Predicting the future is difficult, but as traders and investors, we should have a plan. Like all other plans, this plan will also change as the underlying scenario changes - the market is constantly evolving. This plan is based solely on my prediction of the market's development over the next year, and it provides insights into my thoughts on 2025, but should not be interpreted as financial advice.

VX: TTZS6308

→ On January 10, the Bitcoin ETF is launched;

→ BTC sets a new high, briefly triggering an Altcoin season;

→ Subsequently, it enters a period of volatility in Q2 and Q3, with BTC fluctuating between $50,000 and $60,000;

→ After the election, BTC sets a new high, rising all the way to $100,000;

→ It has not been able to effectively break through the $100,000 mark for the time being, and is currently hovering above $90,000.

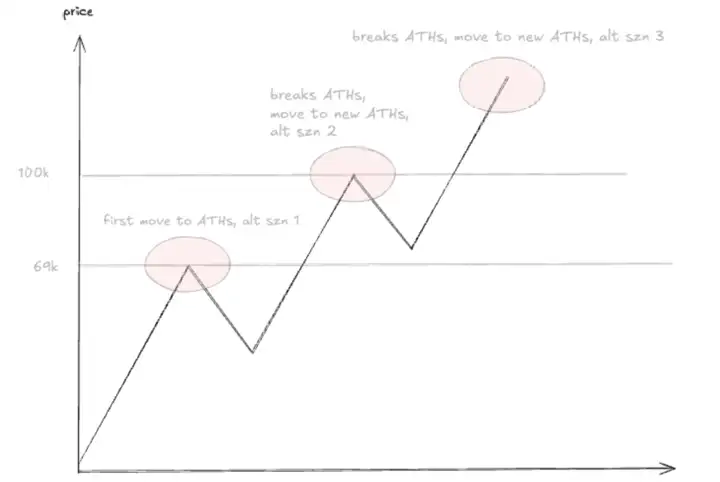

It should be noted that Altcoin seasons often start at the peak of Bitcoin. The first one was during the process of BTC's assault on $69,000, which it failed to effectively break through; the second one was during the process of BTC's assault on $100,000.

The next Altcoin cycle is likely to start after BTC stabilizes above $100,000. I cannot predict the future, and although I hope this will happen in the first quarter of 2025, based on the facts, we may also see a repeat of the Q2 and Q3 volatility in 2024 in the coming months - I must be prepared for this. Therefore, here are all the scenario assumptions I have drawn up.

Scenario 1: Bitcoin and Altcoins rise together

In that case, the rise will be the only theme of 2025, and we will also enter another Altcoin season. Due to the continued rise of Bitcoin, all coins will perform well, and we will repeat the market conditions of the last two months of 2024, with the entire market "rising, rising, rising".

Probability: 30% - 40%;

Corresponding strategy: Take advantage of the current "panic" to buy, and get on board the strong Altcoins.

Scenario 2: Bitcoin rises, other coins have smaller gains

This will replay the plot of 2024, and in the coming months, we will see Altcoins remain volatile, but Bitcoin become more bullish (because only Bitcoin is rising). Some Altcoin sectors will also perform well.

Probability: 50% - 60%;

Corresponding strategy: Still take advantage of the current "panic" to buy, but need to get on board specific Altcoin sectors, the key is to avoid the high-profile areas and look for the next potential emerging narrative.

Scenario 3: Bitcoin rises, Altcoins fall

This means that the current time is the top for Altcoins, although Bitcoin will continue to perform well.

Probability: 20% - 30%;

Corresponding strategy: Sell all Altcoins. Although we have to bear some of the drawdown, if Altcoins don't rise, we may have to sell them all.

Scenario 4: Bitcoin falls, Altcoins fall

Probability: 10% - 20%.

I believe a few things will happen. I believe BTC's next new high will not take as long as in 2024, because the macroeconomic tailwind truly exists. In a regulatory environment that can be described as hell, although the ETF has been launched, TradFi still needs to work hard to sell the story of BTC to clients, because the whole world does not believe in the importance of Bitcoin.

Now that Trump is about to take office, the talk of a Bitcoin strategic reserve (SBR) has been hyped up. The market sentiment has already changed, and I won't speculate on the possibility of establishing a strategic Bitcoin reserve system - I have no experience in the intertwining of politics and finance.

What I care about is the narrative - the fact is that the incoming new administration has brought a lot of new attention to digital assets, and it is now easier to convince people to buy Bitcoin, because even the president of the world's largest country is frequently discussing it.

This change in the macroeconomic backdrop is very important. Therefore, I believe Bitcoin will continue to have a tailwind in 2025, while Altcoins is a similar but different story.

The key is positioning and timing. I am optimistic about 2025, but I don't know how long it will take for the market conditions to arrive - although I do believe that the bull run will come faster than in 2024, without catalysts, Altcoins will still bleed heavily.

Whether it's Bitcoin or other coins, as long as the cycle hasn't peaked, my plan is to always maintain a net long position. I don't think 2025 will see a repeat of the summer of 2024, but I think we'll encounter periods similar to the current one - the market is just relatively quiet, but prices are still well maintained.

The on-chain world is completely different, when the tide goes out, the on-chain market can easily see -70% volatility. Therefore, for the on-chain market, my goal has always been to sell at the peak of attention, and reinvest the funds into the top Altcoins (top 20), and then gradually start to deploy further.

I don't think Altcoins will top out here, because I don't think Bitcoin will continue to rise while Altcoins die, and I don't think Bitcoin will reach a cyclical top at this level.

So my conclusion is: BTC will continue to rise, and the gains will exceed 2024; for Altcoins, my theme is still to be aggressive, but I need to know when to switch to defense, but the defensive tendency will be lower than in 2024.