Background: Stablecoins have become a battleground

Cryptocurrencies have always given the impression of high volatility, with tokens easily surging and plummeting, seemingly having little to do with "stability". Stablecoins, on the other hand, are mostly pegged to the US dollar, and can not only be used as chips to exchange for other tokens, but also serve payment functions. The overall market capitalization of this sector exceeds $200 billion, making it a relatively mature segment of the crypto market.

However, the most common stablecoins currently on the market, USDT and USDC, are both issued by centralized institutions, and the combined market share of the two accounts for nearly 90%. Other projects also want to grab a slice of this big 'BTC'. For example, the Web 2.0 payment giant PayPal is launching its own stablecoin pyUSD in 2023 to stake an early claim; recently, Ripple, the parent company of XRP, has also issued RLUSD in an attempt to challenge the stablecoin market.

The above two cases are more about the payment business use of stablecoins, with the backing assets mostly being US dollars or short-term government bonds. Decentralized stablecoins, on the other hand, emphasize more on yield, anchoring mechanisms, and composability with DeFi.

The market's desire for decentralized stablecoins has never waned. From DAI to UST, from the types of collateral to the anchoring mechanism, the development of decentralized stablecoins has gone through several iterations. Ethena pioneered the use of spot-futures arbitrage + staking to generate yield, opening up users' imagination for yield-bearing stablecoins. The market capitalization of the USDe stablecoin has reached $5.9 billion, making it the third largest in the market. Recently, Ethena has collaborated with BlackRock to launch the USDtb stablecoin, which provides yield from real-world assets (RWA) and avoids the risk of negative funding rates, offering stable income in both bull and bear markets, rounding out their product line and making Ethena a focus of market attention.

In light of Ethena's successful case, the market has also seen the emergence of more and more yield-bearing stablecoin-related protocols, such as: Usual, which recently announced a partnership with Ethena; Anzen, built in the Base ecosystem; and Resolv, which uses ETH as collateral. What are the anchoring mechanisms of these three protocols? Where do the yields come from? Let's take a look.

Source: Ethena Labs

USUAL: Strong team background, token design has Ponzi-like attributes

USUAL is an RWA yield-bearing stablecoin, with the underlying yield-generating assets being short-term government bonds. The stablecoin is called USD0, and by staking USD0, users can obtain USD0++. $USUAL is used as the staking reward. They believe that current stablecoin issuers are too centralized, like traditional banks, and rarely distribute value to users. USUAL will make users co-owners of the project, with 90% of the value generated returned to users.

In terms of the project team, CEO Pierre Person was a member of the French National Assembly and a political advisor to French President Emmanuel Macron. The Asia-Pacific executive Yoko was the fundraising manager for the French presidential election. The project has strong political and business connections in France, and the key to the success of an RWA project is the transfer of physical assets to the chain, as well as the support and regulation from the government, which USUAL clearly has an advantage in.

Regarding the project mechanism itself, the USUAL token economics have Ponzi-like attributes. It is not just a mining token with a fixed issuance, but its issuance is tied to the TVL of the staked USD0 (USD0++), following an inflationary model. However, the issuance will vary based on the "revenue growth" of the protocol, strictly ensuring an inflation rate < protocol growth rate.

Whenever new USD0++ bond tokens are minted, a corresponding proportion of $USUAL will be generated and distributed to the participants. The Minting Rate, which determines this conversion ratio, will be highest at the TGE and follow a gradually declining exponential curve, with the aim of rewarding early participants and creating token scarcity in the later stage to drive up the intrinsic value of the token.

In simple terms, the higher the TVL, the less USUAL will be issued, and the higher the value of each USUAL token.

Higher USUAL price -> Incentivize staking USD0 -> Higher TVL -> Less USUAL issuance -> Higher USUAL price

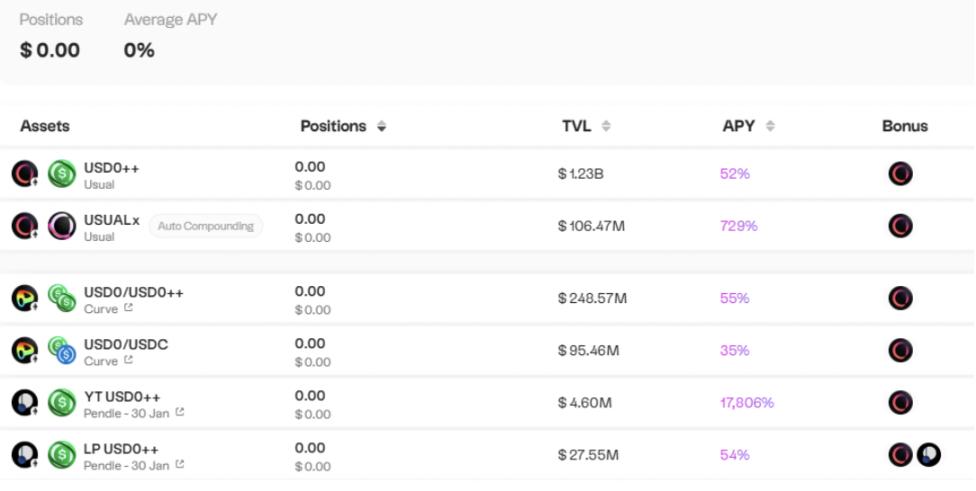

The market cap of USD0 has increased by 66% in the past week, reaching $1.4 billion, surpassing PyUSD. The APY of USD0++ is also as high as 50%.

Recently, Usual has also partnered with Ethena, accepting USDtb as collateral, and will subsequently migrate part of the reserve assets of the USD0 stablecoin to USDtb. Over the next few months, Usual will become one of the largest minters and holders of the USDtb.

As part of this collaboration, Usual will set up a sUSDe vault for USD0++ holders, allowing Usual users to earn sUSDe rewards while maintaining their core exposure to Usual. This will enable Usual users to leverage Ethena's rewards while increasing Ethena's TVL. Finally, Usual will incentivize and enable the swapping of USDtb-USD0 and USDtb-sUSDe, increasing the liquidity between core assets.

They have also recently opened USUAL staking, with the reward source being 10% of the total USUAL supply, currently offering an APY of up to 730%.

USUAL:

- Current price: 1.04

- Market cap rank: 197

- Circulating market cap: $488,979,186

- TVL: $1,404,764,184

- TVL/MC: 2,865

Source: usual.money

Anzen: Tokenization of credit assets

Anzen's issued stablecoin is USDz, currently supporting five chains: ETH, ARB, MANTA, BASE, and BLAST. The underlying assets are a portfolio of private credit assets, and by staking USDz, users can obtain sUSDz and earn RWA yields.

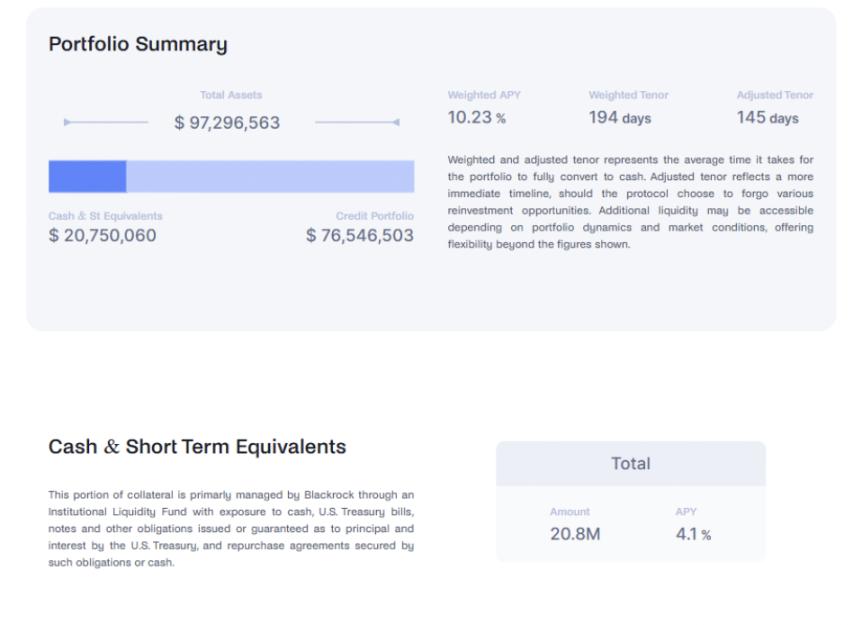

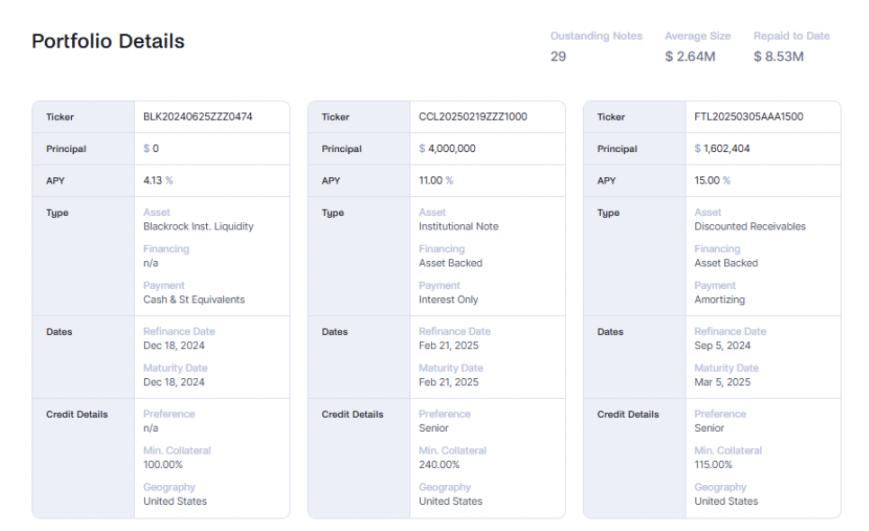

The underlying assets are in collaboration with the licensed US broker-dealer Percent, with the risk exposure mainly in the US market. The portfolio is diversified across 6-7 assets, with a maximum single asset allocation of 15%. The current APY is around 10%.

The partners are also well-known in traditional finance, including BlackRock, JP Morgan, Goldman Sachs, Moody's Ratings, and UBS.

Source: Anzen

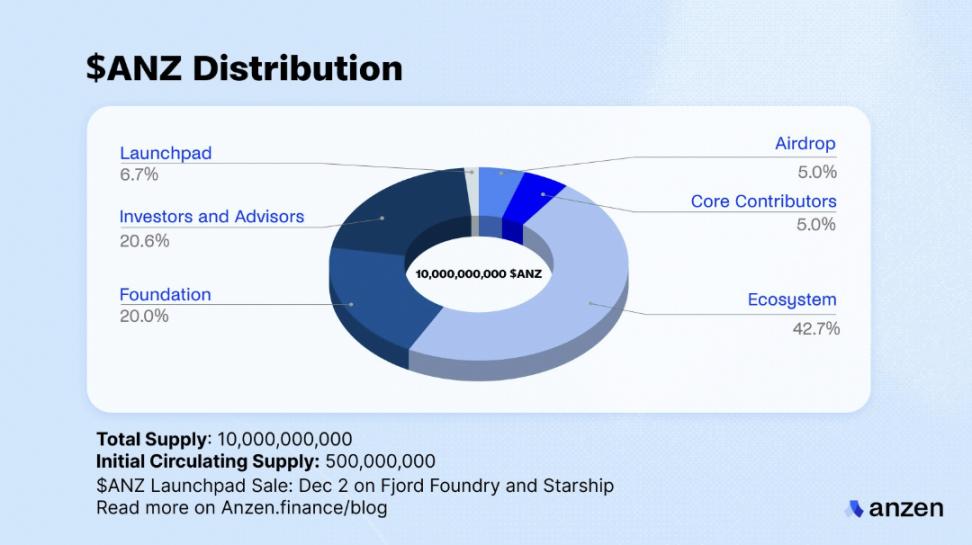

In terms of financing, Anzen has raised $4 million in seed funding from Mechanism Capital, Circle Ventures, Frax, Arca, Infinity Ventures, Cherubic Ventures, Palm Drive Ventures, M31 Capital, and Kraynos Capital. They have also successfully raised $3 million through a public offering using Fjord.

In the ANZ token design, a ve model is used, where ANZ can be locked and staked to obtain veANZ, which entitles the holder to a share of the protocol's revenue.

Source: Anzen

ANZ:

- Current price: 0.02548

- Market cap rank: 1,277

- Circulating market cap: $21,679,860

- TVL: $94,720,000

- TVL/MC: 4,369

Resolv: Delta-neutral stablecoin protocol

Resolv has two products, USR and RLP:

- USR: A stablecoin minted with ETH as collateral, with RPL providing price peg assurance. Users can stake USR to earn stUSR and receive yields.

- RLP: USR has over 100% collateral, and the excess collateral is used to back RLP. RLP is not a stablecoin, and the amount of collateral required to mint or redeem RLP is determined by the latest RLP price.

For the ETH used to generate USR, Resolv employs a delta-neutral strategy, with the majority of the collateral directly deposited and staked on-chain. A portion of the collateral is held by institutions as futures margin.

The on-chain collateral is 100% deposited in Lido, with the short position margin ranging from 20% to 30%, i.e., using 3.3 to 5 times leverage. 47% of this is on Binance, 21% on Deribit, and 31.3% on Hyperliquid (using Ceffu and Fireblocks as the CEX custodians).

- Income sources: on-chain staking and funding rates

- Basic rewards (70%): stUSR + RLP holders

- Risk premium (30%): RLP

Assuming the collateral pool generates a profit of $20,000:

- The basic reward calculation formula is $20,000*70%=$14,000, and is distributed proportionally based on the TVL of stUSR and RLP

- The risk premium calculation formula is $20,000*30%=$6,000, distributed to RLP.

Therefore, RLP receives a larger share of the profits, but if the funding rate is negative, the funds will be deducted from the RLP pool, and RLP also has higher risks.

Recently, Resolv has launched on the Base network and also launched a points program, where holding USR or RLP can earn points, laying the groundwork for future token issuance.

Related data:

- stUSR: 12.53%

- RLP: 21.7%

- TVL: 183M

- Collateralization ratio: 126%