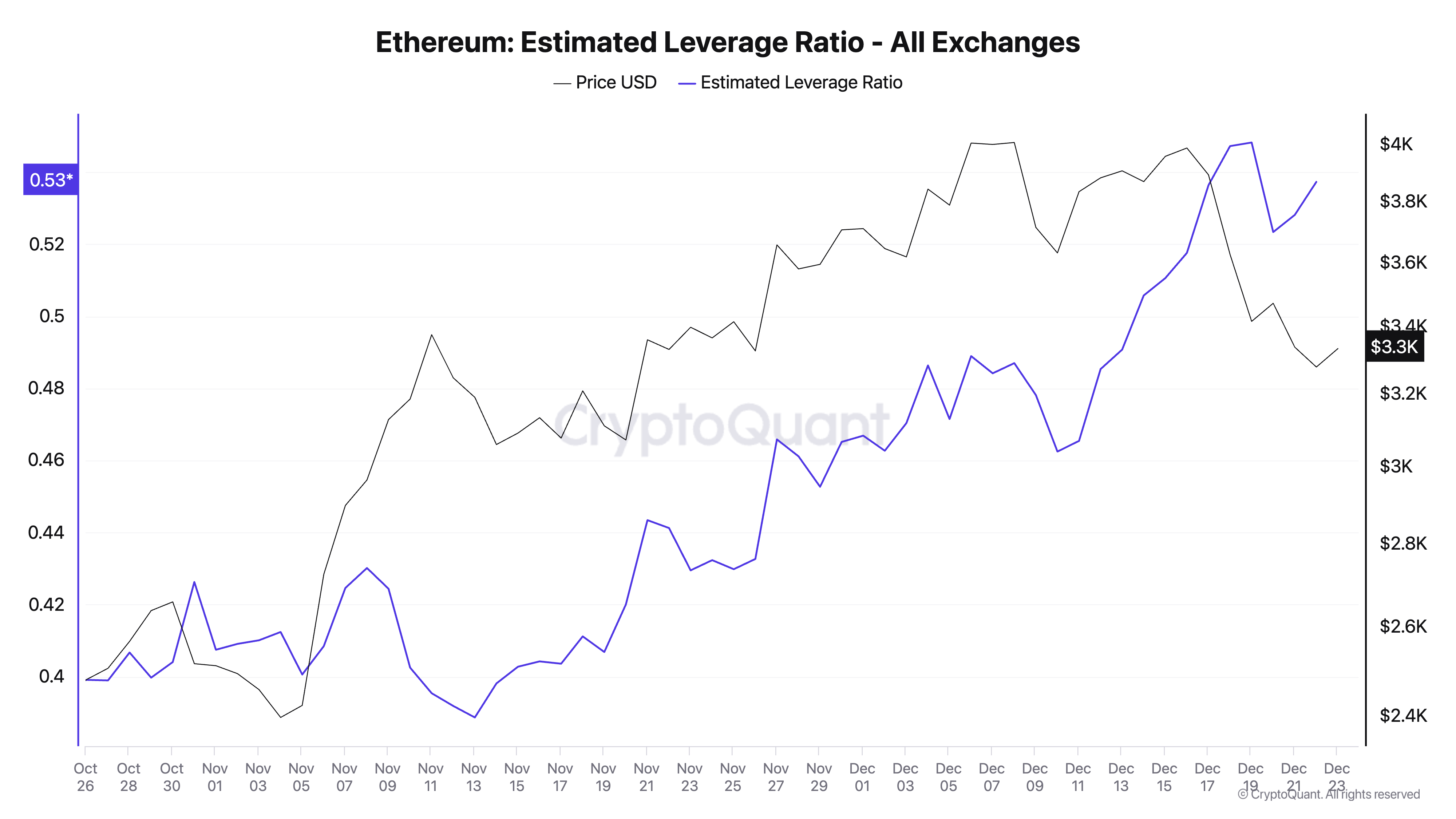

First, Ethereum's rising Estimated Leverage Ratio (ELR) reflects the potential for a price rebound and indicates persistent risk appetite. According to CryptoQuant, it currently stands at 0.53.

The ELR of an asset measures the average leverage used by traders to execute trades on cryptocurrency exchanges. It is calculated by dividing the asset's open interest by the exchange's reserves of that currency.

The rising ELR of ETH indicates an increasing risk appetite among traders. This suggests that many investors are optimistic about the future price appreciation of the coin and are willing to leverage their positions to amplify potential gains.

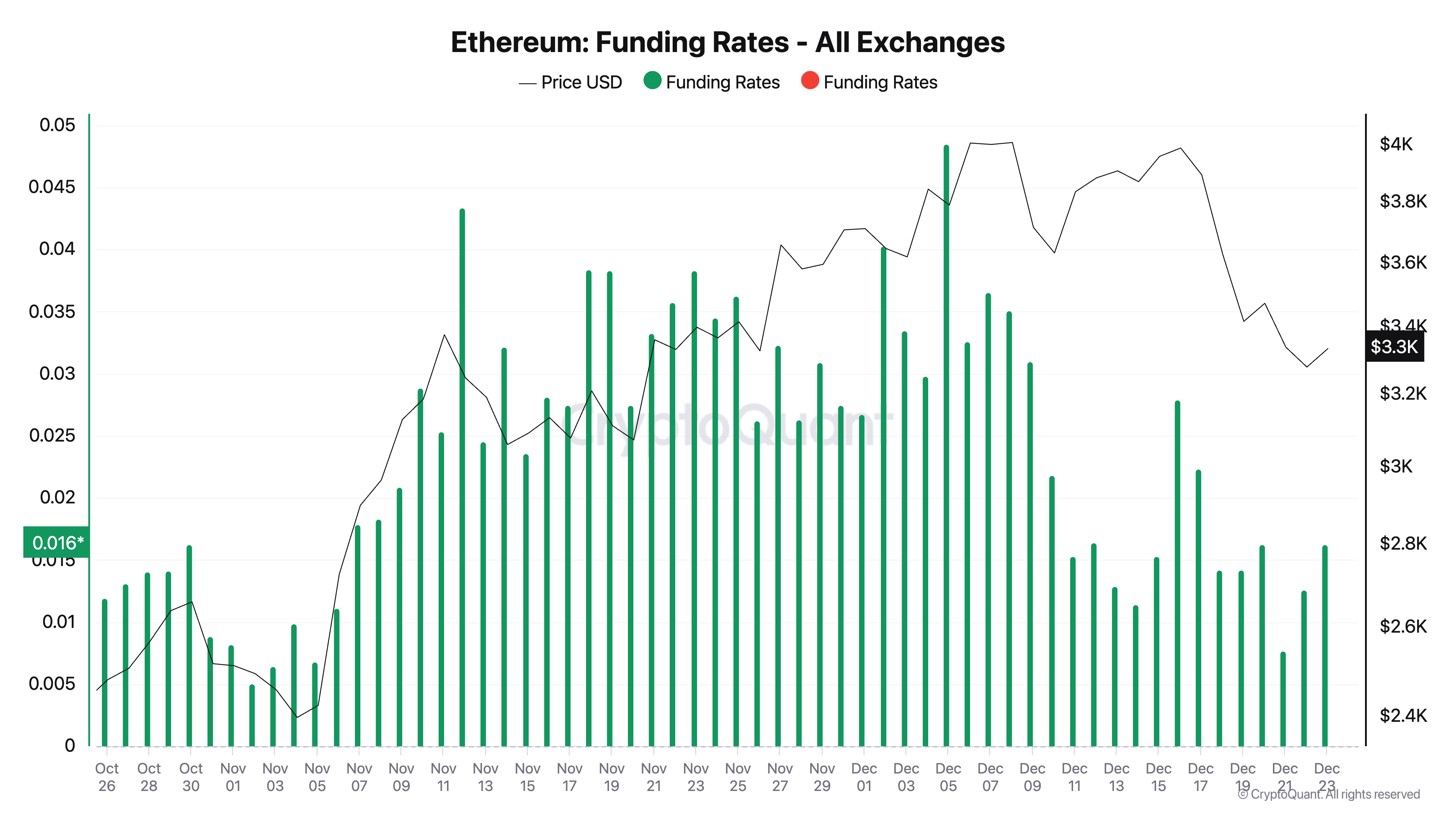

Additionally, ETH's positive funding rate is another signal that the price could rebound soon. According to CryptoQuant, it currently stands at 0.016. Despite the recent price decline, the funding rate across cryptocurrency exchanges has remained positive, reflecting the bullish sentiment towards ETH.

The funding rate of an asset is the periodic fee exchanged between long and short traders in the futures market. This ensures that the perpetual futures price aligns with the spot price. When the funding rate is positive, long traders pay short traders, indicating bullish sentiment and expectations of price appreciation.

ETH Price Forecast: $4,000 Target Still in Sight

ETH is currently trading at $3,344. If the bullish bias persists and buying activity increases, ETH's price could rise above the $3,439 resistance level. A breakout at this level could propel the coin towards $3,733, paving the way for a breach of the $4,000 psychological barrier.

However, if the downtrend persists, ETH's value could drop to $3,232, which could invalidate this bullish outlook.