Title: Why Ethereum maxis say ETH will be the 'comeback kid' of 2025

Author: Tom Mitchelhill

Translator: Daisy, Mars Finance

Analysts and experts say that AI agents, a series of important network upgrades, and an improved regulatory environment in the US are reasons for Ethereum supporters to be excited about 2025.

Ethereum supporters say that AI agents, major network upgrades, increased institutional interest, and a crypto-friendly government under the new US President Donald Trump, bringing comprehensive regulatory reform, are reasons to be excited about 2025.

Kain Warwick, founder of Infinex, told Cointelegraph that while Ethereum had a relatively flat performance in 2024, the asset is like a "compressed spring" that has been primed for a breakout in 2025.

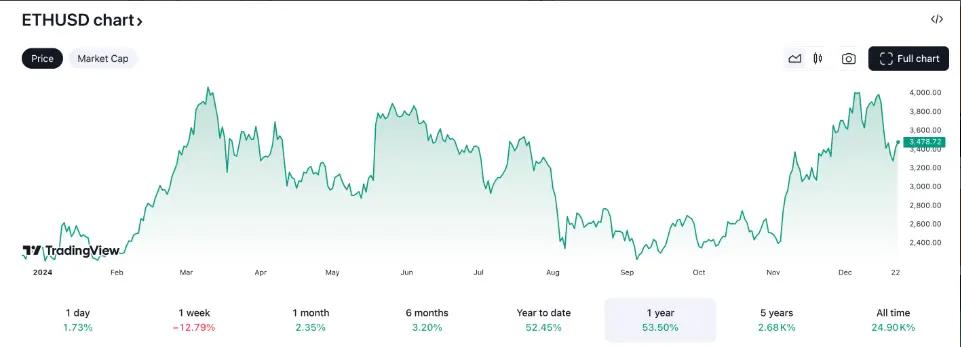

According to TradingView data, ETH has posted a year-to-date gain of 53.5%, rising from $2,350 on January 1 to the current $3,478.

ETH has posted a year-to-date gain of 53.5%. Source:TradingView

Meanwhile, other major cryptocurrencies including Solana, Cardano, and Ripple's XRP have gained 92.7%, 57%, and 276.5% respectively year-to-date.

"The longer you compress it, the bigger the rebound. There are a lot of tailwinds, and there are some headwinds, but once it breaks through, people will say 'wow'," Warwick said.

Source:Kain WarwickHe mentioned Ethereum Improvement Proposals (EIPs) and the resulting user experience improvements as key inflection points for Ethereum and ETH price performance.

"In 2025, I think we'll see big improvements in account abstraction, big progress in L2 interoperability, and a much-improved user experience across L2s."

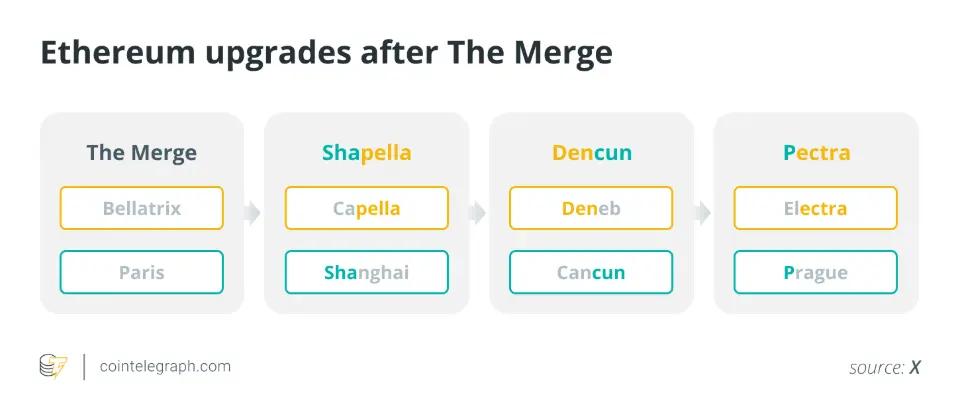

Ethereum to Receive Pectra Upgrade in 2025

One of the major upgrades that Warwick and other Ethereum supporters are eagerly anticipating is the Pectra upgrade - the next major milestone on Ethereum's roadmap, expected to launch in early 2025.

Gaia Regis, co-founder and CEO of reStaking platform Byzantine, said the Pectra upgrade will fundamentally change the way Ethereum's security layer operates.

"Currently, Ethereum staking is heavily reliant on liquidity. Essentially, many ETH holders want to participate in staking. This is generally a good thing, as more nodes mean more decentralization and higher security," she said.

However, Regis said Ethereum has now reached a massive scale - over 1 million Ethereum validators communicating - which is starting to slow down the network.

"Pectra solves this by increasing the maximum effective balance of validators from 32 ETH to 2,048 ETH, drastically reducing the number of validators required and relieving pressure on the network," Regis said.

"Less pressure means a faster network and a better user experience for Ethereum users."

In September this year, Ethereum core developers decided to split the Pectra upgrade into two main packages. The first Pectra package will introduce a total of eight EIPs, the most important of which is EIP-7702, aimed at improving the user experience of wallets and chain abstraction.

"This will make staking cheaper, leading to more people participating in staking, and thus reducing staking rewards over time. This is why we are very bullish on reStaking. Many people will want to boost their staking rewards by securing other networks."

Trump's Crypto-Friendly SEC to Particularly Benefit ETH

Saul Rejwan, managing partner at crypto venture firm Masterkey, told Cointelegraph that Ethereum and more "legitimate" projects in the crypto space, particularly DeFi and decentralized physical infrastructure (DePIN), will benefit the most under a Trump administration and a more crypto-friendly US Securities and Exchange Commission (SEC).

On December 4, Trump nominated crypto-friendly businessman and former SEC commissioner Paul Atkins as the next SEC chair, while current chair Gary Gensler plans to step down on January 20.

"In a more favorable regulatory environment, DeFi projects on Ethereum will thrive, and areas like reStaking just need a little regulatory push to attract institutional investors," he said.

"We expect this new leadership to lower barriers to entry, allowing early crypto entrepreneurs and resilient companies to innovate and succeed more easily."

Stablecoins, Tokenization, and AI Agents

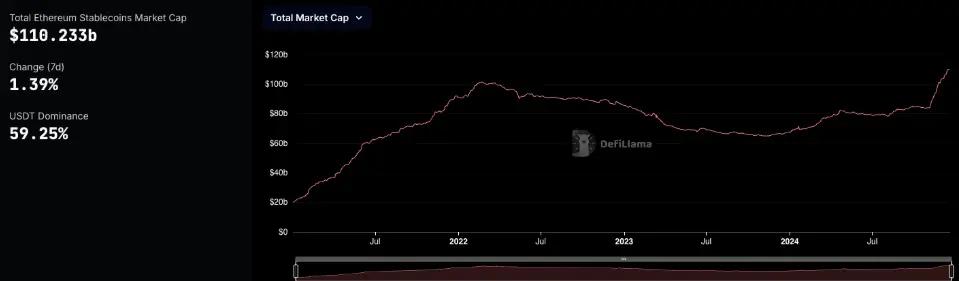

Matt Houghan, chief investment officer at Bitwise, said Ethereum has three major tailwinds as it enters 2025 and expects the asset to have a breakout year.

"Ethereum sits at the center of the three biggest trends in crypto: the rise of stablecoins, tokenization, and AI agents. It dominates market share in all three of these areas," Houghan said.

He added: "I think the excitement around these three areas next year will bleed into Ethereum, making it the comeback king of 2025. You can already see this in its recent strong performance and ETF inflows."

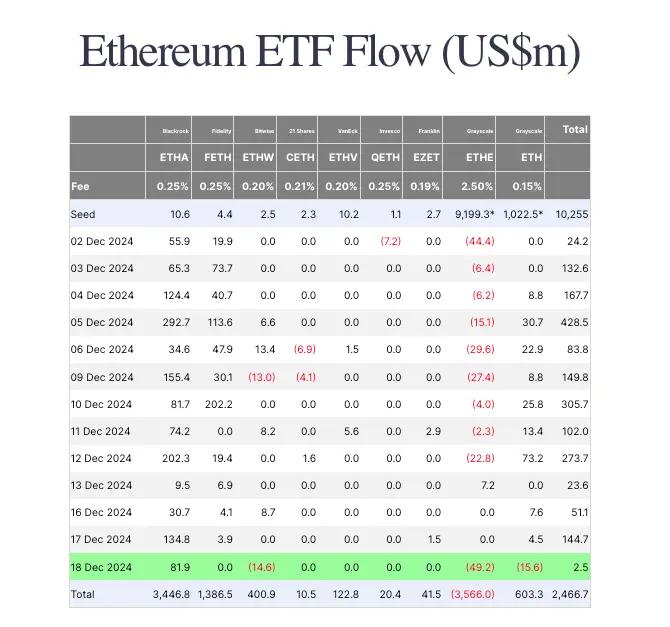

Over the past two weeks, Ethereum ETFs have witnessed over $1.5 billion in net inflows, one of the largest inflow periods for the eight spot funds, according to Farside Investors data.

Ethereum ETFs have witnessed over $1.5 billion in net inflows in the last two trading weeks. Source: Farside InvestorsLike Rejwan, Houghan believes the new crypto-friendly SEC under Trump will be particularly beneficial for Ethereum.

"I'm excited to see the 'Sword of Damocles' that has been hanging over the US crypto industry for the past four years lifted. The new approach in Washington will unleash millions of crypto entrepreneurs, many of whom will build killer apps on Ethereum and its Layer 2 networks," Houghan said.

"We're entering the golden age of crypto, and Ethereum will be one of the primary beneficiaries of this thriving ecosystem."

Houghan said that overall, Bitwise expects ETH to break its previous all-time high of $4,878 and reach a "conservative" new high of $7,000, as he described it.

More Layer 2s, reStaking, and Better DApps

Edu Timmers, chief marketing officer at crypto company Keyrock and an Ethereum supporter, believes the launch of new Layer 2 networks like Abstract and Deutsche Bank projects will enhance the breadth of applications in the Ethereum ecosystem.

Timmers also mentioned the rise of on-chain perpetual contract protocol Hyperliquid built on Arbitrum, as evidence of Ethereum's growing on-chain dominance, and said he expects the Ethereum and decentralized applications (DApps) ecosystem to start competing with centralized market leaders like Binance in the new year.

"Projects like Hyperliquid will start competing with centralized players like Binance in 2025, rather than decentralized projects like Uniswap," Timmers said.

Additionally, Timmers said Ethereum reStaking is another underappreciated area worth watching in 2025, stating that it will make the network more robust and multi-functional.

"As the chain begins to transfer security to the Ethereum through solutions like EigenLayer, may see a breakthrough."