Author: Ana Paula Pereira, Cointelegraph; Translated by: Tong Deng, Jinse Finance

Software company MicroStrategy is holding a special shareholder meeting to expand its stock issuance plan and purchase more Bitcoin.

According to the proxy filing submitted to the U.S. Securities and Exchange Commission on December 23, the company is seeking permission to increase the authorized shares of Class A common stock and preferred stock, in order to have greater flexibility to issue more shares as needed in the future.

The first amendment aims to increase the authorized Class A common stock from 330 million to 10.33 billion shares, while the second amendment aims to increase the authorized preferred stock from 5 million to over 1 billion shares.

MicroStrategy's filing submitted on December 23, 2024. Source: Street Insider

Behind these proposals is MicroStrategy's $21 billion plan. The plan was disclosed in October, outlining the company's goal to purchase an additional $42 billion worth of Bitcoin over the next three years. The plan includes raising $21 billion through stock sales and another $21 billion through fixed-income securities.

According to MicroStrategy's filing:

"Proposals 1 and 2 of this special meeting request an increase in the authorized shares of the company's stock to support the further implementation of our $21 billion plan and future broader capital market activities as well as other corporate purposes."

The company has been regularly acquiring BTC since 2020, but the pace has accelerated since the plan was announced. In December alone, it purchased 42,162 bitcoins, worth over $4 billion at current prices.

At the end of October, MicroStrategy reported a 17.8% return on its BTC holdings and plans to achieve an annual return of 6% to 10% between 2025 and 2027. Since then, it has reportedly raised $13 billion through stock issuance and $3 billion through convertible bond issuance.

"We are executing on our $21 billion plan at a much faster pace than initially anticipated," the filing states.

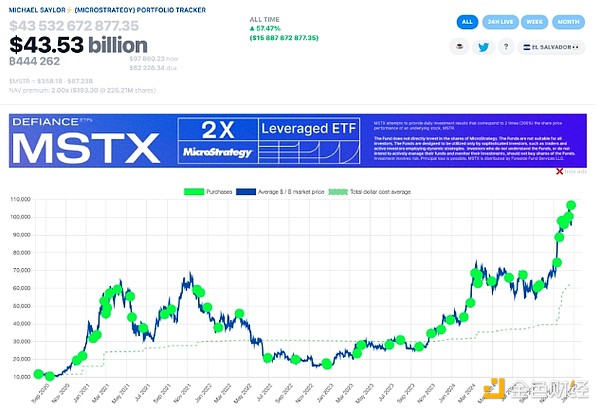

As of December 22, the company and its subsidiaries collectively hold approximately 444,262 BTC, worth around $43.53 billion. The total acquisition cost of these tokens is $27.7 billion, with an average purchase price of $62,257 per BTC.

MicroStrategy currently holds over 444,262 BTC. Source: Saylor Tracker

The company's stock on the Nasdaq has risen over 422% so far this year - largely due to its Bitcoin strategy. The date for the special shareholder meeting has not yet been announced. The company's next earnings report is scheduled for February 2, 2025.