Background Introduction

Recently, the token listing auction mechanism of the Hypurr Fun platform and Hyperliquid has attracted widespread attention. The token Farm launched by Hypurr Fun recently was listed on the Hyperliquid spot market, and its market value quickly soared to $20 million. The continuous rise of the HYPE token has led more users to pay attention to the Hypurr Fun ecosystem. As an order book-style DEX, the token listing of Hyperliquid is different from the permissionless form of Raydium, etc. How does the Hypurr platform, which is similar to pump.fun, integrate with it? What are the specific rules and trading processes behind it?

1. Hyperliquid: From Transparent Mechanism to Top 50 in Market Cap, Redefining the DEX Market

The emergence of Hyperliquid has broken the traditional "black box token listing" model. The successful journey of the HYPE token entered the top 50 in market cap within just two weeks after the TGE, once surpassing projects like Fantom, Bittensor, and even Arbitrum itself. This success not only refocuses the market's attention on DEXs, but also demonstrates Hyperliquid's precise market insight. The project did not take the old path of VC financing and then washing volume before listing, but won the market's recognition through a transparent mechanism.

After this airdrop, the popularity of Hyperliquid also began to soar. The record-breaking auction of SOLV is a turning point for Hyperliquid to transition from a meme playground to the mainstream, and Solv Protocol will be the first top project to be listed on Hyperliquid.

2. Hyperliquid: The Open and Transparent Listing Mechanism Injects New Vitality into the Market

One of the reasons why Hyperliquid's token listing mechanism has attracted widespread discussion is a post by Moonrock Capital CEO Simon on Twitter. He claimed that "Binance requires a potential project to provide 15% of its total token supply to ensure its listing on the CEX, which accounts for 15% of the total token supply, worth about $50-100 million." This centralized operation has made many project parties and investors hesitant, while Hyperliquid has injected a breath of fresh air into the market through an open and transparent token listing mechanism.

It can be said that the crypto industry has long been plagued by centralization, and the wealth effect of each token listing is almost taken away by the CEX (listing fee) and the scientists (front-running after listing), and the project party has to bear a considerable listing fee, which will sacrifice the quality of the project, and ultimately it is the retail investors who foot the bill. The token listing event and the current logic of retail investors embracing memecoins and rejecting VC coins are of the same nature, the core of which is still inseparable from fairness.

3. Hyperliquid: Adopting the Dutch Auction Mechanism to Ensure a Fair Price for Token Listing

Hyperliquid adopts a Dutch auction mechanism to determine the order of token listing. Project parties need to apply for the deployment permission of the native HIP-1 token, and then determine the final price of the token through a Dutch auction. The starting price of the auction is higher than the market expectation, and gradually decreases over time until a bidder accepts the price. This mechanism not only reflects the true psychological expectation of the bidders, but also achieves token listing at a fair price.

The specific process is a 31-hour Dutch auction, during which the token deployment fee linearly decreases from the initial price to $10,000 USDC. If the auction fails, the initial price will be restored to $10,000 USDC, and if successful, the starting price of the next auction will be twice the previous price. For example, if the winning bid price in the last auction is $100,000, the starting price of the next auction will be $200,000, and it will decrease over time.

4. Hyperliquid: The Crowdfunding Auction Mechanism Enhances the Transparency and Quality of Token Listing

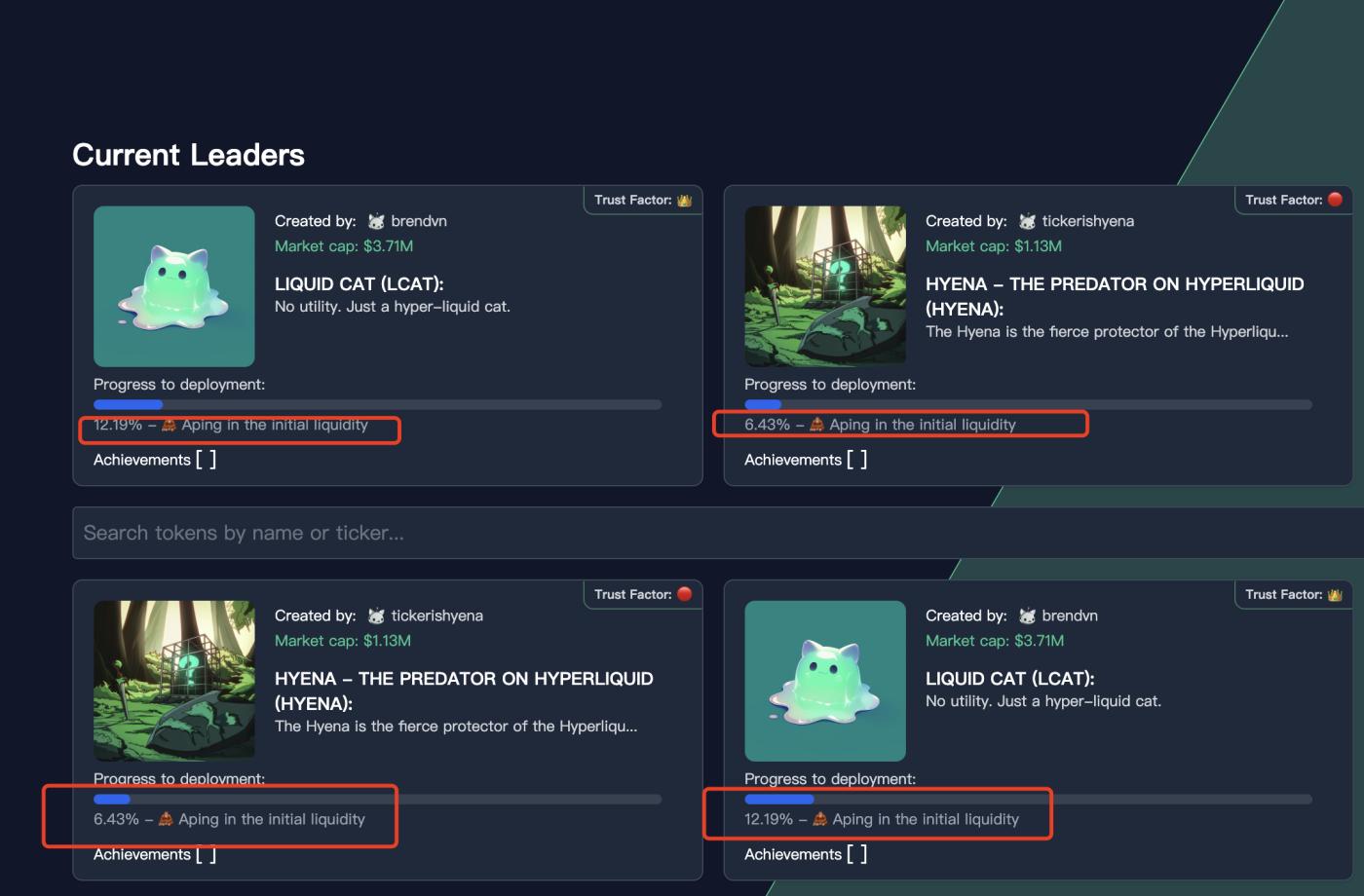

In Hyperliquid's token listing auction mechanism, the Hypurr Fun protocol is equivalent to establishing a "crowdfunding" platform, where participating users invest funds and then compete for spot listing opportunities on Hyperliquid.

Deploying a token on Hyperliquid requires paying a gas fee, which will be refunded to the HLP Vault. At the same time, Hyperliquid holds an auction every 31 hours, with a maximum of 282 listings per year. This passive "quota" approach not only improves the quality of the listed projects, but also protects the interests of the community. Compared to the traditional CEX's black box operations, Hyperliquid's token listing mechanism is more open and transparent, forming a virtuous cycle. Currently, Hypurr is still in the early stage and is in a continuous upward trend, so there may be more "mining" opportunities. The tools are obviously very incomplete, and cannot be compared with other mature pump-type ecosystems at all.

5. Hypurr: Obtain Token Information and Trading Dynamics in Real-time via Web Version and Telegram

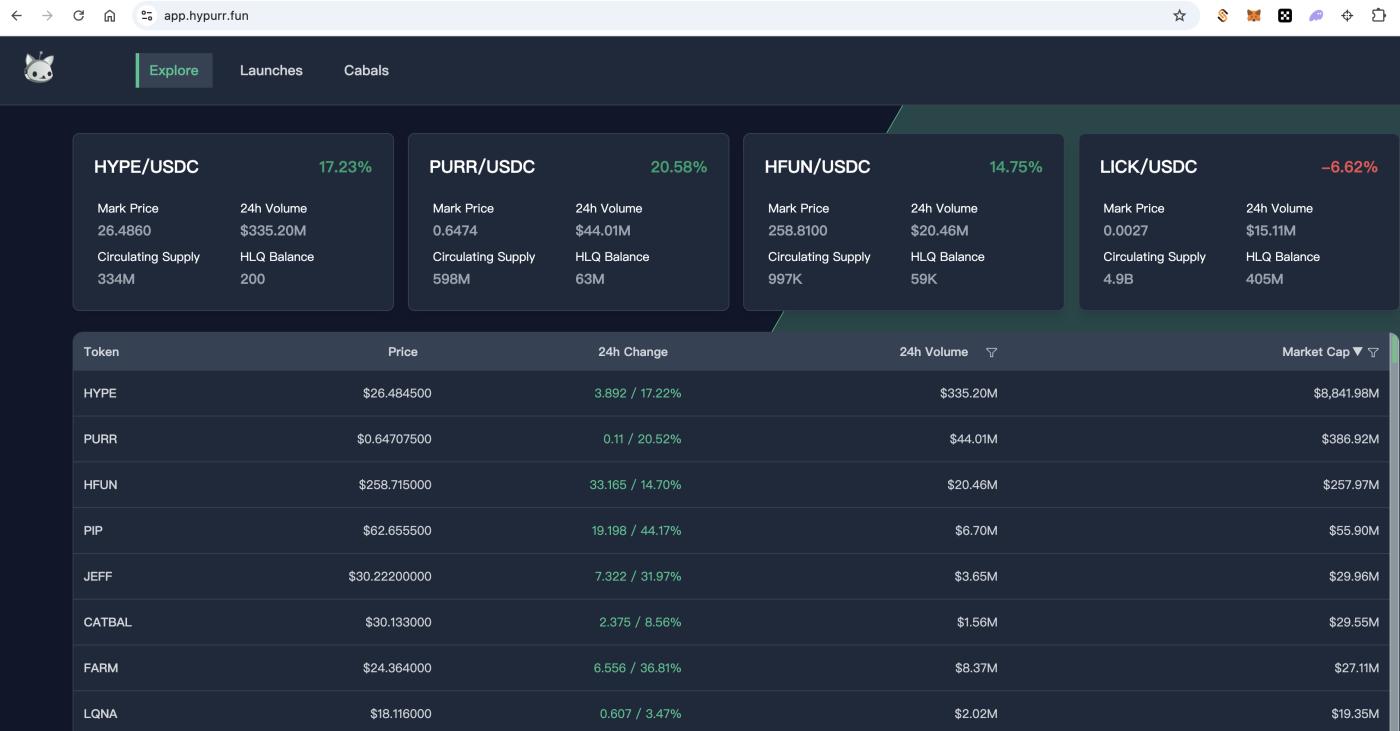

https://app.hypurr.fun/launches

The web version can be used to query Hypurr token information and trading conditions, including project introduction, token price, market cap, trading volume and other basic information.

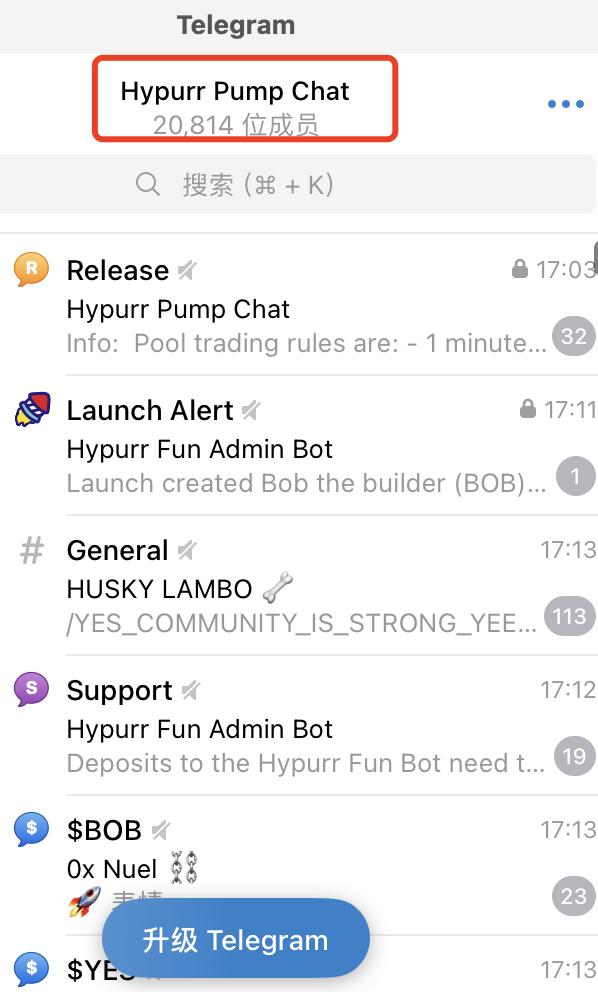

New tokens can be obtained through the Telegram channel, the path is Hypurr official bot→Prelaunch market channel→Launch Alert subchannel, through Telegram you can know more timely which new tokens have been added, without having to refresh the webpage to get the information.

6. Hypurr Fun: Purchase Tokens through Telegram Bot and Web Version

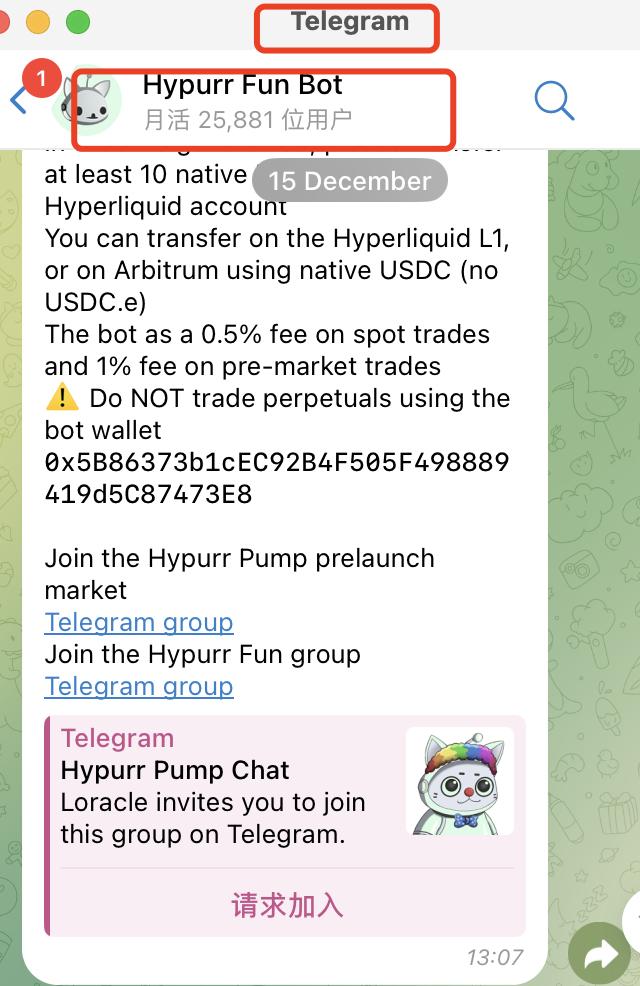

Currently, Hypurr Fun only supports token purchase through the Telegram Bot. After entering the Bot, a pop-up message will provide the wallet address, and more information can also be obtained through the Wallet module. At present, only native USDC deposits from Hyperliquid L1 or Arbitrum are supported (USDC.e is not supported).

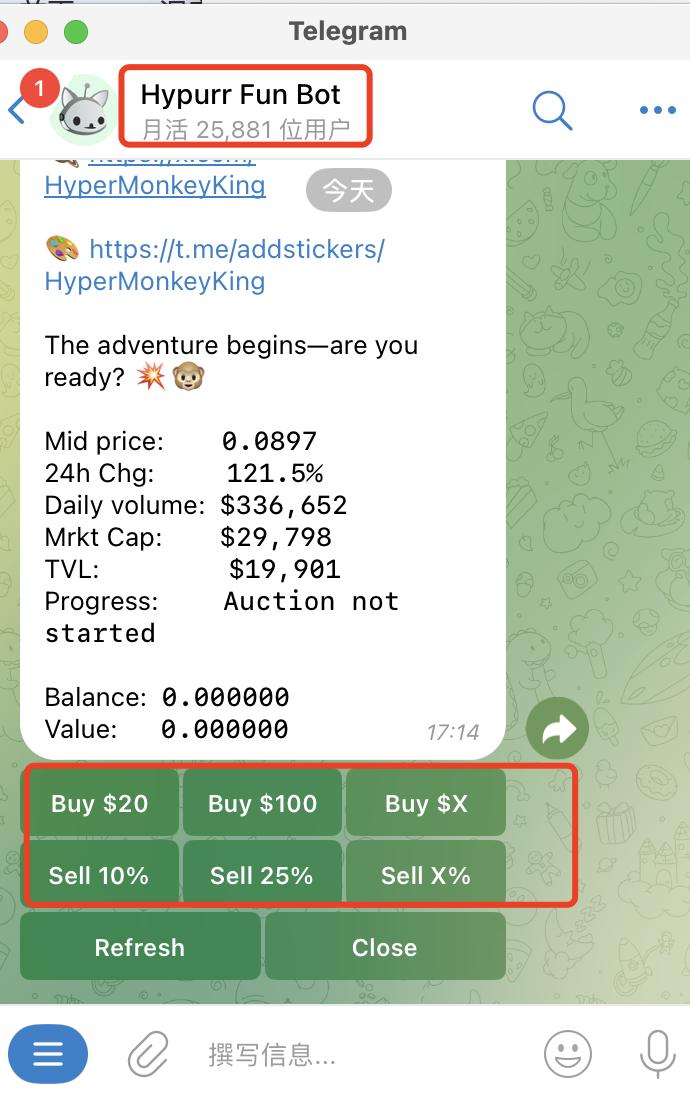

There are two main ways to purchase tokens:

1. Jump from the web version to the token channel, and then jump to the Trade interface through the pinned message.

2. Purchase through "/launches" (sorted by trading volume or price) or "/chat" on the Telegram homepage. The former is an official data filtering tool, and you can directly select the purchase quantity after clicking; the latter is a public chat channel, where users can discover popular tokens and jump to trade through clicking.

7. Hypurr Fun and Hyperliquid: Project Popularity Surges, Wealth Effect and FOMO Sentiment Reappear

Since many projects are still only 5% complete on the Hypurr Fun platform, when the progress reaches 100%, it means that the liquidity pool will increase 20 times, and the corresponding market cap can be imagined. Many people will focus on the projects with around 5% progress and relatively high community heat. In the past few days, friends around me have joined many WeChat groups, constantly monitoring everyone's "new token" situation, hoping to get a share. The daily increase of dozens of times, but the difficulty in using Telegram groups to buy and sell has blocked the entry of many people. The numerous projects on the Hyperliquid platform have exhibited a significant wealth effect. User enthusiasm is high, and the overall atmosphere makes people recall the hot IDO scene in the early 2020s. On the Hyperliquid platform, market participants show extremely high activity. Whether it's the online community or offline communication, users show strong participation enthusiasm. The market's "FOMO" sentiment is particularly prominent, and each new project launch attracts a large amount of attention and investment.

8. In-depth Reflection on the Success of Hyperliquid

The success of Hyperliquid is not accidental, its epic airdrop and transparent token listing mechanism have great educational significance for the market. After the FTX bankruptcy, the founder Jeff decided not to trust CEX anymore and refused VC investment. He believes that many projects have polished their data through VC investment, and ultimately exit through listing on large trading platforms, which is an unsustainable model. Hyperliquid has witnessed the victory of the decentralized spirit, and its transparent and open mechanism and strong community cohesion have pushed the Perp DEX to a new peak.

In summary, Hyperliquid's token listing mechanism has revolutionarily changed the black box operations of the existing CEX token listing, and has driven the public transparency of the entire industry. In the call of the market, fairness and openness have become the new standard, and Hyperliquid has undoubtedly been at the forefront of this trend.

Risk warning: The above content is about the listing auction mechanism of Hyperliquid and the operation of the Hypurr Fun "crowdfunding" platform, which is only for demonstration purposes. The tutorial on internal trading does not involve specific projects. The operation risk is relatively high, and you may face huge losses, please participate with caution.