Table of Contents

ToggleMarket Analysis – The market gradually recovers after a major decline, do not rush to open leverage, wait patiently for Q1 next year

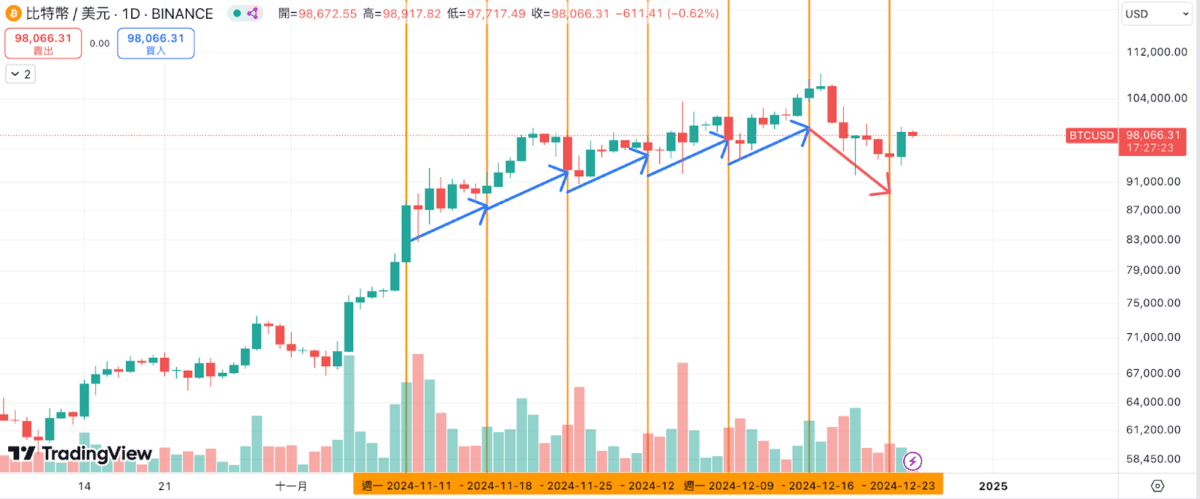

The past week can be said to be the largest decline encountered in this bull market so far, both in terms of the number of liquidations and the amount. The decline in Altcoins has also exceeded everyone's expectations, with the prices of many Altcoins having fallen back to their starting points, as if the bull market had never happened. Social media is also full of graduation articles, which really proves that only when you take profits is it true that you have made money, and before you exit, it is just paper wealth. The crypto market can change dramatically in a single day.

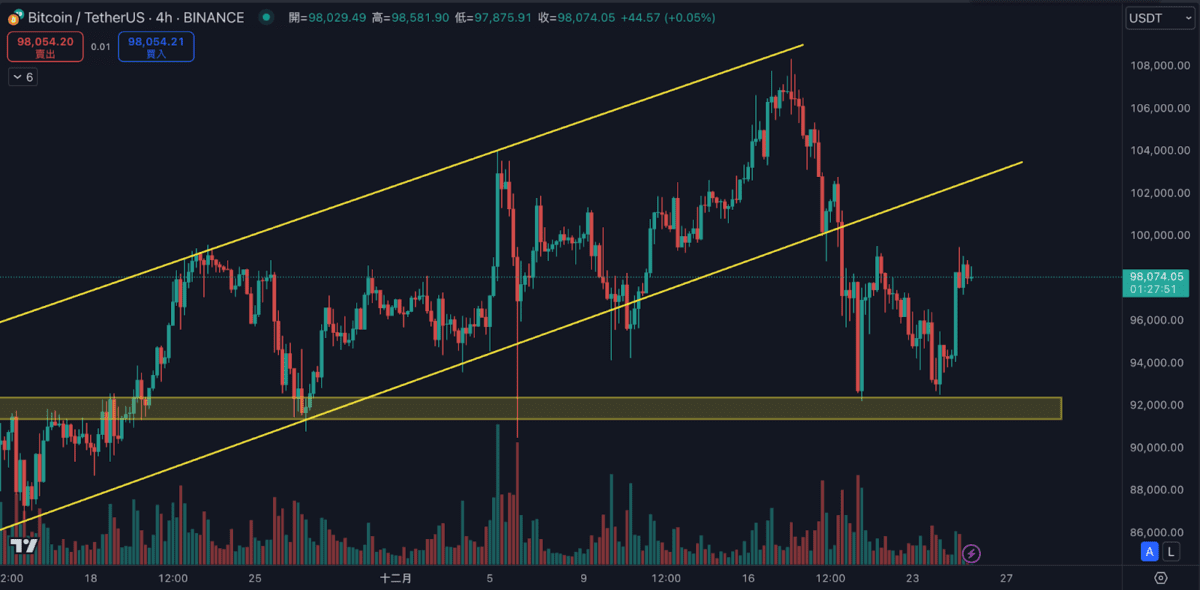

After a few days of plunge, the market saw a relatively large rebound yesterday, with BTC rebounding from a low of $92,500 to a high of $99,487, a rebound of about 6%. Altcoins also recovered simultaneously, but the overall prices are still far from the bull market highs last week. Recently, the market focus has been on AI Agent, desci, and platform tokens, among which the performance of platform tokens has been very strong despite the overall market weakness, with BNB, BGB, and GT all rising.

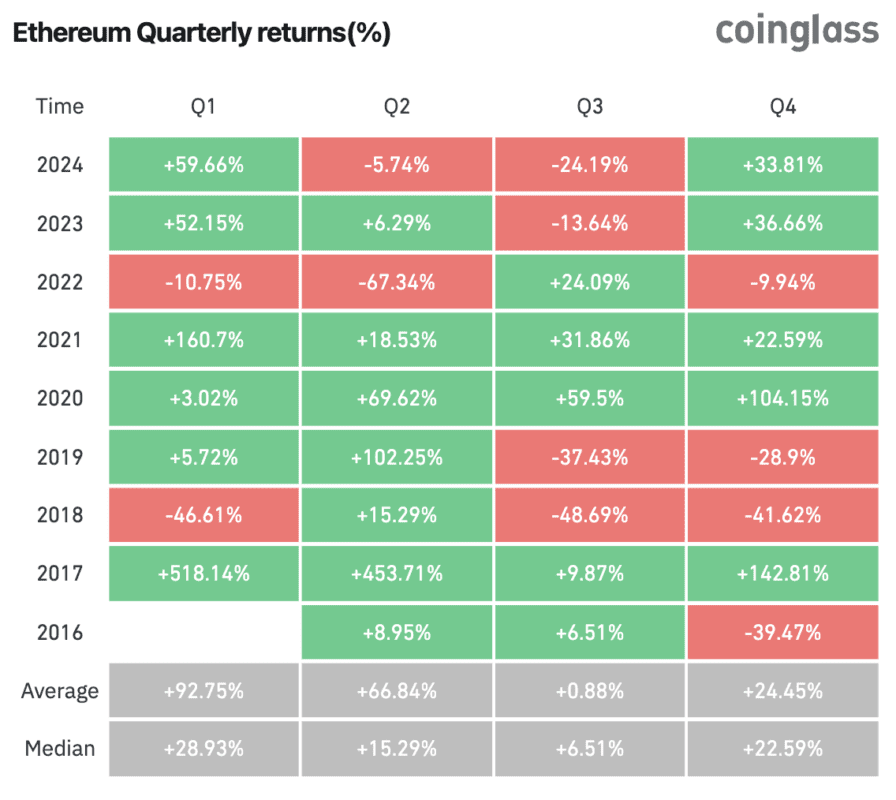

For the next operation, as mentioned in last week's report, there may be fluctuations around Christmas, and the current rebound is the first relatively obvious one after the big drop. During the rest period of European and American funds, the chance of immediately returning to the highs in the short term is not high. The coins that have risen sharply recently are mostly mid-to-late market cap coins, and the overall direction has not changed much. Therefore, GT Radar has also reduced the leverage of each investment group last week to avoid unnecessary fluctuation wear and tear. The real opportunity for a big rally will be in Q1 next year. The chart below also shows the historical Q1 gains of ETH, which are indeed the best among all quarters, so in the near future, a low-leverage or grid-based more conservative approach should be adopted.

The scale of micro-strategy buying Altcoins has shrunk

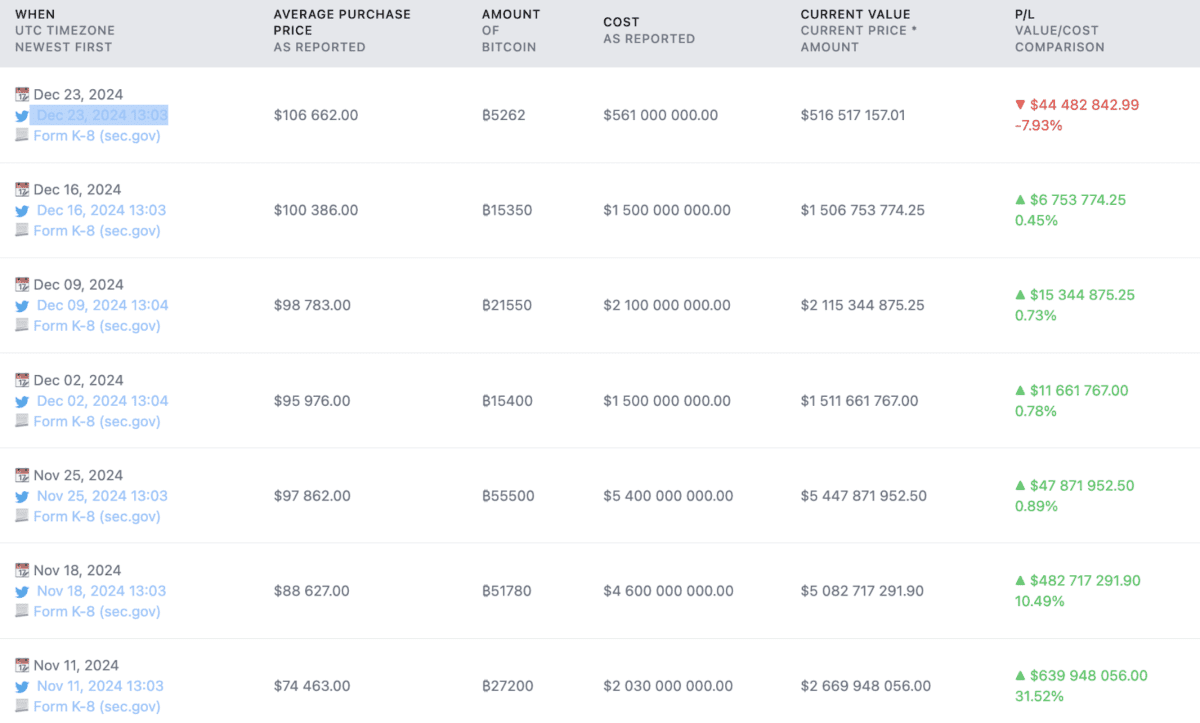

The public company micro-strategy announced this week that it has purchased $561 million worth of , with an average purchase price of $106,662. According to past records, this is the seventh consecutive week that the company has bought . However, after the company announced the purchase news, fell further, because the amount of purchased by the company was far lower than the previous few weeks (about 1/3 of the previous week), causing the market to start questioning the company's willingness to buy at this price level.

Will the "lock-up period" before micro-strategy's financial report affect the market?

On the other hand, micro-strategy is about to enter the "lock-up period" before the release of its financial report, during which (about 4 to 6 weeks) insiders will be prohibited from trading the company's stocks or related securities, and micro-strategy's convertible bonds and additional share issuance will also be restricted. In addition, although the regulations do not explicitly prohibit it, major asset transactions such as "purchasing " may be included in the company's internal restrictions. Therefore, the market generally believes that micro-strategy may not be able to participate in the market and continue to absorb market supply in the next 4 to 6 weeks.

Data shows that has shown a relatively stable upward trend in the past 7 weeks during micro-strategy's purchase period, with last week being the only time it declined. In addition to the negative news from the Federal Reserve, the weakening of micro-strategy's purchasing power may also be one of the potential factors.

Binance Copy Trading Analysis

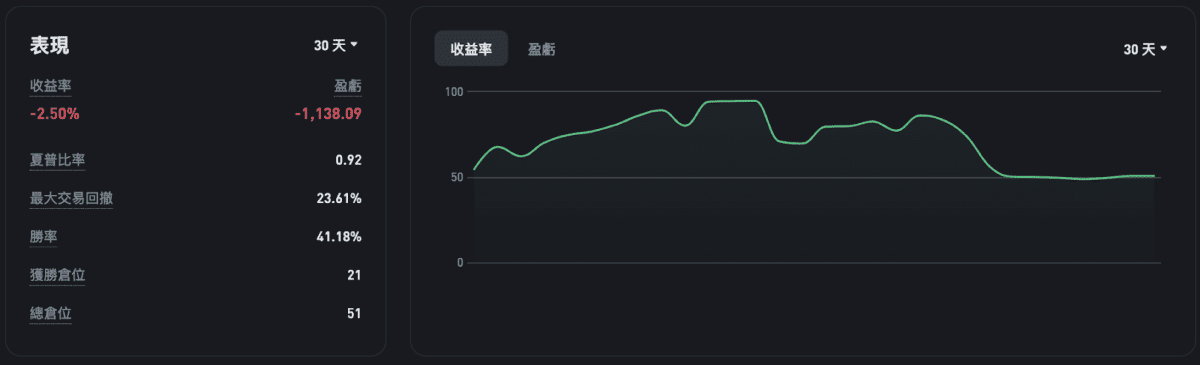

GTRadar - BULL

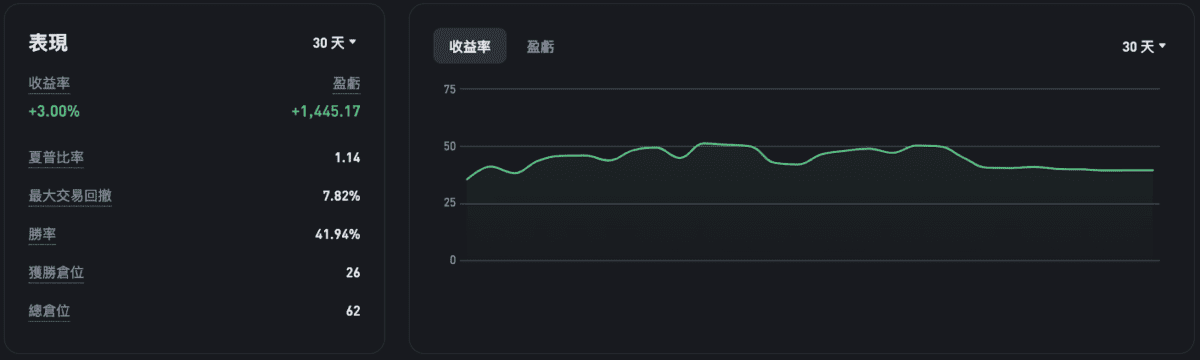

GTRadar - Balanced

GTRadar - Potential Mainnet OKX

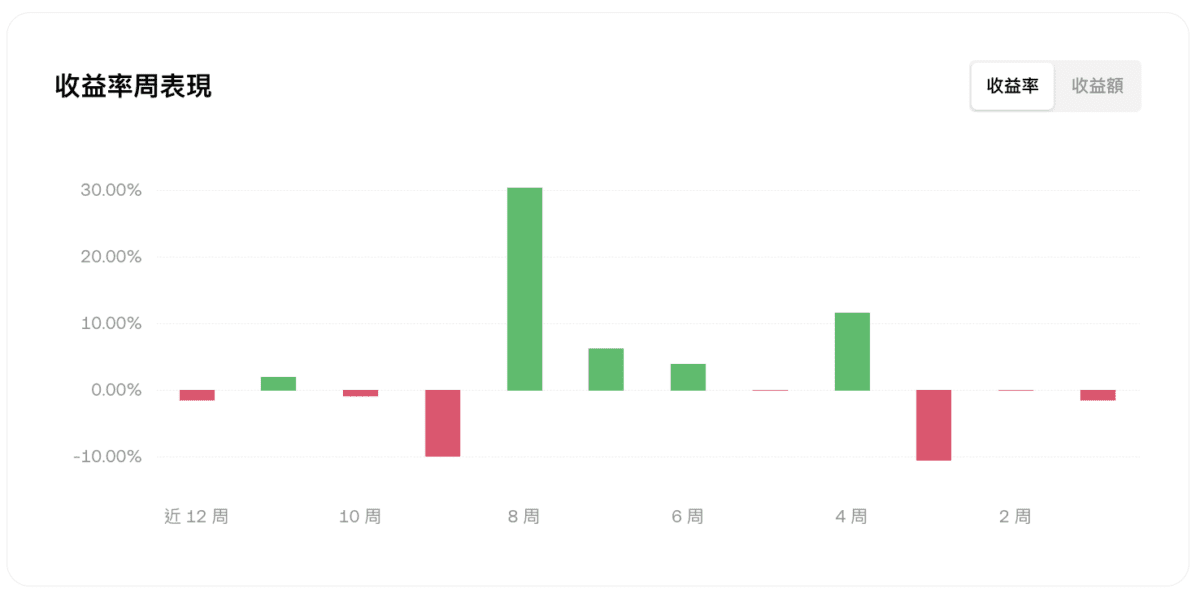

- The 7-day returns of 'GTRadar - BULL', 'GTRadar - Balanced' and 'GTRadar - Potential Mainnet OKX' are +0.39%, -0.63% and -1.63% respectively, and the 30-day returns are -2.5%, +3% and -0.57% respectively.

- Currently, 'GTRadar - BULL' holds a net long position of 10%, mainly in BTC and ETH.

- Currently, 'GTRadar - Balanced' holds a net long position of about 5%, mainly in BTC and BNB.

- Currently, 'GTRadar - Potential Mainnet' holds a net long position of about 10%, mainly in ETH.

- Copy traders who frequently change their investment portfolios tend to have lower long-term returns than those who consistently follow a single portfolio. Do not easily stop copy trading due to short-term drawdowns, as the drawdowns may actually be a good time to start copy trading, as frequent in-and-out trading can significantly reduce returns.

Headline News

Fed hints at slowing rate cuts, causing US stocks and Bitcoin to plummet

Although economists and analysts had already expected the pace of rate cuts next year to slow, the Fed officials' hint that there will only be two rate cuts in 2025 was still beyond market expectations, and the Fed also forecast that inflation may not return to the 2% target until 2027, later than the original forecast of 2026. This series of news has severely impacted the short-term trend of risk assets. In addition to the decline in the three major US stock indices, Bitcoin has also fallen from $106,000 to below $93,000 in recent days.

El Salvador recently announced that as part of a $1.4 billion loan agreement with the International Monetary Fund (IMF), the country will make major adjustments to its Bitcoin policy, including changing the mandatory acceptance of Bitcoin by merchants to voluntary, the government's gradual withdrawal from the national crypto wallet Chivo, tax payments limited to US dollars only, and restricting the scope of Bitcoin-related economic activities in the public sector.

Binance conducted a survey of 27,000 users from six continents around the world to explore the future development trends of the cryptocurrency market. 23.89% of respondents believe that the AI concept sector will emerge as the leader of the crypto market in 2025. Furthermore, in the most popular held assets among users, meme coins ranked first with a 16.1% share, indicating their high popularity and market influence.

Aptos Labs co-founder Mo Shaikh resigns as CEO

Mo Shaikh, co-founder and CEO of Aptos Labs, the development company of Layer 1 blockchain Aptos, announced on Thursday that he will step down as CEO of Aptos Labs to "start a new chapter", but will continue to serve as a strategic advisor to help the company's development.

US SEC approves first hybrid Bitcoin-Ethereum crypto index ETFs

According to documents released on Thursday, the SEC has authorized the listing of Hashdex's "Hashdex Nasdaq Crypto Index US ETF" on the Nasdaq exchange, and authorized the listing of Franklin Templeton's "Franklin Crypto Index ETF" on the Cboe BZX exchange. The documents show that the Bitcoin and Ethereum allocations of these two crypto index funds will be calculated based on free-float market capitalization.

US Bitcoin ETFs see record $680 million net outflows

According to data compiled by SoSoValue, US Bitcoin spot ETFs recorded a net outflow of $680 million last Thursday, setting a new single-day net outflow record and ending a 15-trading-day streak of net inflows. Additionally, US Ethereum spot ETFs recorded a net outflow of $60.47 million on Thursday, ending an 18-trading-day streak of net inflows.

Justin Sun continues to sell Ethereum, selling nearly 180,000 ETH in the past month

Since November 10, Justin Sun has cumulatively deposited 179,101 ETH (about $645 million) into HTX, at an average price of $3,601. As of the 25th, Sun still holds 106,905 stETH (worth about $372.4 million) and 56,277 eETH (worth about $195.8 million), of which 25,000 ETH ($87 million) are being unstaked from Etherfi and may be further transferred to HTX.

Japanese listed company Metaplanet adds 619.7 Bitcoins

Metaplanet, a Japanese company listed on the Tokyo Stock Exchange, announced on Monday that it has further acquired 619.7 Bitcoins (BTC) at a total cost of 9.5 billion yen (about $60.68 million), with an average purchase price of 15,330,073 yen per Bitcoin.

Security expert warns that Hyperliquid has been targeted by North Korean hackers

According to information shared by cybersecurity researcher Tayvano on X, multiple North Korean hacker-associated addresses are conducting transactions on the decentralized exchange Hyperliquid, and Tayvano claims that the North Korean hackers are not trading, but testing. Tayvano also repeatedly urges Hyperliquid to address this issue.

Former President Donald Trump announced on his social media platform Truth Social on Sunday that he has nominated economist and former advisor Stephen Miran to serve as Chairman of the Economic Advisory Council. The council will provide the administration with advice on economic policy and strategy.

Uniswap's Layer 2 network Unichain expected to launch public mainnet in early 2025

Uniswap Labs, the developer of the decentralized Altcoin exchange Uniswap, announced over the weekend that its Ethereum Layer 2 network Unichain is expected to launch its public mainnet in early 2025, and plans to integrate permissionless Proof-of-Stake on the launch day.

MicroStrategy announces acquisition of 5,262 BTC for approximately $561 million

According to an SEC filing disclosed by MicroStrategy on Monday, the company acquired approximately 5,262 BTC for around $561 million between December 16 and December 22, at an average price of about $106,662 per BTC. As of December 22, 2024, MicroStrategy and its subsidiaries hold a total of approximately 444,262 BTC, at an aggregate cost of around $27.7 billion and an average price of $62,257 per BTC.

Buying BTC as a corporate reserve asset? Robinhood CEO: Discussed, but no plans yet

In a recent interview with Anthony Pompliano, Robinhood CEO Vladimir Tenev stated that as Robinhood's interest in Altcoins grows, the idea of "BTC reserves" has been brought up from time to time. However, aside from holding some BTC to meet customer trading demands, the company currently has no plans to hold BTC as an investment asset.

MicroStrategy plans to issue billions of shares to purchase more BTC

According to MicroStrategy's 14A proxy statement filed with the SEC, the proposal plans to increase the Class A common stock from 330 million to 10.33 billion shares, and the preferred stock from 5 million to 1.005 billion shares. The company stated that the proposed share increase will support its "21/21 Plan" (a $42 billion BTC acquisition plan).

The above content does not constitute any financial investment advice, all data is from the official announcement of GT Radar, and each user may have slight differences due to their respective entry and exit prices, and past performance does not guarantee future results!