XRP has been in a prolonged correction and has not reached $3 this year.

As January 2025 approaches, the likelihood of XRP achieving this target is low. Market conditions and technical indicators appear to be delaying a significant upswing.

XRP, price has risen but network value has not

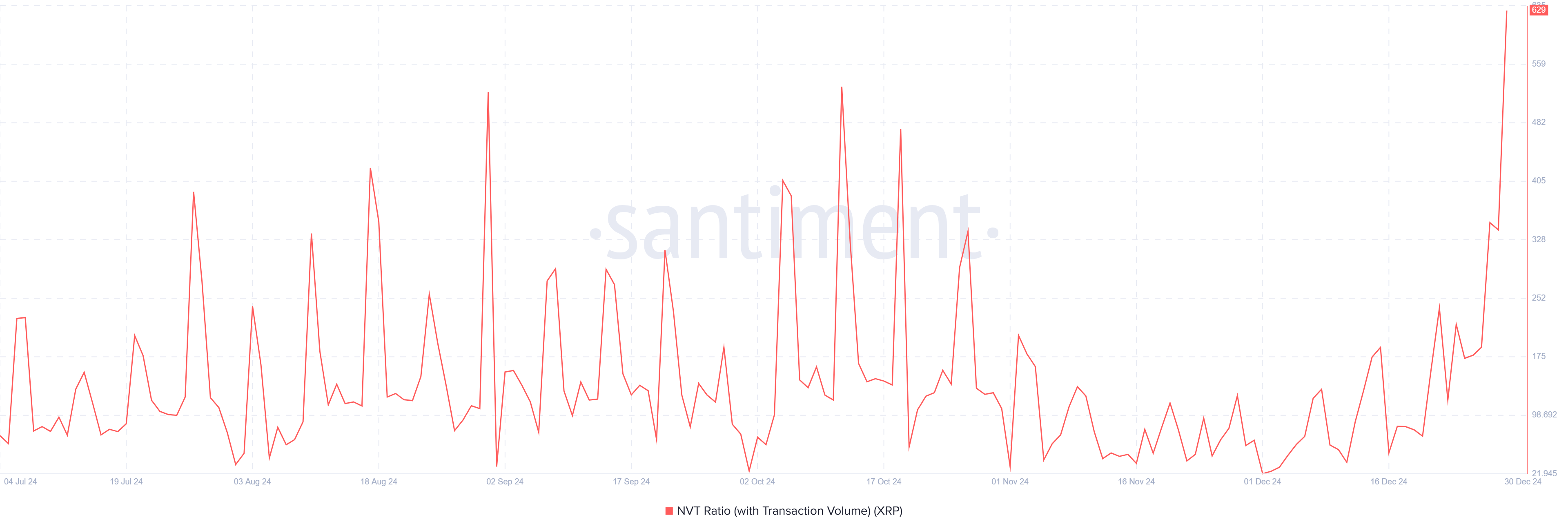

The NVT (Network Value to Transactions) ratio indicates that the network value of XRP is exceeding its transaction value. Historically, such imbalances occur before a correction, and an overvalued network value can lead to losses for investors.

This market situation makes recovery difficult. If transaction activity to support the network value does not increase, XRP may face the risk of long-term stagnation or decline, and the short-term growth outlook is limited.

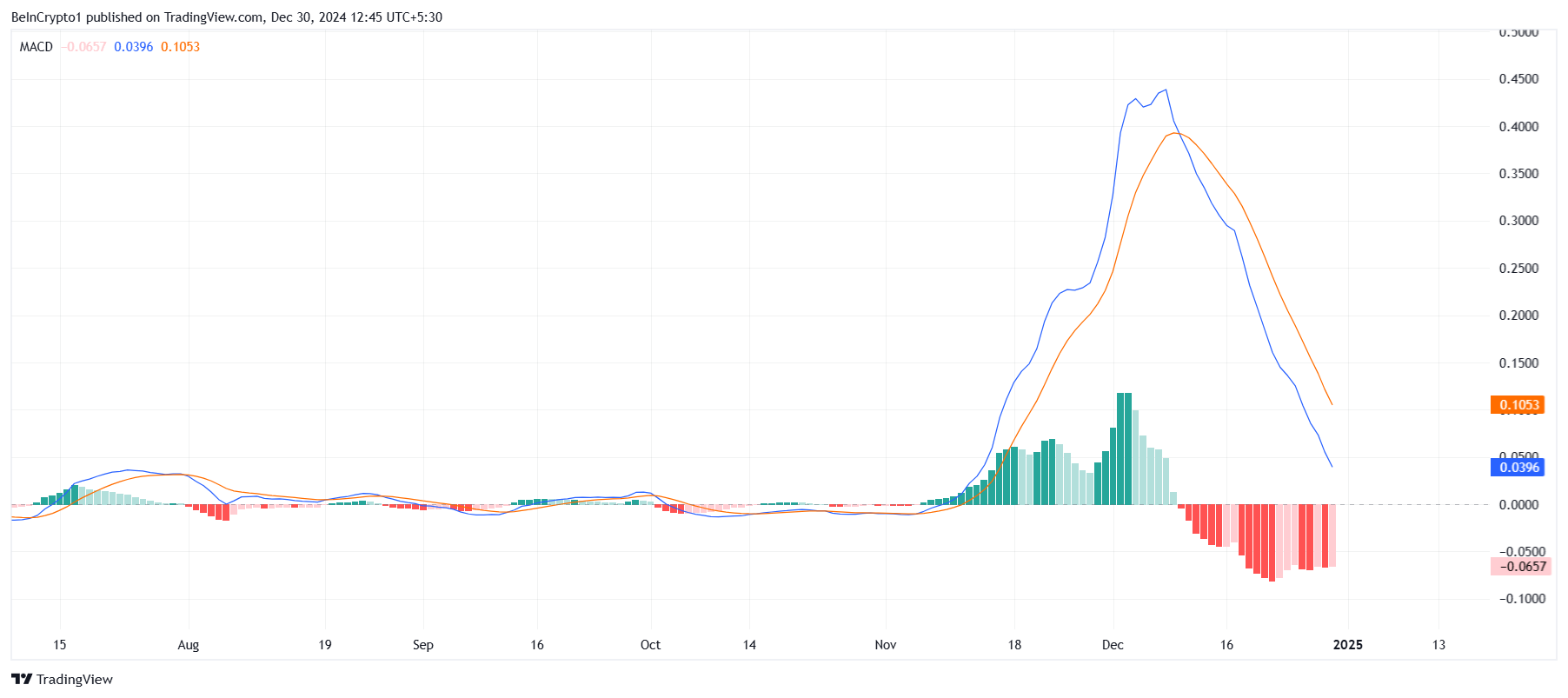

The MACD (Moving Average Convergence Divergence) indicator reinforces the bearish outlook, with no signs of a bullish crossover. This momentum deficit is unlikely to change as 2025 begins. The bearish crossover reflects a broader negative market signal.

These technical indicators suggest that the downward pressure on XRP will continue. If a reversal does not occur, the altcoin may struggle to break out of the current correction range, and if selling pressure intensifies, it could face further declines.

XRP Price Prediction: Failure to Break $2.73 Poses Additional Correction Risk

XRP has been in a correction over the past month, remaining below the $2.73 resistance level and above the $2.00 support level. This pattern reflects the previous correction period that lasted for more than 3 months before XRP finally rallied in November of this year, increasing the likelihood of a similar timeline.

If history repeats itself, XRP may not break through $3 by the end of February 2025. During this prolonged correction, a significant sell-off could push the altcoin down to $1.28, potentially amplifying losses for investors.

However, a shift in broader market sentiment could alter XRP's trajectory. If the $2.73 resistance level is breached, the price is likely to rise to $3, invalidating the bearish outlook and signaling a new bullish phase for the altcoin. This could even lead XRP to surpass its previous all-time high of $3.31.