Key Points Summary

The imbalance in investment opportunities between retail investors and venture capitalists in the cryptocurrency market is an ongoing topic of discussion.

Fair Launch platforms aim to provide fair investment opportunities to address this imbalance, but they still face structural limitations.

Innovative approaches such as providing investment opportunities based on on-chain and off-chain data, and using transparent fair launch mechanisms under AI agent control, are gaining attention.

1. Introduction

Source: rsuthar94, Dune Analytics

Launchpad platforms like Pump.fun and DAOS.Fun are gaining momentum in the cryptocurrency market. They have attracted attention due to their high trading volumes and active user participation. Unlike traditional ICOs and IEOs, these platforms employ fair distribution mechanisms - all users can freely participate in the initial token investment, without the need to pre-sell to capital providers. This model, which allows retail investors to participate from the beginning, share in the value, and benefit from the fair distribution of tokens, has gained widespread attention. This trend highlights the long-standing exclusion of retail investors from quality investment opportunities, and also raises market expectations for more inclusive investment models.

This report will analyze whether Fair Launch platforms can effectively address the inequality of investment opportunities for retail investors and support the sustainable development of the cryptocurrency market.

2. Retail vs. VCs: The Origin of the Conflict

The inequality of investment opportunities between retail investors and venture capital firms has long been a persistent issue in the traditional financial market, and the same problem exists in the cryptocurrency market. Venture capital firms acquire large quantities of tokens at low prices during the private sale stage, and then sell them at higher prices in the public market, profiting from the price increase. This process puts retail investors at a disadvantage, as they are forced to enter the market at higher prices, further fueling their dissatisfaction with the lack of fair investment opportunities.

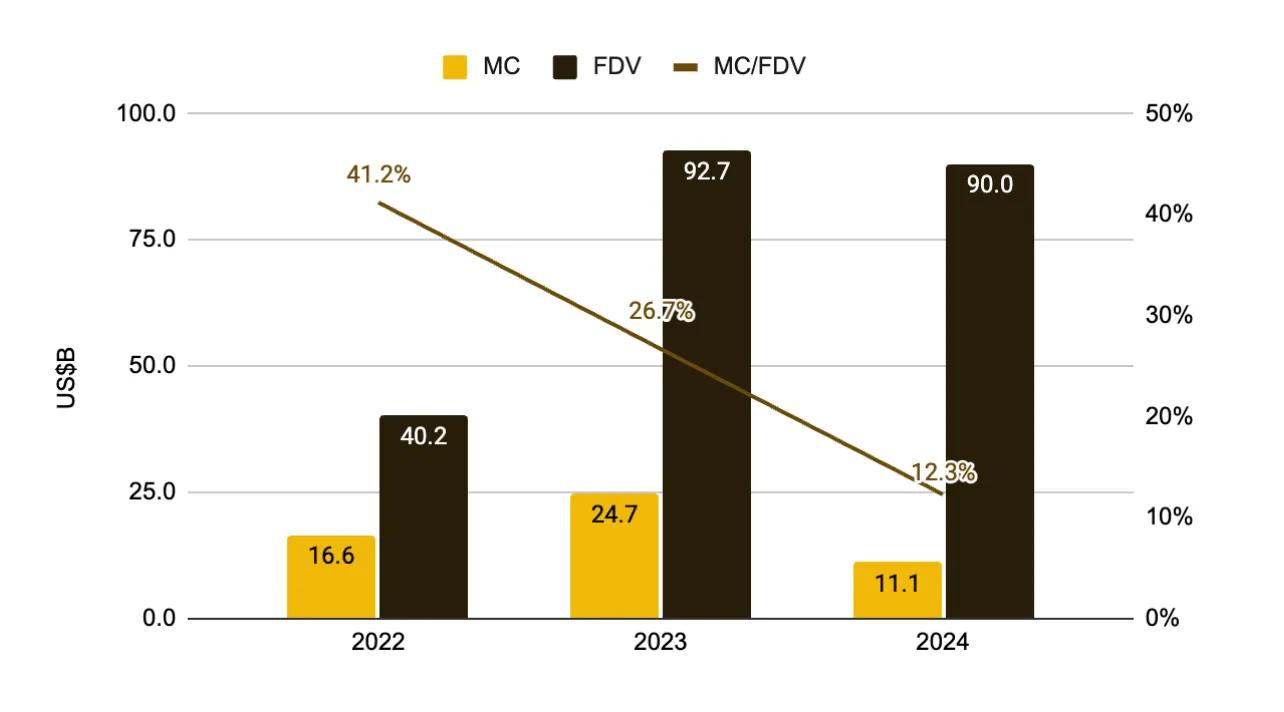

MC/FDV of tokens issued in 2024 reaches a near 3-year low, source: Binance Research

This problem is supported by data. According to Binance Research, the market capitalization (MC) to fully diluted valuation (FDV) ratio in the cryptocurrency market has continuously declined from 41.2% in 2022 to 12.3% in 2024. This indicates that the proportion of circulating tokens traded in the market is decreasing, while the proportion of locked-up supply is increasing. The limited supply artificially inflates the token prices, allowing early investors like venture capitalists to profit. However, when a large amount of locked-up supply enters the market during the unlocking period, the oversupply often leads to a price crash, and retail investors are the first to bear the losses. Ultimately, the inflated pricing at issuance often results in financial losses for retail investors.

Against this backdrop, retail investors are naturally attracted to fair launch platforms. These platforms eliminate the risks associated with token unlocking by distributing all tokens upfront, providing an equal starting point for all participants. This model promotes a more balanced token distribution and a healthier ecosystem development, meeting the demands of retail investors to participate in projects early on.

3. Fair Launch Platforms: True Alternatives or Another Form of Imbalance?

Fair launch platforms have opened up new opportunities for retail investors and positioned themselves as alternatives to traditional investment models. However, whether these platforms truly solve the problem of unequal investment opportunities remains debatable. On the surface, they create a fair environment where all participants are on an equal footing. But in practice, new forms of inequality and challenges have emerged.

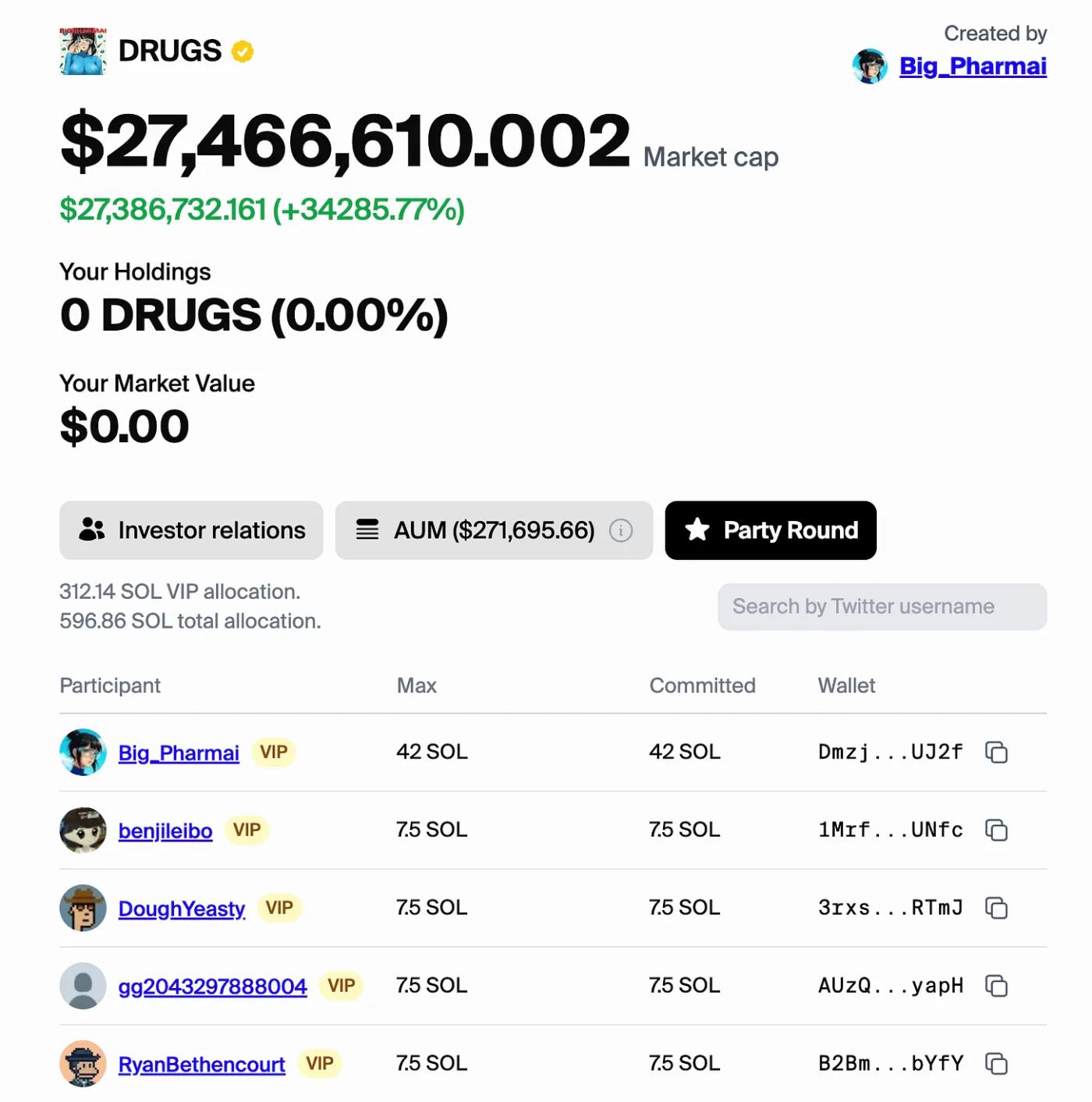

$DRUGS VIP participant list, source: DAOS.fun

Taking Pump.fun as an example, the platform faces challenges from automated tools, such as token generation event (TGE) sniping bots and trend bots, which often occupy trading opportunities, pushing retail investors to the back. Additionally, some projects use mechanisms like whitelists to disrupt fairness, prioritizing specific groups or forming interest groups to provide preferential conditions for insiders. These issues erode the original intent of fair launch platforms. In reality, inequality has not been eliminated, but rather taken on a new form, and retail investors still struggle to access fair participation opportunities. What's more concerning is that this pattern is now repeating at a faster pace. Since fair launch platforms often skip the traditional venture capital due diligence process, they end up exposing retail investors to even greater risks, further exacerbating the inequality of investment opportunities.

4. The Deeper Roots of Unequal Investment Opportunities

Fair launch platforms have not fundamentally solved the problem of unequal investment opportunities. To truly understand this issue, we need to examine it from a more fundamental perspective. This inequality is not just about the difference in opportunities between retail investors and venture capitalists, nor is it solely about the fairness of opportunities. More importantly, it threatens the long-term sustainable development of the entire ecosystem.

If a project is solely focused on fundraising, then opening up investment opportunities to everyone makes sense. But token-based ecosystems should not just aim to raise funds; they need to grow together with investors and ecosystem participants, continuously creating and developing value. This requires genuine participants who are not only interested in short-term gains, but also willing to contribute to the long-term development of the ecosystem.

In this context, the role of venture capital is particularly important. Venture capitalists not only provide financial support, but also bring a wide network of connections, human and material resources, and validate the stability and reliability of projects through early research and due diligence. This also explains why some fair launch platforms may incentivize pre-vetted participants through early access.

To solve the problem of unequal investment opportunities, simply achieving equal access is not enough. The long-term growth and sustainable development of the ecosystem requires a structured approach that can identify and incentivize those participants who can make substantive contributions. This is a fundamental challenge that the Web3 ecosystem urgently needs to address.

5. Finding a New Balance: A Value-Driven Ecosystem

The current cryptocurrency market is caught between two extremes: the pursuit of absolute equality in the fair launch model, and the traditional model centered on a small group of seasoned investors. Neither of these models fully reflects the inherent value of the Web3 industry. Therefore, we need to shift towards a "value-driven participant selection" strategy, which identifies and attracts participants who can make significant contributions to the ecosystem, focusing on their value creation capabilities rather than simply considering capital size or investor type. Two recent cases have demonstrated the potential of this new approach.

5.1. Legion: Community-Driven Investment Rounds Platform

Source: Legion

Legion, as a community-driven investment platform, is committed to selecting investors who can create real value for the ecosystem. The platform's goal is not only to raise funds, but also to build sustainable partnerships between project teams and investors.

Source: Tiger Research, LegionThe core platform's Legion Score system comprehensively evaluates investors' on-chain activities, social influence, GitHub contributions, and project recognition, among other multidimensional data. The scoring system is based on investors' actual contribution capabilities to the ecosystem, rather than just their financial resources. Investors need to submit a cover letter and Legion score, detailing their potential contributions and participation plans, which helps establish trust with project teams. This approach not only enhances the fairness of investment opportunities but also promotes deeper interaction between project teams and investors. Legion is creating a new investment model that, while enhancing the credibility of the crypto market, has also built a community ecosystem that values contribution.

5.2. AI-Pool: A Fair Launch Platform Based on AI Agents

AI-Pool is an experimental fair launch platform based on AI agents, proposed by user Skely on December 24, 2024. The idea quickly gained attention and spread within a few hours. Many investors have funded the project, raising over $5 million. Note: Skely's account has been suspended due to reports of a fake account. The specific reasons are unclear, as it was reported by a third party. Additionally, the platform is an early, untested experimental project and is not yet stable or reliable. However, the user's idea is still promising.

Source: SkelyAI-Pool aims to solve the pain points of existing fair launch platforms through AI agents. Compared to the common issues of centralized operations and insider trading in traditional platforms, AI-Pool adopts a trusted execution environment (TEE) to achieve process transparency. The TEE protects the AI wallet's private keys and ensures the autonomous operation of the AI agents, effectively reducing the unfairness caused by centralized control and insider trading. Although AI-Pool still faces challenges such as bot interference and lack of liquidity, it has unique advantages in ensuring the fairness of token issuance and initial distribution, providing a new approach to addressing the unfair distribution problem in centralized platforms. With further technological improvements, AI-Pool has the potential to become a model for enhancing the trust and transparency of the cryptocurrency market.