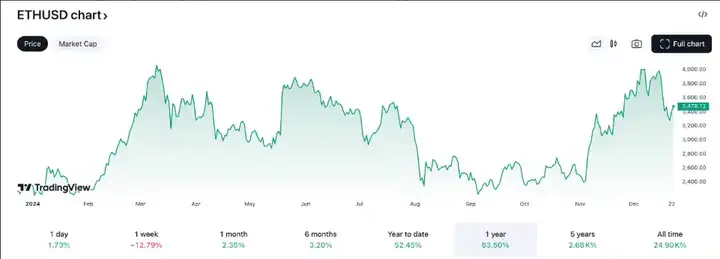

In the past year's performance of the crypto market, Ethereum has been overshadowed by Bitcoin and other public chain tokens, including Solana and Sui. The latest data shows that Sui is leading with an astonishing 434.1% increase, while Solana has also achieved 84.2% growth, far exceeding ETH, which has made Ethereum supporters and holders feel relatively depressed recently.

VX: TTZS6308

Followin' Trump's inauguration, he may bring favorable policies that could inject new growth momentum into ETH.

Changing regulatory environment to revive legitimate crypto projects

Trump announced that he will nominate former SEC commissioner Paul Atkins as the next SEC chairman, which could fundamentally change the regulatory environment. Previously, the SEC led by Gary Gensler took a tough stance on DeFi projects, including investigating major projects like Uniswap, which has restricted the development of the Ethereum ecosystem.

Additionally, the new government may gradually phase out the "VC token worthless theory," as under the previous regulatory environment, many venture capital firms' investments in blockchain infrastructure and innovative projects were often overlooked, while the market was once obsessed with speculating on meme coins lacking utility.

Trump's crypto-friendly stance and the potentially more friendly SEC policy will change this phenomenon, and legitimate projects will no longer need to worry about receiving Wells notices from the SEC one after another, but will instead receive more support from regulatory agencies.

Staking rewards ETF may become a new engine for capital inflow into Ethereum

On the other hand, under the new Trump administration, the SEC may approve more ETF applications targeting Ethereum, especially those with staking rewards functionality. This move not only can bring higher capital inflows to Ethereum but also enhance its attractiveness as an asset. Staking rewards may rise to 4%-5%, which will be more attractive to institutional investors given the backdrop of interest rate cuts by the Federal Reserve.

Soft endorsement from the Trump family's investment

Additionally, the Trump family's decentralized finance project "World Liberty Financial" has already invested a large amount of capital in the Ethereum ecosystem, purchasing core assets such as ETH, Chainlink, Aave, and ONDO. This action not only represents one of the biggest "soft" endorsements of the Ethereum ecosystem but will also stimulate more capital to focus on the future development of this blockchain network.

AI intelligent agents, a series of important network upgrades, and the improvement of the US regulatory environment are all reasons to be optimistic about Ethereum in 2025.

As of now, ETH (Ether) has cumulatively increased by 53.5% so far this year, rising from $2,350 on January 1 to the current $3,400.

The longer it is suppressed, the greater the rebound force.

Ethereum will see the Pectra upgrade in 2025

One of the highly anticipated major upgrades is the Pectra upgrade - the next important milestone on Ethereum's roadmap, expected to be launched in early 2025. The Pectra upgrade will fundamentally change the way Ethereum's security layer operates.

Currently, Ethereum staking mainly relies on liquidity. Essentially, many ETH holders want to participate in staking. This is usually a good thing, as more nodes mean more decentralization and higher security.

However, Ethereum has now reached a massive scale - with over 1 million Ethereum validators communicating - which is starting to slow down the network's speed.

Pectra solves this problem by increasing the maximum effective balance of validators from 32 ETH to 2,048 ETH, significantly reducing the required number of validators and relieving network pressure.

Reduced pressure means a faster network and a better user experience for Ethereum users.

This will make staking cheaper, leading to more people participating in staking, and consequently, staking rewards will decrease over time. For this reason, we are very optimistic about reStaking. Many people will want to secure other networks to increase their staking rewards.

In the past two weeks, Ethereum ETF net inflows have reached $1.5 billion, making it one of the largest inflow periods among the eight spot funds.

Moreover, Ethereum's current ETF has accumulated net inflows of over $2.1 billion in December, setting a new high, nearly double the inflow in November.

Capital is flowing in, but the price hasn't risen much yet. Once the upward trend is unlocked, the room for growth is unimaginable.