As 2024 enters its final week, cryptocurrency traders are facing a critical moment, evaluating the latest economic data and the decisions of major central banks. This year, the global market has experienced severe volatility, going through macroeconomic changes, regulatory adjustments, and significant developments in the digital asset ecosystem. Bitcoin is approaching its annual quarterly high closing price, and the breakthrough growth of Ethereum Layer-2 highlights the vitality of the market.

The following information will help you understand the end of December and prepare for 2025.

Table of Contents

Key Economic Calendar Highlights for December 2024

Expected Highlights This Week

Best Performing Crypto Areas in 2024

Outlook for Next Week: 1st Week of 2025

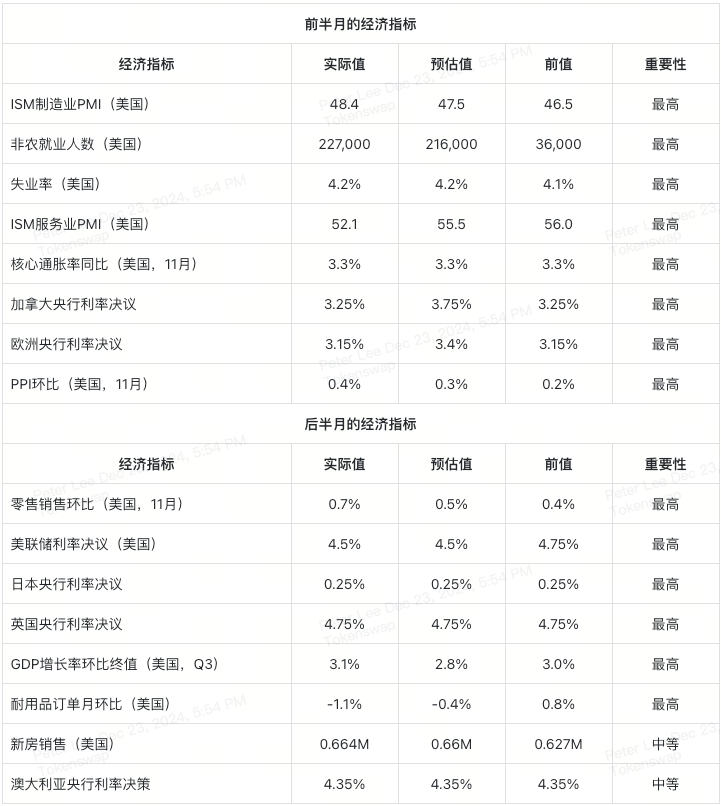

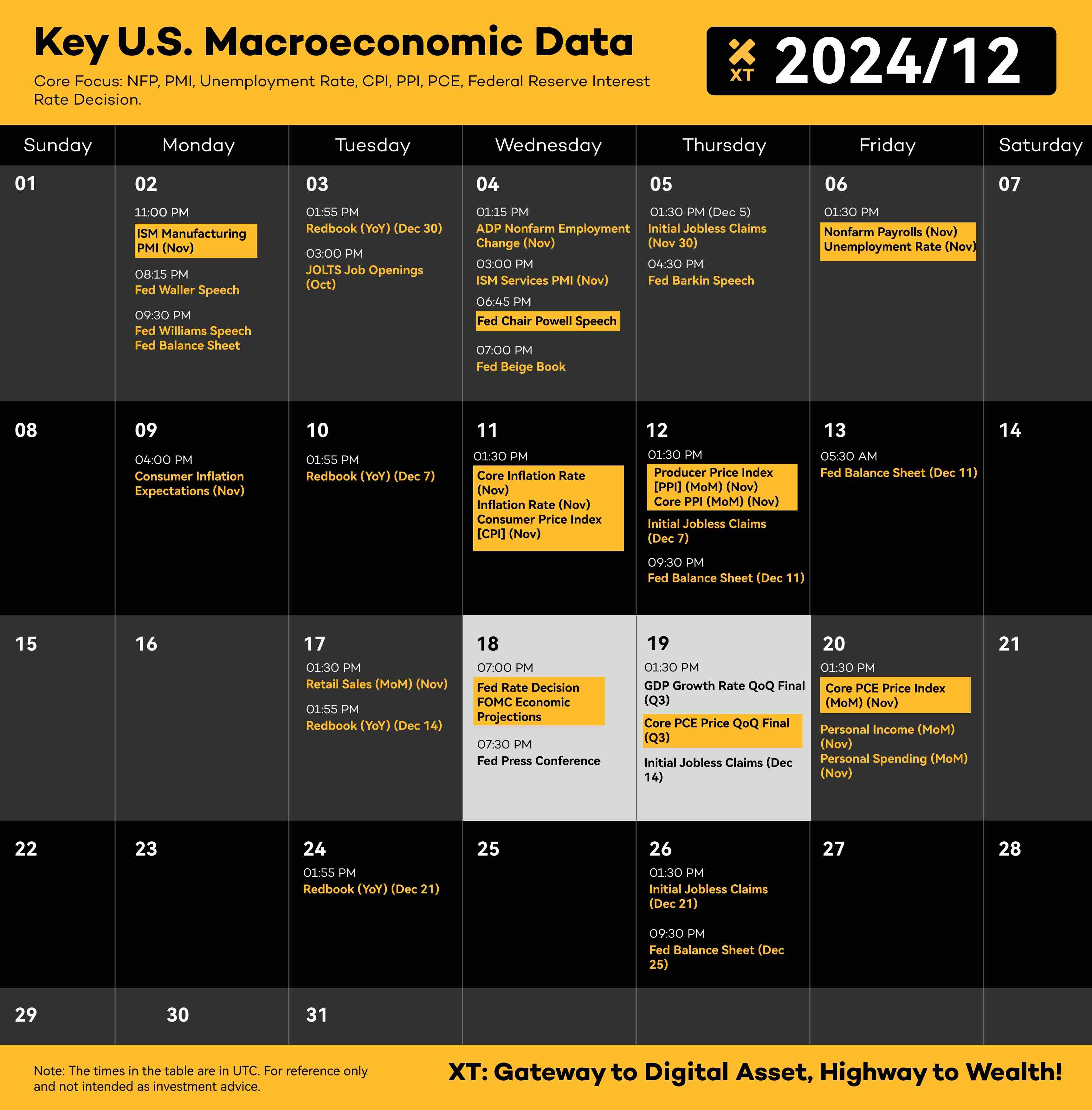

Key Economic Calendar Highlights for December 2024

Image Source: Follow @XTexchange on Twitterhttps://x.com/XTexchange

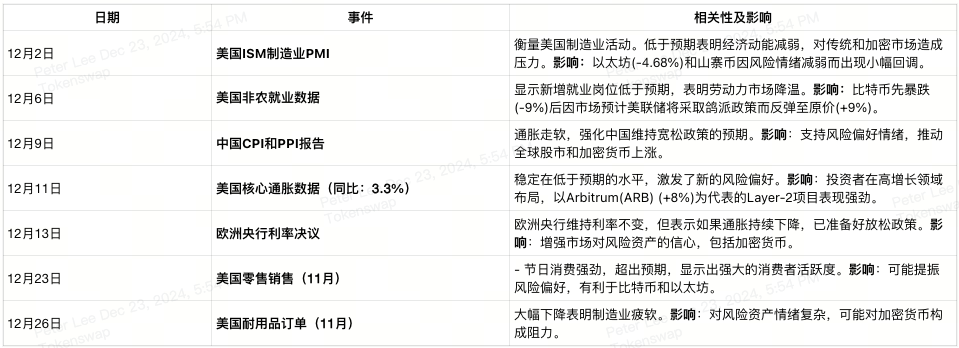

Key Dates and Impacts:

Expected Highlights This Week

December 23 (Monday) to December 25 (Wednesday)

Highlights: The market will continue to digest US retail sales and GDP data, while also monitoring changes in durable goods orders to gain insights into the overall economic trend. Strong retail data highlights the active consumer spending during the holiday period, while the GDP growth rate (+3.1%) further validates the resilience of the economy. However, the significant decline in durable goods orders (-1.1%) exposes potential weaknesses in the manufacturing sector, which could become a drag on risk assets.

Analysis:

Consumer Behavior and Sentiment: The robust retail data reflects strong consumer confidence, which may translate into higher participation in risk assets, including cryptocurrencies. The strong holiday spending could attract institutional capital to capitalize on the favorable macroeconomic conditions.

Manufacturing Risks: The decline in durable goods orders suggests that businesses may be cutting back on capital expenditures, which could negatively impact the risk sentiment in the stock market and crypto market. Investors may become more focused on the cyclical fluctuations in the economy.

Potential Crypto Market Impact:

Bitcoin and Major Altcoins: If the market sentiment remains optimistic, leading assets like Bitcoin and Ethereum may stabilize or experience a slight uptick.

DeFi and Layer-2 Platforms: The strong retail data may stimulate capital inflows into yield-generating decentralized platforms, such as stablecoins and attractive lending protocols.

December 26 (Thursday) to December 27 (Friday)

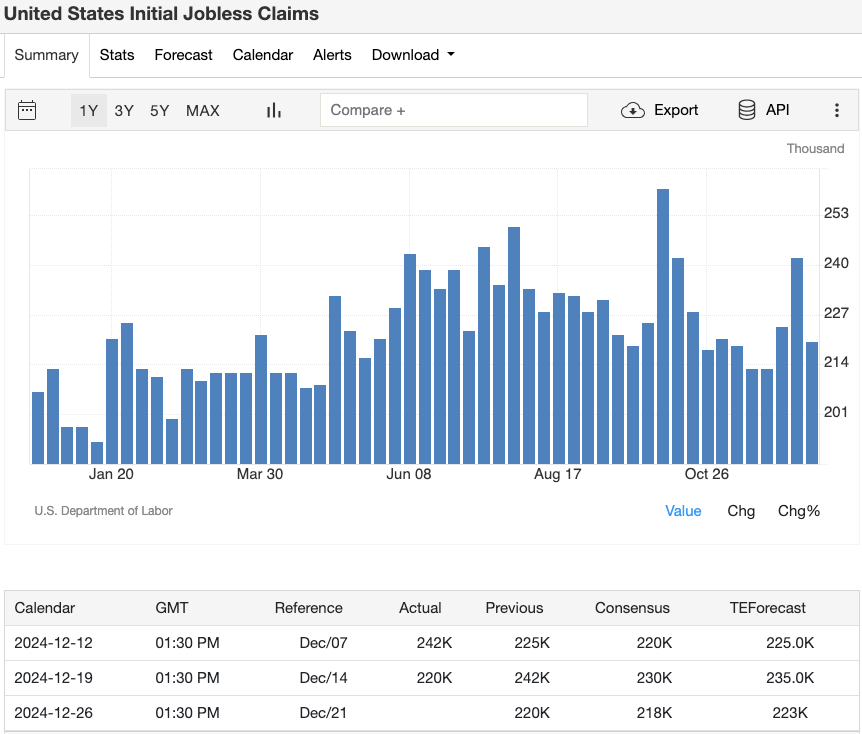

Highlights: In the latter part of the week, the market will focus on changes in US initial jobless claims and crude oil inventories. The initial jobless claims may challenge the resilience of the labor market, while the crude oil inventory data will reveal shifts in inflationary pressures and energy market demand.

Analysis:

Labor Market Signals: A rise in unemployment claims could dampen overall market sentiment, increasing volatility in traditional and crypto markets. Conversely, stable or declining labor market data may boost risk appetite, particularly for assets related to non-essential consumer spending, such as NFTs and gaming tokens.

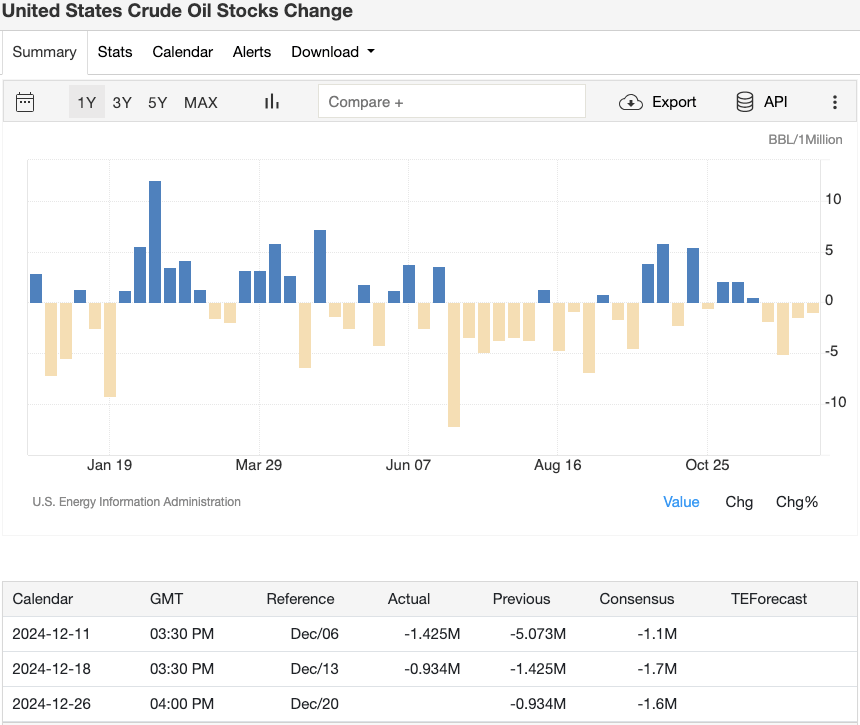

Energy Market Impact: A significant decrease in crude oil inventories may raise concerns about inflation, while an increase in inventories could alleviate some market pressure, indirectly affecting energy-related crypto assets like Bitcoin.

Potential Crypto Market Impact:

NFTs and Metaverse Tokens: These tokens are more sensitive to changes in consumer spending. Stability in the job market may support the continued growth of this sector, while positive consumer confidence data may stimulate investor interest.

Privacy Coins: In the absence of significant macroeconomic changes, privacy coins may maintain range-bound trading. If new regulatory or geopolitical risks emerge, privacy coins could become a hedging tool.

In-Depth Analysis of This Week's Economic Data

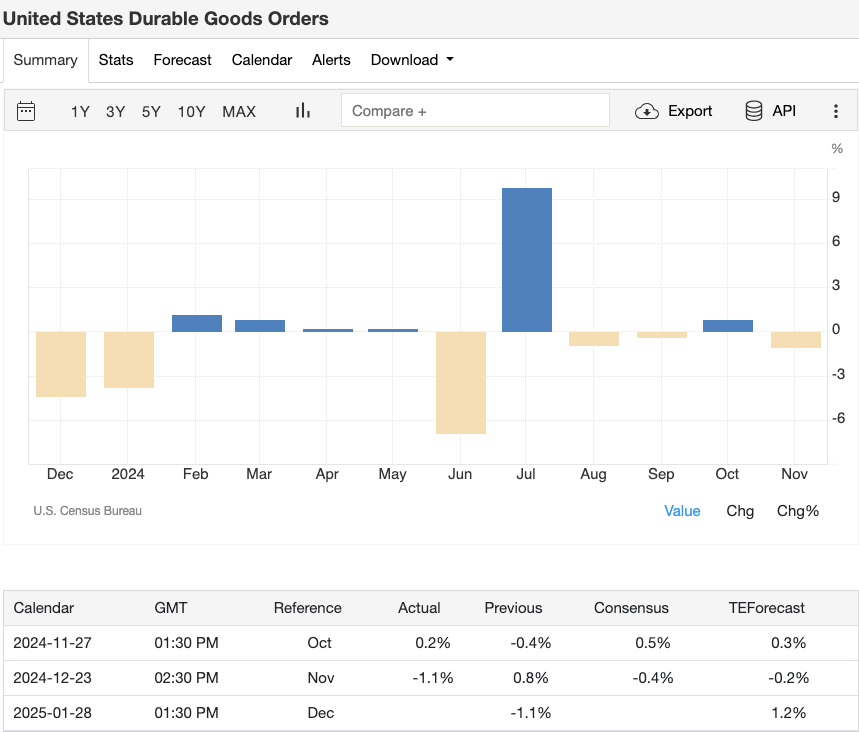

US Durable Goods Orders (Monday):

Source: Trading Economics

Durable goods orders are a key indicator of manufacturing activity. A significant decline in the data may suggest a slowdown in economic momentum, potentially putting pressure on risk assets, including cryptocurrencies. Conversely, if the data unexpectedly rises, it could provide a boost to growth-oriented sectors, driving the performance of both traditional and digital assets.

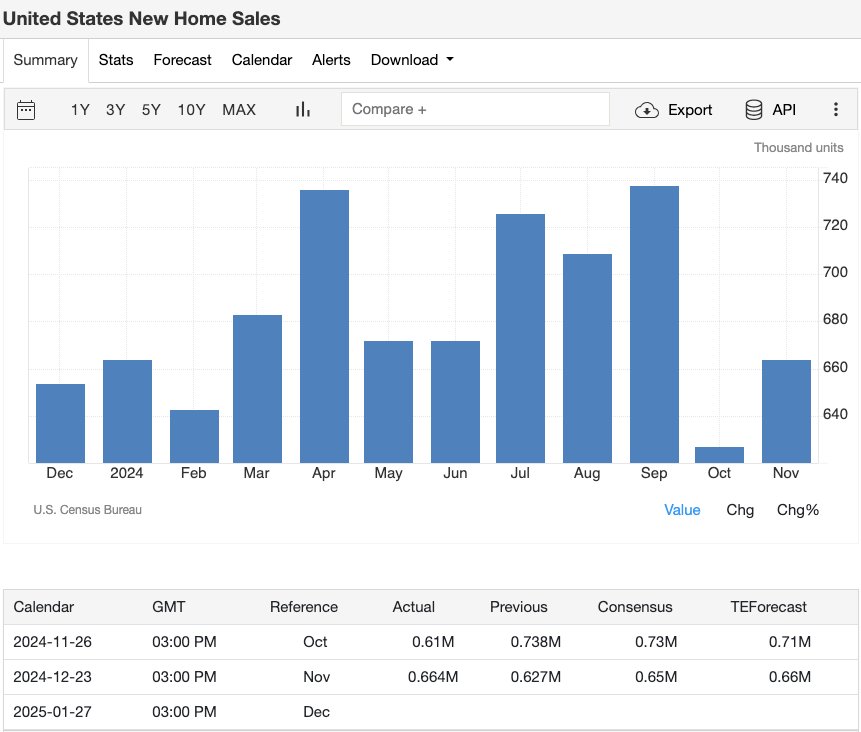

US New Home Sales (Tuesday):

Source: Trading Economics

New home sales reflect consumer confidence and the broader economic health. Strong sales data may reinforce risk appetite, benefiting high-growth crypto sectors like DeFi and NFTs. Conversely, weak data may trigger a more cautious market sentiment.

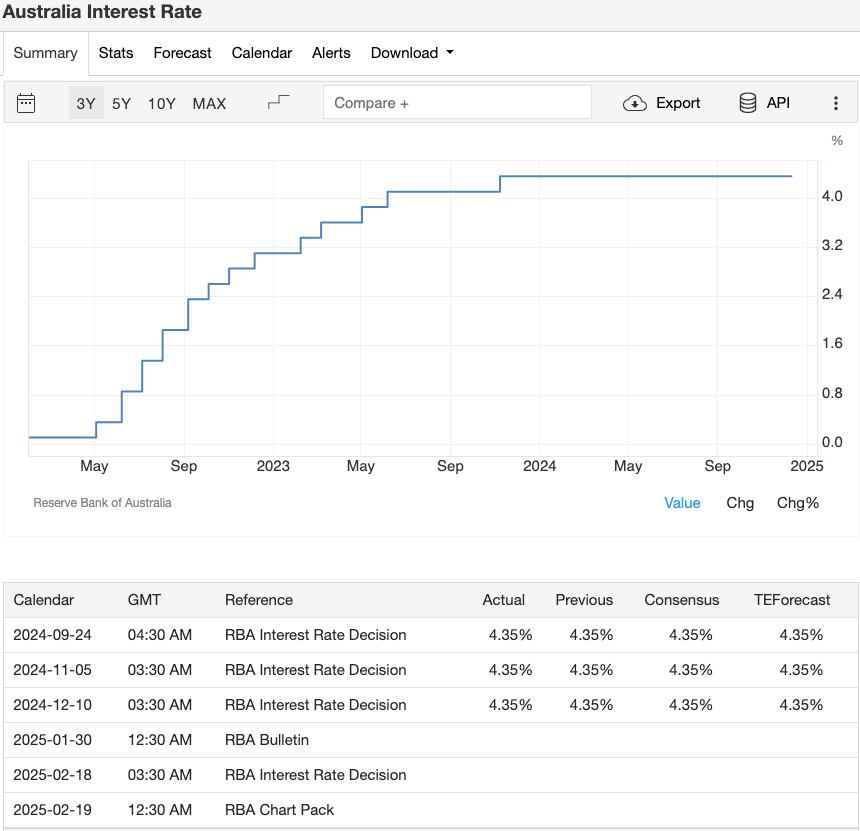

Australia Interest Rate Outlook (Tuesday):

Source: Trading Economics

The Reserve Bank of Australia's (RBA) hawkish stance on interest rate policy reflects a balance between inflation and economic growth. A dovish policy tilt may encourage capital inflows into risk assets, but the central bank's persistent caution on inflation may limit the optimism in the crypto market.

US Initial Jobless Claims (Thursday):

Source: Trading Economics

Weekly initial jobless claims data is a timely indicator of the health of the labor market. A rise in unemployment claims may weaken risk appetite, while stable or declining data may support market resilience, indirectly boosting the crypto market.

US Crude Oil Inventories Change (Thursday):

Source: Trading Economics

Changes in crude oil inventories have a significant impact on inflation expectations and broader market sentiment. A notable decrease in inventories may exacerbate inflationary concerns, while inventory oversupply could alleviate some market pressure, affecting energy-related crypto assets like Bitcoin.

Market Sentiment:

Early commentary suggests that institutional investors maintain a cautiously optimistic stance on the market, with major central banks maintaining a steady policy path. Durable goods orders and new home sales data will provide important economic context, while the dynamics of the labor market and energy inventories will offer further insights into economic stability.

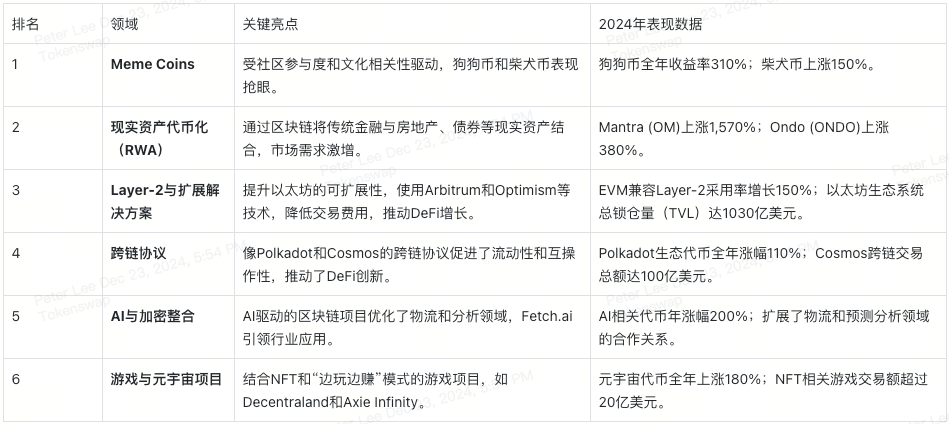

Best Performing Crypto Areas in 2024

In 2024, the crypto market experienced significant growth in several areas. From the community-driven hype led by Meme Coins, to the improvements in infrastructure with real-asset tokenization and Layer-2 solutions, these emerging sectors have injected vitality into the market. Additionally, the introduction of AI technology and the proliferation of metaverse projects have created more possibilities for the future.

As we enter 2025, these top-performing areas are likely to continue shaping the crypto market landscape. DeFi innovations, scalability solutions, and further advancements in tokenization will be key drivers of market adoption. Investors should closely monitor the dynamics in these areas to capture potential growth opportunities.

Outlook for Next Week: Week 1 of 2025

Emerging Themes

As 2024 transitions into 2025, the new week will present a series of key economic indicators that will have a significant impact on market sentiment and trading strategies. The following are the areas that require close attention:

China Manufacturing Data:

NBS Manufacturing PMI (December 31): Expected to remain stable, with a forecast value of 51, reflecting moderate growth in factory activity.

Caixin Manufacturing PMI (January 2): Expected to rise to 51.5, indicating the strongest expansion since mid-2024, driven by growth in foreign demand and exports.

German Unemployment Change (January 3):

Expected to see a slight increase of 7K in the number of unemployed, indicating that the German labor market remains resilient despite global economic headwinds.

US ISM Manufacturing PMI (January 3):

The December reading is forecast to be 48.4, suggesting that the trend of manufacturing contraction is stabilizing, with improvements in new orders and employment indices.

Australian Interest Rate Outlook:

The minutes of the Reserve Bank of Australia meeting (December 24) indicate that despite potential inflationary pressures, its policy stance remains stable. Economic activity and consumer spending have been mixed, and geopolitical risks persist.

Transitioning to 2025

Improved Chinese manufacturing data and stable German unemployment figures may boost market risk appetite. Conversely, if the US ISM Manufacturing PMI data is weaker than expected, it could dampen investor sentiment and impact the Altcoin market. Crypto traders should remain vigilant and adjust their strategies based on evolving macroeconomic signals.

Strategies and Risks

Short-term Strategies:

Position Adjustment: Expect volatility in the first week of 2025 due to manufacturing and labor market data, and use stop-loss protection to safeguard profits and reduce risk.

Timing the Market: Focus on areas that may react quickly, such as Layer-2 solutions and DeFi lending platforms, especially after a strong performance in the Chinese Manufacturing PMI data.

Long-term Positioning:

Focus on Layer-2 and Tokenization: Continue to increase focus on Layer-2 projects and the tokenization of real assets, as these areas have shown strong fundamentals.

Asset Portfolio Diversification: Utilize stablecoins to diversify investments and mitigate rapid market fluctuations, avoiding over-reliance on high-risk assets (such as Meme Coins and speculative Altcoins).

Risk Management:

Macroeconomic Data Monitoring: Closely monitor the US ISM Manufacturing PMI and German Unemployment Change, looking for economic trend signals that may impact Altcoin adoption and market sentiment.

Global Policy Impacts: Watch for unexpected statements from major central banks, particularly the Reserve Bank of Australia, to adjust investments in Australia-related digital assets and the global market.

Conclusion

The economic indicators in the first week of 2025 will provide critical signals for the market's direction. The recovery in Chinese manufacturing, the stability of the German labor market, and the improvement in US manufacturing trends will all influence global investors' risk appetite. These macroeconomic trends suggest a cautiously optimistic start to the year and potential upside for strategically positioned Altcoins.

Key Focus Areas:

Chinese Manufacturing PMI Data: This data is a key driver of global market sentiment and may impact supply chain-related tokens and overall market confidence.

US ISM Manufacturing PMI: It will provide an important reference for the health of the US economy, and its results will directly affect the attractiveness of risk assets.

German Unemployment Trends: As a pillar of the European economy, the stability of the German labor market will strengthen confidence in the European market and related Altcoins.

By closely monitoring these global trends and macroeconomic data, traders can leverage volatility to capture short-term opportunities while building a robust long-term investment framework.

Disclaimer: Economic data and forecasts are subject to change at any time. This content is for reference only and does not constitute investment advice.

Wishing you successful trading and prudent investments in the first week of 2025!