Key Points

The crypto market will see transformative growth in 2025, continuing its trend of maturity and adoption.

The key themes for 2025 include the macroeconomic environment, blockchain metaverse, transformative innovations, and changes in user experience.

Executive Summary

Looking ahead to 2025, the cryptocurrency market is on the cusp of transformative growth. As the asset class matures, institutional adoption increases, and use cases expand across various domains. Just in the past year, the US has approved spot ETFs, tokenization of financial products has surged, stablecoins have seen tremendous growth and further integration into the global payments framework.

Achieving these milestones has not been easy. However, while these accomplishments may seem to be the pinnacle of years of effort, there are increasing signs that they may just be the starting point for even greater changes.

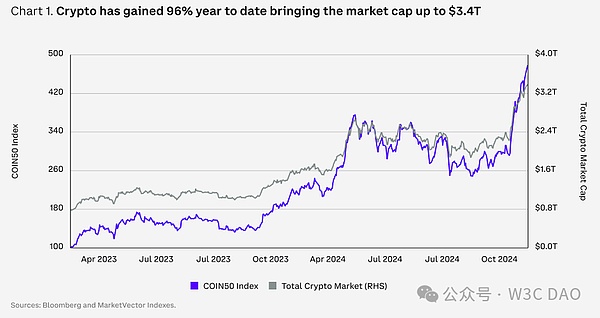

As we look back on the past year, the crypto market has emerged from the challenges of rate hikes, regulatory crackdowns, and an uncertain outlook, displaying remarkable resilience. Despite these challenges, cryptocurrencies have established themselves as a viable alternative asset class and have shown enduring vitality.

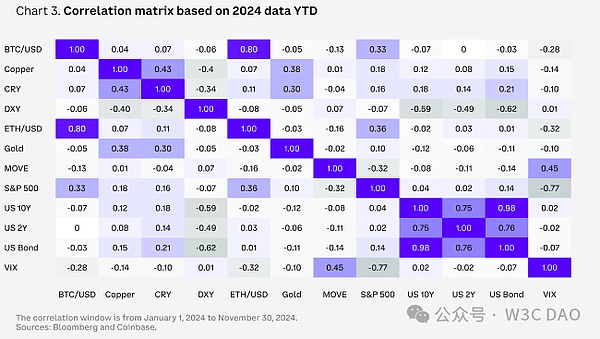

From a market perspective, the uptrend in 2024 differs significantly from previous bull market cycles. Some differences are superficial: for instance, the term "web3" has been replaced by the more apt "onchain". Others are more profound: fundamental demand is gradually replacing narrative-driven investment strategies, partly due to the deepening of institutional participation.

Furthermore, not only has Bitcoin's dominance risen, but the innovations in Decentralized Finance (DeFi) have also pushed the boundaries of blockchain's possibilities, laying the foundation for the establishment of new financial ecosystems. Major central banks and financial institutions around the world are discussing how to leverage cryptocurrencies to improve the efficiency of asset issuance, trading, and record-keeping.

Looking ahead, the current crypto market presents many promising developments. At the frontier of transformation, decentralized peer-to-peer exchanges, decentralized prediction markets, and AI agents equipped with crypto wallets are emerging. In the institutional realm, stablecoins and payments (bringing crypto and fiat banking solutions closer together), on-chain credit scoring-supported uncollateralized on-chain lending, and compliant on-chain capital formation all show tremendous potential.

While cryptocurrencies are widely known, the innovative technical structure still makes them appear complex and difficult to understand for many. However, technological innovations are also changing this, with more projects aiming to improve the user experience by simplifying blockchain complexity and enhancing smart contract functionality. Such successes may open the doors to a new class of users entering the crypto world.

Meanwhile, earlier in 2024, the US laid the groundwork for regulatory clarity, and this progress is expected to accelerate further in 2025, potentially solidifying the position of digital assets in mainstream finance.

As the regulatory and technological environment evolves, we expect the crypto ecosystem to see significant growth, with broader adoption driving the entire industry closer to its full potential. 2025 will be a pivotal year, and its breakthroughs and advancements may shape the long-term trajectory of the crypto industry for decades to come.

Theme 1: The 2025 Macroeconomic Roadmap

The Fed's Demands and Objectives

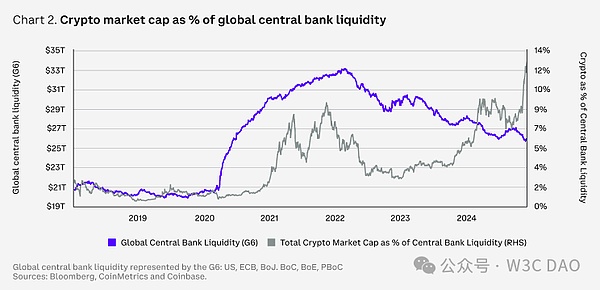

Donald Trump's victory in the 2024 US presidential election became the most important catalyst for the crypto market in Q4 2024, pushing prices 4-5 standard deviations above the three-month average. However, looking ahead, we believe the long-term direction of monetary policy will be more important than the short-term impact of fiscal policy responses, especially given the Fed's impending critical juncture. That said, distinguishing between the two is not easy. We expect the Fed to continue easing policy in 2025, but the specific pace may depend on the strength of the next expansionary fiscal policy. This is because tax cuts and tariffs may push inflation higher, and while overall CPI has declined to 2.7% year-over-year, core CPI still hovers around 3.3%, above the Fed's target.

The Fed's desired outcome is a disinflation from current levels, meaning prices need to continue rising but at a slower pace, to help achieve its other mandate - maximum employment. In other words, they want to control the pace of price increases. On the other hand, households, after the high spending of the past two years, want to see deflation, i.e., price declines. However, while price declines may be politically more palatable, they could trigger a vicious cycle ultimately leading to an economic recession.

Nevertheless, the current baseline scenario remains a soft landing, buoyed by lower long-term rates and the support of "American Exceptionalism 2.0". The Fed's rate cuts have essentially become a formality, as credit conditions have already been easing, creating a favorable environment for crypto performance in the next 1-2 quarters. Additionally, if the anticipated deficit spending of the new administration materializes, the increased circulation of US dollars in the economy may bring greater risk appetite, including for crypto assets.

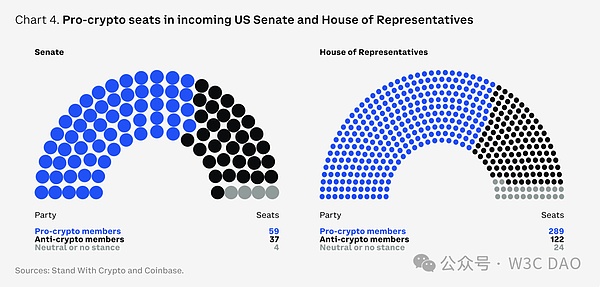

The Most Crypto-Supportive Congress in US History

For years, the US has faced political ambiguity in the crypto realm, but we believe the next legislative session may be an opportunity for the US to establish regulatory clarity for the crypto industry. This election has sent a strong signal to Washington: the public is dissatisfied with the current financial system and craves change. From a market perspective, a bipartisan pro-crypto majority in the House and Senate may shift the US regulatory stance from anti-crypto to pro-crypto, providing a boost to the crypto market's performance in 2025.

A new area of discussion is the potential for creating a strategic reserve. In July 2024, Senator Cynthia Lummis (Wyoming) proposed the "Bitcoin Bill" after the Bitcoin Nashville conference, and the Pennsylvania legislature has also introduced the "Pennsylvania Bitcoin Strategic Reserve Act". If passed, the Act would allow the state treasurer to invest up to 10% of Pennsylvania's general fund in or other crypto-based tools. Currently, pension funds in Michigan and Wisconsin hold crypto assets or crypto ETFs, and Florida is also following suit. However, creating a strategic reserve may face some challenges, such as legal restrictions on the Fed's balance sheet holding such assets.

Meanwhile, the US is not the only jurisdiction making progress on regulation. The growing global demand for crypto is also driving more thoughtful regulatory competition internationally. Looking abroad, the EU's Markets in Crypto-Assets (MiCA) regulation is being implemented in phases, providing a clear framework for the industry. Many G20 countries, as well as major financial centers like the UK, UAE, Hong Kong, and Singapore, are also actively developing rules to accommodate the evolution of digital assets, creating a more favorable environment for innovation and growth.

Crypto ETFs 2.0

The US approval of spot and Ether (ETH) exchange-traded products (ETPs and ETFs) is a significant milestone for the crypto economy, with net inflows reaching $30.7 billion since their launch (about 11 months). This figure far exceeds the inflation-adjusted $4.8 billion attracted by the SPDR Gold Shares ETF (GLD) in its first year after launching in October 2004. According to Bloomberg data, the performance of these ETFs has placed them in the top 0.1% of the approximately 5,500 ETF launches over the past 30 years.

These ETFs have changed the market dynamics of and , pushing 's market share from 52% at the start of the year to 62% by November 2024 by establishing new demand anchors. According to the latest 13-F filings, almost all types of institutional investors, including endowments, pension funds, hedge funds, investment advisors, and family offices, have now held these products. Additionally, the US-regulated related options launched in November 2024 may further enhance risk management capabilities and provide more cost-effective asset exposures.

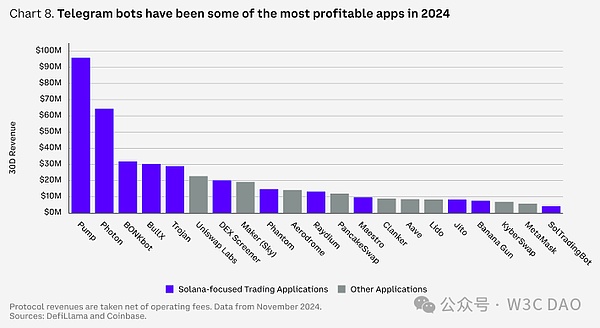

Here is the English translation of the text, with the terms in <> retained as is: The focus of the market going forward is whether the issuing institutions will expand the range of exchange-traded products to cover other tokens such as , , and . While potential approvals may only benefit a limited asset portfolio in the short term, more noteworthy is the potential impact if the U.S. Securities and Exchange Commission (SEC) allows to be included in ETFs, or removes its requirement for cash-based rather than in-kind ETF share creation and redemption. Introducing an in-kind creation and redemption mechanism can not only improve the price consistency between ETF share prices and actual net asset values (NAVs), but also help narrow the price spreads of ETF shares. This means that Authorized Participants (APs) no longer need to quote at a cash price higher than the trading price of , thereby reducing costs and improving efficiency. The current cash-based model also raises some issues, such as exacerbating price volatility from continuous buying and selling of and , and triggering taxable events, which would not apply in in-kind transactions. : The "Killer App" of the Crypto Realm By December 1, 2024, the total market capitalization of stablecoins grew by 48% to reach $193 billion. Some market analysts expect the industry to grow to nearly $30 trillion in the next five years based on current trends. Although this valuation seems massive, equivalent to the current size of the entire crypto market, it only accounts for about 14% of the $21 trillion U.S. M2 money supply. We believe the next wave of real-world adoption in crypto may come from the stablecoin and payments space, which also explains the surge of interest in this area over the past 18 months. Compared to traditional methods, stablecoins can enable faster and cheaper transactions, leading to increasing usage in digital payments and cross-border remittances, with more payment companies also expanding their stablecoin infrastructure. In fact, we may be increasingly approaching a day when the primary use case of stablecoins is no longer trading, but global capital flows and commercial activity. Beyond that, the potential political significance of stablecoins should not be overlooked, particularly in terms of their potential to address the U.S. debt burden. The Tokenization Revolution In 2024, the tokenization space continued to make significant progress. According to rwa.xyz data, tokenized real-world assets (RWAs, excluding stablecoins) grew by over 60% from the end of 2023, reaching $13.5 billion as of December 1, 2024. Analysts forecast the industry could grow to at least $2 trillion, or even up to $30 trillion, in the next five years, a potential increase of nearly 50-fold. Of course, these efforts also face unique challenges, including the fragmentation of liquidity across multiple chains and persistent regulatory hurdles. However, significant progress has been made on both fronts. Ultimately, we expect tokenization to be a gradual and ongoing process; however, its benefits are already widely recognized. This is a golden period for experimentation and exploration, ensuring enterprises are positioned at the forefront of technological advancements. The Revival of Decentralized Finance (DeFi) DeFi is dead. Long live DeFi. In the previous cycle, decentralized finance suffered major setbacks as certain applications were found to provide unsustainably high yields through token incentives. However, a more sustainable financial system has since emerged, integrating real-world use cases and transparent governance structures. We believe changes in the U.S. regulatory environment may inject new vitality into the prospects of DeFi. This may include establishing a regulatory framework for stablecoins, as well as providing pathways for traditional institutional investors to participate in DeFi, particularly as we see increasing synergies between off-chain and on-chain capital markets. All these signs indicate that the influence of DeFi may soon surpass its crypto-native user base and begin to integrate more deeply with traditional finance (TradFi). Telegram Trading Bots: The Hidden Profit Center After stablecoins and native L1 trading fees, Telegram trading bots have become one of the most profitable sectors in the crypto industry in 2024, with net protocol revenues even surpassing major DeFi protocols like and (now renamed ). This profitability is largely driven by the surge in trading and meme coin activities. Telegram trading bots are a chat-based token trading interface where users can directly create custodial wallets in the chat window, fund their wallets, and manage their funds through buttons and text commands. As of December 1, 2024, the bot users are primarily concentrated in tokens (87%), followed by (8%) and (4%).Here is the English translation of the text, with the content inside <> retained without translation:The main attraction of these applications stems from their convenience in DEX trading, especially for tokens that have not yet been listed on exchanges. Many bots also provide additional features, such as the "grab" function during token listings and integrated price alerts. Telegram's trading experience is quite attractive to users, with nearly 50% of Trojan users reusing the platform for four days or more (only 29% of users stop using it after one day), which has also led to its high average revenue per user of $188. Although the increasingly fierce competition between Telegram trading bots may eventually reduce trading fees, we believe Telegram bots (as well as other core interfaces discussed below) will continue to be leading profit centers by 2025.

Prediction Markets: Fundamental Capabilities

Prediction markets emerged as one of the biggest winners during the 2024 US election cycle. Platforms like Polymarket outperformed traditional polling data, which had previously predicted election results to be closer. This is a victory for the crypto industry, as blockchain-based prediction markets have shown significant advantages over traditional polls, while also demonstrating the unique applications of this technology. Prediction markets not only showcase the transparency, speed, and global accessibility provided by blockchain, but their blockchain foundation also enables decentralized dispute resolution and automated, result-based settlement, in contrast to non-blockchain versions.

While many believe the relevance of such dApps may decline after elections, we have already seen them expand into other domains such as sports and entertainment. In the financial realm, these markets are more accurate than traditional surveys in reflecting economic data releases (such as inflation and nonfarm payroll data), which may keep them relevant and valuable even after elections.

Gaming: Making Entertainment the Focus

Gaming has always been a core theme in the crypto space, due to the potential transformative impact of on-chain assets and markets. However, cultivating a loyal user base for crypto games has been a challenge. Compared to the player communities of successful traditional games, many crypto game users are more motivated by profit than pure entertainment. Additionally, many crypto games are distributed through web browsers and require self-hosted wallet setups, limiting the audience to crypto enthusiasts rather than a broader player base.

However, compared to the previous cycle, games integrating crypto technology have made significant progress. The core trend is a gradual shift away from the early "fully on-chain owned games" crypto-punk ideology, towards selectively on-chaining assets to unlock new functionalities without impacting the gaming experience. In fact, we believe many renowned game developers now view blockchain more as a supporting tool rather than a core marketing feature.

Off the Grid is a typical example of this trend. When this first-person shooter battle royale game launched, its core blockchain component (Avalanche subnet) was still in testnet, yet it became the top free game on the Epic Games platform. Its appeal stems primarily from the unique gameplay, rather than crypto tokens or item trading markets. Notably, this game is paving the way for expanding distribution channels for crypto-integrated games, with its release covering Xbox, PlayStation, and PC (via the Epic Games store).

Mobile has also become an important distribution channel for crypto-integrated games, whether native apps or embedded applications (such as Telegram mini-games). Many mobile games also selectively integrate blockchain components, with most of the actual activity running on centralized servers. These games often allow gameplay without the need to set up external wallets, thereby lowering the barrier to entry and enabling non-crypto-savvy players to easily get started.

We believe the line between crypto games and traditional games may continue to blur. The leading "crypto games" of the future may be crypto-integrated rather than crypto-centric, focusing more on polished gaming experiences and distribution channels rather than token-earning mechanisms. However, while this may drive broader adoption of crypto technology, how it directly translates to demand for liquid tokens remains unclear. In-game currencies may continue to remain siloed across games, and non-crypto players may not welcome external investors' interference in in-game economies.

Decentralized Physical World

Decentralized Physical Infrastructure Networks (DePINs) have the potential to revolutionize real-world allocation problems by guiding the creation of resource networks. In theory, DePINs can overcome the typical initial scale economy challenges faced by such projects. DePIN projects span domains like computing power, cellular communication towers, and energy, providing a more resilient and lower-cost way of aggregating resources.

A prime example is Helium, which operates by distributing tokens to individuals who provide local cellular hotspots. By rewarding hotspot providers with tokens, Helium can establish coverage networks across much of the urban areas in the US, Europe, and Asia, without bearing the substantial upfront capital costs of building and distributing communication towers. Instead, early adopters have been incentivized by gaining early stakes in the network through tokens.

However, we believe the long-term revenue and sustainability of these networks require case-by-case analysis. DePINs are not a panacea for resource allocation problems, as the pain points vary greatly across industries. Decentralized strategies may not be suitable for certain industries or may only solve specific issues within an industry. We believe this space is likely to see significant differences in network adoption rates, token utility, and revenue generation, which are more likely to depend on the target industry itself rather than the underlying technology network used.

Artificial Intelligence: Creating Real Value

Artificial Intelligence (AI) has remained a focus of investor attention in both traditional markets and the crypto space. However, we believe the impact of AI in the crypto realm is multifaceted, with the narrative often shifting. In the early stages, blockchain technology was seen as a way to address the trustworthiness of AI-generated content and user data (e.g., verifying the authenticity of data). AI-driven intent-driven architectures were viewed as potential user experience improvement tools. Subsequently, the focus shifted to decentralized AI model training and computing networks, as well as crypto-based data generation and collection. More recently, the focus has turned to autonomous AI agents that can control crypto wallets and engage in social media interactions.

We believe the full impact of AI on the crypto space remains unclear, as evidenced by the frequent shifts in the narrative. However, this uncertainty does not diminish the transformative potential of AI for the crypto realm, as AI technologies continue to make breakthroughs. AI applications are also becoming increasingly accessible to non-technical users, which may further accelerate the development of creative use cases.

The key question, in our view, is how these transformations can create lasting value for liquid tokens, rather than just company equity. For example, many AI agents operate on traditional technology tracks, with short-term "value manifestations" (such as market attention) flowing more towards memecoins rather than the underlying infrastructure. While liquid tokens related to the infrastructure layer have also experienced price appreciation, their usage growth has typically lagged behind the price increases. We believe this disconnect between price and network metrics, combined with the market's rotating focus on AI memecoins, reflects a lack of strong consensus among investors on how to capture AI's growth in the crypto space.

Theme Three: Blockchain Metaverse

Multichain Future or Zero-Sum Game?

The popularity of alternative Layer-1 (L1) networks has once again become an important theme in the aftermath of the previous bull market cycle. Emerging networks are competing on lower transaction costs, redesigned execution environments, and minimized latency. However, we believe the expansion of the L1 space has reached a point of general blockchain space oversaturation, even as high-value blockchain space remains scarce.

In other words, additional blockchain space itself does not inherently have high value. However, a vibrant protocol ecosystem, an active community, and dynamic crypto assets can still endow certain blockchains with the ability to charge premium fees. For example, Ethereum remains the core for high-value DeFi activities, even though its mainnet execution capabilities have not seen significant improvements since 2021.

Here is the English translation of the text, with the specified terms retained and not translated: Despite this, we believe investors are still attracted to the differentiated ecosystems that these new networks may nurture, even as the barriers to this differentiation are constantly rising. High-performance chains like , , and are competing with for market mindshare, while the upcoming release of is also seen as a strong contender for developer attention. Historically, DEX trading has been the biggest driver of on-chain fees, requiring strong user onboarding, wallets, interfaces, and capital support to form a virtuous cycle of growing activity and liquidity. This concentration of activity often leads to a "winner-takes-all" dynamic across different chains. However, we believe the future may still be multi-chain, as different blockchain architectures offer unique advantages in meeting diverse needs. While appchains and solutions can provide custom optimization and lower costs for specific use cases, a multi-chain ecosystem allows for specialization while benefiting from the broader network effects and innovation across the entire blockchain space. Although (L2) has exponential scaling capabilities, the debate around the Ethereum rollup-centric roadmap continues. Criticisms include the "predatory" impact of L2 on L1 activity, fragmentation of liquidity and user experience, especially as L2 is seen as the cause of Ethereum network fee declines and the "ultrasound money" narrative unraveling. New controversies around L2 also include trade-offs in decentralization, the split of different virtual machine environments (e.g., potential EVM fragmentation), and the choice between "based" and "native" rollups. Nevertheless, from the perspective of increasing block space and reducing costs, L2 has achieved tremendous success. The introduction of binary large object (blob) transactions in the March 2024 Ethereum Dencun (Deneb + Cancun) upgrade reduced L2 average costs by over 90% and drove a 10x growth in Ethereum L2 activity. Furthermore, we believe that allowing multiple execution environments and architectures to experiment within the Ethereum ecosystem is a long-term advantage of the rollup-centric approach. The increased convenience of custom network deployments is driving more and more applications and companies to build chains they can better control. Major protocols, such as and (formerly MakerDAO), have explicitly included chain-building in their long-term plans, while the Uniswap team has also announced plans to launch a -focused L2 chain. Even some traditional companies are getting involved, such as Sony's announcement of plans to launch a new chain called . As the blockchain infrastructure stack matures and becomes more commoditized, we believe the appeal of owning block space is increasing, especially for regulated entities or applications with specific use cases. The technology stack supporting this trend is also evolving. In past cycles, application-centric chains primarily used the Cosmos or Polkadot SDK. Now, the growth of the (RaaS) industry is driving the launch of more projects' own L2 chains, with service platforms like and simplifying integration with other services through their marketplaces. Similarly, the development of 's subnets may see a surge in adoption due to the AvaCloud hosted blockchain service, which significantly simplifies the process of launching custom subnets. We believe that a simple user experience is one of the most critical factors in driving mass adoption. Although the crypto industry has historically been focused on technical depth due to its cypherpunk origins, the focus is now rapidly shifting towards simplifying the user experience. Specifically, the entire industry is working to abstract the complexity of crypto technology into the background of applications. Some recent technical breakthroughs are making this transition possible, such as the adoption of account abstraction to simplify onboarding, and the use of session keys to reduce signing friction. The adoption of these technologies will make the security components of crypto wallets (such as seed phrases and recovery keys) invisible to most end-users - similar to the seamless security experience on the internet today (like https, OAuth, and passkeys). We expect to see more passkey onboarding and in-app wallet integration trends by 2025, such as the Coinbase Smart Wallet's passkey onboarding and the integration of and with Google login. In our view, improving user interfaces to "control" user relationships is one of the most important transformations in crypto user experience. This transformation will be achieved in two ways: first, by enhancing the experience of standalone wallets, as mentioned earlier. Onboarding processes are becoming increasingly simplified to cater to user needs. For example, integrated app functionalities (such as swapping and lending) within wallets can keep users within their familiar ecosystems. At the same time, applications are also competing to abstract blockchain technology components into the backend by integrating wallets, to control user relationships. This includes transaction tools, games, on-chain social, and membership applications, which automatically configure wallets for registered users through familiar methods (like Google or Apple's OAuth). Overall, the crypto industry will face fierce competition in attracting and retaining users. As the Telegram trading bot's average revenue per user (ARPU) has demonstrated, many retail crypto traders have relatively lower price sensitivity compared to traditional finance (TradFi) entities. In the coming year, we expect the efforts to "control" user relationships to go beyond the trading domain and become a greater focus for protocols.As regulatory clarity continues to improve and more assets are tokenized off-chain, simplifying Know Your Customer (KYC) and Anti-Money Laundering (AML) processes has become increasingly important. For example, certain assets are limited to qualified investors in specific regions, making identity verification and eligibility certification a core pillar of the long-term on-chain experience.

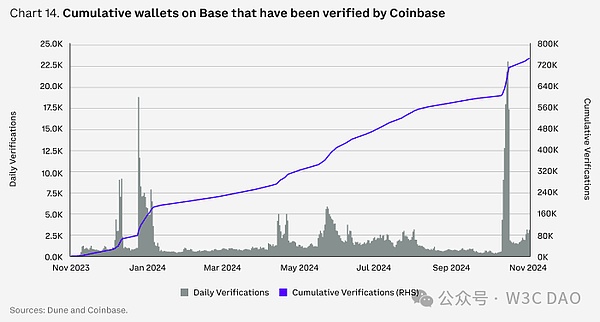

In our view, this involves two key components. The first is creating on-chain identity itself. The Ethereum Name Service (ENS) provides a standard that resolves human-readable ".eth" names to one or more cross-chain wallets. Variants of this technology have now appeared on networks like Basenames and Solana Name Service. The adoption of these core on-chain identity services is accelerating, with major traditional payment providers (such as PayPal and Venmo) now supporting ENS address resolution.

The second core component is building attributes for on-chain identity. This includes confirming KYC verification and jurisdiction data, which other protocols can then view to ensure compliance. The core of this technology is the Ethereum Attestation Service, which provides a flexible service for entities to provide attested attributes to other wallets.

These attested attributes are not limited to KYC and can be freely extended to meet the needs of the attestor. For example, Coinbase's on-chain verification leverages this service to confirm a wallet is associated with a Coinbase trading account and located within a specific jurisdiction. Some new real-world asset-backed lending markets will restrict usage rights on Base through these verifications.