It was a historic year for the cryptocurrency industry. There were defining moments that shaped many industries during 2024, and we have selected the five most impactful events that propelled the cryptocurrency market to an all-time high.

From the SEC's approval of a Bitcoin ETF to the crazy meme coin rally, here are the five key events that shaped the cryptocurrency market in 2024.

SEC Approves Bitcoin Spot ETF

In the fourth quarter of 2023, Grayscale scored a remarkable legal victory against the SEC in the matter of converting their Bitcoin Trust into an Exchange Traded Fund (ETF). This sparked exciting anticipation for asset management firms to bring Bitcoin to the institutional market, which materialized in January 2024.

The year started with the SEC approving 12 Bitcoin spot ETFs, marking the first time Bitcoin entered the US retail investment market. The impact was immediate, with retail investors pouring hundreds of millions of dollars into these funds. In fact, the Bitcoin ETFs grew faster than any other ETF in history.

Consecutively, Bitcoin broke its all-time high from 2021 in just under two months after the approvals, crossing the $70,000 barrier in March. This success influenced the introduction of Bitcoin-based Exchange Traded Products (ETPs) in other global markets like the UK.

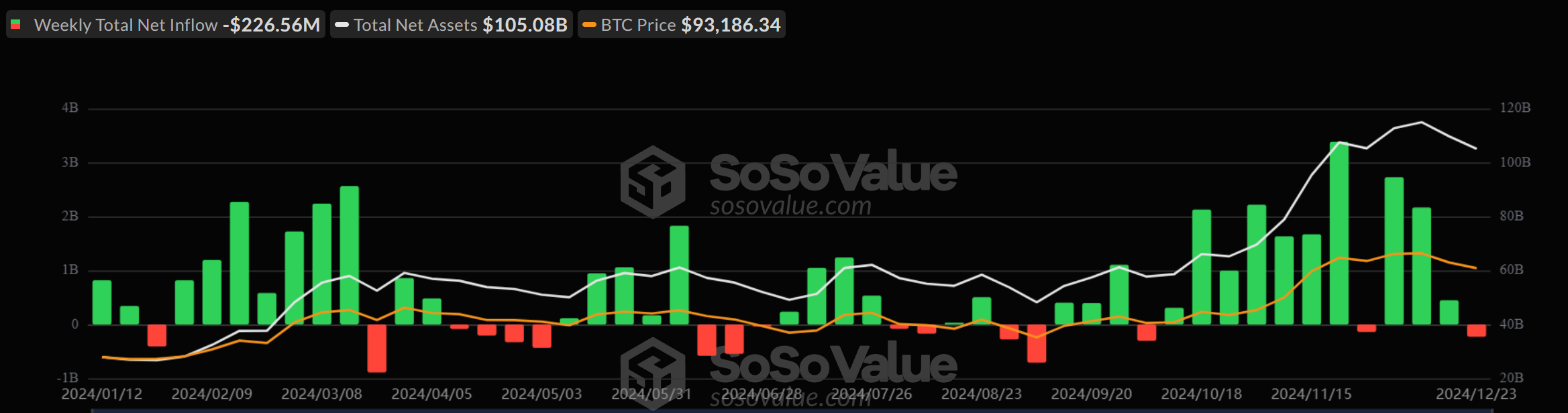

As of Christmas 2024, the 12 US Bitcoin spot ETFs have exceeded $105 billion in total net assets, accounting for nearly 5.7% of the BTC supply. Notably, these ETFs now manage more assets than gold ETFs.

The remarkable success of Bitcoin ETFs in the US has opened the doors to institutional adoption of cryptocurrencies. Soon after, Ethereum ETFs were also approved, and several other altcoins have submitted similar applications to the SEC.

"This year's market momentum has shown that regulated financial products play a crucial role in driving adoption. The substantial inflows into existing ETFs highlight strong demand for regulated cryptocurrency investment tools. Financial institutions have incentives to expand their offerings if market performance supports additional assets. Looking ahead to 2025, we expect to see a wider range of cryptocurrency ETFs entering the market." – Forrest Bai, Co-Founder of Foresight Ventures

While the Bitcoin ETF has opened the gates, industry experts believe 2025 will set an even bigger stage, with a variety of cryptocurrency ETFs dominating the retail market. Cardano Stadelman, CTO of the Komodo platform, thinks a Solana ETF will take the lead, given that former US President Donald Trump had previously launched his NFT collection on this network.

However, some industry experts express more cautious views, concerned that the increased inflows into these funds could lead to liquidity issues.

"Cryptocurrencies have their own cycles, and retail activity, DeFi growth, and global adoption all play a big role in price movements. However, if too much liquidity gets tied up in ETFs in the traditional markets, there are risks. To thrive in the long term, cryptocurrencies need to focus on building decentralized solutions that don't solely rely on external validation." – John Patrick Mullin, CEO and Co-Founder of MANTRA

Solana Meme Coin Frenzy

The cryptocurrency community will remember 2024 as the year of the Solana meme coin craze. Meme coins already existed on Solana, but platforms like Pump.fun helped propel their popularity.

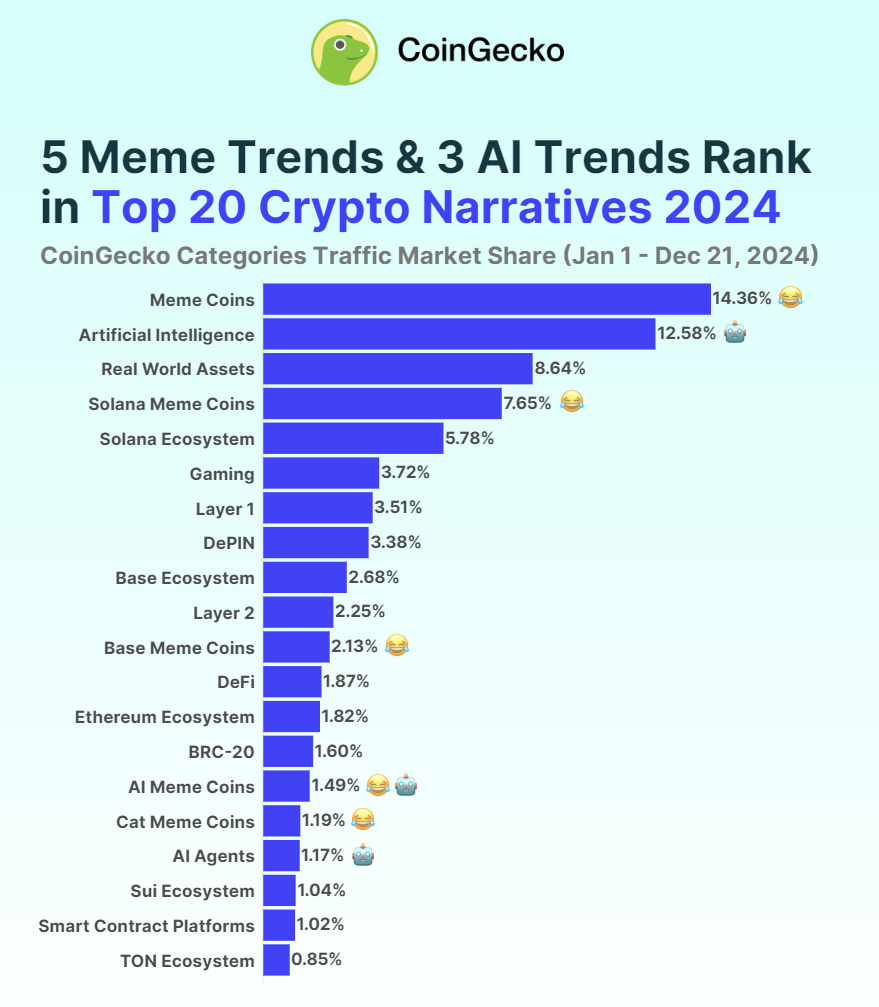

This momentum has catapulted Solana's meme coins to the 4th spot in investor interest, accounting for 7.65% of the discussion around cryptocurrency narratives, according to CoinGecko.

Additionally, the total market value of Solana-based meme coins now exceeds $16 billion. In fact, three out of the top five meme coins in the market, including DogwifHat (WIF) and BONK, are operating on the Solana network. WIF has surged over 1,100% this year, while BONK has seen an astonishing 38,000% growth over the past 2 years.

"While meme coins have gained popularity, we believe their dominance will fade as they transition to meaningful utility and real-world adoption. Emerging technologies like AI agents and confidential computing will draw more attention to more impactful blockchain use cases." – Jonathan Schemoul, CEO of Aleph.im and key contributor to LibertAI

Meanwhile, this surge in meme coin activity has propelled Solana to become the second-largest blockchain after Ethereum. The network's Total Value Locked (TVL) has exceeded $8.6 billion, and SOL reached an all-time high of $263 in November.

So, what made Solana so appealing to meme coin creators in 2024? The answer lies in its scalability and accessibility. Pump.fun has simplified the token launch process, requiring minimal effort to create and distribute meme coins.

"2024 was the year Solana established its dominance in the meme coin market, but in 2025, AI meme coins could gain attention, leading to diversification. Companies like a16z and Crew AI have made it easier than ever to create AI-based tokens by launching open-source frameworks for autonomous AI agents. This could encourage projects to explore other blockchains like Sui that are suitable for AI meme coins with fast transactions and low costs." - Hisham Khan, CEO & Co-founder of Atoma

Additionally, Solana's low transaction fees have facilitated widespread participation by combining humor and financial opportunities. These factors drove the explosive growth of meme coins on Solana during 2024.

However, the extreme volatility of these meme coins has raised concerns in the market. Recent statistics show that most Solana meme coin traders are actually incurring losses, with only a few profiting from speculative trading.

"There is a shift from memes to meaning, from rapid ascent and rug pulls to projects focused on real utility and community adoption." - Matt O'Connor, Co-founder of Regin

'Crypto President' Donald Trump Wins US Election

While cryptocurrencies aim for decentralization, the political influence cannot be denied due to regulatory factors. Donald Trump's electoral victory in 2024 had a significant impact on the cryptocurrency industry, bringing optimism and growth.

His pro-crypto stance had already led to several major developments even before his official presidential term began.

After Trump's victory, the cryptocurrency market surged by nearly $1 trillion as investors felt regulatory oversight would be relaxed. Consecutively, Bitcoin reached new all-time highs, eventually reaching $100,000.

However, the biggest impact was on Ripple's XRP, which had been suppressed for nearly 4 years due to SEC lawsuits. With Trump's victory and the promise of SEC restructuring, XRP recorded its highest price in 6 years.

"If the US continues to ease regulations, it will have a ripple effect globally. Countries like China and Russia may not immediately jump into cryptocurrencies, but they will take note as tokenized assets and blockchain technology become essential to global finance." - John Patrick Mullin, CEO & Co-founder of MANTRA

The administration's positive outlook encouraged institutional investors to enter the market, further legitimizing digital assets. Trump's appointments of crypto-friendly candidates like Paul Atkins, David Sacks, and Elon Musk signal a shift towards more crypto-friendly policies.

Additionally, Trump had promised to pursue a national Bitcoin reserve during his campaign, and his party's senators have agreed with this idea. These discussions demonstrate the willingness to integrate cryptocurrencies into the national financial system.

"The strategic Bitcoin reserve plan would be the most audacious macroeconomic plan. The incoming president has confirmed plans to halt CBDC efforts and support self-custody for cryptocurrency holders. Crypto-friendly individuals have close ties to the president, which could help the next administration deliver on its cryptocurrency promises." - Maxim Sakharov, Co-founder of WeFi

The pro-crypto policies have already increased cryptocurrency adoption globally, with a 683% increase among 18-25-year-old users, indicating growing interest from the younger generation.

The European market has also seen substantial inflows into cryptocurrency-related exchange-traded products, reflecting an optimistic outlook for the industry's future.

"The changes in the US could trigger greater legitimacy and institutional adoption globally, potentially setting a standard that other regions can follow. A notable region is China's cryptocurrency market and Hong Kong, which has emerged as an important gateway for innovation. Hong Kong's progressive crypto stance is clear, having launched an Ethereum ETF before the US, demonstrating its openness to digital assets." - Forrest Bai, Co-founder of Foresight Ventures

As the industry continues to evolve, sustained high-level government support will play a crucial role in shaping its future path.

Bitcoin Price Surpasses $100,000

Perhaps the biggest and most anticipated event of 2024 was Bitcoin reaching $100,000. This was a psychological milestone for Bitcoin and the entire cryptocurrency community. Reaching six-digit figures reflects the asset's maturity and has boosted the confidence of both institutional and retail investors.

For companies like MicroStrategy, who have consistently supported a Bitcoin-first strategy, this was a validation of their predictions. This is reflected in MSTR's stock performance and its recent inclusion in the Nasdaq-100.

Additionally, after reaching $100,000, more governments have started to consider the idea of Bitcoin reserves, including countries that were previously skeptical about cryptocurrencies, such as Russia and Japan.

Companies like Amazon are also reportedly exploring Bitcoin investments, suggesting the potential for cryptocurrencies to be integrated into business models. Such interest from major corporations could drive further adoption and innovation within the cryptocurrency ecosystem.

"This historic milestone has shown how policy changes can drive institutional adoption. However, the recent pullback serves as a reminder that Trump's pro-crypto stance was quickly reflected in prices after the initial rally. Major global financial hubs are already recalibrating their approaches. But market volatility is likely to persist amid macroeconomic uncertainty. Particularly with the Federal Reserve's 2025 rate hike schedule remaining uncertain," - OKX Global CCO, Lennix Lai.

In summary, Bitcoin reaching $100,000 has strengthened its legitimacy and encouraged wider adoption in the public and private sectors. However, the threat of volatility remains high due to macroeconomic uncertainty.

Gary Gensler Resigns

Gary Gensler's tenure at the SEC has been challenging for the U.S. cryptocurrency industry. However, with Trump's re-election, the SEC is undergoing significant restructuring.

In November, Gary Gensler announced his resignation as SEC Chair. Gensler was a controversial figure in the cryptocurrency industry due to his strict regulatory approach.

"Gensler's policies were extreme, but the question remains whether we will move to another extreme. I think there has already been progress in the SEC towards a more neutral stance and pushing for regulation/adoption," - HELLO Labs CEO, Sander Gortjes.

During his tenure, Gensler argued that most cryptocurrency tokens should be considered unregistered securities and must comply with existing securities laws. This perspective led to enforcement actions against major cryptocurrency exchanges, including Binance and Coinbase.

Critics argue that Gensler's "regulation by enforcement" strategy created uncertainty and hindered innovation in the cryptocurrency space. Meanwhile, Trump has already nominated Paul Atkins as his successor, who is a long-time advocate of digital assets.

"There are more pieces that need to fit together on the path to greater regulatory clarity for cryptocurrencies. Global regulators need to be on the same page, the market needs to mature, and institutions need to be ready. More crypto-friendly regulation can bring more institutional players to the table, but it's worth remembering the inherent volatility of cryptocurrencies. Bitcoin's 10-15% swings and larger moves in smaller tokens will persist regardless of the regulatory environment," - OKX Global CCO, Lennix Lai.

The cryptocurrency community views this transition as an opportunity for a more favorable regulatory environment. They expect the new administration to adopt policies that support industry development.

"Gary Gensler is not the origin of the SEC's crackdown on cryptocurrencies in the U.S. However, he expanded enforcement actions more than his predecessors. With Paul Atkins, market innovators may find their relationship with regulators to be easier and more rewarding," - WeFi co-founder, Maxim Sakharov.

Overall, Gensler's tenure at the SEC was characterized by a strict stance on cryptocurrency regulation, which led to significant friction with industry participants who perceived his policies as obstacles to innovation and growth.