Last Night's Frenzy: From "Everyone Sending Money" to "Founder Disappearing"

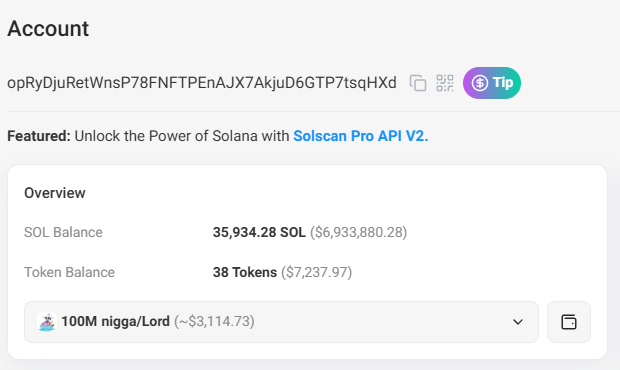

If the crypto market is a stage that never lacks new stories, the protagonist of last night was undoubtedly AI-Pool. This token pre-sale project initiated by Skely not only raised over 35,000 SOL in a short period of time, but also sparked a dizzying FOMO frenzy. However, this seemingly perfect pre-sale drama suddenly reversed at its climax, as Skely's X account was blocked, and the original "trust me, bro" trust instantly collapsed, turning into a chorus of FUD.

Why was there such a strong FOMO?

To a large extent, this was related to Skely's personal background and endorsement. He is a member of the ai16z DAO, and the founder of this DAO, Shaw (@shawmakesmagic), even personally followed his dynamics. ai16z DAO is seen as an influential group in the crypto circle, and the discussions around it are a hot topic in itself. When Skely announced AI-Pool, this background quickly amplified the market's expectations for the project. Many investors saw Skely as a "trustworthy insider," and they were afraid of missing out on this potential windfall.

FUD Caused by Account Blocking

But just after the pre-sale funds exceeded 35,000 SOL, Skely's X account was suddenly blocked, adding a layer of unease to the market. Why was it blocked?

Someone joked, "Is it because the AI consciousness has awakened, or did Skely really rug?" Although these statements sound like jokes, they do reflect the market's doubts. After Skely's account was blocked, the community's speculations about the event were diverse, mainly divided into two possibilities:

1. Suspicion of a Real Rug

Some investors pointed out that Skely's project Twitter account had changed usernames multiple times, a behavior often seen as a lack of transparency in the crypto market. In addition, the project had problems such as an unclear distribution mechanism and unlimited fundraising from the start, making people suspect that the real intention was to complete a capital harvest. For this reason, some speculate that Skely may have already prepared to run away under the guise of AI.

2. A Mistaken Blocking Scenario

Others believe that Skely's account may have been blocked due to the platform's misjudgment. A fake Skely account (@123skelyy) with a gold verification badge had previously posted a fake address in the original post, trying to defraud users. The real Skely account (with a blue verification badge) was very likely blocked first by the platform due to the fake account using its gold badge to report it. The high priority processing mechanism for gold-verified accounts may have led the platform to mistakenly block the blue-verified Skely.

According to the latest community news, the project will still proceed as planned.

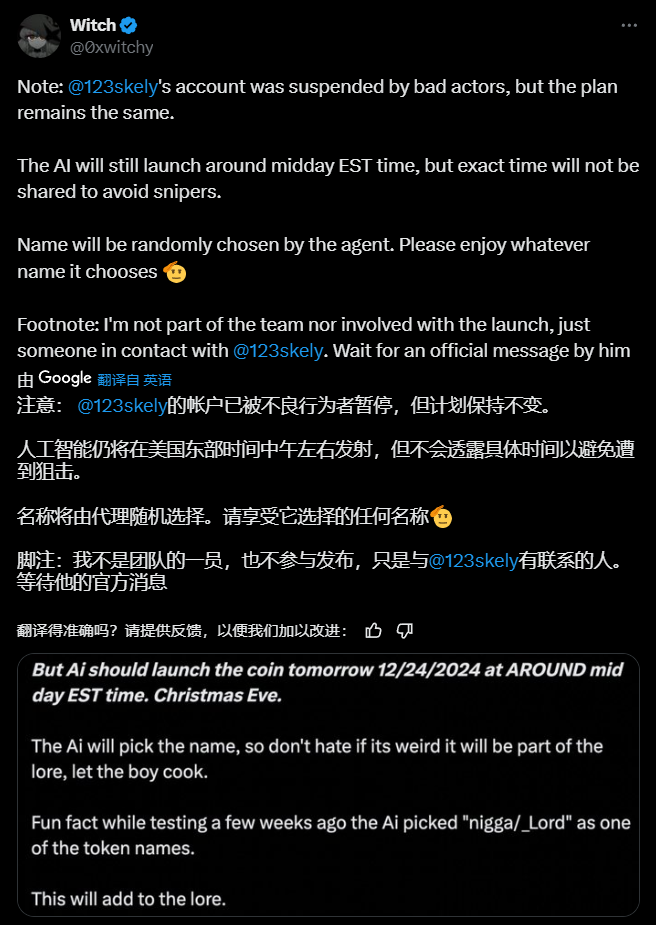

X platform user @0xwitchy posted that "the X account of AI-Pool founder Skely has been temporarily frozen due to malicious reporting, but the project plan remains unchanged. AI will launch the token release around noon Eastern Time as originally planned, and the specific time will not be announced publicly to avoid interference from token snipers. The token name will be randomly selected by AI, and investors need to be prepared to accept any possible naming."

This tweet was later reposted and supported by ai16z founder Shaw, injecting a foundation of trust into the project. @0xwitchy also emphasized that she is not a team member and is not involved in token issuance, but has had contact with Skely. She suggested that the community wait for Skely's further official statement.

Although the account turmoil has brought considerable controversy, the news of the project's progress has undoubtedly injected a glimmer of confidence into the market. Whether AI-Pool can deliver on its technical promises as scheduled will be a key step in verifying whether this innovation is truly worth looking forward to.

The Brilliance of Technology: AI Agent and TEE, the True Hope of Decentralization?

From a purely technical perspective, AI-Pool's design is indeed attractive. The core of the project is the combination of Trusted Execution Environment (TEE) and AI Agent, trying to solve the recurring problems of rug pulls and internal malice in traditional pre-sales through technical means.

Private Keys Not in Human Hands

AI-Pool uses the TEE technology of the Phala Network to generate and store private keys in a secure isolated computing environment. This means that even the project developers cannot access these core data, fundamentally eliminating the possibility of "running away with the money." This technical design is similar to the double-lock system of a bank vault: funds can only be safely scheduled when strict conditions are met.

Transparent and Verifiable Interactions

Each transaction generates a remote authentication credential, allowing the outside world to track the flow and status of funds in real-time through these credentials. Unlike the previous model relying solely on trust, this "machine trust" is built on code and consensus, providing investors with a higher sense of security.

However, although the technical concept is exciting, the current AI Agent can only execute pre-programmed logic and is still far from true autonomous decision-making. In other words, the drama played by AI is still ultimately controlled by the developers. How far this "decentralization" can go in the true sense is worth deep consideration.

Skely's Other Projects: The Current Status of GFC

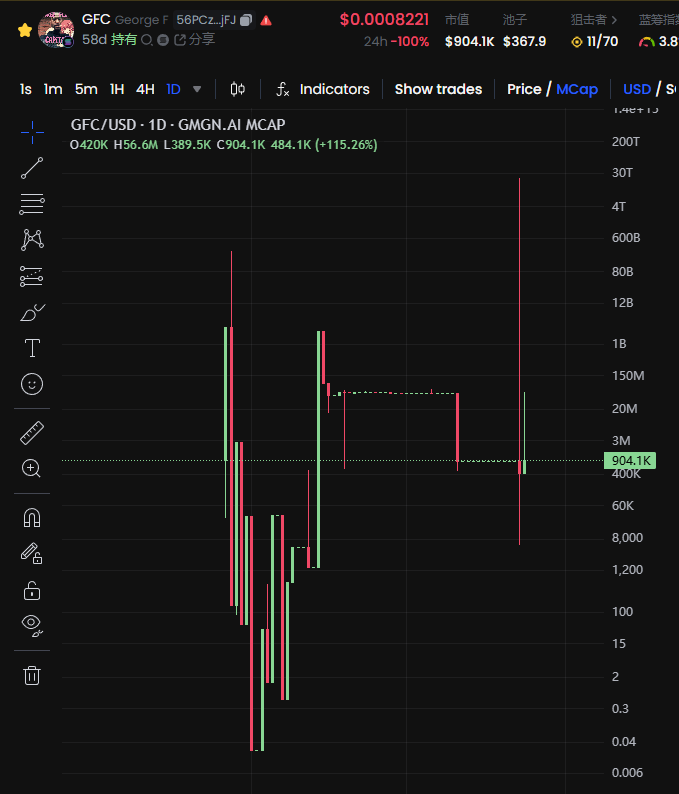

The success of AI-Pool has inevitably drawn attention to Skely's other projects, one of which is GFC (Global Funding Club). This project is an experimental fund initiated by Skely under the ai16z DAO framework, aiming to use community funds to support innovative blockchain projects. Currently, GFC's market cap is around $1M, and although it is still inferior in scale to AI-Pool, it provides more credit support for Skely's background.

However, the project has stagnated, with too little trading volume, and currently only has some players trading AI_Pool expectations in PVP. If AI-Pool cannot be delivered smoothly, GFC also faces the risk of zeroing out.

The Rise of PHA: The Unexpected Winner of the AI Craze

The popularity of AI-Pool has unexpectedly pushed Phala Network (PHA) into the center stage. This network, which supports the core technology of AI-Pool, has quickly attracted attention in the market due to its TEE technology, even causing a 50% price increase in PHA.

Why Phala?

Phala's Trusted Execution Environment is the technical pillar for the project to achieve decentralization, and its core capability is to ensure the security and privacy of data, while providing a reliable interface for on-chain and off-chain interactions. In other words, Phala provides an "absolutely secure" studio for AI execution, without worrying about external interference.

This "unexpected explosion" not only validates the market potential of TEE technology, but also makes more projects start to focus on the intersection of AI and decentralized technology. Perhaps AI-Pool is just a small prelude in Phala's long-term growth.

Calm Reflection: How Far Does the AI Agent Still Have to Go from Frenzy to Landing?

If the emergence of AI-Pool has opened a new door, its underlying flaws should not be overlooked. Although the AI Agent provides a new narrative model for the crypto market, the current technical and mechanism design still has many shortcomings.

- The Paradox of Decentralized AI: Currently, it still relies on the terminal instructions provided by developers, which is not entirely consistent with the "decentralization" concept of . The project control rights are still concentrated in the hands of a few developers, and investors' trust in AI is actually trust in the developers.

- Transparency of the Mechanism: The unlimited fundraising and vague distribution criteria expose the defects in the mechanism design of the current model. If these issues cannot be clearly resolved, similar projects in the future may have difficulty gaining long-term trust from investors.

- Limitations of Technology: The functions of the AI Agent are currently mainly limited to the automation of the pre-sale process, and are still far from the goals of "autonomous trading" and "smart investment". A real breakthrough requires the coordination of multiple technologies, such as more accurate decentralized oracles and more efficient distributed computing.

Epilogue: The Two Sides of FOMO and FUD

The story of is still ongoing. It is both a microcosm of technological experimentation and a true portrayal of the frenzy and risks of the crypto market. Perhaps the final result of this experiment is not important, because it has already ignited a spark of imagination in the market. In the future, as technology progresses, can the AI Agent truly become a game-changer for ? What kind of ecosystem will the market create for this new narrative? Let's wait and see.