【Foreword】

By 2024, the development of stablecoins has gone through 10 years, during which it has withstood multiple risk shocks and trust adjustments, and has re-entered a rapid development track since the second half of 2023, attracting widespread attention from the industry, policymakers, and the academic community.

From the development trend, stablecoins have shown good resilience, gained increasingly higher market recognition, and have obvious oligopolistic characteristics, with the market capitalization share of the top two stablecoins exceeding 90%, and the market capitalization share of US dollar stablecoins exceeding 95%, and they are showing a trend of integration and development with traditional financial institutions.

From the application scenarios, stablecoins were initially mainly used for trading of crypto assets, but in recent years, their applications in conventional financial activities such as cross-border payments and foreign exchange savings, as well as in new financial activities such as decentralized finance (DeFi), have been rapidly expanding.

From the development prospects, the future development space of stablecoins depends on whether they can solve the redemption run risk in risk management, whether they can handle the market competition between central bank digital currencies and digital currency bridges in the development model, and whether they can respond to the increasingly strict access and compliance policy requirements in financial regulation.

Source: Shen Jianguang, Zhu Taihui: "Ten Years of Stablecoin Development: Trends, Applications and Prospects", International Finance, 2024 Issue 12, pp. 68-73.

Stablecoins are digital currencies issued by the private sector based on fiat currencies or other assets (such as USDT, USDC, DAI, etc.), of which more than 95% are US dollar-based stablecoins; there are also stablecoins based on digital assets or collateralized (such as DAI), stablecoins collateralized by physical assets such as gold and silver (such as PAXG), and a small number of algorithmic stablecoins without collateral (such as FRAX).

Since the launch of the first stablecoin (USDT) in 2014, the development of stablecoins has withstood multiple risk shocks, and has re-entered a rapid development track since the second half of 2023. As of November 2024, the total market capitalization has already approached $200 billion, and with the rapid development of Web3.0, the development trend, application scope and future prospects of stablecoins have once again attracted widespread attention from all walks of life.

Stablecoins are issued based on blockchain technology and have a good balance between openness and stability in their functional characteristics. Specifically, stablecoins have very good openness, support controllable anonymity, can be traded directly peer-to-peer, and have a cross-border nature; at the same time, unlike "native" cryptocurrencies such as Bitcoin, stablecoins maintain relatively stable value by pegging to the US dollar, Euro, or other traditional fiat currencies, or by pegging to physical assets such as gold.

Stablecoins are the bridge between central bank digital currencies (the digitization of fiat currencies) and digital assets (Token based on algorithms).

In the digital asset (cryptocurrency) field, there is a clear pyramid structure in liquidity: at the top are stablecoins pegged to fiat currencies, followed by Bitcoin and Ethereum, then ERC20 type cryptocurrencies and native tokens of other blockchains, and at the bottom are Non-Fungible Tokens (NFTs) (Zou Chuanwei et al., 2023).

As of November 2023, the total market capitalization of digital assets has already exceeded $3.27 trillion. In most cases, digital assets can only obtain real purchasing power after being converted into fiat currencies.

Stablecoins, especially US dollar stablecoins, are the unit of account, medium of exchange, and store of value in the digital asset and cryptocurrency market, and their trading volume has long surpassed the sum of the two largest cryptocurrencies - Bitcoin and Ethereum.

01 Trends in Stablecoin Development

(I) In terms of total volume, stablecoins have recovered a rapid growth trend after weathering the shocks

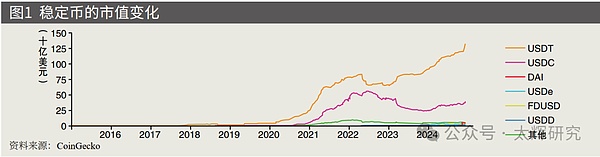

Three major factors drove the rapid growth of the stablecoin market from 2017 to 2021. USDT and USDC are the two largest stablecoins globally, accounting for about 90% of the stablecoin market, and their trends basically represent the overall trend of the stablecoin market.

Prior to 2017, USDT's market capitalization was always below $7 million, but starting from 2017, benefiting from the bull market in digital assets, Tether's simultaneous launch on three major exchanges, and China's ban on virtual token issuance, USDT saw a surge in volume, reaching nearly $1.4 billion by the end of 2017, and then maintained rapid growth for nearly 5 years. The growth trend of USDC was similar to that of USDT from its launch to May 2022.

The collapse of UST caused the stablecoin market to experience a correction of about a year.

In the first half of May 2022, the value of the world's third largest stablecoin TerraUSD (UST) plummeted from $1 to a low of $0.04 in 5 days, causing a huge shock to the entire stablecoin market.

USDT's market capitalization fell from $83 billion to $65.8 billion in mid-July 2022, and did not return to $83 billion until May 2023.

USDC's market capitalization fell from around $55 billion in May-June 2022 to around $45 billion by the end of 2022; in March 2023, it was hit by the collapse of Silicon Valley Bank (where USDC's reserve funds were held at the time) and regulatory decoupling investigations, and by December 2023 its market capitalization had further dropped to around $25 billion.

Stablecoins have gradually resumed rapid growth since the second half of 2023.

With the dissipation of risk shocks and the improvement in stablecoin transparency, the stablecoin market has re-entered a rapid growth track, especially since November 2023.

As of November 24, 2024, the total market capitalization of stablecoins has reached nearly $200 billion, of which USDT's market capitalization has exceeded $130 billion, more than 1.5 times the pre-May 2022 level; USDC's market capitalization has exceeded $39 billion, still some distance from the high of $56 billion in May-June 2022.

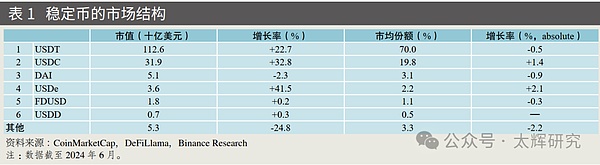

(II) In terms of structure, the stablecoin market exhibits a clear oligopolistic characteristic

In terms of issuers, stablecoins issued by Tether and Circle account for about 90% of the market. USDT was launched in November 2014 and USDC in October 2018, and they are the two largest stablecoins globally, accounting for about 70% and 20% of the stablecoin market respectively, and their trends basically represent the overall trend of the stablecoin market.

In terms of currency types, US dollar stablecoins are the main channel for capital inflow and outflow in the cryptocurrency market. Currently, fiat currency stablecoins, especially US dollar stablecoins, are dominating, serving as the unit of account, medium of exchange, and store of value in the cryptocurrency market, with their trading volume long surpassing the sum of the two largest cryptocurrencies - Bitcoin and Ethereum.

The two largest stablecoins, USDT and USDC, are both US dollar stablecoins, and together with other types of US dollar stablecoins, US dollar stablecoins account for more than 95% of the supply. In addition, these stablecoins are mainly issued on the Ethereum blockchain, with increasing attention on blockchains such as TRON.

(III) In terms of model, the cooperation between stablecoins and traditional financial institutions is constantly expanding

In the payment sector, in 2020, the US online payment company PayPal began to support consumers to trade cryptocurrencies through their PayPal and Venmo accounts, and launched the US dollar-pegged stablecoin PayPal USD; in September 2024, it announced that it would allow merchants to buy, hold and sell cryptocurrencies through their business accounts.

In October 2024, the US online payment company Stripe acquired the stablecoin platform Bridge for $1.1 billion, the largest acquisition in the cryptocurrency field to date.

At the same time, Stripe has resumed the service of US businesses making cryptocurrency payments using the stablecoin USDC on Ethereum, Solana and Polygon.

In the financial institution sector, in September 2024, Japan's three major banks - MUFG, SMBC and Mizuho - jointly launched a cross-border payment system called "Project Pax": using stablecoins instead of traditional intermediary banks in cross-border payment models to improve efficiency and reduce costs.

The project integrates SWIFT payment information into the stablecoin system, allowing banks to use stablecoins for settlement, but corporate clients do not need to contact or understand the operation of stablecoins.

Here is the English translation of the text, with the terms in <> retained and not translated: In terms of asset allocation, a survey conducted by EY-Parthenon (2023) in April 2023 on 256 global institutions showed that although some institutional investors remain cautious about investing in and , more and more institutional investors are optimistic about the investment prospects in this field and will increase their investment allocation: 25% of institutional investors increased their holdings of , and related products in 2022, 38% of institutional investors will increase their holdings in 2023, and 69% of institutional investors are expected to increase their holdings in 2024-2025, with asset management companies and hedge funds expected to increase the most (81% and 71% respectively).The "Multi-Currency Bridge" platform conducts cross-border payments, and the transaction parties do not need to keep separate accounts. Cross-border transactions can be realized with synchronized settlement, and it can also be applied to cross-border fund transfers (cross-border foreign exchange transactions), realizing synchronized settlement of foreign exchange transactions (PvP).

Compared to the traditional cross-border payment model, the "Multi-Currency Bridge" has the function of "peer-to-peer" payment. Benefiting from the use of distributed ledger technology, the banks on the platform can realize "payment equals settlement" without the need to open accounts with each other or open accounts with a third-party institution, realizing synchronized settlement of foreign exchange transactions (PvP), and the entire process is completed in real-time, greatly improving the efficiency of payment settlement.

At the same time, the "Multi-Currency Bridge" uses modular construction, separating and modularizing different functions, improving the scalability of the platform. Participating countries and regions do not need to establish a local CBDC system to join the "Multi-Currency Bridge", greatly reducing the entry threshold.

However, it should be pointed out that although it has programmability based on smart contracts, which improves the efficiency of payment settlement, some users are concerned that the government can control the use of CBDC, and privacy is difficult to be fully protected due to the monitoring of transactions.

(3) In financial regulation, policy uncertainty will still be the most important factor affecting the development of stablecoins

Stablecoins have a substitution effect on the currency of the user's country or region. Currently, only a few countries and regions such as the European Union have formulated relevant laws, and other countries and regions have not yet clarified the regulatory policies for stablecoins in payment and asset transactions. Regulatory uncertainty will have a significant impact on the development of stablecoins and digital assets, as well as the development of high-compliance stablecoins (such as USDC) and low-compliance stablecoins (such as USDT).

In October 2020, the Financial Stability Board proposed high-level regulatory recommendations for the sound development of stablecoins.

The core of the FSB's regulatory recommendations is to comprehensively include stablecoin-related activities and functions into regulation in accordance with the principle of "same business, same risk, same regulation" (FSB, 2020), specifically including: clarifying the specific regulatory authorities based on the functions and activities of stablecoins, defining the product attributes of stablecoins (whether stablecoins are securities or commodities, etc.), and the institutional licenses required for stablecoin issuers (whether they need to hold money transfer service provider licenses or bank-type licenses, etc.); clarifying the specific regulatory measures for stablecoin-related activities, such as requirements for stablecoins to deal with redemption "bank runs", anti-money laundering and counter-terrorist financing requirements, etc.; and strengthening cross-border regulatory coordination and cooperation (especially in cross-border payments).

The European Union is at the forefront of crypto-asset regulation.

In April 2023, the European Parliament formally passed the Regulation on Markets in Crypto-Assets (MiCA), which clarified the types of crypto-assets covered by regulation, the transparency and disclosure requirements for the issuance, public offering and trading of crypto-assets on trading platforms; the authorization and supervision requirements for crypto-asset service providers, issuers of asset-referenced tokens and e-money token issuers, as well as their operational, organizational and governance requirements; the requirements for the protection of holders in the issuance, public offering and trading of crypto-assets; the requirements for the protection of clients of crypto-asset service providers; and the measures taken to prevent insider trading, unlawful disclosure of inside information and market manipulation.

With the formal implementation of MiCA, the crypto-currency exchange OKX has stopped supporting USDT trading pairs within the EU, and Binance and Kraken are considering delisting USDT from their European platforms; but the issuer of USDC, Circle, announced in July 2024 that USDC and EURC stablecoins have already met the requirements of MiCA and become the first compliant global stablecoin issuers under the MiCA regulation.

It is expected that licensed access and compliant regulation for stablecoin operations will be the trend in the future. In December 2023, the Hong Kong Monetary Authority and the Hong Kong Financial Services and the Treasury Bureau jointly issued a public consultation document on the regulation of stablecoins and digital assets, requiring stablecoin issuers to apply for relevant licenses from the Monetary Authority and meet requirements such as capital requirements, stabilization mechanisms, and compliance with anti-money laundering and counter-terrorist financing regulations.

The United States is also formulating a regulatory framework for stablecoins and digital assets, with the current direction being that stablecoin operations must comply with existing regulations and legal requirements, such as meeting the anti-money laundering and know-your-customer (KYC) requirements of the Financial Crimes Enforcement Network (FinCEN) and obtaining money transmission licenses in various states.