Author: Leeor Shimron

Translator: BitpushNews

2024 will be a historic inflection point for Bitcoin and the broader crypto ecosystem. This year, the first Bitcoin and Ethereum ETFs will be listed, marking true institutional adoption. Bitcoin will break the $100,000 milestone, while stablecoins continue to solidify the US dollar's dominant global position. To further drive this momentum, the winning US presidential candidate will make support for Bitcoin a core pillar of their campaign.

Overall, these milestones will cement 2024 as the year the crypto industry proves itself an unstoppable force on the global stage. As the industry shifts its focus to 2025, here are seven major predictions for what could happen next year.

1) A G7 or major BRICS country will establish and announce a strategic Bitcoin reserve

The Trump administration's proposal to establish a Strategic Bitcoin Reserve (SBR) for the US has sparked much debate and speculation. While adding Bitcoin to the US Treasury's balance sheet would require significant political will and Congressional approval, the mere proposal of this idea has far-reaching implications.

By signaling the possibility of an SBR, the US is effectively inviting other major countries to consider similar measures. Game theory suggests these nations may be incentivized to take preemptive action, potentially racing to secure strategic advantages in diversifying their national reserves before the US. Bitcoin's limited supply and its emerging role as a digital store of value may heighten the urgency for countries to act quickly.

Now, a "who's first" race is unfolding, as to which major country will be the first to incorporate Bitcoin into its national reserves, holding it alongside gold, foreign exchange, and government bonds for asset diversification. This would not only cement Bitcoin's status as a global reserve asset, but could also reshape the international financial landscape, with profound implications for economic and geopolitical power structures. Any major economy establishing a strategic Bitcoin reserve could mark the dawn of a new era in sovereign wealth management.

2) Stablecoins will continue to grow, doubling to over $400 billion

Stablecoins have become one of the most successful mainstream use cases in crypto, bridging traditional finance and the crypto ecosystem. Hundreds of millions globally use stablecoins for remittances, everyday transactions, and to hedge local currency volatility by leveraging the relative stability of the US dollar.

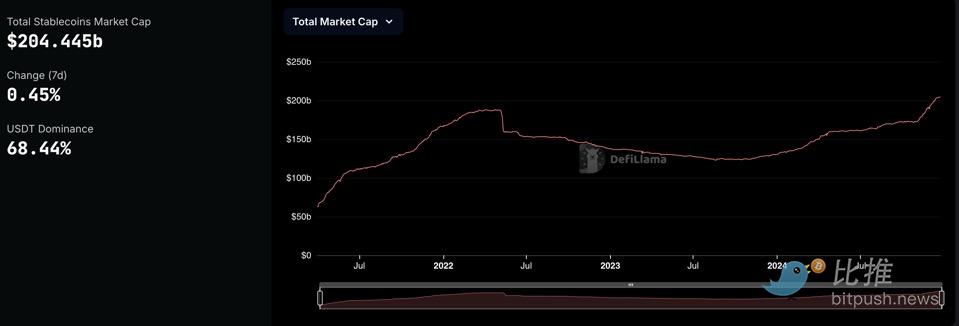

In 2024, stablecoin circulation will reach an all-time high of $200 billion, led by Tether and Circle. These digital currencies leverage blockchain networks like Ethereum, Solana, and TRON to facilitate seamless, borderless transactions.

Looking ahead, stablecoin growth is poised to accelerate in 2025, potentially doubling to over $400 billion. The passage of stablecoin-specific legislation will drive this growth, likely providing much-needed regulatory clarity and fostering innovation in the industry. US regulators are increasingly recognizing the strategic importance of stablecoins in strengthening the US dollar's global dominance and solidifying its status as the world's reserve currency.

3) Bitcoin DeFi supported by L2s will emerge as a major growth trend

Bitcoin is transcending its role as a store of value, with Layer 2 (L2) networks like Stacks, BOB, Babylon, and CoreDAO unlocking the thriving Bitcoin DeFi ecosystem's potential. These L2s enhance Bitcoin's scalability and programmability, enabling decentralized finance (DeFi) applications to flourish on the most secure and decentralized blockchain.

2024 will be a transformative year for Stacks, with the Nakamoto Upgrade and the launch of sBTC. The Nakamoto Upgrade will inherit 100% Bitcoin determinism for Stacks and introduce faster block speeds, significantly improving the user experience. Meanwhile, the trustless Bitcoin-pegged asset sBTC, launched in December, enables seamless DeFi participation - including lending, swapping, and staking - all underpinned by Bitcoin's security.

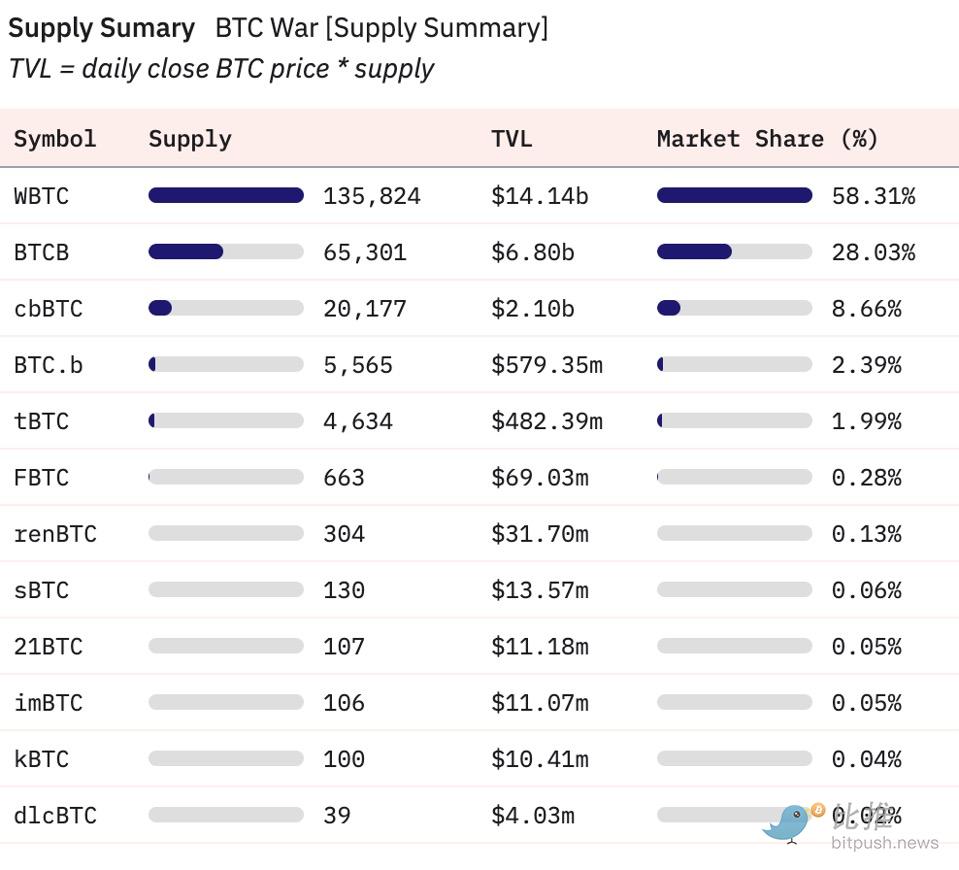

Previously, Bitcoin holders seeking DeFi opportunities were forced to move their Bitcoin to other networks like Ethereum. This process relied on centralized custodians like WBTC (BitGo), BTCB (Binance), and cbBTC (Coinbase), exposing users to centralization and censorship risks. Bitcoin L2s reduce these risks, providing a more decentralized alternative that allows Bitcoin to natively operate within its own ecosystem.

Looking ahead to 2025, Bitcoin DeFi will see exponential growth. I predict that the Total Value Locked (TVL) on Bitcoin L2s will exceed the current $24 billion represented by wrapped Bitcoin derivatives, accounting for around 1.2% of the total Bitcoin supply. As Bitcoin's market cap reaches $2 trillion, L2 networks will enable users to more securely and efficiently unlock this vast potential value, solidifying Bitcoin's position as the foundation of decentralized finance.

4) Bitcoin ETFs will continue to surge, with new crypto-focused ETFs emerging

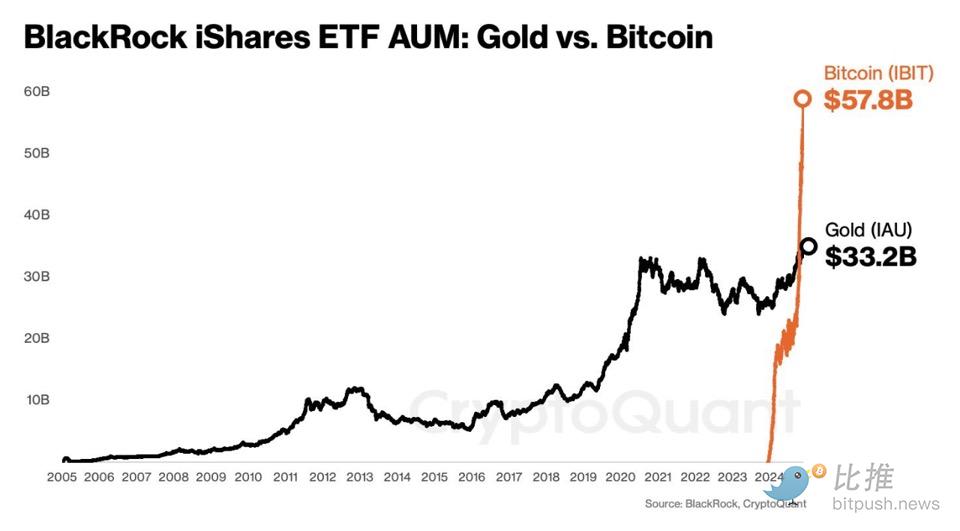

The launch of spot Bitcoin ETFs marked a historic milestone, becoming the most successful ETF debut ever. These ETFs attracted over $108 billion in Assets Under Management (AUM) in their first year, demonstrating unparalleled demand from retail and institutional investors. Major players like BlackRock, Fidelity, and Ark Invest played a crucial role in bringing regulated Bitcoin exposure to traditional financial markets, laying the foundation for a wave of innovation in crypto-focused ETFs.

Following the success of Bitcoin ETFs, Ethereum ETFs will also emerge, providing investors with opportunities to gain exposure to the second-largest cryptocurrency by market cap. Looking ahead, I expect staking to be integrated into Ethereum ETFs by 2025. This feature will enable investors to earn staking rewards, further enhancing the appeal and utility of these funds.

ETFs for other crypto protocols, such as Solana, are expected to launch soon, as Solana is renowned for its high-performance blockchain, thriving DeFi ecosystem, and rapid growth in gaming, NFTs, and memecoins.

Additionally, we may see the introduction of weighted crypto index ETFs, aiming to provide diversified investment in the broader crypto market. These indices could include top-performing assets like Bitcoin, Ethereum, and Solana, as well as emerging protocols, offering investors a balanced portfolio to capture the growth potential of the entire ecosystem. Such innovations will make crypto investing more accessible, efficient, and attractive to a wider range of investors, further driving capital inflows into the space.

5) Another "Magnificent Seven" company, besides Tesla, will add Bitcoin to its balance sheet

The Financial Accounting Standards Board (FASB) has introduced fair value accounting rules for crypto assets, effective for fiscal years beginning after December 15, 2024. These new standards require companies to report their holdings of Bitcoin and other cryptocurrencies at fair market value, capturing real-time gains and losses from market fluctuations.

Previously, digital assets were classified as intangible assets, forcing companies to record impairment charges and prohibiting the recognition of unrealized gains. This conservative approach often underestimated the true value of crypto assets on companies' balance sheets. The new rules address these limitations, making financial reporting more accurate and rendering crypto assets a more attractive asset for corporate balance sheets.

The seven giants - Apple, Microsoft, Google, Amazon, Nvidia, Tesla and Meta - have a total cash reserve of over $600 billion, giving them great flexibility to allocate some capital to Bit. With the strengthening of the accounting framework and the increase in regulatory transparency, one of these tech giants, except for Tesla, is likely to add Bit to its balance sheet.

This move will reflect prudent financial management:

Hedge against inflation: Prevent the devaluation of fiat currency.

Diversify reserves: Add uncorrelated limited digital assets to their investment portfolio.

Leverage appreciation potential: Leverage the historical long-term growth of Bit.

Strengthen technological leadership: Remain consistent with the spirit of digital transformation and innovation-driven.

With the implementation of new accounting rules and the adaptation of corporate finance, Bit may become a key reserve asset for the world's largest tech companies, further legitimizing their role in the global financial system.

6) The total market capitalization of cryptocurrencies will exceed $8 trillion

In 2024, the total market capitalization of cryptocurrencies will soar to a historic high of $3.8 trillion, covering a wide range of use cases, including Bit as a store of value, stablecoins, DeFi, Non-Fungible Tokens, meme coins, GameFi, and SocialFi. This explosive growth reflects the industry's growing influence and the increasing adoption of blockchain-based solutions across different industries.

By 2025, the influx of developer talent into the crypto ecosystem is expected to accelerate, driving the creation of new applications that will achieve product-market fit and attract hundreds of millions of additional users. This wave of innovation may give rise to breakthrough decentralized applications (dApps) in areas such as artificial intelligence (AI), decentralized finance (DeFi), decentralized physical infrastructure networks (DePIN), and other emerging fields still in their infancy.

These transformative dApps offer tangible utility and solve real-world problems, driving increased adoption within the ecosystem and boosting economic activity. As the user base expands and capital flows into the space, asset prices will also rise, pushing the overall market capitalization to unprecedented heights. Riding this momentum, the cryptocurrency market is poised to surpass $8 trillion, marking the industry's continued growth and innovation.

7) The revival of crypto startups, with the US regaining its status as a global crypto powerhouse

The US crypto industry is on the cusp of a transformative revival. The controversial "enforcement-centric" approach of Gary Gensler, the outgoing Chair of the US Securities and Exchange Commission, which has stifled innovation and forced many crypto startups to move overseas, will come to an end with his departure in January. His successor, Paul Atkins, brings a vastly different perspective. As a former US Securities and Exchange Commissioner (2002-2008), Atkins is known for his pro-crypto stance, support for deregulation, and leadership in crypto-supportive initiatives like the Token Alliance. His approach promises to establish a more collaborative regulatory framework that fosters innovation rather than suppressing it.

The end of "Operation Chokepoint 2.0", a secret plan aimed at restricting crypto startups' access to the US banking system, lays the foundation for the revival of cryptocurrencies. By restoring the right to fair access to banking infrastructure, the US is creating an environment where blockchain developers and entrepreneurs can thrive without excessive restrictions.

Regulatory clarity: The change in SEC leadership and a balanced regulatory policy will reduce uncertainty for startups, creating a more predictable environment for innovation.

Access to capital and resources: With the removal of banking barriers, crypto companies will find it easier to access capital markets and traditional financial services, enabling sustainable growth.

Talent and entrepreneurship: The reduction in regulatory hostility is expected to attract top blockchain developers and entrepreneurs back to the US, revitalizing the ecosystem.

The increase in regulatory transparency and the renewed support for innovation will also lead to a significant increase in token issuance within the US. Startups will be able to issue tokens as part of their financing and ecosystem-building efforts without fear of regulatory backlash. These tokens, including utility tokens for decentralized applications and governance tokens for protocols, will attract domestic and foreign capital while encouraging participation in US projects.

Conclusion

Looking ahead to 2025, it is clear that the crypto industry is entering a new era of growth and maturity. With Bit consolidating its position as a global reserve asset, the rise of ETFs, and the exponential growth of DeFi and stablecoins, the foundations for widespread adoption and mainstream attention are being laid.

Supported by clearer regulations and breakthrough technologies, the crypto ecosystem is poised to transcend boundaries and shape the future of global finance. These forecasts highlight a year full of potential, as the industry continues to prove itself an unstoppable force.