Followin' Pencils Protocol was initially a comprehensive DeFi platform on the Scroll ecosystem, based on a series of product modules such as Farming, Vaults, and Auction. It not only became an important liquidity and yield hub on Scroll, but also an important LaunchPad market and traffic pool, continuously providing momentum for the development of the Scroll ecosystem. It is reported that the protocol's peak TVL exceeded $400 million, backed by 700,000 users, which represents the market's recognition of Pencils Protocol.

In the new stage of ecosystem development, Pencils Protocol is expanding the narrative of the ecosystem. By launching a yield-oriented DEX called Pencils Swap, the DEX can be connected to multiple chains and build an ecosystem that integrates yield and liquidity for all-chain traders and crypto projects. As the infrastructure of the new crypto era, Pencils Protocol is gearing up for the next stage of DeFi development.

Pencils Swap: The Liquidity and Yield Hub of the On-chain World

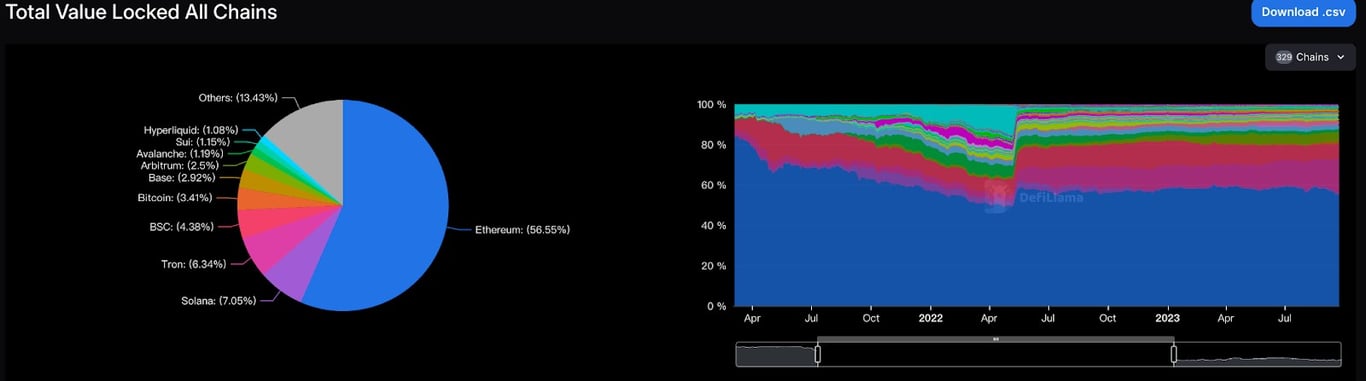

Multi-chain has always been a major theme in the development of the crypto market. As more and more on-chain ecosystems are facing the market, not only has it exacerbated the decentralization of liquidity, but it has also led to an imbalance in liquidity between different on-chain ecosystems.

From the user's perspective, the imbalance of liquidity between different on-chain ecosystems is a potential yield opportunity, as some liquidity-scarce ecosystems often offer more attractive DeFi yield opportunities in order to better capture liquidity. However, on the other hand, traders usually need to switch back and forth between different on-chain ecosystems to pursue these yields, which brings a highly fragmented experience. At the same time, although the potential yield opportunities are obvious, for relatively scarce niche on-chain ecosystems, DeFi applications themselves may face poor trading experience, high yield risks (high slippage, high impermanent loss, etc.) and unstable yields due to lack of liquidity. So in general, except for a few professional investors, the enthusiasm of most investors for liquidity arbitrage is not high.

For some on-chain projects, especially relatively niche native on-chain projects, the difficulty of capturing liquidity (especially capturing multi-chain liquidity) is constantly increasing. Although these projects may offer relatively attractive yields, as mentioned in the previous text, their efficiency in attracting liquidity is still relatively low. In this market cycle, the discussion volume of the DeFi narrative has dropped significantly, the entire industry is facing serious involution, the yield is generally not high, and users are gradually losing interest in the lack of innovation in the DeFi concept. In addition, veteran DeFi 2.0 ecosystem projects like OlympusDAO and Tokemak have also proven to be not a persistent and effective liquidity solution.

In fact, the barrier between chains is a major obstacle. The fragmented user experience and the high cost of multi-chain exploration are suppressing users' enthusiasm for multi-chain yields. At the same time, crypto projects are usually only able to capture liquidity on their local chain, and they also face relatively high costs and thresholds when expanding to multi-chain liquidity. So from this perspective, as long as the complexity brought by native chains can be effectively simplified, the cost, risk and threshold for users to explore yields can be reduced, and more quality options can be provided. Crypto projects can also acquire multi-chain liquidity through more optimized paths, continuously attracting active users.

The Pencils Swap launched by Pencils Protocol, which is oriented towards Yield, is the "final push" to achieve this goal.

The Narrative of Pencils Swap

Pencils Protocol is launching Pencils Swap, with the main goal of being a yield aggregation layer and a liquidity aggregation layer. By establishing a series of native cross-chain facilities, this layer can establish interoperability with ecosystems of different technical characteristics.

1. Investor Yield Side

Pencils Swap can "aggregate" multi-chain ecosystems and find arbitrage opportunities in the DeFi protocols of different chain ecosystems, such as the potential arbitrage difference between different prices of the same token on different chain DEXes, and the difference in contract prices of the same asset on different derivative DEXes. Currently, the Vaults module has integrated a series of advanced LP yield strategies, allowing users to maximize their yields in each transaction through the Vaults tools on Pencils Swap and directly receive the yields. Users can also access key details such as routing, fees, and price impact through the dashboard, and stay informed of historical transactions and liquidity situations at all times.

Compared to users independently LP arbitraging on different DEXes, Pencils Swap itself can significantly reduce slippage and improve efficiency through automatic routing, creating a wide range of profit opportunities for LPs. Users not only have more predictable potential yields, but also have better and more stable profitability.

Similarly, for different traders, Pencils Swap has designed three different trading fee tiers to ensure that users, whether trading stable assets or high-volatility assets, have good flexibility and better profitability.

l 0.05%: Applicable to high-frequency trading and assets with relatively low price volatility.

l 0.30%: The general fee rate applicable to most trading pairs.

l 1.00%: Applicable to assets with high price volatility.

So on the user side, Pencils Swap not only has good profitability, but also provides a series of yield features, becoming the best tool for users to capture LP arbitrage yields from the multi-chain market.

2. Liquidity Demand Side

Pencils Swap is not only a DEX with multi-chain strategy yield capabilities, but also a liquidity aggregation hub, providing liquidity for multi-chain projects.

As a multi-chain yield aggregation hub, Pencils Swap connects investors holding assets, i.e. liquidity sources, on one end, and the liquidity pools of different DeFi protocols on the other end. As long as there are arbitrage opportunities, there will be capital flows.

Pencils Protocol is building Pencils Swap into the ultimate platform driven by liquidity. For dApps with liquidity needs, they only need to integrate with Pencils Swap to realize the connection with liquidity sources and other liquidity pools. Relying on this liquidity-rich environment, on-chain projects can efficiently capture liquidity at minimal cost and achieve smoother launches with community-driven support.

Overall, Pencils Protocol is folding the obstacles brought by native chains, and through interoperability with multiple chains, it is empowering different needs to seamlessly access the multi-chain ecosystem, folding a series of obstacles brought by native chains. Pencils Swap not only serves as a problem solver for users to capture LP arbitrage yields across multiple chains, providing a seamless experience for users to seek yields across multiple chains.

At the same time, for liquidity demanders, their liquidity capture target is no longer just the local chain. Through the connection to multiple chains provided by Pencils Swap, it empowers crypto projects with broader liquidity capture capabilities, significantly improving the efficiency of cross-chain liquidity, injecting more vitality into the DeFi market while bringing new growth points.

A New Example of Composability: Pencils Swap + Auction, Envisioning a New LaunchPad Ecosystem

Pencils Protocol recently launched the Auction function, with a community-centric LaunchPad platform being the main feature of the Auction module. With the launch of Pencils Swap and its deep integration with the Auction module, Pencils Protocol is also expected to create a new paradigm for the multi-chain LaunchPad ecosystem.

Supported by Pencils Swap, the new LaunchPad ecosystem can enable projects to capture funds across multiple chains in a single Launch. Based on Pencils Swap as the aggregation portal, users from different chain ecosystems can participate in the Launch through Pencils Swap, and projects no longer need to deploy launches on multiple chain LaunchPad platforms, which is expected to save costs and significantly improve user coverage and fundraising efficiency.

After the project launch, Pencils Swap can also provide support for better token market cap management for the Launched projects. In fact, different chain ecosystems have gaps in liquidity, trading volume and other aspects, which will bring arbitrage opportunities for users, and for Pencils Swap, as long as there are arbitrage opportunities, it means that it can attract a large number of arbitrage groups from multi-chain ecosystems to contribute liquidity to the tokens, greatly alleviating the subsequent market making pressure on the tokens.

Followin' through the brand-new collaboration with the Vaults section, based on a series of arbitrage strategies, not only can it bring considerable LP arbitrage returns to the participating token holders, further enhancing user token holding stickiness and loyalty, but it can also bring more considerable profitability to the Launch projects. The project party even acts as an arbitrageur, artificially creating arbitrage opportunities and price differences, attracting the participation of external arbitrageurs and traders, greatly increasing the on-chain activity and trading volume of the project, as well as the number of token-holding users, providing a foundation for the project to move towards a broader market.

So through the brand-new combination of Pencils Swap and Auction, it not only provides the basis for multi-chain synchronous Launch of projects, but also further empowers the token market value management, token holder profitability, project party income, and even the long-term development of the future. The brand-new paradigm combination is also laying the foundation for the transformation of the LaunchPad market.

In the long run, Pencils Swap will not only be a DEX, but will also further develop into an important infrastructure in DeFi, and will power the next explosion of DeFi.

Pencils Liquidity Incentive Program

To further promote the comprehensive development of the ecosystem, Pencils launched the Liquidity Incentive Program after the successful launch of the Swap function. The program aims to provide generous rewards for liquidity providers, as well as additional incentives for Farming participants, ensuring that users enjoy the highest cross-chain APR and premium experience.

Activity Duration:

Start Time: December 19, 2024, 08:00 AM (UTC)

End Time: January 1, 2025, 07:59 AM (UTC)

Liquidity Pools:

To participate in this activity, liquidity providers must add liquidity to the following designated pairs:

l ETH/USDC

l ETH/USDT

l ETH/STONE

l USDT/USDC

l ETH/wrsETH

Users only need to complete the "Add Liquidity" operation for the specified currency pairs on the Pencils Liquidity page to officially join the activity.

1. Reward Mechanism

Basic Reward:

By providing liquidity for the designated trading pairs, participants will share in the platform's DAPP revenue reward pool, with a total reward of up to 20,000 DAPP!

2. Additional Staking Rewards

During the activity period, users who have staked for more than 10 consecutive days in any Pencils Farming pool and participated in this liquidity incentive activity will enjoy an additional 20% increase in DAPP earnings from the liquidity rewards.