Author: Paul Veradittakit, Managing Partner at Pantera Capital Source: veradiverdict Translated by: Shan Ou Ba, Jinse Finance

Last week, Coindesk published my 8 predictions for 2025, and I want to share the full version here, including an overview of this year, a review of my 2024 predictions, and my predictions for 2025.

Every year, bulls and bears use short-term case studies to predict the demise or exponential growth of cryptocurrencies. But each year, these two groups are not entirely correct.

Some major events this year: the Ethereum Dencun upgrade, the US election, crypto ETFs, the Wyoming DUNA Act, the wBTC controversy, Robinhood receiving a Wells notice, the nearly $2 billion Hyperliquid airdrop, Bitcoin breaking $100,000, and SEC Chairman Gary Gensler announcing his resignation in January.

2024 saw no major market disruptions. While it did not bring a flood of new capital, it proved that more and more crypto companies have sustainable business models. Bitcoin's market cap reached $1.9 trillion, and all other cryptocurrencies totaled $1.6 trillion. The crypto market cap has doubled since the beginning of 2024.

The diversification of the crypto market has increased its resilience to shocks. Sectors like payments, DeFi, gaming, ZK, infrastructure, and consumer-facing applications are all growing, each with their own funding ecosystems, markets, incentive mechanisms, and bottlenecks.

This year at Pantera, we invested in companies tackling specific problems in these ecosystems.

• Crypto gaming companies faced challenges in adopting Web3 data analytics tools, so we invested in Helika, a gaming analytics platform.

• Web3 AI products often face adoption challenges due to the fragmentation of the AI technology stack, so Sahara AI aims to create an integrated platform that enables permissionless contribution while maintaining a seamless user experience like Web2.

• Facing infrastructure chaos and fragmented order flows, Everclear standardizes processes by connecting all stakeholders.

• zkVM integration is complex, so Nexus takes a modular approach to meet the needs of customers who only require part of the hyperscale layer.

• Consumer applications struggle to attract users, so we made our largest-ever investment in TON, a blockchain directly integrated with Telegram's 950 million monthly active users.

In 2025, we will enter a new year with potential regulatory clarity, sustained mainstream interest, and the tailwind of rising crypto prices. Even if the market is slightly depressed this summer, crypto users are entering the new year with a strong sense of optimism (or "greed").

CoinMarketCap's Fear and Greed Index

Review of 2024 Predictions

Last year, I made predictions for this year. Here I will score myself, with 1 being the least accurate and 5 being the most accurate.

1. The Bitcoin Renaissance and "DeFi Summer 2.0"

Accuracy: 4/5

• In 2023, Bitcoin price rose from $16,000 in January to a high of $40,000 in December.

• The current Bitcoin price is over $90,000, and Bitcoin dominance exceeded 60% this year.

• There was indeed a Bitcoin DeFi summer, but defining success depends on specific metrics.

• Less than 1% of Bitcoin was wrapped and used in DeFi, a weak growth from last year. Bitcoin ecosystems like Mezo, Stacks, and Merlin built communities but struggled with sustained user growth.

• I had predicted that Ordinals, inscriptions, and staking might drive 1% of Bitcoin users to try DeFi, but this prediction was not fully realized.

However, this year's launch of Babylon allowed users to directly lock Bitcoin without wrapping, attracting around $2 billion of Bitcoin. The price increase also helped TVL reach $3.549 billion, 10 times last year's (around $300 million), but still short of my prediction of 1% or about 200,000 Bitcoin (currently worth $19 billion).

2. Tokenized Social Experiences for New Consumer Use Cases

Accuracy: 2/5

• If excluding meme coins, prediction markets, or gambling-type applications, this prediction largely fell flat.

• The definition of tokenized social experiences evolved this year, with the rise and success of on-chain gaming becoming the focus.

• Games built on platforms like TON (Telegram) and Arbitrum performed well and successfully integrated tokenization mechanics.

• The growth of Farcaster (and frames) has stabilized. DePin projects like Helium, Grass, and Blackbird are still in early stages.

But in new consumer use cases, the results were meager. We invested in Morph, a global consumer layer, hoping it can be a leader in this area.

3. Growth of "Bridges" Between Traditional Finance and DeFi, Such as Stablecoins and Mirrored Assets

Accuracy: 5/5

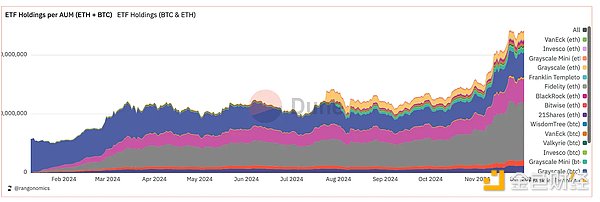

• ETF inflows continued to grow, with the total for Ethereum and Bitcoin ETFs reaching a record $119 billion.

Flows of ETH and Bitcoin ETFs

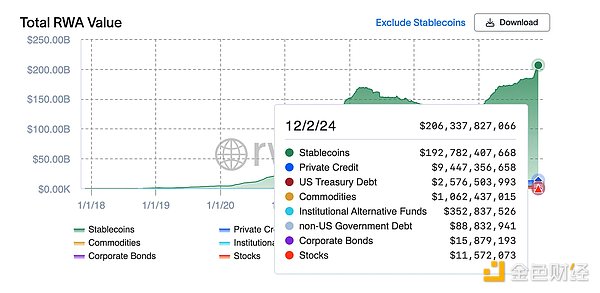

Since the beginning of this year, the amount of RWA has grown by over 60%, reaching over $13 billion, and the amount of stablecoins has reached a historic high of $192 billion.

RWA Data

Mirrored assets became a hot topic, with Ethena, Ondo, and M^0 leading the mirrored asset trend. Assets like sUSDe have annualized yields (APY) close to 30%.

Protocols like Morpho and Pendle allow leveraging, yield farming, and cyclical borrowing/lending of these assets.

Superstate and other protocols further strengthened the direct connection between Traditional Finance (TradFi) and Decentralized Finance (DeFi).

4. Modular Blockchains and Zero-Knowledge (ZK) Proofs Converging

Accuracy: 4/5

Zero-Knowledge (ZK) Proofs are an efficient way of verifying or proving, and have now been successfully integrated as infrastructure components in multiple blockchains and protocols.

• Polygon, Conduit, and OP Stack have now integrated Succinct's SP1.

• Nexus partnered with protocols like QED and Caldera, but has not yet seen exponential growth.

While there has been progress, it has not yet reached the level of exponential growth.

5. More Compute-Intensive Applications (like AI and DePIN) Gradually Onboarding

Accuracy: 2/5

Despite the price increase, in reality, very few truly compute-intensive applications have actually onboarded.

• A few AI projects, aside from their token value, have not yet gained widespread, permissionless market acceptance.

• Helium is one of the few companies that has truly developed a product more competitive than Web2 alternatives.

• Grass aligns to this trend to some extent, but overall, the DePIN (Decentralized Physical Infrastructure Network) wave has not truly arrived.

6. Integrations and the "Hub-and-Spoke" Model of Appchains in Public Chain Ecosystems

Accuracy: 2/5

Although some application chains have chosen a hub-and-spoke model, we have observed an interesting trend:

• Applications choose to create their own chains, often through Rollup-as-a-Service (RaaS) providers or specific ecosystems (such as Arbitrum Orbit or OP Stack). For example:

• Unichain has adopted the OP Stack.

• Application chains have found that subscribing to a platform with built-in interoperability protocols and other features is simpler and more performant than building their own hub-and-spoke chain.

At the underlying architecture level, many chains may use hub-and-spoke techniques in some stack modules (such as messaging, propagation, and liquidity aggregation), but they have not adopted the hub-and-spoke model as the core design principle of the chain.

2025 Predictions

The views expressed in this article are the author's opinions as of the date of publication and are subject to change at any time. Predictions do not guarantee future results.

This year, I invited the Pantera team's investors to participate in the predictions. I will divide the predictions into two categories: Upward Trends and Emerging Concepts.

Upward Trends

1. Real-World Assets (RWA) will account for 30% of the total value locked (TVL) on-chain (currently 15%)

This year, on-chain RWA funding grew by over 60%, reaching $13.7 billion. About 70% of RWA is private credit, with the rest mostly in Treasuries and commodities. The inflows into these categories are accelerating, and more complex RWA may be introduced by 2025.

First, private credit is accelerating due to infrastructure improvements. The digital portion almost accounts for all of this, and the asset value will increase by nearly $4 billion by 2024. As more companies enter this space, it becomes easier to use private credit as a means to move funds into cryptocurrencies.

Second, there are trillions of dollars in US Treasuries and commodities off-chain. On-chain, there are only $2.67 billion in US Treasuries, and their ability to generate yield (unlike stablecoins, which can earn interest for issuers) makes them a more attractive alternative. BlackRock's BUIDL US Treasuries fund has only $500 million on-chain, while it has hundreds of billions in government bonds off-chain. Now, the DeFi infrastructure has fully embraced stablecoins and US Treasuries RWA (integrating them into DeFi pools, lending markets, and perps), and the resistance to adopting them has greatly diminished. The same is true for commodities.

Finally, the current scope of RWA is limited to these basic products. The infrastructure for creating and maintaining RWA protocols has been greatly simplified, and operators have a better understanding of the risks and appropriate mitigations of on-chain operations. There are specialized companies managing wallets, minting mechanisms, oracle feeds, crypto-native banking, etc., meaning that it may eventually be feasible and viable to introduce stocks, ETFs, bonds, and other more complex financial products on-chain. These trends will only accelerate the use of RWA until 2025.

2. 1% of Bitcoin will participate in Bitcoin-Fi

Last year, my prediction for Bitcoin-Fi was more optimistic, but the Bitcoin TVL did not reach 1-2% of all Bitcoin.

This year, due to native Bitcoin-Fi protocols (like Babylon) not requiring cross-chain bridges to use, the high returns on Bitcoin, the high price, and the increased demand for Bitcoin-based assets (like Runes, Ordinals, BRC20), it is expected that 1% of Bitcoin will participate in Bitcoin-Fi.

3. Fintech companies will become the gateway to cryptocurrencies

TON, Venmo, Paypal, and Whatsapp have all witnessed the growth of cryptocurrencies due to their neutrality. They are gateways for users to interact with cryptocurrencies, but they do not push specific applications or protocols; in fact, they can serve as simplified entry points for cryptocurrencies. They attract different users; TON has its existing 950 million Telegram users, Venmo and Paypal have 500 million payment users each, and Whatsapp has 2.95 billion monthly active users.

For example:

• Felix operates on WhatsApp, allowing instant money transfers via messages, with funds that can be digitally transferred or withdrawn in cash at partner stores (like 7-11).

• Felix uses stablecoins and Bitso on Stellar as the underlying infrastructure.

• MetaMask now supports users buying cryptocurrencies through Venmo.

• Stripe acquired the stablecoin company Bridge, and Robinhood acquired the crypto exchange Bitstamp.

Ultimately, every fintech company will become a gateway to cryptocurrencies, whether intentionally or by supporting third-party applications. The proliferation of fintech may rival the crypto holdings of small centralized exchanges (CEXs).

4. Unichain will become the largest L2 by trading volume

Uniswap's current total value locked (TVL) is close to $6.5 billion, with a daily trading volume of $10-40 billion and 50,000-80,000 transactions per day. Arbitrum has a daily trading volume of around $1.4 billion (one-third of which comes from Uniswap), and Base has a daily trading volume of around $1.5 billion (one-quarter of which comes from Uniswap).

If Unichain can capture half of Uniswap's trading volume, it will easily surpass the current largest L2 and become the king of trading volume.

5. NFTs will see a resurgence, but focused on specific use cases

NFTs are being viewed as tools on-chain, rather than as an end in themselves. NFTs are gradually becoming practical tools in on-chain gaming, AI (for model ownership trading), identity, and consumer applications.

Examples:

• Blackbird is a dining rewards app that integrates NFTs into its customer identity system, connecting Web3 with the hospitality industry. Restaurants can use NFTs to provide consumer behavior data and easily create/mint subscriptions, memberships, and discounts.

• Sofamon develops Web3 Bit Monster sticker packs (NFTs), unlocking the financial layer of the sticker market. They collaborate with KOLs and K-pop stars to combat digital counterfeits and reflect the growth in on-chain IP value.

• Story Protocol aims to tokenize global IP assets, with originality at its core. The project recently raised $80 million at a $2.25 billion valuation.

• IWC (Swiss luxury watch brand) launched member NFTs, providing exclusive events and community access for holders.

NFTs can be used to identify transactions, transfers, ownership, memberships, and to represent and value assets, enabling monetization and potential speculative growth. This flexibility gives NFTs strong potential, and future use cases will only continue to increase.

6. Restaking mainnet launches

In 2025, protocols like Eigenlayer, Symbiotic, and Karak will officially launch their restaking mainnets, with operators earning revenue through active validation services (AVS) and slashing mechanisms. However, the hype around restaking seems to have waned this year.

The impact of restaking will grow as more networks use it. If a protocol uses the infrastructure supported by a particular restaking protocol, it can derive value from that connection even without a direct link. So, even if some protocols lose attention, they may still have massive valuations.

We believe that restaking remains a multi-billion dollar market, and as more applications become Appchains, they will leverage restaking protocols or other protocols built on top of restaking.

Emerging Concepts

7. zkTLS: Bringing Off-Chain Data On-Chain

zkTLS uses zero-knowledge proofs (ZK Proofs) to verify the validity of data from the Web2 world. This new technology is not yet fully deployed, but it is expected (hopefully) to be realized this year, introducing new types of data on-chain.

For example, zkTLS can be used to prove that certain data actually comes from a specific website. Currently, there is no way to verify this. This technology leverages advances in **Trusted Execution Environment (TEE)** and **Multi-Party Computation (MPC)**, and may further improve in the future to keep some data private.

Although zkTLS is still in the conceptual stage, we predict that companies will start to develop and integrate it into on-chain services, such as:

• Verifiable oracles for non-financial data,

• Cryptographically secure data oracles,

to provide trusted external data sources for on-chain applications.

8. Regulatory Support

The US regulatory environment is showing a positive attitude towards cryptocurrencies for the first time. In the latest election, 278 pro-crypto House candidates were elected, while only 122 anti-crypto candidates were elected. The anti-crypto SEC chairman Gary Gensler has announced that he will resign in January. It is reported that Trump plans to nominate Paul Atkins to lead the SEC. Atkins, who served as an SEC commissioner from 2002-2008, is a public supporter of the crypto industry and is also an advisor to the Chamber of Digital Commerce, an organization dedicated to promoting the legalization and adoption of cryptocurrencies.

Trump also appointed tech investor, former Yammer CEO and former PayPal COO David Sacks to the newly created position of "AI and Crypto Czar". In Trump's statement, he mentioned that "David Sacks will work to develop a legal framework to provide clarity for the crypto industry, which has been a long-standing demand of the industry."

We expect to see: a gradual reduction in SEC lawsuits, a clear definition of cryptocurrencies as a specific asset class, and further clarification of tax policies.

2025 may become an important turning point for the development of the US cryptocurrency industry.