Author: Frontier Lab

Market Overview

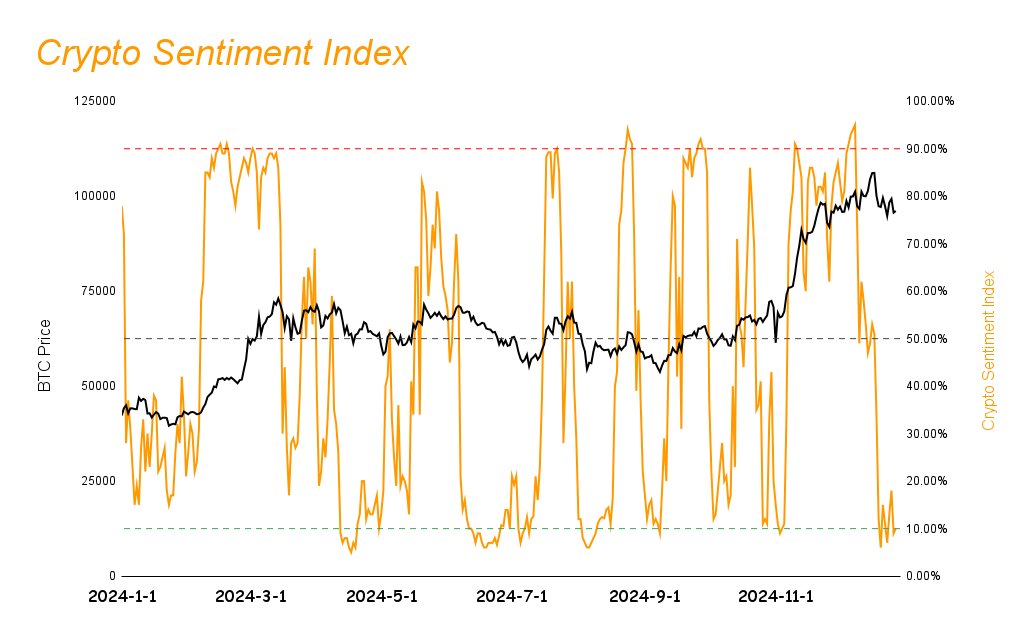

Overall market situation: This week, the cryptocurrency market showed a downward trend under the influence of the Christmas holiday. Although the market sentiment index rose slightly from 7% to 10%, it is still in the extreme fear zone. It is worth noting that despite the overall market weakness, USDC, which is mainly based on the US market, still achieved a 1.91% growth, indicating that institutional capital is still continuously entering the market, injecting certain confidence.

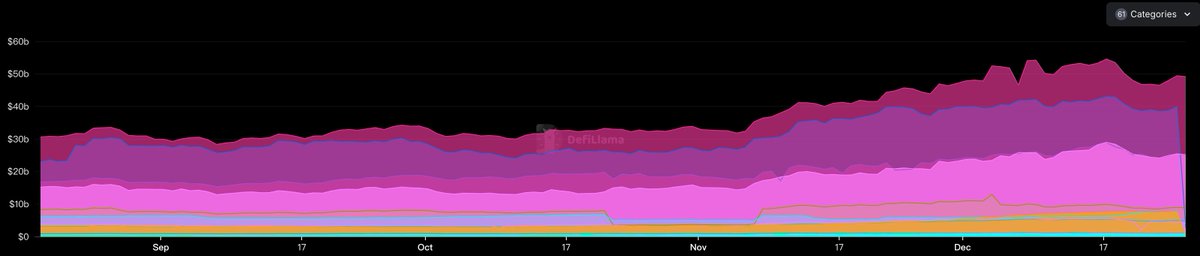

DeFi ecosystem development: The DeFi sector saw a slight 0.37% decline in TVL to $52.7 billion this week, but yield farming projects like Curve Finance performed well, and the overall supply of stablecoins has been growing, indicating that although the market has pulled back, basic liquidity is still flowing in, and yield farming projects are being sought after.

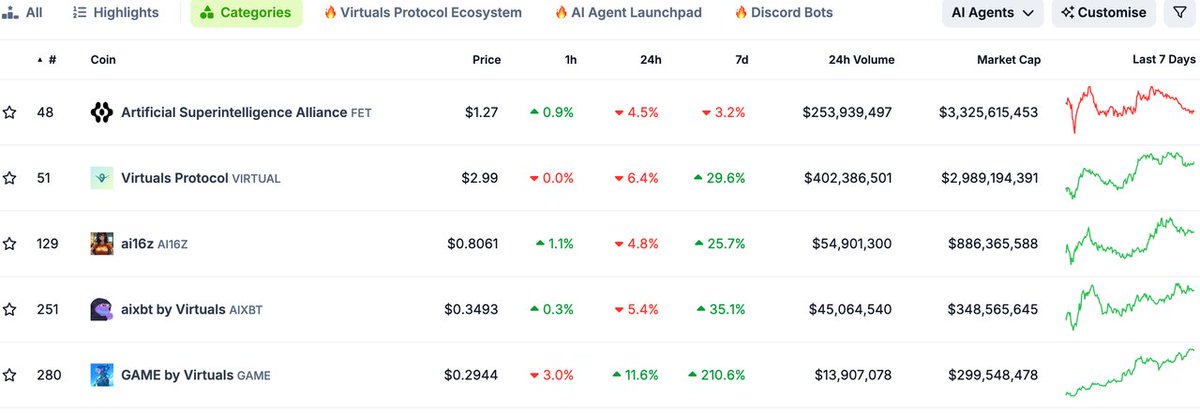

AI Agent development: The AI Agent track continues to receive high market attention, with a total scale reaching $10.9 billion. In particular, the aipool model that combines TEE technology has become a new focus in the market, and is expected to become a new type of asset issuance method after "Stamping", showing the development trend of the deep integration of AI and blockchain technology.

Meme coin trend: Affected by the holiday and the overall market decline, the Meme coin track performed poorly this week, with investor participation and capital inflow significantly reduced. The market heat has temporarily shifted to other tracks, showing the high volatility of this track.

Public chain performance analysis: The public chain sector has shown strong resilience to the decline. Among them, Stacks completed an important milestone of sBTC, BOB pushed forward the development of the BitVM Bridge, and Taiko launched a new round of ecological plans, indicating that major public chains are continuously making efforts in technological innovation and ecosystem building.

Future market outlook: Looking ahead, the market is expected to continue the sluggish trend during the New Year's holiday. It is suggested that investors maintain a defensive configuration, increase the allocation of top assets, and moderately participate in high-yield yield farming projects. In the long run, the market generally expects that the upward trend may come in the first quarter of 2025, and AI Agent and DeFi yield farming projects are worth focusing on.

Market Sentiment Index Analysis

The market sentiment index rose from 7% last week to 10%, still in the extreme fear zone.

Altcoins performed weaker than the benchmark index this week, showing a significant decline. Due to the Christmas holiday, liquidity has dropped sharply, leading to increased price volatility and causing market sentiment not to be high. Given the current market structure, Altcoins are expected to move in sync with the benchmark index in the short term, with a low probability of independent trends.

When Altcoins are in the extreme fear zone, the market is often at a stage bottom and may turn upward at any time.

Overall Market Trend Overview

The cryptocurrency market was in a downward trend this week, with the sentiment index still in the extreme fear zone.

Crypto projects related to DeFi performed outstandingly, showing that the market continues to focus on improving basic yields.

The AI Agent track projects received high attention this week, indicating that investors are actively looking for the next market breakout point.

Hot Tracks

AI Agent

This week, the overall market was in a downward trend, with all tracks in a downward state. Although the prices of most AI Agent track tokens also fell this week, the discussion around this track was the highest in the market. This week, the market discussed a lot about the aipool model, which combines AI Agent and TEE, and its future development in Crypto and its impact on DeFi.

Each time the Crypto market experiences a cyclical surge, a new asset issuance method acts as a booster. For example, the previously popular ICO (Initial Coin Offering), IEO (Initial Exchange Offering), INO (Initial NFT Offering), IDO (Initial DEX Offering), and "Stamping" have all quickly promoted market development and price increases in the Crypto market. Against the background of the rapid integration of AI and Crypto, the aipool model has become a relatively hot asset issuance method at the moment, and is also a continuation of the "打钱FI" trend in early 2024. If the aipool model is widely accepted by the market, it will soon usher in a wave of asset issuance driven by this model, so we should pay close attention to aipool-type projects.

Top 5 AI Agent projects by market capitalization:

DeFi Track

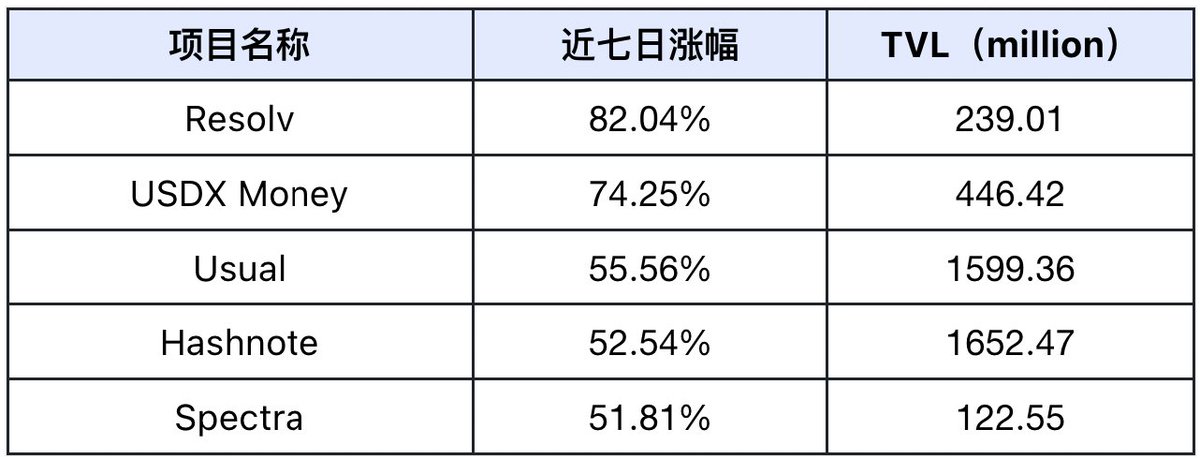

TVL Growth Ranking

Top 5 projects with the highest TVL growth in the past week (excluding projects with TVL less than $30 million), data source: Defilama

Resolv (not yet launched): (Recommendation index: ⭐️⭐️⭐️)

Project introduction: Resolv is a delta-neutral stablecoin project that focuses on the tokenization of market-neutral investment portfolios. The architecture is based on economically viable and fiat-independent yield sources, allowing competitive returns to be distributed to the protocol's liquidity providers.

Latest developments: This week, Resolv completed an important technical upgrade, successfully transforming into an Omnichain project by integrating LayerZero and Stargate technologies. The OFT standard it adopts has also passed security audits by multiple institutions. Resolv has performed outstandingly in ecosystem development this week, attracting $100 million in new capital inflows, with an 84% growth rate. Its USDC Vault on Euler Finance offers an APY of up to 36.36%, attracting $5.67 million in TVL. Resolv has also launched a wstUSR pool on Pendle.fi and introduced a unified points system.

USDX Money (not yet launched): (Recommendation index: ⭐️⭐️⭐️)

Project introduction: USDX Money is an emerging synthetic US dollar stablecoin protocol that aims to provide a new crypto-native stablecoin solution through a multi-chain, multi-asset strategy. The project's core goal is to build the next-generation stablecoin infrastructure and maintain the peg to the US dollar through a delta-neutral hedging strategy.

Latest developments: This week, USDX Money completed a brand new UI/UX upgrade to optimize the user experience. It also launched USDX/USDT and sUSDX/USDX liquidity pools on Curve Finance, with the ecosystem scale continuing to expand. The sUSDX has reached a TVL of $170 million through collaboration with Lista DAO. USDX Money has also launched the X-Points incentive program, including content creation, angel program, and held a special Christmas event.

Usual (USUAL): (Recommendation index: ⭐️⭐️⭐️⭐️⭐️)

Project introduction: Usual is a Binance-backed stablecoin project that aims to provide a new stablecoin solution in a decentralized manner. The core mechanism includes three main tokens: the stablecoin USD0, the bond product USD0++, and the governance token USUAL.

Latest developments: Recently, Usual received a $10 million Series A funding led by Binance Labs and KrakenVentures. It has also partnered with the M^0 Foundation to launch a new product called UsualM. Usual has become the largest USD0/USD0++ pool on Curve Finance, with its TVL surpassing $1.5 billion, ranking among the top 5 global stablecoins. The DAO treasury has also doubled to $17 million. Usual has launched a high-yield USUALx staking program offering up to 18,000% APY, and initiated a community airdrop activity.

Hashnote (not yet launched): (Recommendation index: ⭐️⭐️)

Here is the English translation of the text, with the terms in <> retained as is:Project Introduction: The Hashnote project is a solution focused on institutional cryptocurrency management, aiming to provide transparency and optimize asset management through blockchain technology. Hashnote combines digital assets and traditional finance to provide users with innovative yield enhancement solutions, such as USYC.

Latest Developments: This week, Hashnote reached a strategic partnership with CoreDAO and participated in its ecosystem panel meeting, where it launched an innovative Bitcoin dual-staking model that combines BTC and Core Token to provide users with a sustainable yield solution. Additionally, the project CEO shared the new strategy at the meeting, which received over 14,000 views, demonstrating the market's strong interest in this innovative model.

Spectra (SPECTRA): (Recommendation: ⭐️⭐️)

Project Introduction: Spectra is a protocol for the tokenization of future yields. DeFi users can deposit interest-bearing tokens from other protocols for a specified future period and trade the future yields in advance. Spectra's mechanism is to place interest-bearing tokens (IBT) or any fixed-term yield-bearing asset in a smart contract and issue future yield tokens (FYT) as a reward.

Latest Developments: This week, Spectra successfully deployed a new governance contract on the Base mainnet and launched Gauges and Incentivize pages in the Spectra App, optimizing the multi-lock functionality for veSPECTRA holders to participate more efficiently in the Gauge voting mechanism. Spectra also completed an APW emission adjustment, implementing a new emission mechanism at a 1:20 ratio.

In summary, we can see that the projects with the fastest TVL growth this week are mainly concentrated in the stablecoin yield sector (Vault).

Overall Sector Performance

Stablecoin Market Cap Steadily Grows: USDT decreased from $145.1 billion last week to $144.7 billion, a decline of 0.27%, while USDC grew from $42.1 billion to $42.9 billion, an increase of 1.91%. Although the market has been in a downward trend this week, USDC, which is primarily focused on the US market, still saw growth, indicating that the market's buying power continues to maintain a steady influx of capital.

Liquidity Gradually Increases: The risk-free arbitrage rate in the traditional market has been continuously declining due to the ongoing rate cuts, while the arbitrage rate in on-chain DeFi projects has been increasing due to the appreciation of cryptocurrency assets, making a return to DeFi a very good choice.

DeFi Sector TVL

(Data source: https://defillama.com/categories)

Capital Situation: The TVL of DeFi projects increased from $52.9 billion last week to $52.7 billion, a slight decline of 0.37% over two consecutive weeks. The main reason is that the Western markets, led by the US market, are in the Christmas holiday period this week, and both the trading volume of various tokens and on-chain activities have declined. Next week is also the New Year's holiday, so the outlook is not expected to improve significantly. Therefore, the focus should be on the overall TVL changes in the market in January, and whether the downward trend will continue.

In-Depth Analysis

Drivers of the Uptrend:

The core driving factors of this round of uptrend can be summarized as the following transmission path: Due to the recent downward trend in the market, the APYs of various DeFi protocols have declined. However, stablecoin yield projects have raised their yields through token/point rewards, which has given the Vault projects a clear advantage from the overall market perspective.

Market Environment: Although in a bull market cycle, the market has been in a downward trend recently, causing a significant drop in the underlying interest rates.

Interest Rate End: The underlying lending rates have risen, reflecting the market's pricing expectations for capital.

Yield End: The yields of stablecoin yield projects have expanded compared to other projects, thereby attracting more users to participate in this transmission mechanism, strengthening the value support of stablecoin yield projects and forming a virtuous growth momentum.

Potential Risks: Due to the recent upward trend in the market, investors have been more focused on yields and borrowing leverage, neglecting the risk of downside. Additionally, due to the Christmas holiday this week, market liquidity has sharply declined, leading to selling pressure that could not be adequately absorbed, causing prices to continue to fall. This has triggered the liquidation of long positions, increasing the risk of cascading liquidations and further price declines.

Performance of Other Sectors

Public Chains

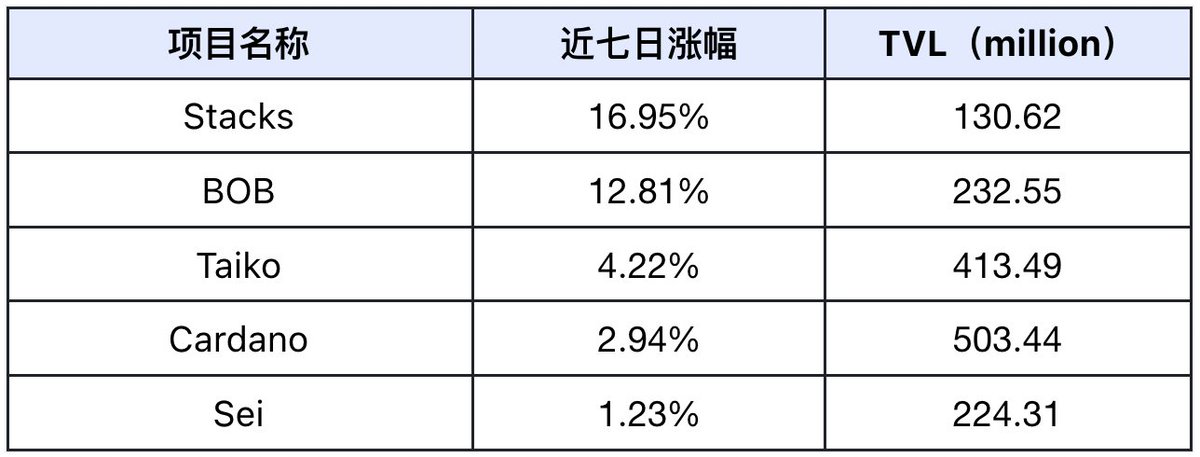

Top 5 public chains by TVL growth in the past week (excluding chains with smaller TVL), data source: Defilama

Stacks: This week, 922 BTC were transferred to the Stacks network, completing the first phase of the 1,000 BTC deposit limit for sBTC. In DeFi applications, 35% of sBTC are generating yields on the Zest Protocol, and the ALEX community has voted to allocate 12 million ALEX tokens for the Surge program. Stacks also achieved L1/L2 asset swap functionality through Bitflow Finance and AI Console, and launched the "Stackies" community reward program to incentivize developer contributions.

BOB: This week, BOB collaborated with Fiamma Labs to develop and release a prototype of the BitVM Bridge based on zero-knowledge technology, planned for launch on the testnet in early 2025. BOB also partnered with Lombard Finance for protocol deployment on the BOB chain, and had initial governance discussions with Aave to bring their protocol to the BOB network. Additionally, BOB launched a 6-week DeFi incentive program, rewarding LST holders for participation through Babylon Points, and held community education tasks and Spaces events.

Taiko: This week, Taiko launched Trailblazers Season 3, setting up a 6 million TAIKO token reward pool, and introduced the Liquidity Royale activity to reward the top 100 liquidity providers with 12,000 TAIKO tokens. The number of projects on the Taiko chain has grown to 130, with the addition of Symmetric as a key DEX partner. Taiko also held its first community meetup in Turkey with ITU Blockchain and Node 101, and strengthened community building through holiday gift-giving and meme contests.

Cardano: This week, Cardano highlighted the technical advantages of its slashing mechanism in safeguarding user ADA assets, and launched convenient web application development tools. It also deepened its partnership with hardware wallet provider Ledger, and advanced its decentralized governance through the DReps (Delegated Representatives) voting model.

Sei: This week, Sei released a major technical breakthrough called "Giga", successfully scaling EVM to process 5 gigagas per second, a 50-fold performance improvement. Through Developer Office Hours, Sei unveiled the Giga Roadmap for future technology development, and launched the EVM Wrapped feature to allow users to view their activities across multiple EVM chains, enhancing cross-chain interoperability. Sei also launched the "12 Days of Christmas" holiday event and partnered with PythNetwork, Silo, and Nansen.

Top Gainers

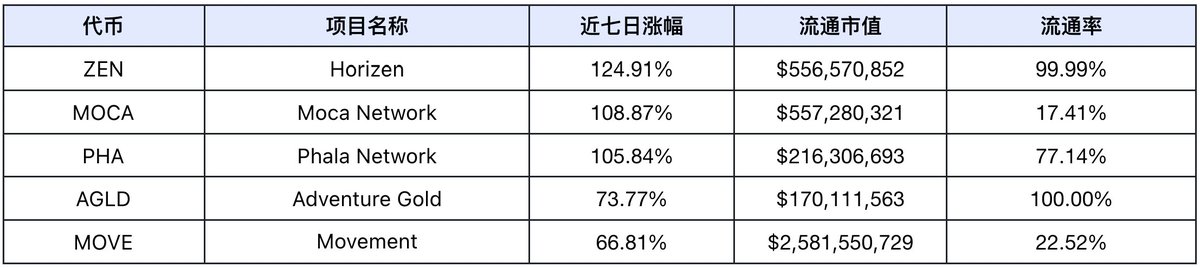

Top 5 token gainers in the past week (excluding low-volume tokens and meme coins), data source: Coinmarketcap

ZEN: This week, Horizen successfully deployed the Horizen 2.0 Devnet testnet, introducing an optimized zero-knowledge (ZK) solution to reduce technical complexity and costs. Horizen also established a strategic partnership with Automata Network to advance Web3 development, and gained recognition from institutional investors through Grayscale's Horizen Trust. Horizen completed the final halving of ZEN and listed it on the Bitvavo exchange, while actively preparing for the token distribution plan of the zkVerify project.

MOCA: This week, Moca Network successfully integrated with SK Planet's OK Cashbag app, which brought significant user growth, including 1.5 million page views and 800,000 wheel spin interactions. Moca Network remained active in community operations, enhancing user stickiness through Christmas marketing campaigns (#MocaFam) and focusing on user security education by repeatedly issuing anti-fraud reminders.

PHA: This week, Phala Network officially launched Phala 2.0, integrating GPU TEE technology and Ethereum Layer 2 scaling capabilities. Phala Network also partnered with NVIDIA, and joint testing showed that TEE achieved nearly 99% efficiency on H100/H200. Phala Network also announced the decision to migrate the Khala chain to the Ethereum mainnet. Phala Network's TEE-as-a-Service has been adopted by multiple projects, including Flashbots, and annual data shows a significant increase in AI Agent contract executions to 4,500, with 37,650 active TEE Workers, demonstrating Phala Network's leading position in decentralized AI infrastructure.

AGLD: This week, Adventure Gold engaged with the community through a Christmas-themed marketing campaign, with a Christmas greeting tweet receiving high community participation (27 likes, 14 retweets). Adventure Gold also collaborated with BladeGamesHQ on AI Agent-driven on-chain economics, showcasing the project's exploration in the integration of gaming ecosystems and AI technology.

MOVE: This week, Movement launched several innovative products based on its technology stack, including Puffpaw Vape (with multi-chain functionality, usage data tracking, and reward features), Vomeus smart Vape with a high-definition screen, and the Sentimint project, which allows users to attach emotions and memories to physical items. Movement also optimized performance through Block-STM parallelization and Rollup architecture, and expanded its on-chain DeFi scenarios through cross-chain integration with WBTC.

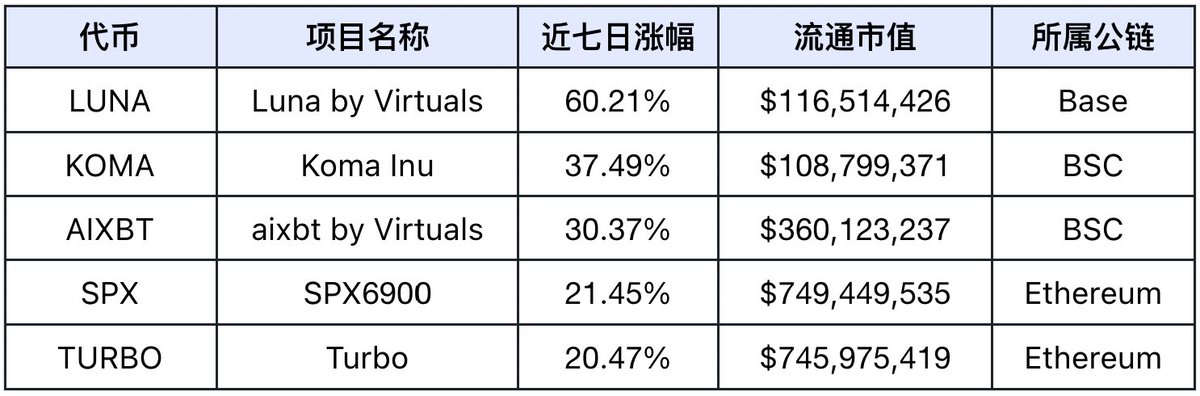

Meme Token Price Increase Ranking

Data source: coinmarketcap.com

This week, Meme projects were significantly impacted by the overall market downturn. Due to the Christmas holiday, there were fewer market participants, leading to capital outflows and reduced investment in Meme tokens.

Social Media Hotspots

Based on the top five daily growth data from LunarCrush and the top five AI scores from Scopechat, the most frequently mentioned topic this week (12.21-12.27) was L1s, with the following tokens listed (excluding tokens with low trading volume and Meme tokens):

Data source: Lunarcrush and Scopechat

According to the data analysis, the highest social media attention this week was on L1 projects. Due to the Christmas holiday, the US-dominated market entered a vacation period, leading to a significant decline in market liquidity. While most investors reduced on-chain investment activities and engaged in selling, L1 projects generally performed better than other sectors, as investors sought to hedge their risks by investing in BTC and ETH, while also allocating funds to various public chains.

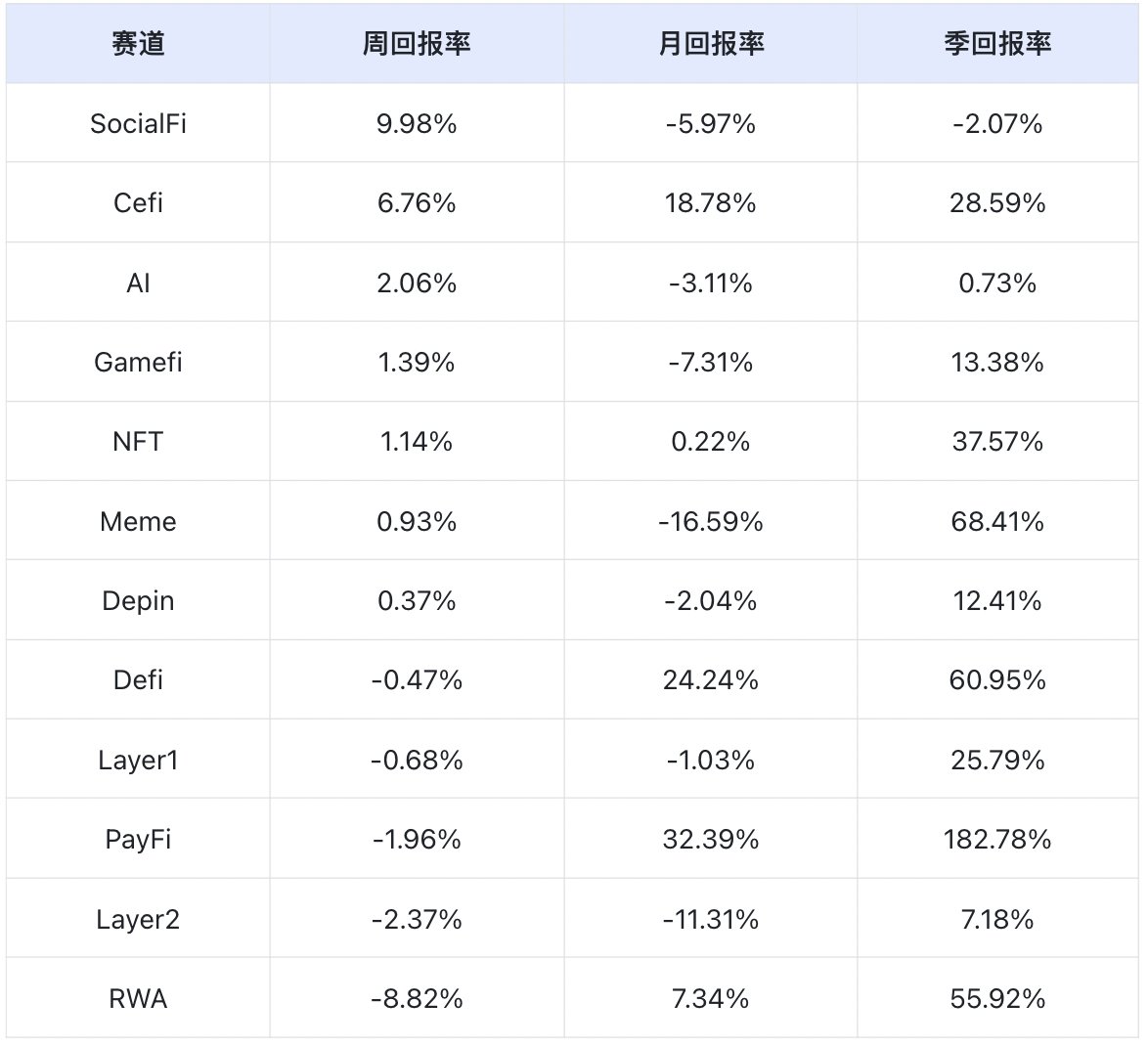

Overall Market Theme Overview

Data source: SoSoValue

Based on weekly returns, the SocialFi sector performed the best, while the RWA sector performed the worst.

SocialFi sector: The dominant player in the SocialFi sector is still TON, accounting for 91.07% of the sector's market capitalization. This week, TON did not follow the market downturn and instead rose by 6.3%, contributing to the SocialFi sector's outperformance. Toncoin also collaborated with GMX to promote the development of high-frequency DeFi trading.

RWA sector: The RWA sector is dominated by OM, ONDO, and MKR, accounting for 44.28%, 23.85%, and 18.36% respectively, totaling 86.49%. This week, OM, ONDO, and MKR declined by 10.76%, 19.86%, and 8.28%, respectively, with a larger decline compared to other sectors, leading to the RWA sector's worst performance.

Upcoming Crypto Events Next Week

Monday (December 30): The European Securities and Markets Authority (ESMA) will release the implementation of the MiCA crypto regulation.

Thursday (January 2): The US weekly initial jobless claims.

Friday (January 3): The court will approve the effective start of FTX's Chapter 11 reorganization plan.

Next Week's Outlook

Macroeconomic factors: Next week will enter the New Year's holiday period, with few macroeconomic data releases. Historically, the market dominated by US investors has tended to experience a decline in purchasing power during the New Year's holiday period, leading to increased market volatility.

Sector rotation trend: While the current market environment for the DeFi sector is poor, investors generally expect a market-wide rally in the first quarter of next year. As a result, most investors are reluctant to sell their tokens and are actively participating in yield farming projects to increase their returns. The AI Agent sector continues to receive market attention, with the asset issuance model based on AI Agent + TEE attracting widespread interest.

Investment strategy recommendations: Maintain a defensive configuration, increase the allocation of top assets like BTC and ETH to enhance the risk-hedging properties of the portfolio. Participate in high-yield DeFi yield farming projects, but exercise caution, maintain a prudent position size, and prioritize risk management.