Author: Alea Research

Compiled by: TechFlow

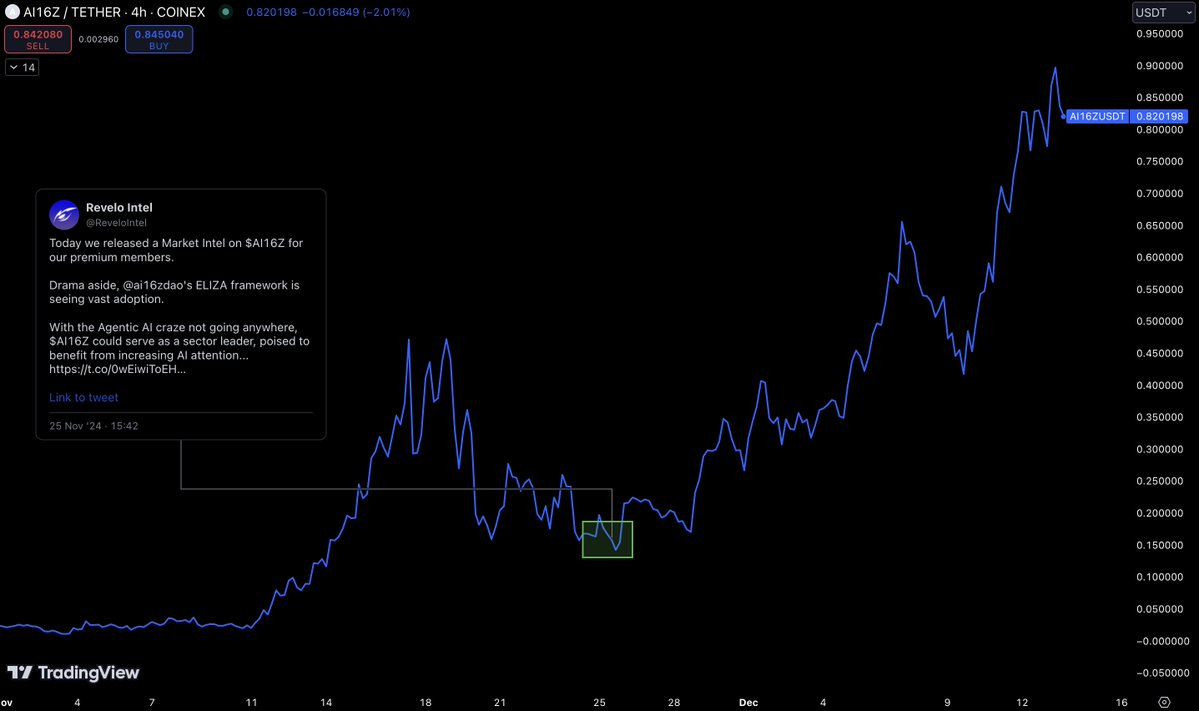

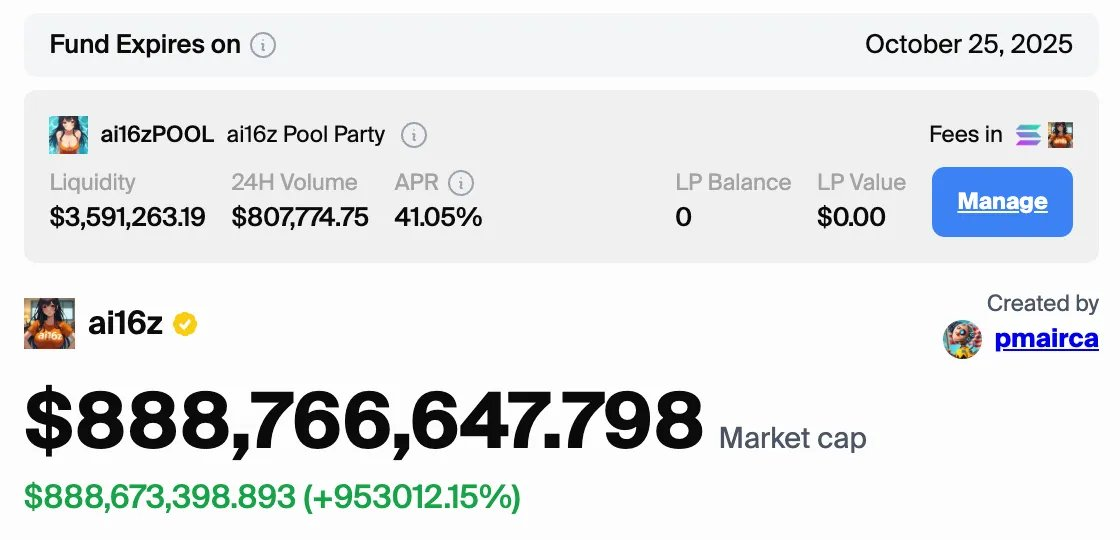

We initially released a market intelligence report on $a16z on November 25, when its price was at the bottom. Subsequently, $a16z rebounded quickly and broke through the $1 billion market cap.

Our core view has remained unchanged, and has even been further validated by the recent price performance. Soaring from a low of around $0.14 to a high of $0.90, $a16z's performance has affirmed our confidence in the blue-chip asset of the Agentic AI field. Even when market sentiment was gloomy and there were many doubts in the community, we still saw the opportunity to accumulate quality assets.

Key Highlights

AI-driven on-chain interactions: AI agents are reshaping the crypto ecosystem, shifting on-chain interactions from human-centric to AI-driven. a16z's ELIZA framework is at the core of this transformation.

Network effects of the open-source ecosystem: As more developers adopt the ELIZA framework to deploy AI agents, the influx of capital into the ecosystem will drive token value appreciation and expand its influence.

Continuously increasing market attention: a16z has become a leader in on-chain trading volume, and it is only a matter of time before major exchanges list $a16z as its influence expands.

First-mover advantage and limited competition: As the most popular on-chain AI development framework, ELIZA has firmly captured the attention of early developers and dominates the ecosystem.

Healthy token structure: Without unlock plans or VC sell-off pressure, $a16z's performance is more consistent with natural growth.

Potential risks: Investors are advised to remain cautious, monitoring the rise of competitors, the potential threats of forks, and the risks associated with high dependence on the team.

The Fusion of Silicon Valley and Solana

a16z has not been affected by VC sell-offs, making it an ideal target to capture the "AI Meme" narrative. Similar to GOAT (the first token to reach a $1 billion market cap through the pump.fun platform), $a16z has also successfully crossed this threshold and attracted more market attention due to its uniqueness.

As the intersection of the two hot topics of AI and Memes, $a16z has the potential for viral propagation. The project is not only the foundational layer for developers to build the ecosystem, but is also closely related to open-source contributions, treasury growth, and network effects. Currently, there are already over 250 projects developed based on the ELIZA framework, and we believe that $a16z's listing on top-tier exchanges is just a matter of time as media coverage increases and on-chain trading volume rises.

Agentic AI is steadily establishing its position as a mainstream trend, demonstrating a new approach that combines the explosive propagation effect of memecoins with actual infrastructure functionality. Marc Andreessen's public support for this trend, by donating $50,000 worth of Bitcoin to Truth Terminal, not only lends institutional-level credibility, but also highlights its long-term potential. As a representative project of this trend, a16z not only carries cultural heat, but also provides the necessary infrastructure support for the expansion of on-chain AI agents, making it an important force in driving the development of this field.

AI and Memes have occupied about 60% of the overall sentiment and attention in the cryptocurrency space.

Since last year, artificial intelligence has continuously absorbed various emerging trends, amplifying the value and influence of these trends - it has clearly become the foundation for the next major "meta" in the cryptocurrency space. Whenever a new trend catches attention - be it gaming, NFTs, or meme coins - AI agents (supported by frameworks like ELIZA) are always able to adapt faster, integrate more efficiently, and ultimately become indispensable infrastructure. This dynamic forms a positive feedback loop, constantly strengthening the influence of artificial intelligence, replacing other competing trends, and solidifying its core position in the entire ecosystem.

The core idea of a16z lies in the dynamism of its narrative. As each market cycle progresses, AI-driven systems continually prove their ability to absorb and surpass other trends, allowing the AI-led "meta" to maintain its heat. Investing in a16z is essentially betting on this self-reinforcing dominance.

Overview: The Blueprint of $a16z

a16z is an AI-driven decentralized autonomous organization (DAO) aiming to create the first crypto venture capital fund managed by AI. Its core product is the ELIZA framework, and the $a16z token is the tool for investing in and holding shares of the fund. Users holding a certain amount of the token can submit investment proposals to Marc Aindreesen (@pmairca), who will evaluate and take action.

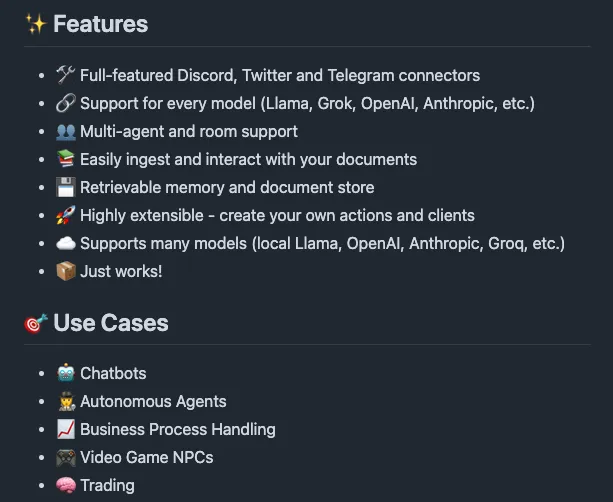

Through the ELIZA framework, a16z can deploy agents that can interact across multiple platforms, performing tasks such as summarizing conversations, reading documents, and conducting on-chain transactions.

ELIZA is an open-source framework designed specifically for building agents with on-chain functionality.

The core goal of the project is to create an ecosystem of AI agents, while also attracting more AI developers to the crypto space. The combination of the open-source model and the viral propagation characteristics of memecoins makes a16z highly attractive to both developers and regular users. Whether it's crypto developers who want to deploy agents on blockchains (such as Ethereum L2 or Solana), or AI developers new to the crypto industry, they can all benefit. For example, a client based on Farcaster is already in development.

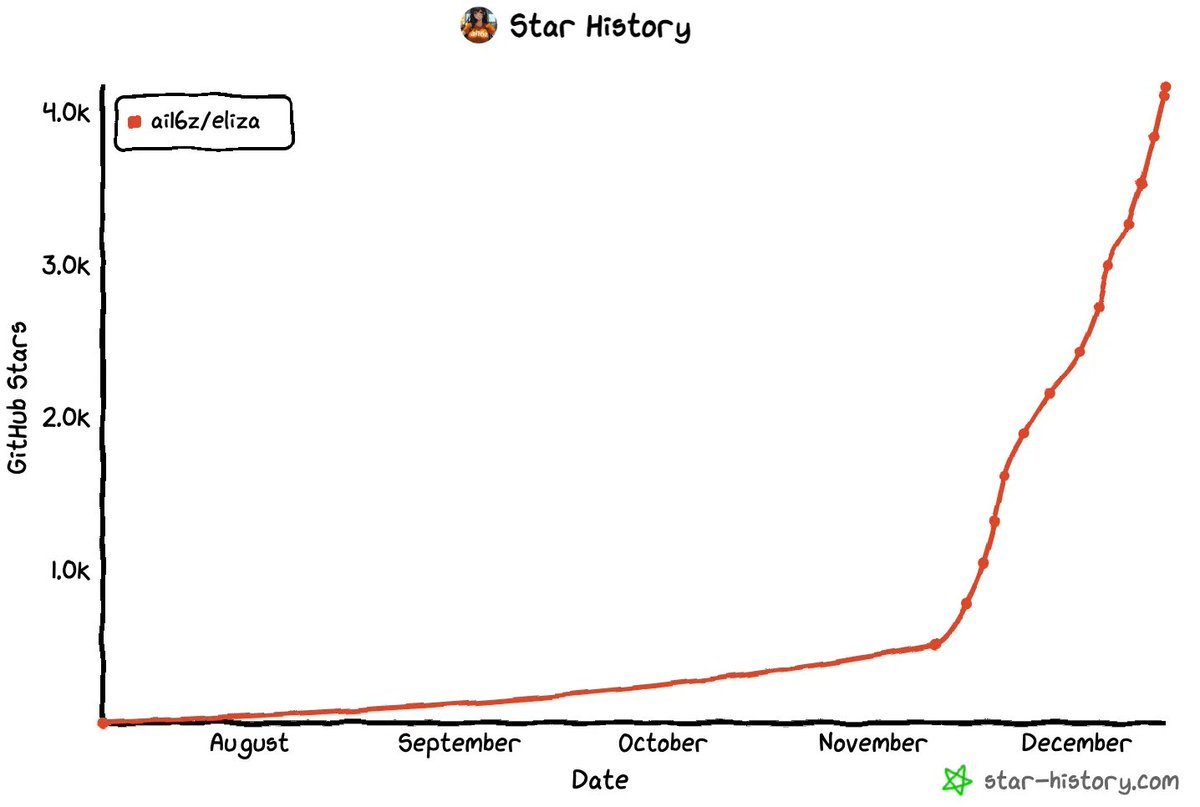

The ELIZA framework is currently hosted on Github, with over 4,200 stars and 1,200 forks.

Furthermore, a16z is also committed to becoming the core hub connecting entrepreneurs, investors, and enthusiasts in the crypto and AI domains, which will be key to maintaining its competitive advantage.

Industry Outlook: The Fusion of AI Agents and Memes

During the Meme coin super-cycle, the emergence of "Agentic Memes" has attracted the attention of almost all cryptocurrency participants. For fund managers and professional investors, this provides a reasonable justification for proving that investing in viral propagation and internet culture is meaningful. This narrative may seem like a paradigm shift, but it actually reflects the real applications and concrete results at the intersection of cryptocurrencies and artificial intelligence.

The market is currently showing investment fatigue for infrastructure projects and "AI x Crypto" conceptual products (i.e., projects with concepts but difficult to implement). However, the narrative of "Agentic AI" is particularly attractive to liquid token investors, as it combines the rapid growth characteristics of Meme coins with actual functionality and future potential.

Here is the English translation of the text, with the specified terms translated as requested:Unlike typical Meme tokens that lack intrinsic value, proxy AI tokens like $a16z are not only a narrative-driven investment opportunity, but also critical infrastructure supporting on-chain AI agent deployment and scaling. This space has attracted significant liquidity, as investors can efficiently allocate capital without concerns about liquidity issues or long-term lockups. From the perspective of retail investors, this narrative atmosphere evokes memories of the early DeFi Summer and liquidity mining boom.

In our view, a16z is a TechFlow leader in this space, having become the industry gold standard for on-chain AI agent deployment. The ELIZA framework has emerged as the developer's tool of choice for creating social-enabled and personalized agents that can exhibit autonomous life on platforms like X (formerly Twitter) or TikTok, which are key for community building.

$a16z Investment Thesis

The current positioning aims to leverage the network effects driven by increasing developer adoption of the ELIZA framework for agent deployment. This not only drives capital inflows into the $a16z fund, but also further entrenches its dominance in the ecosystem. This growth forms a positive feedback loop: as the ecosystem expands, token demand increases, enhancing its value as a narrative representative.

Currently, the fund's net asset value (NAV) has exceeded $20 million.

From a broader perspective, the core of this investment thesis lies in the $a16z token's role as the gateway to the "Proxy AI" narrative. The ELIZA framework has rapidly become the primary on-chain infrastructure for AI agent deployment, with its open-source model attracting more and more developers to the space. This trend of bringing top AI developers into the crypto realm further drives network effects, while also enhancing the NAV and narrative premium of the decentralized autonomous organization (DAO), solidifying its market position.

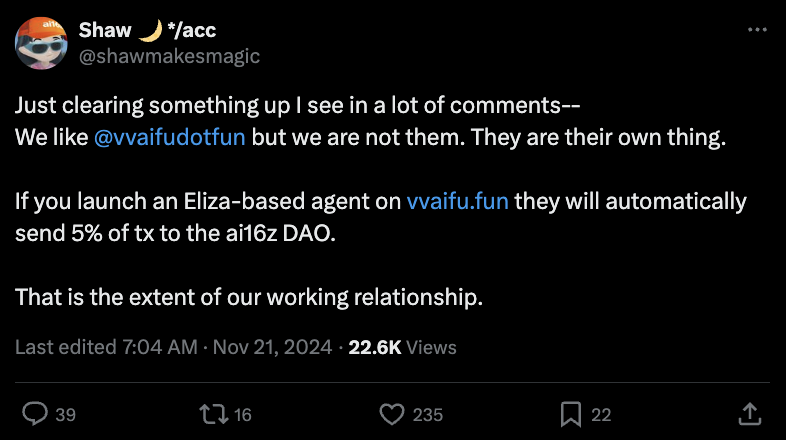

Ultimately, attention and user adoption will be key growth drivers, and the core of managing investment positions lies in understanding how much of the success is derived from the technology itself versus market valuation premiums. Additionally, the impact of ecosystem spin-offs, such as vvaifu (a pump.fun platform focused on AI agents), should not be underestimated, as these innovations not only add more layers to the ecosystem, but also further cement the token's position as the core hub for "Proxy AI" growth.

It is worth noting that the broader market has already primed itself for the convergence of cryptocurrencies and artificial intelligence. Investors are eagerly pricing in future expectations and speculating on their potential impacts. This market enthusiasm provides a powerful tailwind for the development of "Autonomous AI Agents" - especially when people start to envision these intelligent agents having their own wallets and autonomously executing transactions on-chain.

Catalysts and Rerating Triggers

The current market competition is exceptionally fierce, particularly with Binance unexpectedly listing $ACT ahead of $GOAT, further adding to the uncertainty. In such an environment, it is likely that "overall market sentiment driving individual project rallies" will occur, and the listing of $GOAT may even have a positive spillover effect on similar tokens. Many in the market are speculating on which token will be the next to be listed by a top-tier exchange. Exchanges not only aim to profit, but also seek to create gains for users, and thus tend to select tokens that can offer high potential returns to retail investors while generating substantial trading volume to earn transaction fees.

Among all potential catalysts, a Binance listing is the most likely near-term driver, especially considering $a16z's recent mention in a Binance industry report. Binance and other exchanges are racing to list tokens related to hot narratives as early as possible, and $a16z has already proven its value through its on-chain trading volume. A successful Binance listing would bring instant market recognition, unlock significant liquidity, and attract a broader retail user base to trade the token. It is worth noting that $a16z also has some structural advantages, such as the absence of token unlocks or VC selloffs, making it attractive to both short-term traders and long-term investors.

Risks and Failure Factors

In the current market environment, early narrative competition is fierce, and retail investors are generally chasing hot trends. Platform risk, dependence on the development team, and the possibility of forks are the main risks facing $a16z, which could quickly lead to a collapse in token value. Currently, the market valuation of $a16z is significantly premium to its assets under management (AUM), and this valuation gap may be bridged through rapid AUM growth, or it may result in substantial losses for late-stage investors. The fund's market cap is slightly above $200 million, while its AUM is only $6 million (after deducting an 8% management fee), implying a token premium of nearly 40x.

To reach breakeven, the fund's AUM needs to grow 40x in the next 11 months. This is an extremely challenging target, unless the AI narrative further explodes and the fund's performance significantly exceeds expectations.

The $a16z investment logic is not without risks; even if GOAT and other tokens perform well, it does not necessarily mean all tokens in the space will see synchronized growth. The most direct risk is platform dependence: many projects, including AI agents built on the ELIZA framework, are heavily reliant on centralized platforms like X. If the policies of these platforms change, or they completely prohibit related activities, it could severely limit the functionality of the agents and disrupt the projects. This is an obvious external risk that the team has little control over.

Furthermore, unlike Meme tokens, the $a16z project is dependent on a small, highly specialized development team, and the execution of its roadmap also carries certain risks. Meme tokens typically have no commitments and are community-driven, but the success of $a16z and ELIZA is highly dependent on the development team's execution. Any loss of core team members or internal conflicts could lead to project delays, loss of market attention, or a decline in execution capabilities. For example, there have been instances of core contributors being accused of insider trading during the $ELIZA token launch (selling large amounts of the old token before the new one was launched), and such events can negatively impact the project's reputation and development.

ELIZA's Open-Source Code and Competitive Pressure

While ELIZA's open-source nature provides flexibility for developers, it also exposes it to the risk of being forked by competitors. If other developers create new frameworks based on ELIZA's code and attract community support, it could lead to ecosystem fragmentation, weakening the network effects and reducing the core value of the token. Additionally, although ELIZA provides a comprehensive development framework, due to its large scale and diverse functionality, many agents targeting specific use cases may prefer to selectively use only certain components of ELIZA, rather than forking the entire framework.

At the same time, market competition has also brought new challenges. For example, Zerebro's Zerepy framework (mainly for Python developers) is gradually gaining recognition and has been mentioned in Binance's official blog. If Binance or other exchanges prioritize launching ZEREBRO over $a16z, this could undermine investors' confidence in $a16z's dominant position and have a negative impact on its market momentum.

In addition, $a16z's DAO model and fund structure also have some long-term sustainability issues. Although this model is attractive at the experimental level, in reality, this fund structure may find it difficult to maintain a valuation multiple higher than the current net asset value (NAV), especially when the fund's returns are limited.

Combining the market's high dependence on narrative-driven factors, these factors indicate that investors need to actively manage risks and constantly re-evaluate their trading strategies.

Volatility and $a16z's Trading Strategy

Since its launch, $a16z has experienced significant price volatility. Investors need to clearly define their positioning to determine how to respond to different market scenarios. For long-term investors, they may need to withstand significant price drawdowns and gradually build positions before catalysts appear, waiting for the market to reprice and bring about an upswing. For short-term traders, they can take advantage of the token's fluctuations around key price levels to profit through flexible long or short operations.

In this investment logic, the key is how to effectively manage volatility. By analyzing the relationship between price trends and major events, potential trading opportunities can be identified. For example, after a16z Crypto's CTO Eddy Lazzarin publicly interacted with the official X account, the token price rose by 50%. In contrast, when the second $ELIZA token was launched, the price temporarily retreated by 50% due to market controversy. For active traders, this price volatility provides opportunities to capitalize on market sentiment and cyclical mispricing.

By positioning in advance before the exchange listing, the goal is to capture value and anticipate market catalysts. Given the significant trading volume $a16z has already generated on-chain, this catalytic effect is foreseeable. The default strategy is to gradually build positions before key catalytic events (such as exchange listings or unexpected ecosystem announcements).

Using $ACT as an example, its price immediately increased 10-fold after listing on Binance - however, considering $a16z's higher market capitalization, such a price surge may be relatively smaller.

From a risk management perspective, it is recommended that investors use strict stop-loss strategies (currently mainly relying on psychological stop-loss) and closely monitor market trends. If the holding period is too long, it is advisable to take profits or reduce positions at high levels after major catalyst announcements.

In summary, this is a speculative trade that requires strict risk management. If the market trend changes or the news fails to elicit the expected market response, the strategy will need to be quickly adjusted. Maintain flexibility, go with the flow, but don't overstay. The current investment opportunity is more narrative-driven than based on true infrastructure-level projects.

Conclusion and Final Thoughts

Overall, the investment logic of $a16z is highly attractive - AI intelligent agents as the core theme are rapidly gaining market attention, and they are also highly aligned with the crypto industry's demand for innovations that are both interesting and practical. As a token, $a16z, with its strong network effects, growing treasury value, and widespread market attention, exhibits a more mature and higher-level "meme coin" characteristic. Furthermore, the flexibility and growing applications of the ELIZA framework provide a solid fundamental support for $a16z, setting it apart from those tokens that rely solely on market hype.

With the continued rise in on-chain trading volume and the push of major catalysts such as centralized exchange (CEX) listings, we believe $a16z is a quality choice worth attention in the current AI-themed risk-on market led by $GOAT. It can not only benefit from the AI-driven narrative, but may also emerge as an outstanding investment target in this trend.