The year 2024 marks an important watershed for the public chain industry, as the industry focus shifts from technological competition to practical application and implementation. In this year, the market capitalization of public chains grew by 105.3% to reach $2.8 trillion, the price of broke through $100,000, and it achieved institutional-level adoption through ETFs. The Layer 2 network expanded to over 200 chains, and the Layer 2 TVL grew by 1,277.6%, all of which demonstrate the industry's transition from technical experimentation to practical real-world applications. The public chain industry is undergoing a shift from being primarily technology-driven to being more application-demand-driven.

Note: Unless otherwise stated, all data in this report is as of December 20, 2024.

Market Dynamics: Growth and Transformation

In 2024, the public chain industry achieved unprecedented growth, with multiple key indicators showing significant expansion.

The total market capitalization of public chains grew by 105.3% to reach $2.8 trillion. 's dominance increased to 69.8%, while 's share decreased from 20.4% to 15.2%. The shares of and remained stable at 3.5% and 3.3%, respectively, with other platforms accounting for 8.1%.

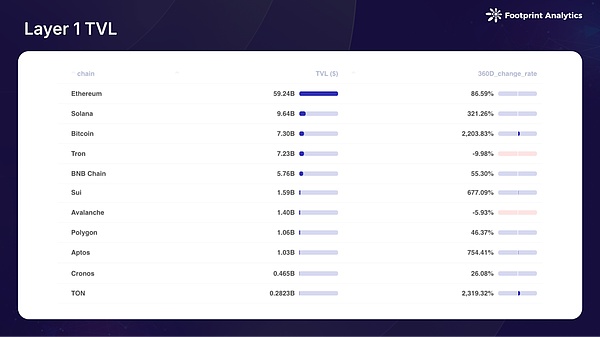

The sector also exhibited strong growth momentum in 2024, with the total value locked (TVL) reaching $102.8 billion at the end of the year, a year-over-year increase of 88.6%. Among the top 10 public chains by TVL, and saw the most significant increases, both exceeding 2,000%. , , and also performed well, with growth rates of 754.4%, 677.1%, and 321.3%, respectively. However, the TVL of and declined.

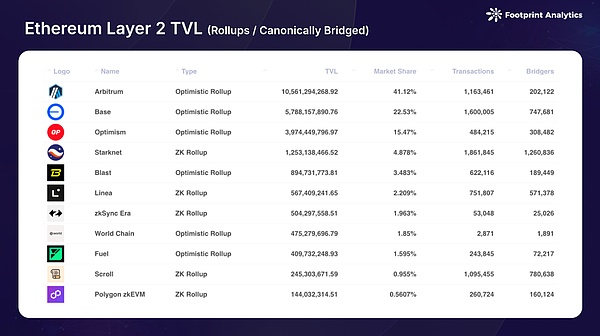

The Layer 2 ecosystem experienced a notable trend of consolidation in 2024. maintained its leading position, with a TVL of $10.6 billion and a market share of 41.1%, down from 50.8% in 2023. emerged as the year's dark horse, with a TVL of $5.8 billion (22.5% share), ranking second, while came in third with a TVL of $4 billion (15.8%). These three platforms collectively accounted for 79.1% of the L2 DeFi TVL, while the market shares of previous competitors like , , and declined.

At the same time, the ecosystem scale continued to expand, with currently 50 Rollups and 70 Validium & Optimium chains running on the mainnet, along with about 90 upcoming chains, bringing the total number of L2 chains to over 200.

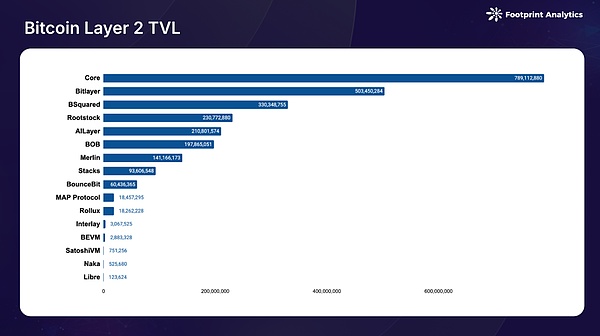

The Layer 2 and sidechain ecosystem experienced explosive growth, with a total TVL of $2.6 billion, a significant increase of 1,277.6% compared to 2023. leads with a TVL of $790 million (30.3% market share), followed by ($500 million, 19.4% share) and ($330 million, 12.7% share). This growth is reflected not only in the TVL but also in the doubling of the number of active chains, which now stands at nearly 20.

Competitive Landscape: Leaders and Challengers

In 2024, the competitive landscape of the public chain ecosystem underwent significant changes, primarily manifested in the strengthening of 's dominance, the resurgence of , and the rise of new challengers.

: From Store of Value to Financial Infrastructure

achieved remarkable growth in 2024, with a price increase of 129.2% and a market capitalization growth of 131.7%. This growth was driven by the institutional adoption of spot ETFs, the April halving event, and the positive sentiment following the U.S. elections. In addition to the $100,000 price milestone, the ecosystem has seen two key developments:

Increased Institutional Adoption: The successful launch of spot ETFs in January fundamentally changed the institutional access landscape, with BlackRock's product quickly reaching $20 billion in assets. surpassed silver and Saudi Aramco to become the world's seventh-largest asset, marking its transition from a speculative asset to a recognized store of value.

The Rise of BTCfi: The ecosystem has expanded beyond price growth through innovative financial products. Projects like Babylon's staking, Solv Protocol's cross-chain solutions, and Core's Fusion upgrade have demonstrated the maturing ecosystem. Cross-chain functionality has made progress through the integration of the BOB network with and the "Super " framework of , although standardization still faces challenges.

: Layer 2 Driving Ecosystem Evolution

2024 was a pivotal year for as it transformed into a Layer 2-centric ecosystem. Despite a 55.8% price increase to $3,744, faced the complex challenge of redefining its role and maintaining relevance amid the growth of Layer 2 adoption. The successful launch of a spot ETF in July gained a certain degree of institutional recognition, but 's price performance lagged significantly behind .

The mainnet underwent important changes through the "Cancun Upgrade," successfully reducing Layer 2 transaction costs and improving scalability. However, the migration of activity to Layer 2 led to a decline in mainnet fee revenue, sparking discussions about 's long-term sustainability. The Ethereum Foundation responded with various initiatives, including implementing Proto-Danksharding (EIP-4844), developing cross-L2 communication standards, and strengthening security requirements for Layer 2 solutions.

The Layer 2 ecosystem exhibited significant growth and integration throughout the year. Notable new entrants, such as , 's Unichain, and Sony's , have enriched the ecosystem. This evolution highlights 's transformation from a pure execution layer to a diversified Layer 2 ecosystem, serving as a settlement and security provider. While revenue models and competitive dynamics remain uncertain, 's continued development in developer activity and innovative scaling solutions demonstrates its adaptability.

: The Third Giant

2024 witnessed the strong resurgence of , with a 70.8% price increase and a 90.9% market capitalization growth, reaching a new all-time high of $260 in November. This revival began with the January airdrop, which sparked unprecedented activity in the ecosystem. has established itself as a hub for retail trading, nurturing a vibrant meme and community. In addition to meme culture, has made progress in various areas, including restaking protocols, modular Layer 2 solutions, and stablecoin innovations. The ecosystem further expanded its influence through the growth of SVM chains like , , , and .

The Rise of New Powers: , , and

: Social Integration Driving Platform Growth

The Open Network () exhibited significant growth in 2024, with the price increasing by 149.6% and its market capitalization growing by 84.3%. 's success is primarily attributed to its deep integration with , effectively bridging traditional social networks and blockchain technology. The platform simplified the crypto experience through the wallet integration and blockchain integration, providing millions of users with easy access to games, memes, and applications, establishing a model for large-scale adoption.

: From Move Language Pioneer to Ecosystem Leader

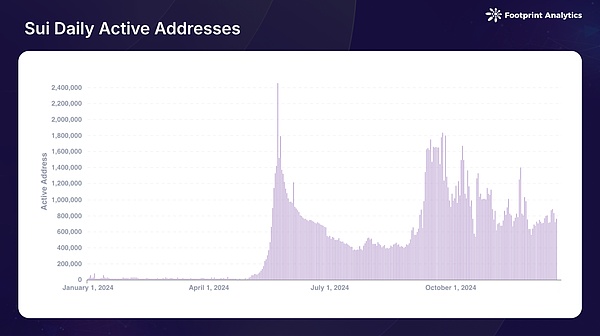

performed impressively, with its token price soaring by 461.6% and its market capitalization growing by 1,363.8%. This success reflects the market's confidence in the language technology and the ecosystem's development. has focused on and gaming, including game integration and the innovative game console development, demonstrating its comprehensive approach to ecosystem growth. The platform's emphasis on user experience and protocol development has created a positive network effect, attracting the participation of both developers and users.

: Institutional Backing Driving Rapid Growth

The significant growth of was driven by multiple key factors. 's user-friendly smart wallet has substantially lowered the entry barrier for mainstream users. The platform gained substantial momentum from successful social apps like and , while the popularity of memecoins further boosted on-chain activity on . The implementation of the "Cancun Upgrade" significantly reduced transaction fees, continuously enhancing 's appeal to developers and users.

Main Trends in the Public Chain Industry in 2024

Emergence of New Chains

In 2024, project teams launched their own public chains. DeFi giant Uniswap announced Unichain; gaming platform Treasure DAO developed a ZK-based Layer 2; the NFT domain saw Pudgy Penguins launch Abstract; and Web3 platform Galxe launched Gravity. In addition, the entry of innovative new chains like Monad, Berachain, and HyperLiquid reflects the transformation of the public chain industry towards specialized blockchain infrastructure.

Institutional Adoption: From Exploration to Strategic Integration

Changing Modes of Institutional Participation

2024 marked a decisive shift in institutional adoption, from experimental blockchain initiatives to strategic implementation. Financial institutions led this transformation, with BlackRock's Bitcoin ETF rapidly reaching $20 billion in assets, and PayPal expanding PYUSD to Solana. Tech giants demonstrated deeper involvement through innovative means: Sony launched the Soneium chain for entertainment applications, while Google Cloud expanded its Web3 portal services. Infrastructure development was particularly noteworthy, with Circle launching native USDC on Sui, and Visa integrating Solana for settlement.

Changing Investment Paradigm

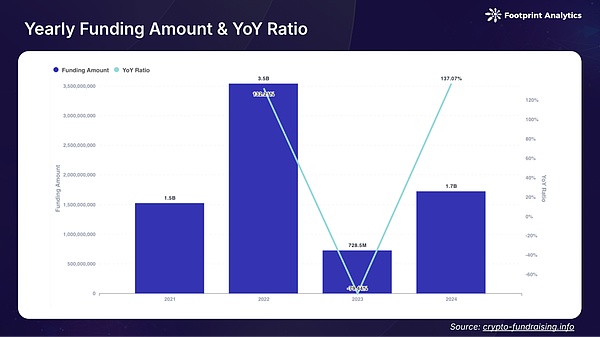

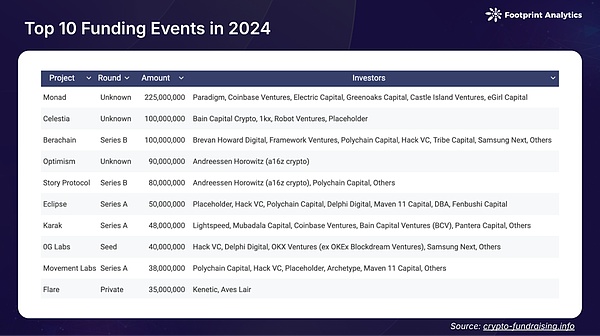

The public chain domain exhibited a strong recovery in 2024, with 174 funding events raising $1.7 billion, a 137.1% increase from the previous year. Notably, institutional investment strategies shifted from pure infrastructure to innovation-driven applications. Early-stage investments accounted for 21.4% of total funding events, while Series A and B rounds made up 31.8%, reflecting a maturing ecosystem.

Venture capital investment philosophies have undergone a significant evolution, prioritizing user-facing applications over traditional infrastructure development. This is evident in the substantial investments in consumer-oriented projects: Monad raised $225 million to optimize the user experience, while Celestia and Berachain each received $100 million for application-oriented infrastructure.

From Technical Competition to Application Innovation

The public chain industry underwent a fundamental transformation in 2024, shifting from a technology-driven to an application-driven strategy. This change challenged the previous "build it and they will come" mindset that had dominated the industry. While technical capabilities have improved significantly, the increased network capacity did not directly translate into corresponding user growth. For example, despite "hardware" constraints, the Ethereum base layer has higher "user operations per second" (UOPS) than most Layer 2s, highlighting the complex relationship between technical capabilities and actual adoption.

This reality has prompted a strategic shift in the ecosystem. Blockchain platforms are increasingly focused on identifying specific user needs and building targeted solutions, rather than pursuing pure technical progress. This "find the users and then build" approach has been reflected in several successful initiatives. The integration of social finance has emerged as a particularly effective strategy, with TON's Telegram integration and Base's friend.tech demonstrating how familiar social platforms can drive blockchain adoption. Simplifying the user experience through account abstraction and familiar authentication methods has significantly lowered the entry barrier for mainstream users.

The evolution of the meme culture in the blockchain space further reflects this shift towards application-driven development. What started as pure speculative activity has evolved into an effective user acquisition channel, particularly on platforms like Solana and Base. These networks have successfully leveraged meme-related initiatives to drive ecosystem growth, while also establishing sustainable community engagement. The success of these user-centric approaches suggests that sustainable growth in the blockchain space is increasingly dependent on understanding and serving user needs, rather than solely advancing technical capabilities.

Outlook for 2025

As the blockchain industry transitions from technical experimentation to practical implementation, 2025 is poised to be a transformative year.

Regulatory Clarity

The regulatory environment shows promising signs of improvement, particularly in the United States. A clearer regulatory framework is expected to benefit the entire industry, especially with progress in stablecoin legislation. This regulatory clarity will facilitate increased blockchain adoption through regulated products and services, while also promoting regulatory competition across jurisdictions.

Public Chain Specialization

Public chain specialization is emerging as a dominant trend, shifting from generic Layer 1 competition to purpose-driven architectures. Supported by cross-chain infrastructure, specialized application chains and optimized execution environments are expected to thrive. The "Rollup-as-a-Service" (RaaS) domain is poised for expansion, providing enterprises and project teams with more convenient customized blockchain solutions.

Technological Innovation and AI Integration

In 2025, technological innovation will shift from pure breakthroughs to application-driven infrastructure upgrades. The implementation of Proto-Danksharding will double Blob capacity, propelling Layer 2 scaling into a new phase; the development of chain abstraction technology will bring more intuitive user experiences; and the standardization of cross-chain communication will simplify interoperability.

At the infrastructure level, we expect to see more developments driven by actual needs. The modular blockchain technology stack will mature, providing specialized solutions for data availability, settlement, and execution layers. Notably, the deep integration of AI technology with blockchain will reshape infrastructure forms: from improving user interfaces to enabling complex on-chain AI agents, from decentralized model training to supporting social finance integration, these innovations will provide support for more complex use cases while maintaining security and decentralization, laying a solid foundation for the next wave of blockchain innovation.

Conclusion

The past year has proven that sustainable growth depends not only on technical capabilities, but also on meaningful user adoption and practical utility. With the foundations in place, including improved regulatory clarity, advancements in technical infrastructure, and increased institutional participation, the blockchain industry is poised to achieve meaningful large-scale adoption. The shift in focus from "what's technically possible" to "what's practically valuable" will define the next stage of growth for the industry in 2025.

The content of this article is for industry research and communication purposes only and does not constitute any investment advice. The market has risks, and investments should be made with caution.