AAVE, the native token powering the decentralized finance (DeFi) lending protocol Aave, has seen a 12% price increase over the past 24 hours. This surge came after a new Chainlink oracle integration proposal.

AAVE is currently trading at $369.10, poised to reclaim its 3-year high of $399.85.

Aave Plans Chainlink Smart Value Recapture (SVR) Integration

On December 23, Chainlink introduced Smart Value Recapture (SVR), an oracle service that captures profits generated from Maximal Extractable Value (MEV) and redistributes them to DeFi protocols.

Following this launch, a community member submitted a proposal to the Aave governance forum to discuss integrating SVR into the lending protocol.

The proposal states that liquidators and searchers often disproportionately profit from Aave's liquidation process, leaving little value for protocol users. By integrating Chainlink's SVR system, the MEV generated from Aave liquidations would be captured and fairly distributed to all participants, including searchers, builders, and the protocol itself.

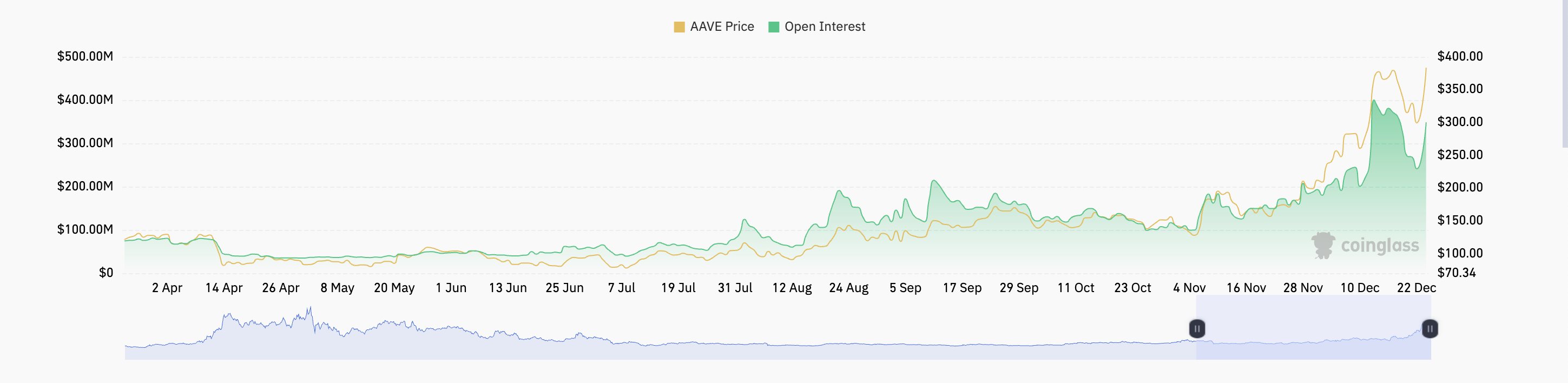

This proposal has driven increased trading activity in Aave. Its value has surged by double digits over the past 24 hours. The rising open interest confirms a surge in altcoin demand.

The current open interest stands at $376 million, a 32% increase.

Open interest represents the total number of outstanding contracts in derivative markets, such as futures or options. When open interest increases during a price rise, as in the case of Aave, it indicates traders are opening new positions in the direction of the price movement, suggesting strong market confidence and the potential for sustained momentum.

Additionally, Aave's Relative Strength Index (RSI) on the daily chart is in an uptrend, reflecting buying activity. It currently stands at 62.88.

This indicator measures the market's overbought and oversold conditions. At 62.88, it is in an uptrend, suggesting market participants are increasingly buying Aave.

Aave Price Prediction: Potential to Surpass $400

Aave is currently trading below a resistance level of $399.85, its 3-year high. If buyers continue to accumulate, Aave could break through this resistance and establish it as a support level. This breakout could push the price above $400 for the first time since 2021.

However, if selling pressure emerges, this bullish outlook could be invalidated, and Aave's price could plummet to $323.46.