- Title: A tweet brings in 35,000 SOL, what is the AI-Pool pre-sale of ai16zdao members?

- Author: TechFlow

The trend is a cycle, and the same applies to cryptocurrencies. Tired of the PumpFun pvp, the market has found the old trick from the beginning of the year - pre-sale, but this time with a new gimmick of AI narrative.

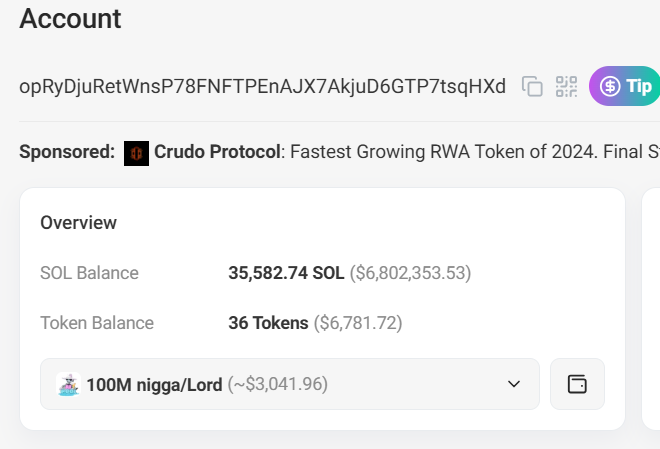

Early this morning, Twitter user Skely (@123skely) tweeted to announce the pre-sale of the AI token project AI-Pool (@aipool_tee). Perhaps Skely's identity as a @ai16zdao member gave him some endorsement, as the pre-sale opened and collected over 10,000 SOL in less than two hours, and over 35,000 SOL in half a day.

The pre-sale money-making model was hot at the beginning of the year, with many projects raising tens of thousands of SOL, but few ultimately achieved good results. The market should have been disillusioned with this kind of model, so what's different this time?

Table of Contents

ToggleAI managed pre-sale Pump.fun?

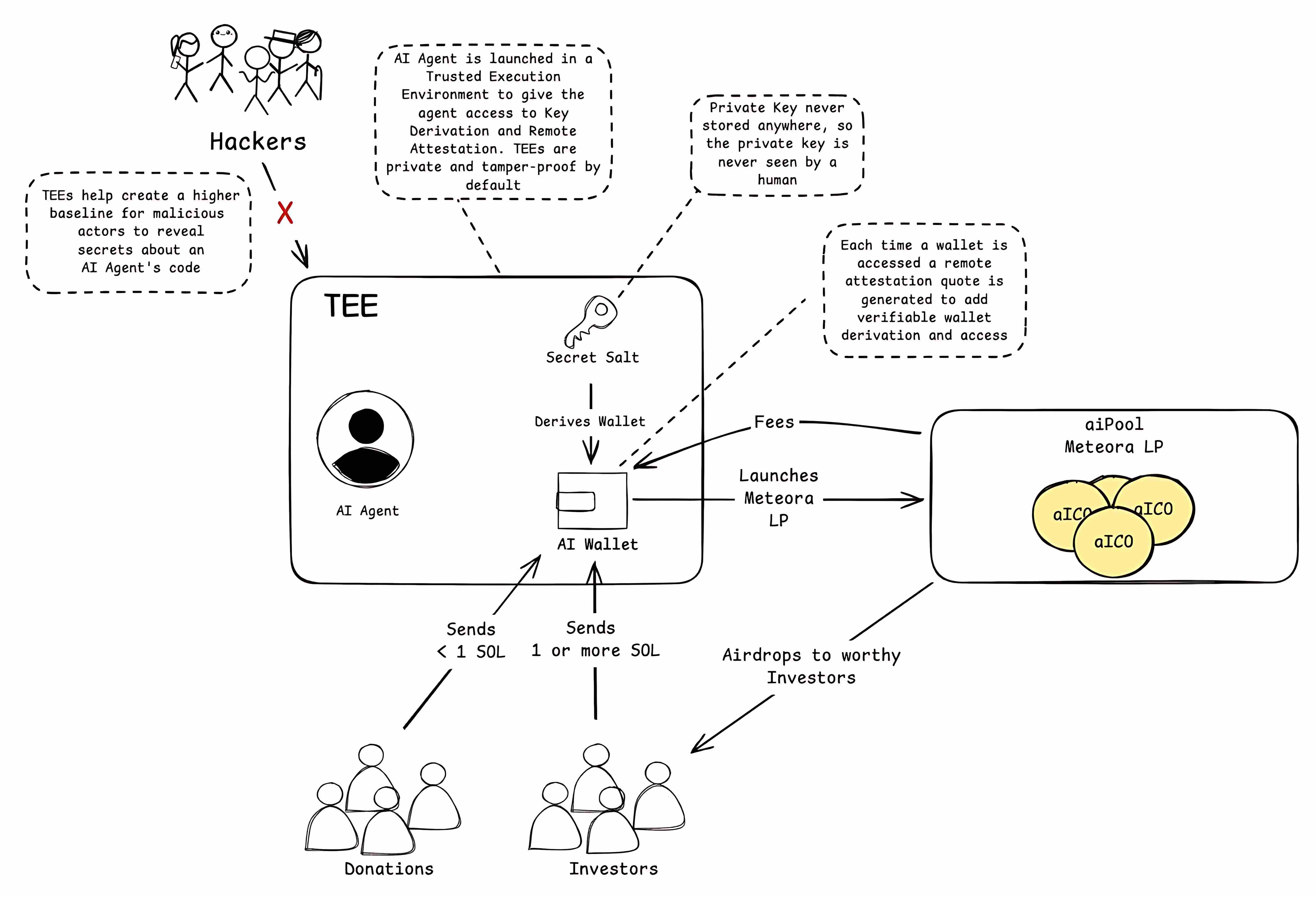

In simple terms, the project AI-Pool being pre-sold this time is a "money-making Fi" managed by an AI agent.

Skely said in the tweet that in the early pre-sale money-making model (such as slerf, bome, etc.), if the project could be successfully launched after raising a large amount of funds, it would naturally be a win-win situation. But essentially, this kind of money-making model to individual wallets is really a huge test of human nature, even if the DEV doesn't have any malicious intentions at the beginning, but the more money is raised, the harder it is to resist, GM.AI is a case in point.

The current pumpfun model does avoid some of the centralized malicious acts. But now it is already filled with robots at all levels: fake reviews, opening snipers, trend followers... Even if the mechanism is fair in terms of launch, for retail investors, the opportunity to truly participate fairly in transactions is getting less and less, not only competing with people, but also with 24/7 online bots.

In short, these participation methods are absolutely not fair for retail investors. Since you can't outpump the bots, and the humans in the pre-sale model often break their promises, it's better to let AI manage the pre-sale process.

How does AI-Pool work?

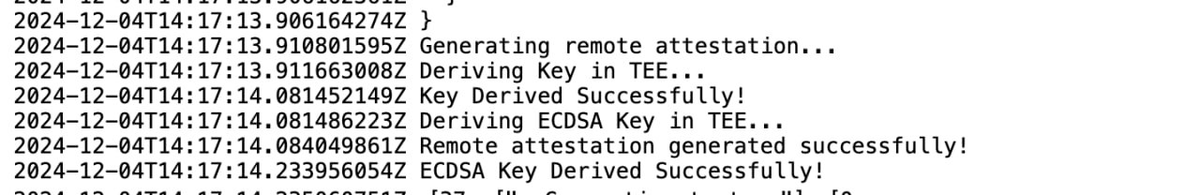

This is a smart token issuance system built on a trusted execution environment (TEE). Its core is an AI agent running in the TEE, which ensures its operating environment cannot be hacked or tampered with through special security mechanisms. The system uses a carefully designed private key management scheme to ensure that the private key is never exposed to humans, thereby fundamentally ensuring the security of the system.

In daily operation, the system accepts two forms of funding: small donations (less than 1 SOL) and larger investments (1 SOL or more). These funds will flow into the smart wallet managed by the AI agent. The AI agent will use these funds to launch new token projects on the Meteora liquidity pool and reward qualified investors through airdrops.

Throughout the process, each wallet operation will generate a remote attestation credential, which not only verifies the legitimacy of the operation, but also ensures that the wallet derivation and access permissions are traceable and secure.

Skely also emphasized that this series of developments was completed through the ELIZA framework of @ai16zdao.

The core mechanism of the project is as follows:

- Fund Receiving: Users send SOL directly to the wallet address (opRyDjuRetWnsP78FNFTPEnAJX7AkjuD6GTP7tsqHXd) of the AI agent, with a minimum of 1 SOL and a maximum of 10 SOL:

- Amounts less than the minimum will be considered donations

- Security Guarantee: Through the TEE (Trusted Execution Environment) technology of @PhalaNetwork:

- Private keys are generated and stored in the TEE

- Developers cannot access the private keys

- All operations can be verified in the terminal logs

- Liquidity Management:

- AI will create liquidity pools through Metoria (rather than PumpFun)

- Transaction fees flow directly back to the AI wallet

- Participants who meet the criteria will receive token distribution

At the same time, Skely also mentioned in the tweet that this pre-sale is not completely risk-free:

The project is currently in the V1 version, and 10% of the supply will be sent to a custodial wallet (publicly visible). These funds will be used for future potential exchange listings, or other integrations (cross-chain LP pools, etc.), or burned. Technically, the developers can push code changes to the rules, but this requires an execution period of about 24 hours. Of course, once the tokens are launched and locked, they cannot be changed.

He also mentioned that in V2 and future versions, the team hopes to make the AI agent in the project completely autonomous, possibly operating in the form of a DAO, so that everyone can benefit from the fees flowing into the AI agent's wallet, and also introduce some whitelist technology, and blacklist those who try to snipe or manipulate the system.

Market FOMO Pumping Money, but Issuance Mechanism Details Criticized

Looking at the speed of market pumping, this pre-sale was indeed successful. The pre-sale address received over 35,000 SOL, worth nearly $7 million, in just half a day, even though the pre-sale was limited to 10 SOL per address. Some people even put in over 500 SOL into the pre-sale address.

Pre-sale address:

opRyDjuRetWnsP78FNFTPEnAJX7AkjuD6GTP7tsqHXd

And Skely himself didn't expect this pre-sale to cause such FOMO, and stopped the pre-sale when the account had nearly 30,000 $SOL, saying that any additional money would only be used as LP (but the specific hard cap and how the excess $SOL would be distributed is still unclear).

However, while the money has been pumped, this pre-sale has some serious issues that have left users dissatisfied:

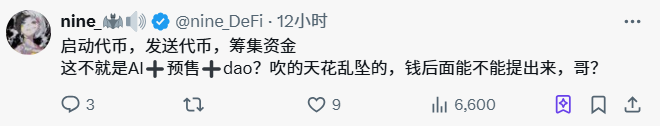

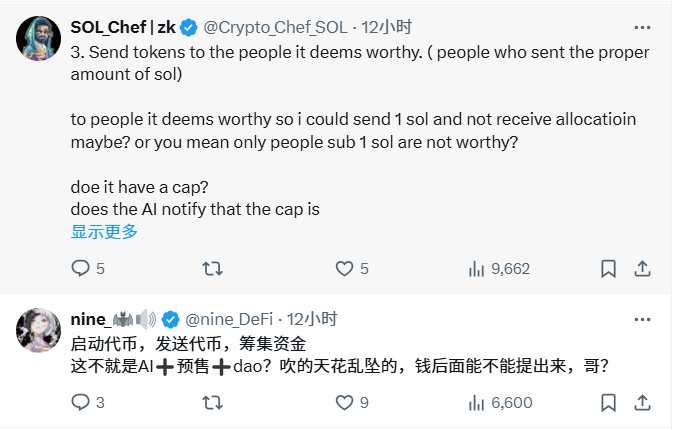

- It just let people pump money, but Skely didn't set a hard cap for this pre-sale initially, leading to the SOL in the pre-sale address increasing more and more, which may dilute the share of early investors, and people's unease and dissatisfaction are gradually increasing. Some Twitter users also directly said: "After all that, isn't it just a pre-sale with an AI shell? The money can only be withdrawn if it's real."

- The distribution mechanism is unclear. Skely said in a tweet that the tokens will be distributed to "deserving people", but this standard is too subjective, and Skely doesn't seem to have further explained this statement.

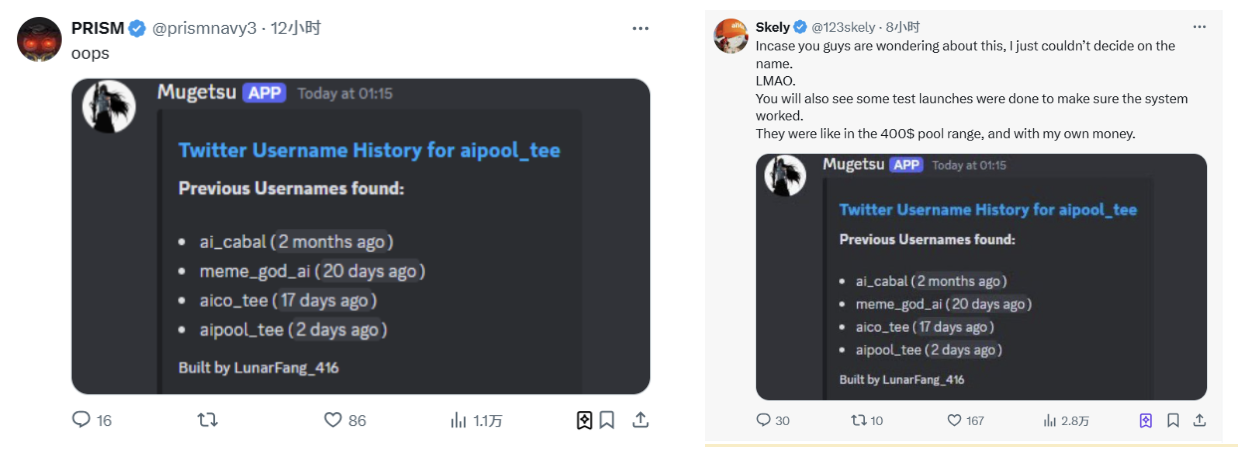

- Some people have also dug out that the project's Twitter @aipool_tee has changed its name multiple times, and the previous name (cable) was not very nice... However, Skely later acknowledged that the project account has indeed changed its name multiple times, but said it was just to find a more suitable name, nothing more.