On December 25, Bitcoin (BTC) hinted at the possibility of a "Santa Rally" as it attempted to recover to $100,000. However, the rally fell short of its target and stalled. This failure of Bitcoin's rebound has made short-term holders question the possibility of a recovery in the near future.

Will the prices of cryptocurrencies still trade below six digits?

Bitcoin, Bearish Sentiment

Bitcoin's failure to rebound to $100,000 pushed the price below $97,000 and negatively impacted its market dominance. However, the downtrend does not stop here.

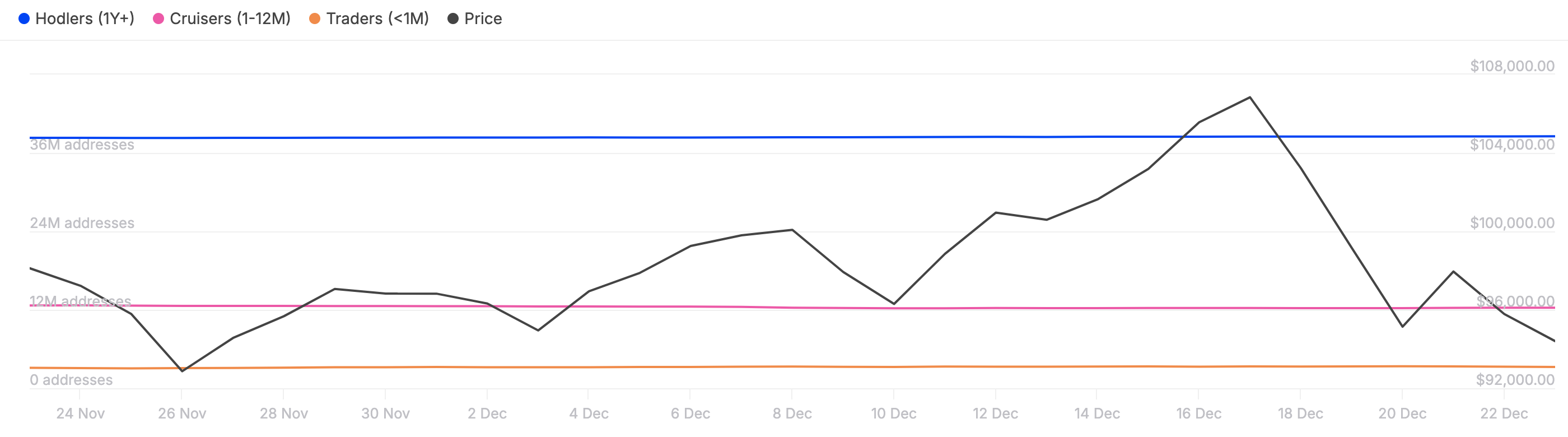

According to the on-chain data platform IntoTheBlock, the 'Holder Net Position Change' metric, which tracks the activity of Bitcoin holders holding for 30 to 365 days, has seen a noticeable decrease last week.

This group is often referred to as short-term holders and plays a crucial role in reflecting market sentiment. An increase in this group would indicate an optimistic outlook, but the recent decrease suggests that confidence is waning among these investors.

If this trend continues, it may indicate that downward pressure on Bitcoin's value could persist in the near future.

Another indicator reinforcing this sentiment is the Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL). The STH-NUPL measures the behavior of investors holding Bits for less than 155 days.

This data can reveal whether Bitcoin's short-term holders are optimistic, fearful, or greedy. According to the on-chain data analysis platform Glassnode, this metric has fallen into the hope or fear zone (orange), indicating that investors are skeptical about a significant rebound in BTC. If this condition persists, BTC may struggle to attract sufficient demand to drive up its price.

BTC Price Prediction: Drop Below $90,000?

On the daily chart, Bitcoin's price faced resistance at $99,332. This obstacle was one of the reasons the cryptocurrency failed to rally to $108,398. This resistance could mean that the failure of Bitcoin's rebound may continue in the short term.

Additionally, the Relative Strength Index (RSI) has dropped below the 50.00 neutral point. This decline indicates that the momentum around BTC has shifted to the downside. If this condition persists, the Bit could risk dropping to $85,851.

However, if buying pressure lifts BTC above the $99,332 resistance, the trend could reverse. In this case, the Bitcoin price could approach $110,000.