In the crypto bull market, there are many opportunities to make money, but there are still unpredictable risks that may arise.

Crypto whales are investors who hold large amounts of cryptocurrencies, including individuals, corporate institutions, and governments. Why do we need to pay attention to the movements of whales? This is because when these whales with large amounts of cryptocurrencies or funds make transactions, they can bring buying pressure and selling pressure (too many sellers, causing the price to fall) that affect the currency price.

For example, when it was reported in early December that the US government had transferred nearly 19,800 bitcoins (worth about $19 billion at the time) to the Coinbase exchange, the market believed that the US government was about to sell these bitcoins, causing the bitcoin price to plummet below $96,000. Typically, when whales transfer assets to an exchange, it can be seen as a "sell" signal, so it is important to be aware of relevant alerts in a timely manner. Next, we will introduce a few tools for monitoring whales!

Etherscan

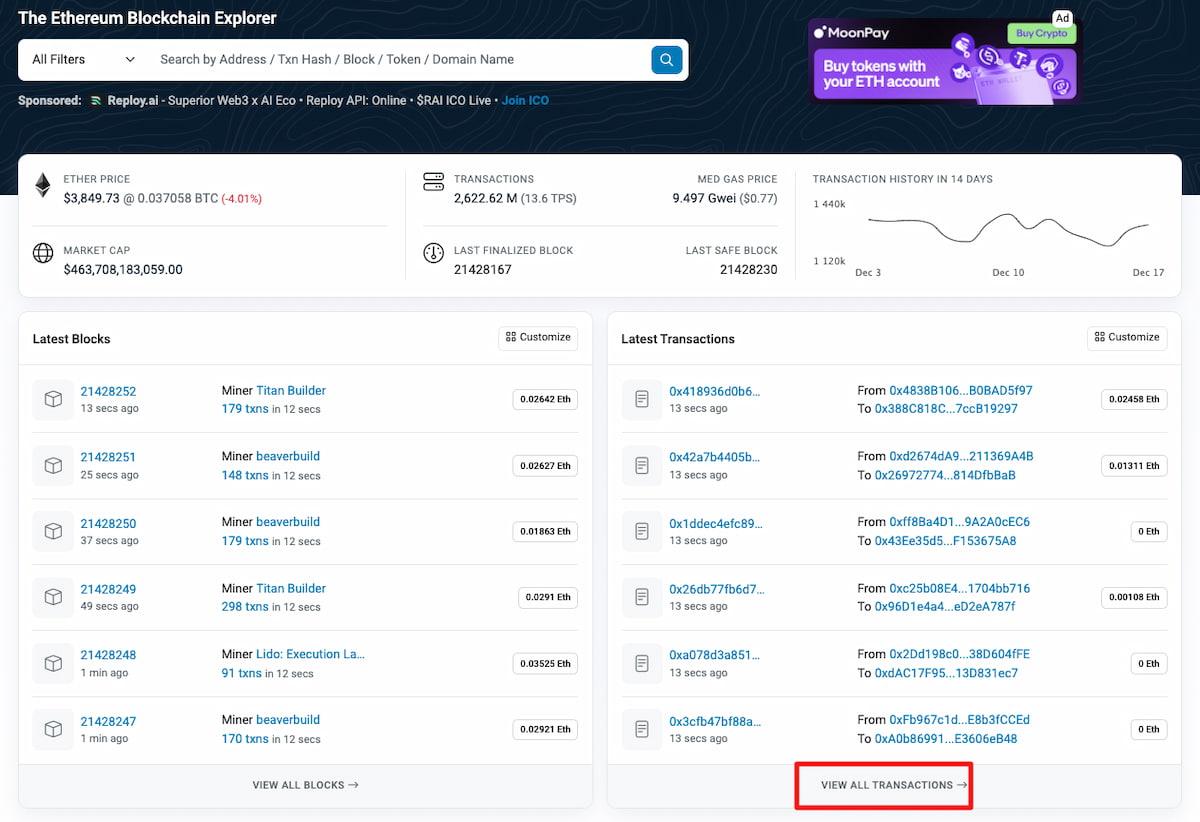

Etherscan is an Ethereum blockchain explorer, where users can see all Ethereum transaction data, market capitalization, Ether current price, and current Gas fee information.

What is Ethereum? How is Gas fee calculated? Recommended reading: What is a smart contract public blockchain? (Part 1) | A guide to the leading second-generation blockchain - Ethereum!

1. After entering the Etherscan homepage, you can first register an account, and then you can create a whale observation list. After registration, click the "View all transactions" in the bottom right corner to open the detailed transaction list.

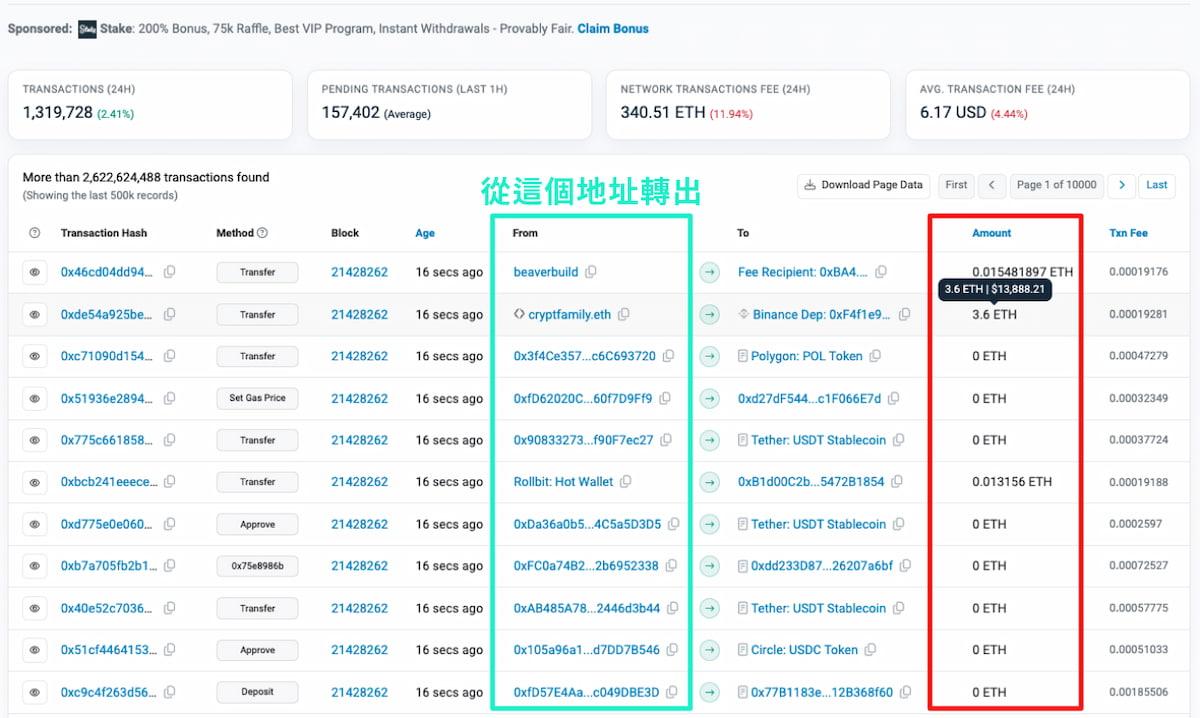

2. After opening, you can first look at the "Amount" on the right. Hovering the mouse cursor over the number will display the US dollar amount, which helps us judge the size of each transaction. If you see an abnormally large amount, you can click the green box on the left to go to the transaction record of that address and decide whether to add it to the monitoring list. However, this is the transaction data of the entire Ethereum blockchain, so the amount is relatively large and it will take more time to filter.

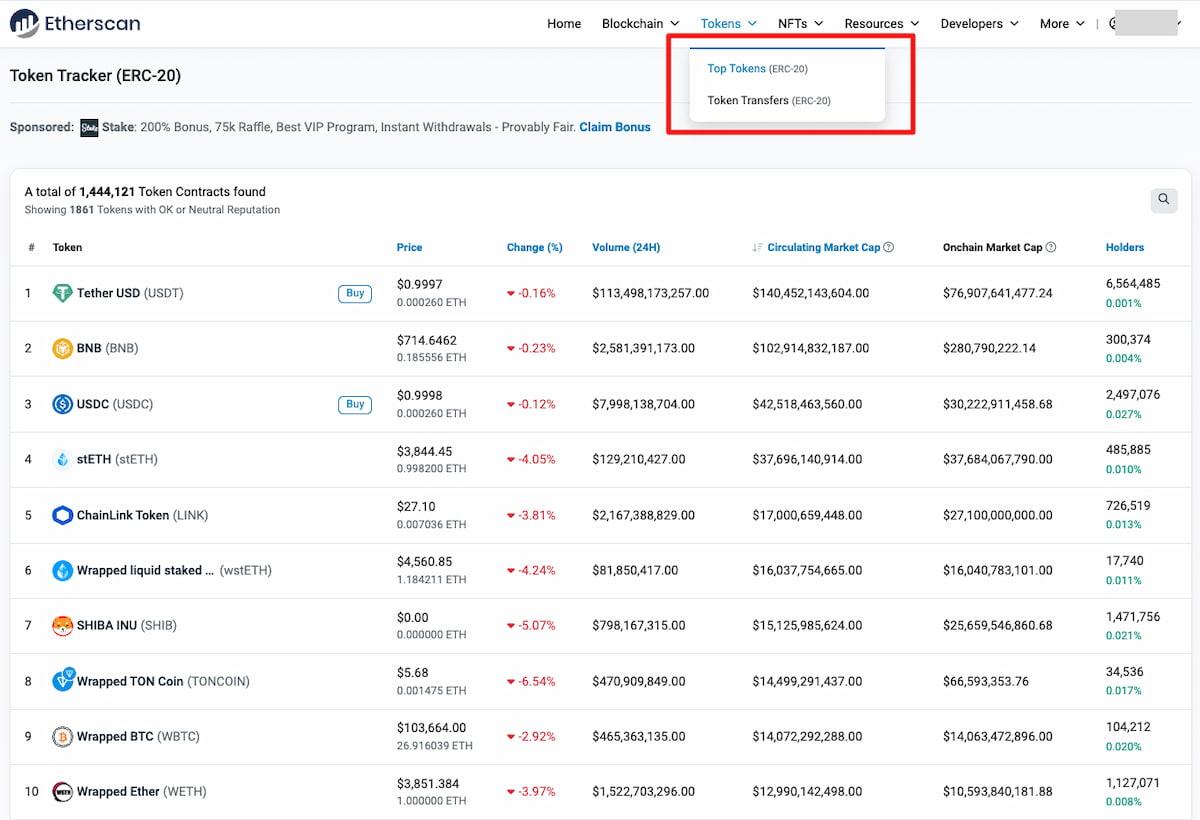

3. Another method is to click "Token" - "Top Tokens" in the top menu, and enter the token ranking list. Here you can see all the ERC-20 (a standard for issuing tokens) tokens on Ethereum, as well as their market capitalization rankings. It's important to note that Etherscan is an "Ethereum" blockchain explorer, so tokens built on other blockchains like Solana cannot be found here.

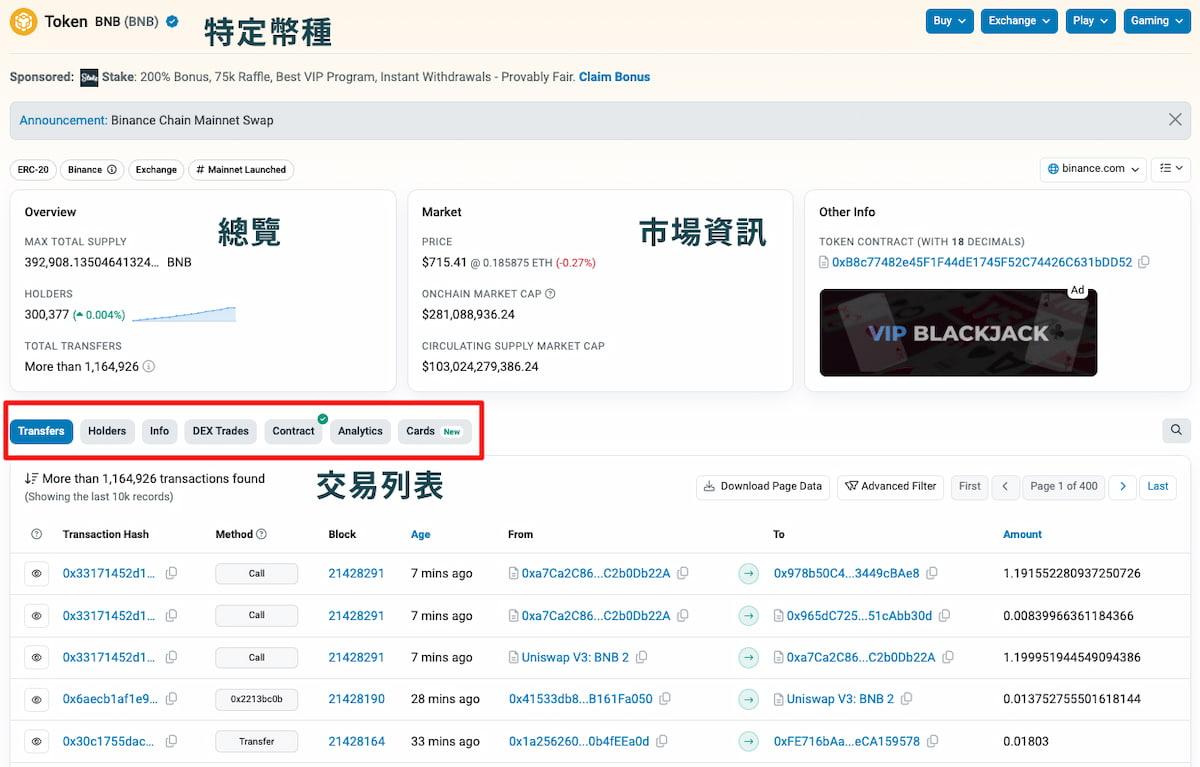

4. After selecting the coin you want to observe, enter the transaction list at the bottom of the token page, where you can also see the transaction amount and the withdrawal address. The red box contains more token details, such as holders, decentralized transaction records, etc.

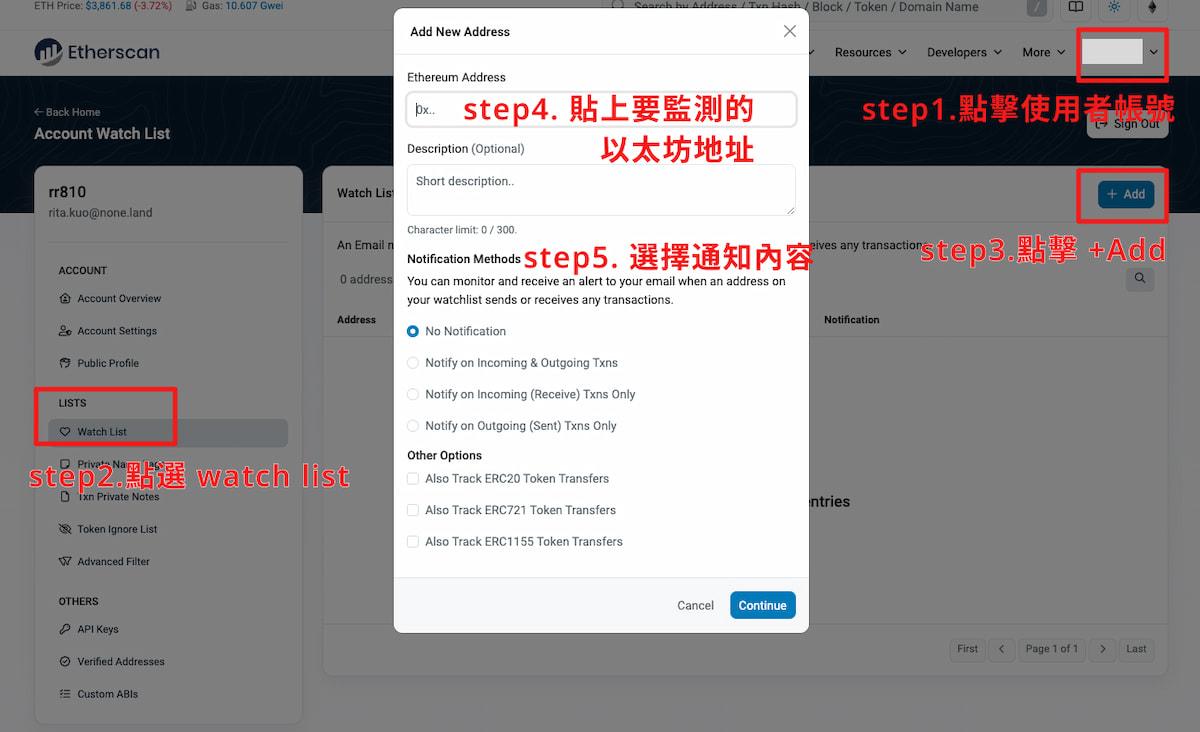

5. After copying the wallet address you want to observe, click the user account in the top right corner, go to the "watch list" - "+ Add" on the left list, and then paste the address you want to monitor and select the content you want to be notified about. The whale observation list is now set up!

Whale Alert

Whale Alert is simpler and more intuitive compared to Etherscan, with the name "Whale Alert". In terms of functionality, it is not as diverse as Etherscan, but it is very suitable for new users to observe whales. Whale Alert has built-in official whale alerts, so you don't need to find addresses with large transaction amounts from thousands of transactions yourself. In addition, Whale Alert also has an X account that you can follow, and you can receive notifications by turning on the notifications!

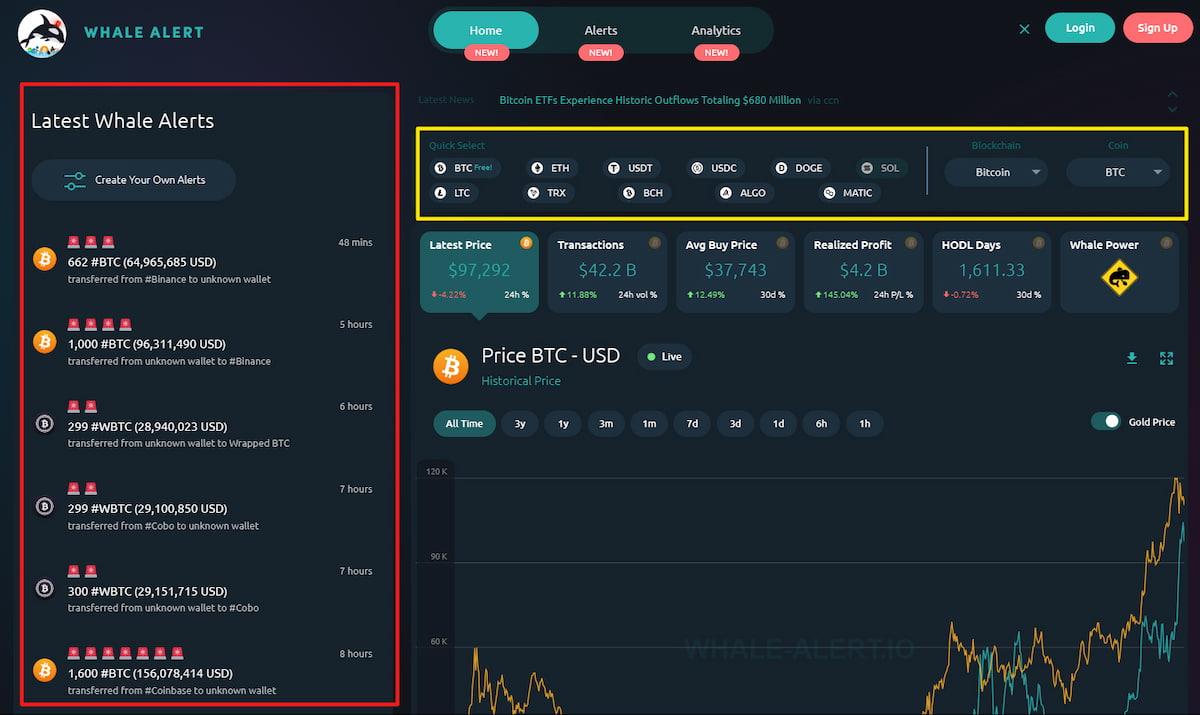

1. Go to the Whale Alert official website, the whale alerts are on the left side of the homepage. The more emojis the alarm has, the larger the amount. The yellow box above the chart can be used to filter blockchains and coins.

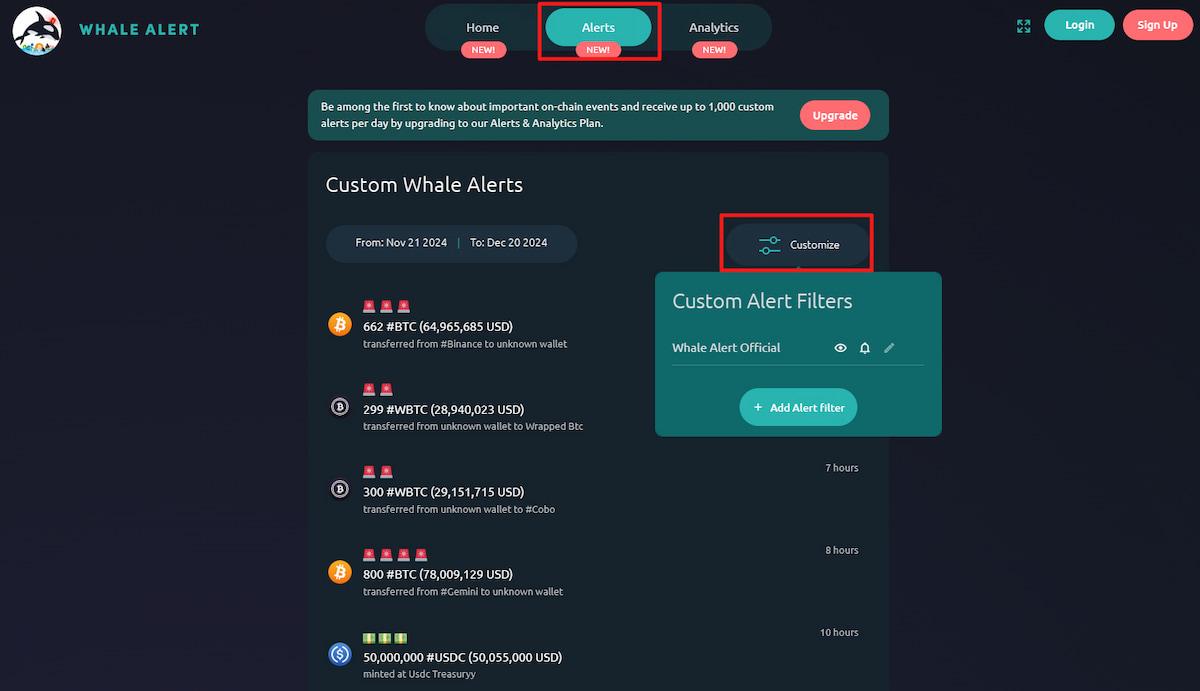

2. If you want to customize the alerts, you need to upgrade the plan, which costs $29.95 per month (about NT$980). After entering the "Alerts" screen, click "Customize" on the right.

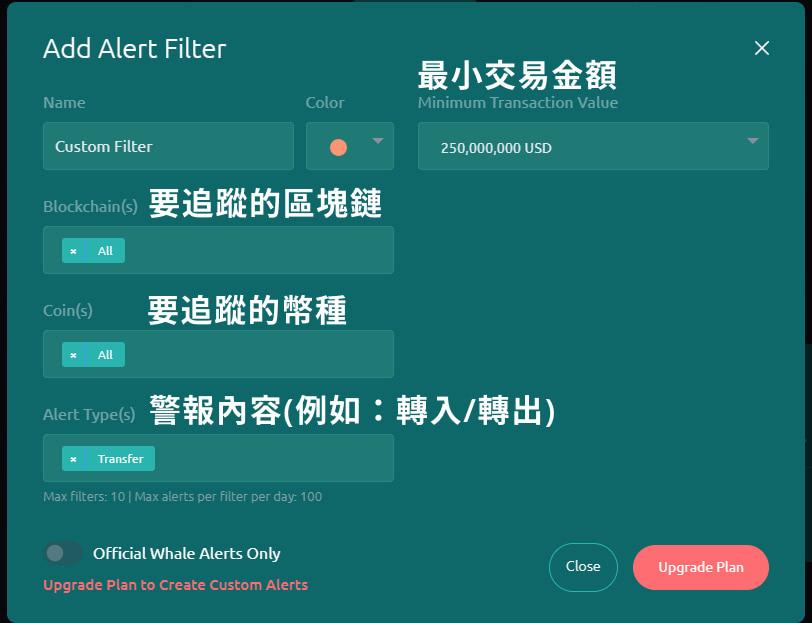

3. Whale Alert's customized alert has a total of five fields that need to be selected. Although you cannot track individual wallet addresses, you can track large transactions of a particular blockchain or coin. It is suitable for investors who don't have time to search or don't know how to choose whale addresses.

DexCheck AI

DexCheck is an AI blockchain analysis platform that provides data on digital assets in decentralized exchanges (DEXs) for traders and investors. DexCheck's features include the upcoming AI search engine, InsightsGPT advanced market analysis tools, whale tracking, token analysis, and Telegram bots.

1. Enter the DexCheck homepage, the first thing you'll see is the basic data analysis of various tokens, such as trading volume, number of trading users, market capitalization, current price, etc.

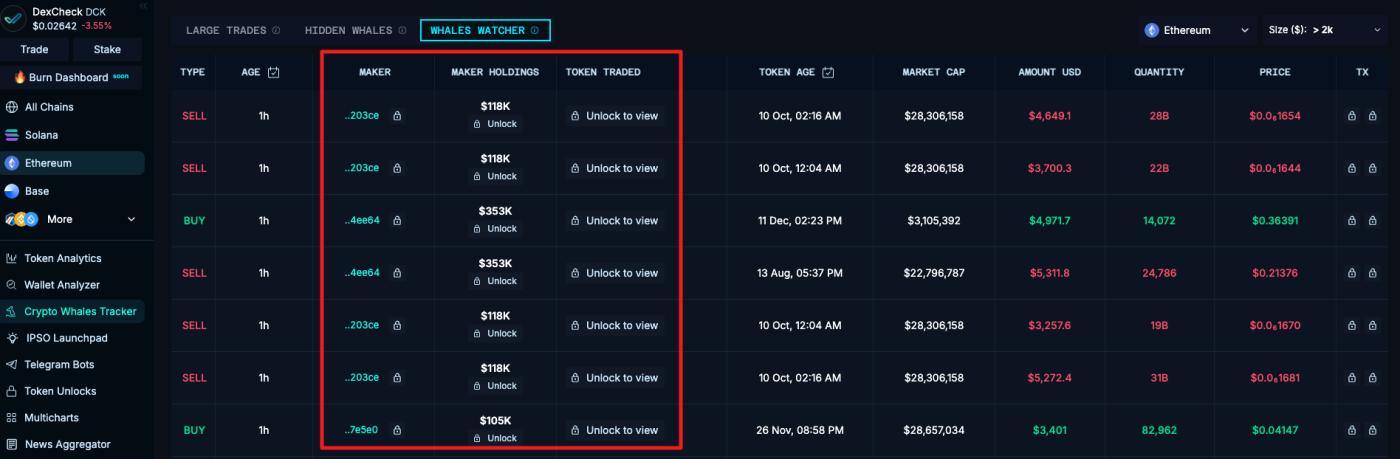

2. Then find "Crypto Whales Tracker" in the left menu, which is the part for tracking large cryptocurrency transactions. You can see large token transactions. The green numbers represent buy-in, and the red numbers represent sell-out. The filter in the top right corner can be used to select the blockchain and minimum amount you want to monitor. The "Maker" column on the right is the wallet address that made the transaction.

3. The next is a more advanced feature, which costs $139 per month (about NT$4,550), to unlock the "Whales Watcher" function. Unlike the "Large Trades" in the previous step, this is about whales that hold a large amount of cryptocurrencies, not just a single large transaction. Unlocking this function means you don't have to find the whale addresses with observation value from thousands or tens of thousands of large transactions yourself.

In addition to the relatively simple Whale Alerts function and interface, Etherscan and DexCheck also have many on-chain data analysis tools. However, here I will briefly introduce the method of finding whale addresses, and interested people can browse these platforms by themselves!

What whales can be tracked?

In addition to relying on the above platforms to find whales, are there any well-known whales that can be added to the observation list?

Of course there are! I also recommend another "de-anonymization" blockchain data analysis platform Arkham. For what Arkham is and how to use it in practice, I recommend reading: What is Arkham and how to use it? How to instantly discover that Tesla transferred $770 million worth of BTC?

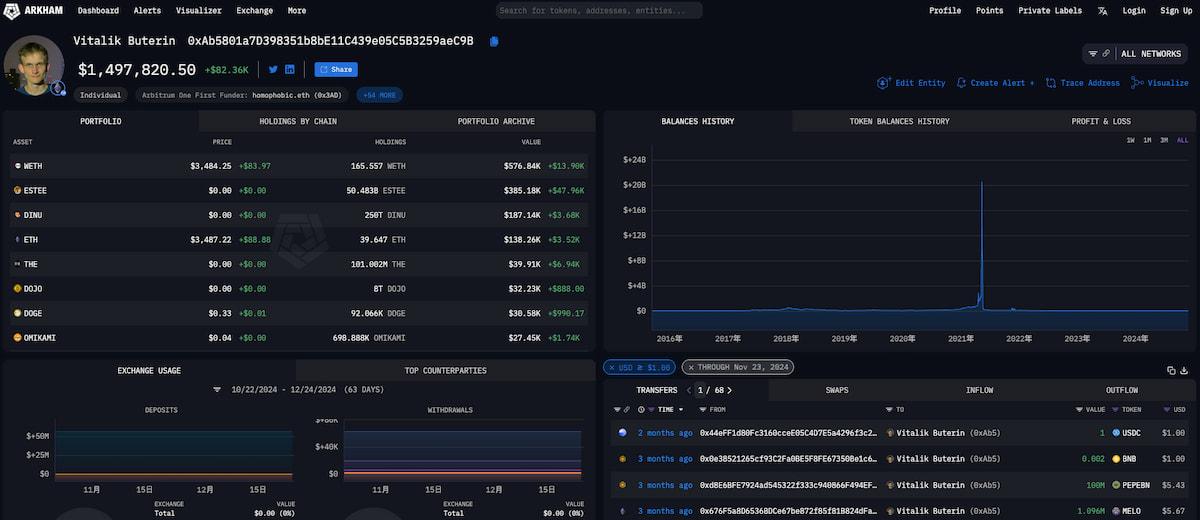

On the Arkham platform, we can see the cryptocurrency holdings of various celebrities, companies, and institutions for free, and track their wallet addresses and set up alerts. For example, the founder of Ethereum V God, can be added to the observation list. The most famous is that in May 2021, he sold 6.6 billion Shiba Inu (SHIB) tokens and donated the funds to charity. This move made the market believe that the SHIB supply would increase significantly, causing the price to plummet 40%.

Another well-known crypto whale is the CEO of the largest US exchange Coinbase, Brian Armstrong, whose address can also be tracked on Arkham.

Other crypto whales include the former CEO of Binance CZ, and the founder of Ripple (the company that issued XRP), Chris Larsen. Although the incoming US President Trump and his family's DeFi project World Liberty Financial (WLFI) cannot yet be called crypto whales, considering that Trump will take office next year, perhaps opportunities can be found in their cryptocurrency fund movements!

Further reading: 170,000 people became millionaires thanks to Bitcoin! Crypto Wealth Rankings: The richest have never shown their faces

What is XRP? Recommended reading: Bitcoin hits new highs, ADA and XRP also soar! What are Altcoins?

By now, you have learned how to track crypto whales! Although it is easier to profit in a bull market than in a bear market, you still need to combine information and technical analysis to determine the timing of buying and selling, so as not to be caught off guard by the market. Also, don't panic just because the whales make big moves, you still need to make your own judgments and analyze various market factors to decide your next step!

If you don't know technical analysis, don't be afraid, Nonechain has a topic plan suitable for beginners: Technical Analysis for Crypto Newbies

( * The content of this article does not constitute any form of investment advice.

All investments have risks, please research and consider carefully before deciding! )

〈What are Crypto Whales and How to Track Them?〉 This article was first published on 《NONE LAND》.