Author: Grayscale Source: Grayscale Research Translator: Shan Eoba, Jinse Finance

The crypto market surged significantly in Q4 2024, as evidenced by the FTSE/Grayscale Crypto Industry Index family. The market's rise mainly reflects the positive reaction to the US election results.

The competition in the smart contract platform space is fierce, with Ethereum still the leader in the field, but underperforming the second-largest market cap, Solana. Investors are also increasingly focused on other alternative Layer 1 networks, such as Sui and The Open Network (TON).

The Grayscale research team has updated the Top 20 asset list, which covers a diverse range of assets across various crypto industry sectors that we believe have high potential in the next quarter. The new assets added this quarter include HYPE, ENA, VIRTUAL, JUP, JTO, and GRASS. It should be noted that these assets have high price volatility and higher investment risks.

The Grayscale Crypto Industry Index system provides a comprehensive framework to help understand investable digital assets and the underlying technology principles. Based on this framework, Grayscale has collaborated with FTSE Russell to develop the FTSE Grayscale Crypto Industry Index series, which are used to measure and monitor the crypto asset category. Grayscale Research incorporates these indices into its ongoing analysis of the digital asset market.

The crypto market valuation surged in Q4 2024, primarily due to the positive market reaction to the US election results. According to the Comprehensive Crypto Market Index (CSMI), the total crypto market capitalization grew from $1 trillion to $3 trillion in the quarter.

Comparing the crypto market capitalization to traditional public and private market asset classes, the digital asset industry's current market size is on par with the global inflation-linked bond market, more than twice the size of the US high-yield bond market, but still significantly smaller than the global hedge fund industry or the Japanese stock market.

With the increase in market valuation, many new tokens have met the inclusion criteria for the crypto industry framework (most assets require a minimum market cap of $100 million). In this quarter's rebalancing, we added 63 new assets to the index series, which now covers 283 tokens.

The consumer and culture crypto industry saw the most new token additions, reflecting the continued strong returns of memecoins and the appreciation of assets related to gaming and social media.

The Competitive Landscape of Smart Contract Platforms

Smart contract platforms are likely the most competitive market segment in the digital asset industry. While 2024 was an important year for Ethereum - it received approval for a US spot exchange-traded product (ETP) and completed a major upgrade - Ether (ETH) underperformed competitors like Solana.

Investors have also turned their attention to other Layer 1 networks, including the high-performance blockchain Sui and the TON blockchain integrated with Telegram.

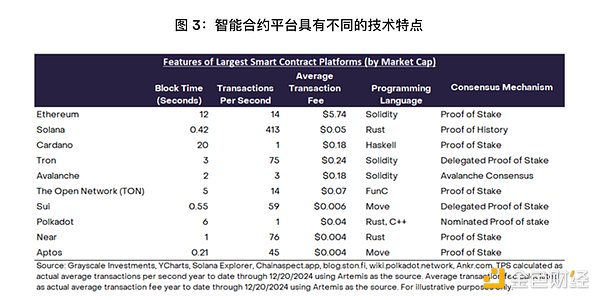

In building infrastructure for application developers, the designers of smart contract blockchains face various design choices that impact the "blockchain trilemma": network scalability, security, and decentralization. For example, blockchains prioritizing scalability often exhibit high throughput and low transaction fees (like Solana), while those prioritizing decentralization and security may have lower throughput and higher fees (like Ethereum).

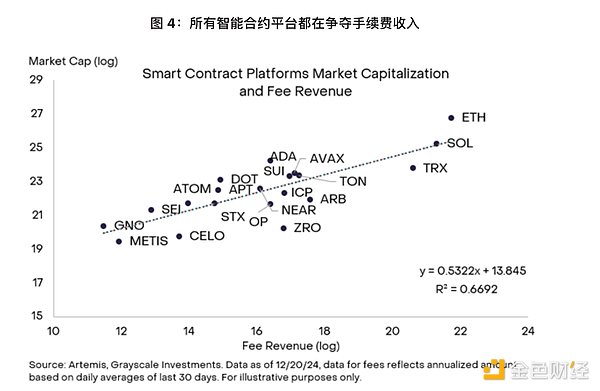

Regardless of the design, the value of smart contract platforms primarily comes from their ability to generate network fee revenue. Fee revenue is generally seen as the primary driver of appreciation for these market's blockchain tokens, although metrics like total value locked (TVL) are also important. Data shows a significant statistical relationship between fee revenue and platform market capitalization.

This quarter, the Grayscale Research Top 20 includes the following smart contract platforms:

• Ethereum (ETH)

• Solana (SOL)

• Sui (SUI)

• Optimism (OP)

The Grayscale Research Top 20 Asset List

Each quarter, the Grayscale research team analyzes hundreds of digital assets to guide the rebalancing process for the FTSE/Grayscale Crypto Industry Index family. We then publish the Crypto Industry Top 20 asset list, which we believe have high potential in the next quarter.

This quarter, we are particularly focused on three major market themes:

1. The US election and its potential impact on the regulation of DeFi and staking;

2. The continued breakthroughs in decentralized AI technology and the trend of AI agents using blockchain;

3. The continued growth of the Solana ecosystem.

Against this backdrop, the six new assets added this quarter are:

• Hyperliquid (HYPE): A Layer 1 blockchain focused on supporting on-chain financial applications, with its primary use case being a fully on-chain perpetual contract decentralized exchange (DEX).

• Ethena (ENA): Ethena has launched a new stablecoin called USDe, primarily backed by hedged positions in Bitcoin and Ethereum.

• Virtual Protocol (VIRTUAL): A protocol built on the Ethereum Layer 2 network Base that allows for the creation and co-ownership of tokenized AI agents.

• Jupiter (JUP): The largest DEX aggregator on Solana, with the highest TVL among all Solana applications.

• Jito (JTO): A liquid staking protocol on Solana, which generated over $550 million in fee revenue in 2024.

• Grass (GRASS): A decentralized data network that allows users to share idle bandwidth through a Chrome extension, with the bandwidth sold to AI companies for training machine learning models.

These assets represent the most promising and innovative sectors across the crypto industry, providing investors with diversified options.

Note: Shaded assets indicate new additions for the upcoming quarter (Q1 2025). *Asterisk denotes industries that the asset belongs to, which are not included in the Crypto Industry Index. Source: Artemis, Grayscale Investments. Data as of December 20, 2024. For illustrative purposes only. Assets may change. Grayscale, its affiliates, and clients may hold positions in the digital assets discussed herein. All assets in our Top 20 list have high price volatility and should be considered high-risk.

In addition to the new themes mentioned, we remain confident in the areas we have focused on in previous quarters, such as Ethereum scaling solutions, asset tokenization, and decentralized physical infrastructure (DePIN). These themes are also reflected in this quarter's Top 20, with the continued inclusion of protocols like Optimism, Chainlink, and Helium, representing the leading positions in their respective tracks.

This quarter, we have removed projects like Celo from the Top 20. While the Grayscale research team still recognizes the value of these projects and believes they remain an important part of the crypto ecosystem, we believe the adjusted Top 20 asset portfolio may offer a more attractive risk-return profile in the next quarter.

Investing in crypto asset classes carries risks, some of which are unique to crypto assets, including smart contract vulnerabilities and regulatory uncertainty. Additionally, all assets in our Top 20 list have high volatility and high risk and may not be suitable for all investors. Therefore, when considering investing in digital assets, investors should comprehensively assess potential risks in the context of their investment portfolio and financial objectives.

Index Definition:

The FTSE/Grayscale Crypto Industry Index (CSMI) measures the price return of digital assets listed on major global exchanges.

Notes:

[1] As of December 20, 2024, the Crypto Sectors Total Market Index rose 58% this quarter. Data source: FTSE, Grayscale Investments.

[2] Data source: FTSE, Grayscale Investments, as of December 20, 2024.

[3] Data source: FTSE Russell, as of December 20, 2024.

[4] Data as of December 20, 2024.

[5] USDe collateral may include other highly liquid stablecoins.

[6] Bitget.