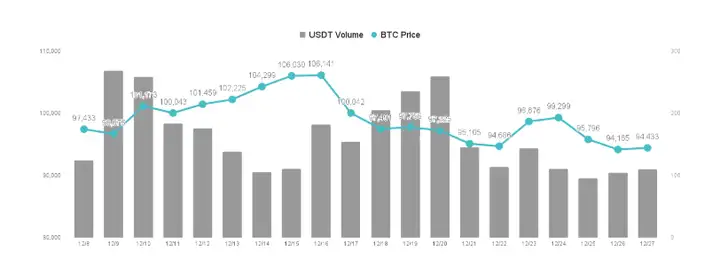

The global investment market entered the Christmas holiday last week. As Europe and the United States have been the biggest driving force behind this Bitcoin bull market, the absence of European and American buy-side during the holiday has led to a decline in cryptocurrency market prices. Bitcoin price has slid from $97,000 to $94,000, a weekly decline of about 5%, while Ether has dropped from $3,500 to $3,300, a weekly decline of about 4%.

VX: TTZS6308

South Korea is a rare exception, where political turmoil has led the public to massively purchase cryptocurrencies, making South Korea the largest buy-side force in Asia.

The current price on the Upbit exchange is 14.445 billion Korean won (about $98,000), while on the US Coinbase exchange it is $95,100, showing a significant Kimchi premium, indicating that South Korean retail investors are aggressively buying Bit.

Furthermore, we are seeing more and more companies adopting Bit as an investment strategy. On December 26, US energy management company KULR Technology Group announced the adoption of a Bit investment strategy, purchasing 217.18 BTC at an average price of $96,556.53 per Bit, totaling $21 million.

Bit investment tools are seeing more innovative investment products being developed under the relaxed regulatory environment of the Trump administration.

Relaxed regulation provides ample room for imagination, helping Bit price to continue rising

Investors are gradually shifting their attention from Bit to mid-cap Altcoins, which have seen a recent surge, including SOL, XRP, AVAX, and DeFi tokens. However, the upward momentum did not last long, and most tokens experienced a significant decline of 5-15%, mainly due to routine selling by Asian and Middle Eastern investors during the European and American holiday season, without any structural changes.

The relaxed regulatory theme under the incoming Trump administration is expected to continue, and more types of Altcoins may be listed on the US stock market through spot ETFs or other derivative financial products, following the model of Bit and ETH to attract massive capital inflows. DeFi companies are also expected to have more room for innovation, such as obtaining the right to issue crypto credit cards, launching higher-leverage staking products, and more token applications combined with AI models, which will drive up the prices of DeFi infrastructure or oracle tokens.

The growth of ETH is also expected to be driven by the expansion of its ecosystem and the new all-time high of Bit, which combined may push ETH price to $6,000. Once ETH breaks through the psychological barrier of $3,500, it may gain further upward momentum and challenge the $4,000 level by the end of the year. For long-term investors, the upward trajectory of ETH's price supported by the fundamentals may reach around $5,000 in the first quarter of 2025.

The current market dynamics indicate a cautiously optimistic outlook for both Bit and ETH. Although challenges and uncertainties remain in the cryptocurrency market, the overall sentiment is still positive. Positioning at the end of the month, reaping the rewards in January.

Since Altcoins do not follow Bit's decline, it indicates that they have reached a relatively bottom level, and Bit cannot keep falling forever and will rebound, so Altcoins will rebound even more when Bit rebounds.