The time window from the near future to around January 5th next year may gradually enter a relatively good time to buy BTC:

VX: TTZS6308

1. Macroeconomic US dollar liquidity: Due to the regular short-term decline in liquidity (liquidity squeeze) at the end of the year, which has led to a sharp increase in SOFR, squeezing risk assets.

Liquidity is expected to recover around January 4th (at which time SOFR will be below EFFR again, and this is also the trend at the end of 2023, with SOFR returning to normal in January 4, 2024).

Specifically, the logic chain is: financial institutions begin to reduce leverage and increase cash or cash equivalents to cope with regulatory compliance at the end of the year -> market liquidity is temporarily withdrawn -> less money leads to a surge in ultra-short-term financing rates -> strategies in the US stock market that are extremely sensitive to short-term interest rates are squeezed and forced to unwind -> the US stock market is squeezed -> BTC follows the squeeze.

2. Whales' situation:

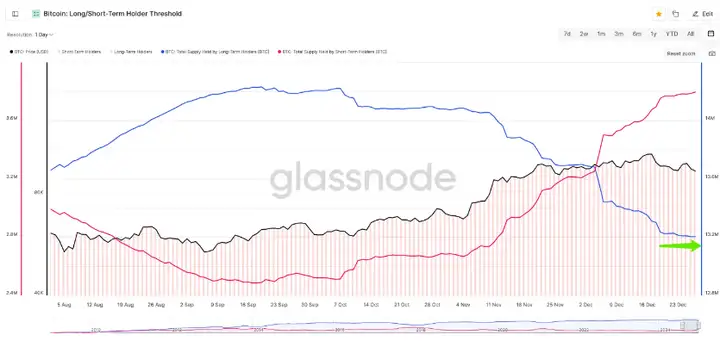

On the BTC chain: Long-term holders (LTHs) have almost stopped the large-scale outflows (a total of 1 million BTC sold) that began after the major uptrend following the election, and the trend of whale selling has stopped.

Bitfinex whales: They have started to persistently buy BTC spot at around 0.2% premium.

Bitfinex's leveraged long BTC positions: They started to increase their positions from the evening of the 28th.

3. Americans are starting to work again:

Recently, USDT has not seen any issuance of around $1 billion, and it is almost confirmed that MSTR has not bought any coins. It is expected that Americans will start to come back and continue to buy coins after January 1st (MSTR is an exception, the optimistic scenario is a two-week blackout period from January 14th to the February 5th earnings call when they cannot finance to buy coins; the pessimistic scenario is a four-week blackout period from January 1st to the February 5th earnings call when they cannot finance to buy coins).

4. The correction has bottomed out:

It has repeatedly bottomed around 92-93, and has corrected about 20% from the high of 108,000 to 92,000. Except for the 8/5 black swan event, the correction in this bull market has been mostly within 20%.

5. The bubble deflation is relatively clean:

Even if the US stock market fell last Friday mainly due to short-term liquidity squeeze, the Nasdaq fell a maximum of 2% intraday, and I observed that BTC also only fell a little more than 2% around 93, giving a sense of relatively clean bubble deflation.

6. On the order book: In the past one or two days, there have been some relatively dense and large-amount orders on the Binance spot market.

Altcoins: They seem to have a hard time falling further.

Since Altcoins don't follow BTC's decline, it means they have already reached a relatively bottom, and BTC won't keep falling either, it will rebound, and Altcoins will rebound even more when BTC rebounds.

The correct strategy is:

Buying may make you feel afraid, but this is the right time.

Selling may make you feel reluctant, but this is a rational choice.

If you can go against the trend and build positions during corrections, and boldly buy during panic sell-offs, you will have an advantage over most people.

Build positions in batches, operate patiently

Don't chase the rally, but build positions during corrections.

Build positions gradually. If the price drops 5%, you shouldn't invest all your funds in Altcoins at once, or you may panic and sell out if the market sees a larger correction (such as a 10%, 20% or even 30% drop).

The correct strategy is: when the price drops 5%, first invest 10% of your funds. This way, when there are larger corrections later (such as 10%, 20% or 30%), you can continue to add positions gradually, instead of being forced out of the market by market volatility.

What if the correction doesn't deepen further? No problem. Don't invest all your funds at once for fear of missing out, or you may be forced to exit in a deeper correction.

There will be more correction and position-building opportunities in the future.

In a market with extremely high volatility, you cannot perfectly time every swing. You don't need to buy at the absolute bottom or sell at the absolute top, just focus on long-term returns.