Author: Nancy, PANews

With the gradual improvement of infrastructure and the gradual implementation of application scenarios, the encrypted AI Agent ecosystem is becoming more and more prosperous, presenting a new market development trajectory, and liquidity and user participation are also constantly increasing. In this AI Agent craze, ai16z and Virtuals Protocol are undoubtedly the two most powerful representative projects, and their ecosystems have attracted the active mining of various capitals that are stirred by the news.

ai16z and Virtuals dominate the AI Agent market, contributing more than half of the market share

Although the AI Agent ecosystem has risen rapidly in the encrypted market, attracting a large amount of attention and capital, its market structure is still relatively simple, mainly relying on the promotion of a few leading projects.

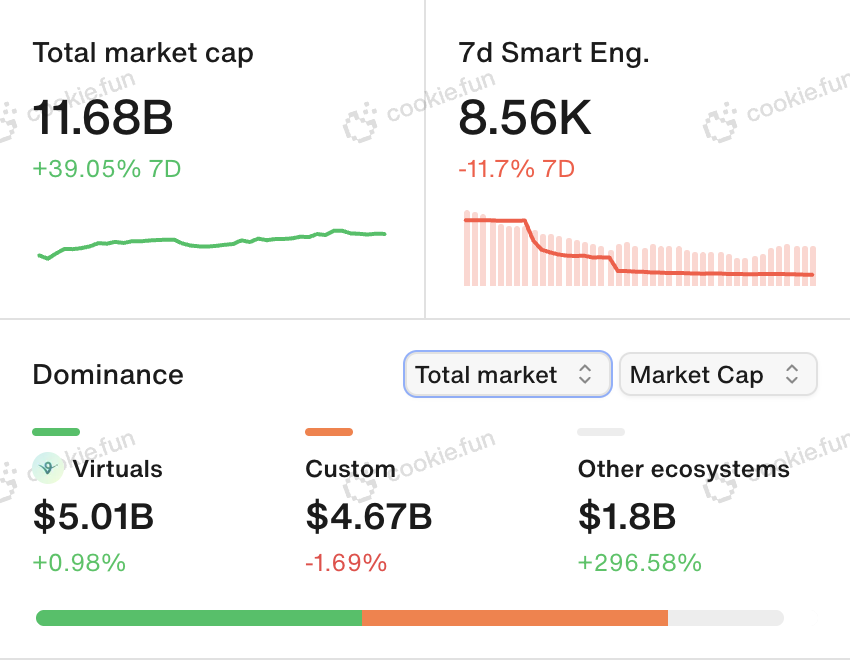

According to the latest data from Cookie.fun, as of December 30, the overall market value of AI Agent has reached $11.68 billion, with a growth of nearly 39.1% in the past 7 days. This growth trend indicates the rapid growth of the AI Agent ecosystem in the encrypted market.

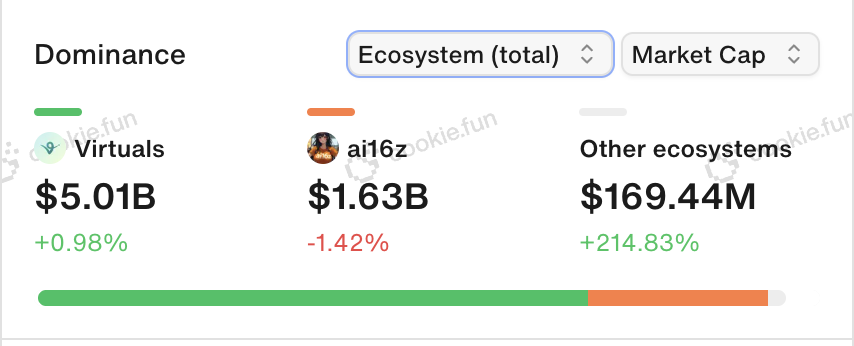

In terms of ecosystem scale, there is a obvious head effect in the entire encrypted AI Agent, mainly dominated by the two projects of Virtuals and ai16z. Specifically, the ecosystem market value of Virtuals reached $5.01 billion, and ai16z reached $1.63 billion, accounting for 56.8% of the AI Agent market share. This also means that the current growth and development of AI Agent is more dependent on the construction of these two leading projects.

At the same time, in terms of type, the market value of Virtuals exceeds that of customized AI Agent, the latter being $4.67 billion, and the cumulative market value of other categories reaches $1.8 billion.

From the on-chain distribution, Base and Solana are the two main battlegrounds for AI Agent. Among them, the market value of AI Agent on Base is about $5.76 billion, and the market value on Solana is $5.47 billion, together contributing 96.1% of the overall market, while the cumulative market value of other chain projects is only $920 million, further indicating that the AI Agent ecosystem is still in its infancy.

Although Base and Solana are on par in terms of market size for AI Agent, there are significant differences in their ecosystem composition. The main project in the Base ecosystem is Virtuals, with 86.9% of the projects coming from this ecosystem. In comparison, ai16z only accounts for about one-third of the market share on Solana, indicating that the AI Agent ecosystem on Solana is more diverse and rich compared to Base.

Presenting different ecosystem development paths, but the market concentration is also obvious

With the rise of Virtuals and ai16z, their ecosystem projects have also become the focus of attention and investment for market investors.

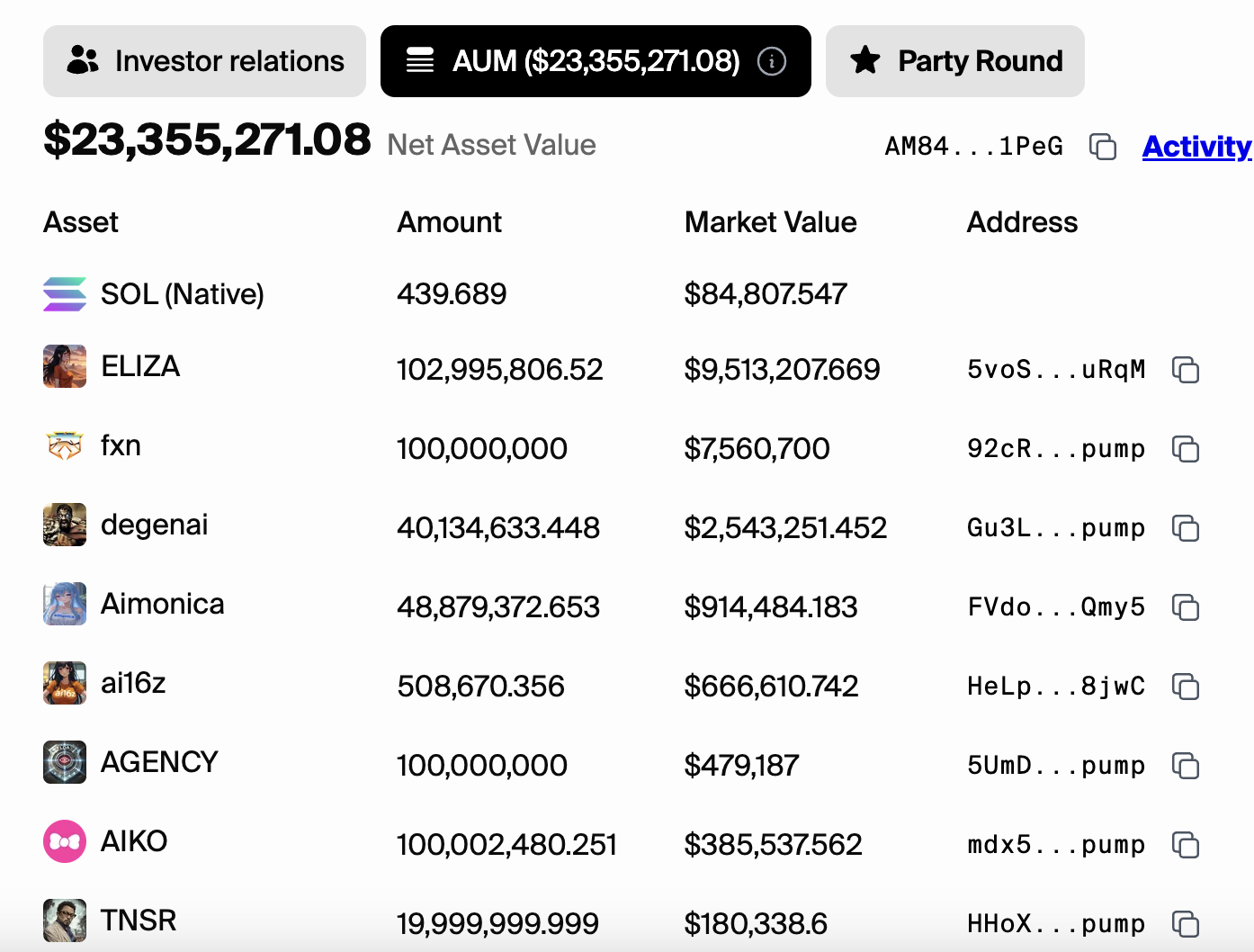

According to daos.fun data, as of December 30, the net asset value (NAV) of ai16z is about $23.355 million, covering more than 1,400 tokens. Among these tokens, only 3 have a market value of more than $1 million, which are ELIZA, fxn and degenai, and the cumulative market value of the three accounts for 84.3% of the overall; there are 6 tokens with asset sizes between $100,000 and $1 million, and the market value of the remaining tokens is all less than $100,000. This distribution pattern shows that the token portfolio of ai16z presents a relatively concentrated feature, with a few high-value tokens dominating the overall asset size, while the market value of most tokens is relatively scattered, indicating that this ecosystem is still in a highly differentiated state.

Compared to ai16z, the quality of Virtuals ecosystem projects is relatively higher, and it has recently been widely discussed due to its market value exceeding the star AI project Bittensor (TAO). However, there is also a certain imbalance in the structure of the Virtuals ecosystem.

The Virtuals official website shows that as of December 30, there are currently about 510 Virtuals ecosystem projects. Among them, there are 4 projects with a market value of over $100 million, which are AIXBT, G.A.M.E, Luna and VaderAI, accounting for 19.2% of the entire ecosystem; there are 99 projects with a market value between $1 million and $100 million, and the remaining about 60% of the projects have a market value of less than $100,000. The Virtuals ecosystem as a whole has gained more market recognition, but there is a certain concentration issue in its development.

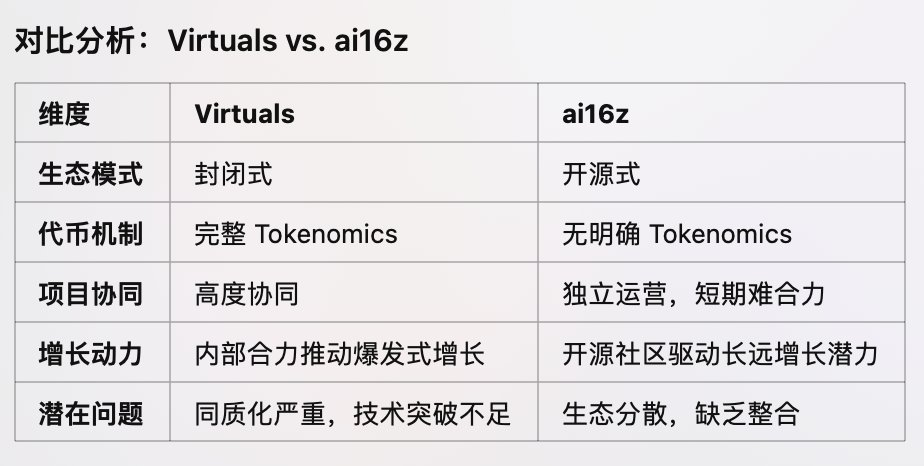

Regarding the different AI Agent development paths of ai16z and Virtuals, Web3 independent researcher Haotian previously pointed out that ai16z is more open-source, more like an "Android-style" developer ecosystem alliance route, but due to the lack of a reasonable evaluation model for the token economics of the ai16z token, its full-stack tokens lack cohesion in the short term. However, this will be solved after a systematic Tokenomics. At the same time, each member of the ai16z full-stack has its own strengths, and the future momentum lies in the power of the developer community. The first thing that founder Shaw needs to do is to lead the scattered full-stack to enter a super open-source growth flywheel driven by the technical open-source community.

In a recent interview with PANews, Shaw revealed that ai16z will announce a new token economic proposal around January 1, 2025, including LP pairing mechanisms, DeFi function integration and other content.

Comparison between Virtuals and ai16z, source: @0xgangWhat

In comparison, Virtuals is more closed. Haotian pointed out that Virtuals has taken the "Apple-style" ecosystem expansion path, more like an AI Agent "star factory". Because Virtuals had a complete token economics from the early stage, users need to pledge the token VIRTUAL to create AI Agent, and users need to consume VIRTUAL tokens to purchase new AI Agent tokens, so the more AI Agent tokens issued on Virtuals, the greater the demand for the Virtuals token, and a positive growth flywheel effect will naturally occur. But because Virtuals focuses on the asset issuance platform, providing a standard AI Agent framework base, it will lead to a certain homogenization of the AI Agent on the platform. Virtuals' asset issuance-oriented and light-tech ecosystem breakthrough is essentially the inherent limitation of a closed ecosystem.

From pure MEME to on-chain applications, AI Agent is revolutionizing the market operation model

The hype behind Virtuals and ai16z reflects the increase in attention to AI Agent, and is also an important manifestation of the evolution of MEME development.

"AI is the biggest theme for the improvement of human technology and productivity in the next 20 years, and can be integrated into all Crypto categories, including DeFi, GameFi, Non-Fungible Token and Decentralized Science. During the rapid growth period, it will bring a large number of new applications and new technologies, all of which can be applied to Crypto," said crypto KOL 0xWizard. He believes that the new targets combined with AI may recreate a chain-based asset market value, or even recreate the entire crypto market value.

"From the initial pure MEME like GOAT, to the chatting AI Agent, then to the chain-based fund like ai16z, and then to the new asset issuance platforms like Virtual and Spore, each step is getting closer to the application. The essence of this round of on-chain market is that new 'application projects' bypass exchanges and VCs, and directly realize the redistribution of interests through the mode of issuing new assets on the chain. At the same time, project parties no longer need to flatter VCs, scramble for resources and find exchanges to pay the fees, they can directly pull out and 'walk' on the chain to see if the market is willing to buy," said crypto KOL @Michael_Liu93.

Haotian also believes that the environment has changed, and the logic of market value capture is also changing, mainly reflected in the following aspects: (1) From the previous stacking of infrastructure that is divorced from actual market demand to using AI Agent applications as a pre-verification of market demand; (2) The profit space of the secondary market has become increasingly narrow due to the previous VC financing rounds, now the project can be constructed in the form of open-source Public Good to directly face the secondary market financing, and the self-management of assets by AI Agent can bring greater imagination space for the project; (3) The previous airdrop method to obtain early users and traffic has brought subsequent operational pressure, the MEME-style secondary market opening can suit the Tokenomics (LP fees, transaction taxes, reserved share release, etc.) for continuous growth; (4) Breaking the ultimate goal of listing on CEX, gradually trending towards DEX as the main, high-quality project parties have a greater chance of "grassroots counterattack"; (5) Realize a new market operation rule, projects that do not get along with the community and do not always focus on the product line will find it difficult to have a chance in the market and ecosystem.