Introduction

Recently, the Altcoin market has experienced violent fluctuations, particularly the significant performance difference between BTC and Ethereum (ETH). Ethereum has broken through the $3,400 mark, driving a significant rebound in its trading ratio (ETH/BTC) against Bitcoin, and the market sentiment is gradually shifting towards the relative strength of ETH. At the same time, the asset size of the Bitcoin spot ETF has grown rapidly, almost on par with the Gold ETF, marking Bitcoin's increasing recognition in the traditional financial market.

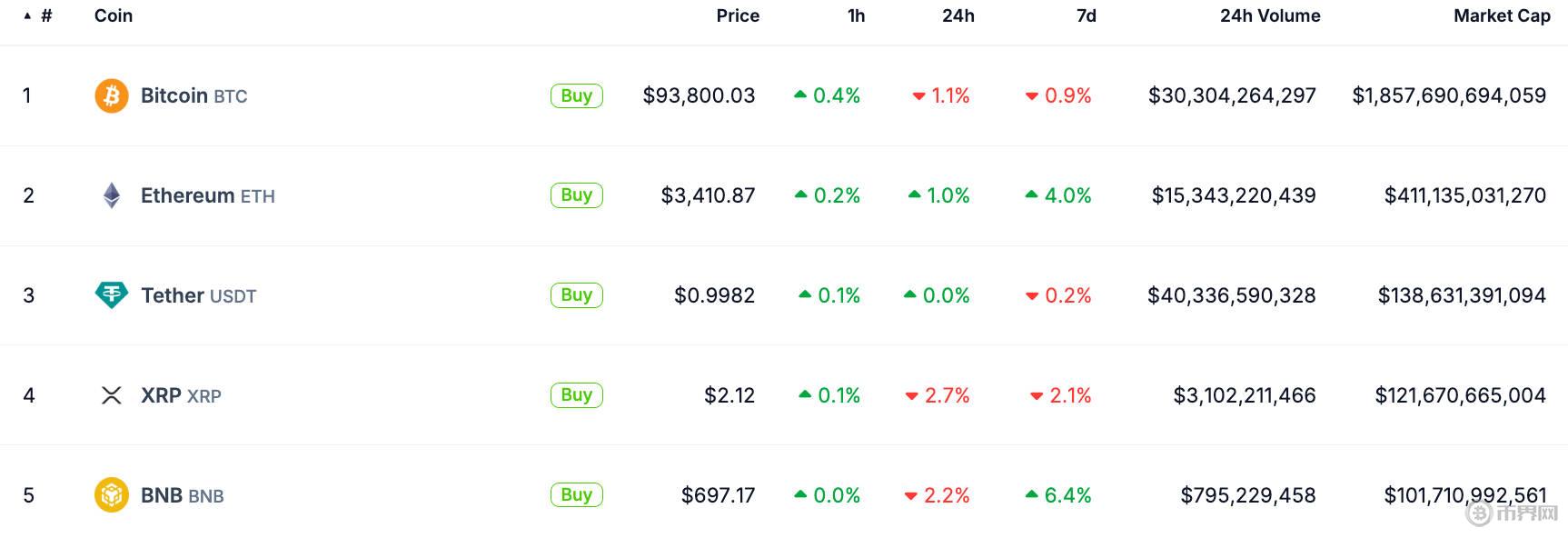

Latest price trend of BTC & ETH today

Ethereum surges, ETH/BTC ratio hits a new weekly high

Today, with Ethereum breaking through $3,400, the ETH/BTC ratio rebounded to 0.03657 at one point, hitting a new high in the past week. In comparison, Bitcoin's performance has been relatively weak, with a 1.1% price drop in 24 hours, briefly falling below $90,000 to $92,868.96.

This wave of Ethereum's rise has made its relative strength performance evident, while Bitcoin's market share (BTC.D) has declined from 61.53% last month to 57.63%. This change implies that Ethereum's leading position in the market is increasingly strengthening, and it provides expectations for the upcoming Altcoin season.

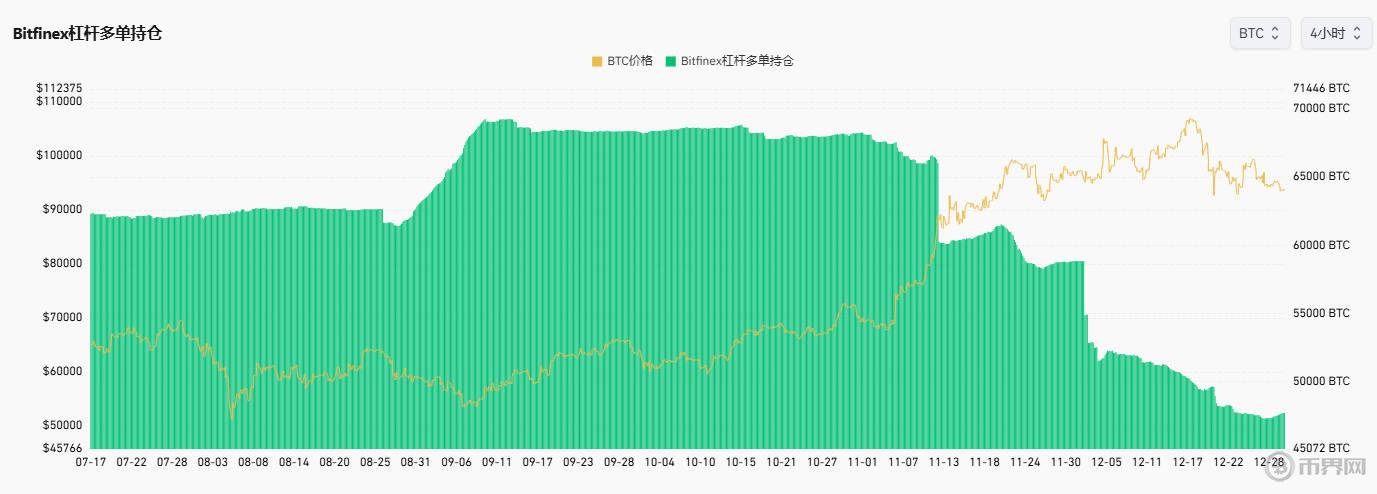

Proportion of long-term ETH holders increases, ETH long positions on Bitfinex rise

According to data from IntoTheBlock, the proportion of long-term holders of BTC and ETH has changed significantly over the past year. The proportion of long-term holders of ETH has surpassed that of Bitcoin, currently at 75.06%, far higher than Bitcoin's 62.31%.

Additionally, the ETH long position holdings on Bitfinex have also shown strong growth, increasing from less than 71,000 ETH on December 22 to the current 104,800 ETH, reflecting the market's optimistic expectations for Ethereum's future performance.

Meanwhile, on-chain data analyst Ai Yi also found that large investors have also shown a high degree of attention to Ethereum in their recent operations. A smart money whale withdrew 40,000 ETH, worth about $133 million, from Bitfinex two hours ago, and then deposited some of the funds into Aave and increased their position on Binance. These operations undoubtedly further strengthen the market's expectations for Ethereum's future rise.

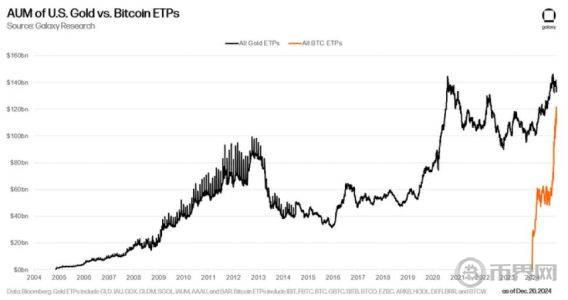

Bitcoin spot ETF rises rapidly, assets approaching Gold ETF

In addition to the price fluctuations of BTC and ETH, the Bitcoin spot ETF has also seen rapid growth. In just one year, the asset management scale (AUM) of the Bitcoin spot ETF has almost matched the global Gold ETF, marking Bitcoin's gradual emergence as a mainstream asset. According to Nate Geraci, CEO of The ETF Store, this growth reflects the rise of Bitcoin as a digital gold and has prompted more traditional financial institutions to actively participate.

Major institutions such as BlackRock, Fidelity, and ARK Invest have successively launched Bitcoin ETFs, allowing institutional and retail investors to more easily participate in the Bitcoin market. Furthermore, Bitcoin ETFs eliminate the need for wallets, private keys, and direct custody, providing a more convenient investment channel for retail investors. This simplified investment method has greatly promoted the popularization of Bitcoin.

Gold ETF vs. Bitcoin ETF: The competition between traditional and digital assets

Although the rapid growth of the Bitcoin spot ETF is noteworthy, Bitcoin still faces certain challenges compared to the Gold ETF. Gold ETFs have been the global asset management leaders for decades, with a global asset management scale exceeding $100 billion. However, as Bitcoin gradually becomes an alternative to safe-haven assets, the gap between it and the Gold ETF is rapidly narrowing.

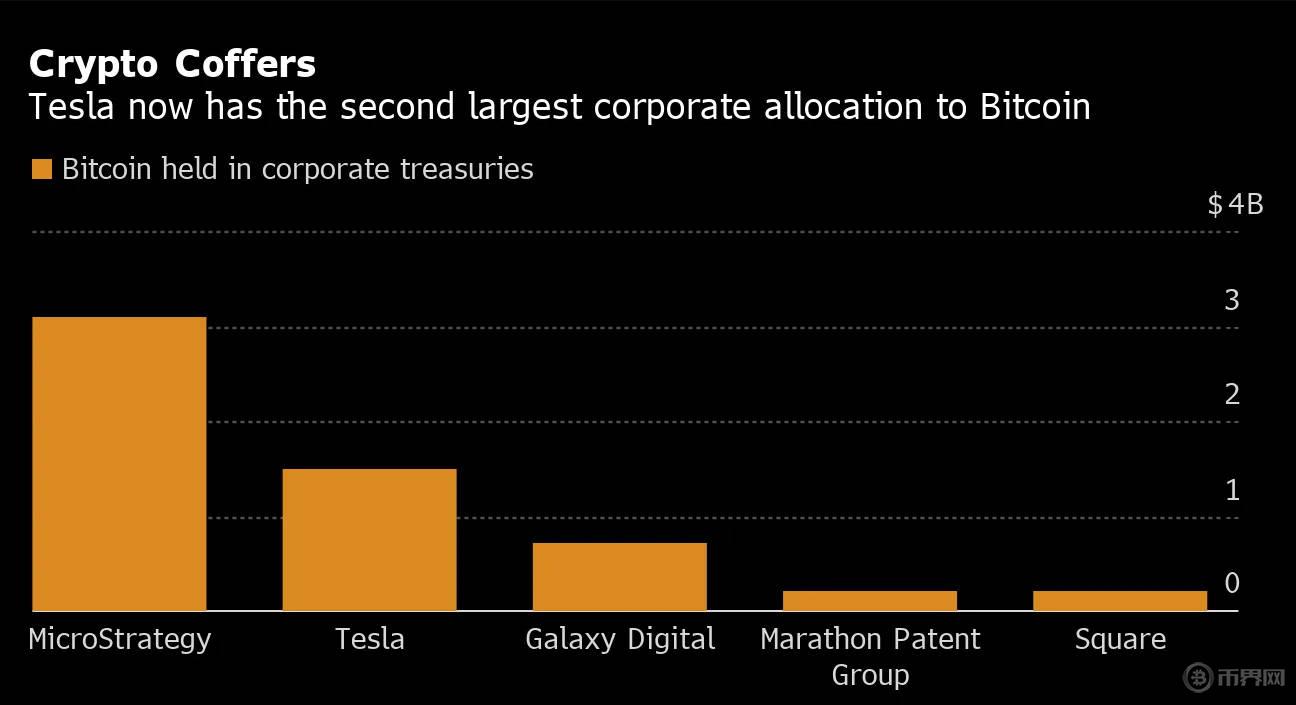

Experts say that Bitcoin, as "digital gold," is attracting more investors, especially against the backdrop of inflationary pressure and currency depreciation. Companies like Tesla and MicroStrategy have also included Bitcoin on their balance sheets, further validating Bitcoin's appeal and market acceptance. Although Bitcoin's volatility is relatively high, its supply cap and growing market demand make it widely seen as having great growth potential in the future.

Ongoing challenges and investment opportunities

Although the growth momentum of the Bitcoin spot ETF is strong, it still faces challenges such as regulatory uncertainty and market volatility. For example, regulatory reviews in regions like the US may affect its further development. Meanwhile, the volatility of Bitcoin prices may also cause some conservative investors to be cautious about investing. In addition, the stability of traditional assets like Gold ETFs still has an advantage, posing a challenge to the long-term growth of Bitcoin ETFs.

However, with the increasing interest of institutional and retail investors in Bitcoin, the rapid growth of the Bitcoin spot ETF undoubtedly brings new investment opportunities to the market. Investors can consider combining Bitcoin ETFs and Gold ETFs to achieve asset allocation diversification and risk hedging.

Conclusion

As important assets in the Altcoin market, BTC and ETH are experiencing dynamic changes. The strong performance of Ethereum and the rapid rise of the Bitcoin spot ETF have brought new development opportunities to the market. Although Bitcoin faces market volatility and regulatory challenges, its position as a mainstream asset has become increasingly stable. Ethereum, on the other hand, may continue to maintain its relative strength in the coming months, driving the arrival of a new Altcoin season.

As the Altcoin market matures, the competition between traditional finance and digital assets will further intensify. Investors should closely monitor these developments to seize the potential of the Altcoin market in the coming years.