Author: BitpushNews

From the historical high to the recent one-month low, Bitcoin has experienced a roller coaster ride in the past week.

Just less than a week ago, the price of Bitcoin surged past $108,000, setting a new all-time high, while in the past 24 hours, its price has fallen below $92,500, reaching the lowest level since November 26.

Over the past week, Bitcoin has fallen by about 13%, Ethereum and Solana have fallen by 18% and 15% respectively, and XRP has fallen 12% to $2.18. The MEME sector has been hit harder, with Dogecoin falling 22% over the past week.

The market is in a critical period at the end of the year. On the one hand, the largest-ever Bitcoin options contract is about to expire, which could trigger violent fluctuations; on the other hand, the macroeconomic environment, especially the policy direction of the Federal Reserve, is putting additional pressure on the market.

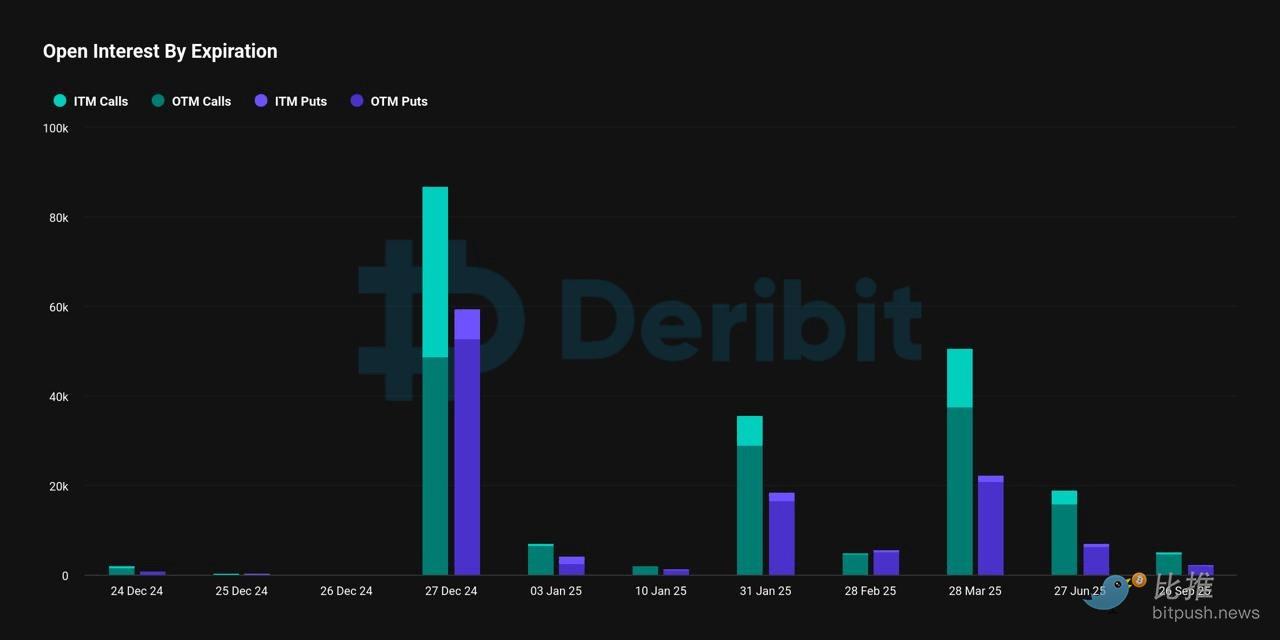

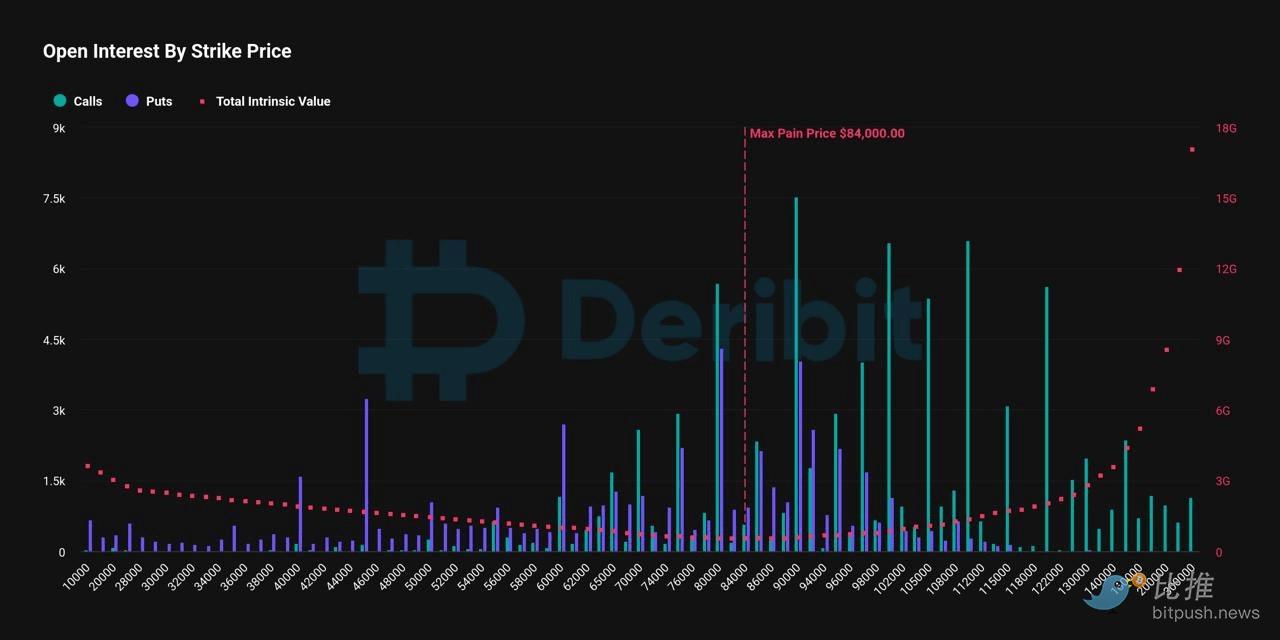

$14 Billion Options Expiration

This Friday, $14 billion in Bitcoin options open interest (OI) will expire. According to data released by Deribit exchange CEO Luuk Strijers, the put-call ratio of the expiring contracts is 0.69, meaning for every 10 call options, there are 7 put options. This indicates a certain degree of bearish sentiment in the market. Additionally, the number of contracts expiring (146,000) is not small, double the amount of the March 2025 expiration (73,000).

Strijers further explained that the expiring contracts account for 44% of the total Bitcoin options open interest ($32 billion). Deribit exchange estimates that over $4 billion of these contracts will be exercised, which will inevitably trigger a lot of trading activity.

Deribit's volatility index (DVOL) has been fluctuating violently recently, and Strijers pointed out that this means traders still have significant disagreements about the future direction of the market.

Strijers emphasized: "The previously dominant bullish momentum is weakening, and the market is currently in a high-leverage upward state. If a significant decline occurs, it may trigger a rapid backlash effect. All eyes will be on the upcoming options expiration date, as it may set the tone for the market's trajectory in 2025."

Crypto Fund Inflows Plummet, ETFs See Record Outflows

Although crypto funds maintained net inflows last week, after dovish comments from Federal Reserve Chair Powell, crypto products experienced record single-day outflows, leading to a sharp decline in inflows. CoinShares data shows that investors injected a total of $308 million into funds last week, including Bitcoin ETFs. But on Thursday alone, investors withdrew a record $576 million, and the outflow rose to $1 billion on Friday.

Institutional Activity May Decrease, But Market Still Has Rebound Potential

In a report, David Lawant, head of research at crypto broker FalconX, wrote that in the short term, price volatility remains the most likely scenario before a "bullish trajectory" emerges in Q1 2025. Sean McNulty, trading manager at liquidity provider Arbelos Markets, believes: "The bulls should keep Bitcoin's price at the $90,000 level by the end of the year, but if it falls below that level, it could trigger further liquidation."

According to MarketWatch data, the "Santa Claus rally" typically occurs in the last five trading days of the year and the first two trading days of the new year.

BRN analyst Valentin Fournier stated that while crypto market trading activity may decrease in the remaining time this year, this does not mean investors should give up hope for the "Santa Claus rally." In a report on Monday, he wrote: "With the expected decline in institutional activity and retail trading volume expected to remain subdued in the last two weeks of the year, volatility should continue to decline, and although the persistent negative momentum may lead to minor losses, the market still has the potential for a strong rebound."