The cryptocurrency market capitalization has recently declined slightly by 1% to $3.33 trillion. However, a broader analysis shows a decline of up to 18.33%, from $3.7 trillion in November to $3.28 trillion on December 24.

VX: TTZS6308

Over the past 24 hours, the market has declined, but trading volume has increased by 3.3% to $121.84 billion. This indicates that the selling pressure from traders is driven by actual conditions.

This market downturn trend usually has a significant impact on the performance of Altcoins, especially since the movement of these tokens is generally in line with the overall market trend. In fact, the decline in capital inflows plays a key role in the continued market weakness.

Significant Decline in Liquidity Cash Flows

The funds flowing into the cryptocurrency market have decreased significantly. This is a sign of a lack of positive investment.

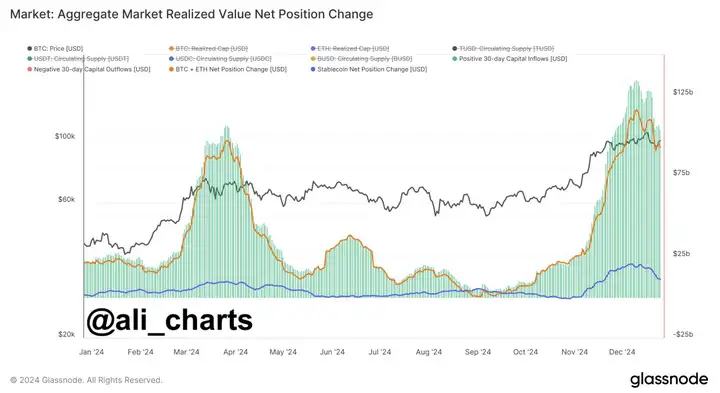

The data on the net position change indicator of the total market realized value shows that capital inflows have declined from $134 billion on December 10 to $100 billion at the time of writing.

For most cryptocurrencies, this sluggishness usually indicates a lack of bullish sentiment in the market. Instead, investors tend to prioritize holding stable assets rather than purchasing more volatile tokens. This will reinforce the bearish sentiment in the market and increase the risk of further declines.

Although capital inflows are generally low, some tokens are expected to maintain strong growth momentum and potentially outperform the overall market.

BNB to Set New Highs

Binance Coin (BNB) remains one of the best-performing cryptocurrencies in 2024, setting two new all-time highs during the year.

After reaching a previous peak of $691.77 in 2021, the BNB price broke through this level in June 2024, reaching $721.80 on the chart. By December 2024, it set another record, trading at $793.86.

As of the time of writing, BNB appears to be in an accumulation phase. If it can overcome this period, BNB may launch another bull run, potentially surpassing its previous highs and reaching a target above $800.

AAVE Maintains Bullish Trend

On the price chart, AAVE remains in a bullish territory. After a few months of a stable market, the asset had a strong breakout in January, surging 332.78% to $399.85, which was the level last seen in 2021.

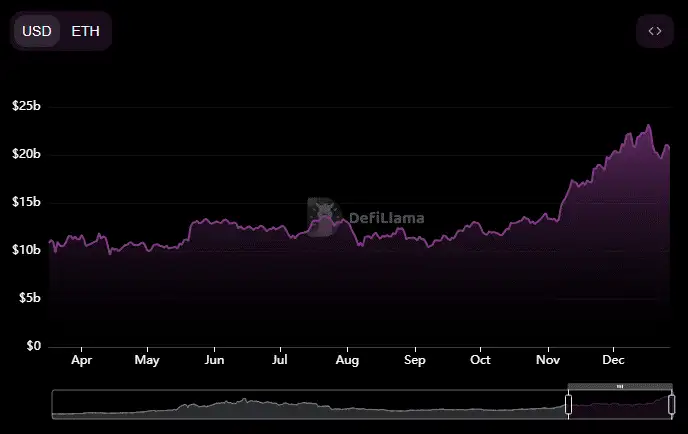

On December 17, AAVE's Total Value Locked (TVL) reached a new high of $23.19 billion. However, the TVL has since slightly declined to $20.63 billion. Nevertheless, AAVE remains fundamentally bullish, especially as the activity of its protocol continues to increase.

If the TVL remains stable or continues to grow, the AAVE price may continue to rise. This is particularly the case as it plays a core role in driving the platform's operations.

Altcoin Season is on the Way

A key condition for the Altcoin season bull market to materialize is a decline in Bitcoin's (BTC.D) dominance, which is an indicator that compares Bitcoin's performance to other Altcoins in the market. When BTC.D is high, it indicates that Bitcoin's performance is better than most Altcoins. Conversely, a lower dominance suggests stronger performance from Altcoins.

As of the time of writing, BTC.D is currently at 58.8%.

Since BTC.D is still relatively high, the Altcoin season may be delayed. The index may need to break below the 50% mark, at least before a significant market decline.

Altcoins have performed weaker than the benchmark index this week, showing a significant decline. Due to the Christmas holiday, liquidity has dropped sharply, leading to increased price volatility and causing the market sentiment to not be high. Given the current market structure, Altcoins are expected to move in sync with the benchmark index in the short term, with a low probability of independent price action.

When Altcoins are in an extremely fearful zone, the market is often at a cyclical bottom and may soon experience an upward reversal.