Introduction: From Hurricane 2024 to Storm 2025

2024 is destined to be a legendary chapter in the cryptocurrency industry. This year, Bitcoin broke through the $100,000 mark, but Ethereum fell into a bottleneck in ecological development; Solana and Base rose against the trend, and the public chain landscape quietly changed; DeFi returned strongly after years of silence, and its combination with real assets (RWA) ignited a new narrative; the integration of AI-Agent and MEME promoted the intersection of technology and culture; the NFT market broke through and recovered with the help of innovation, and those classic old currencies that were once forgotten also ushered in new glory in the loosening of policies.

In our just released "Rush 2024: The 10 Biggest Surprises in Cryptocurrency" , we reviewed the key events of the year:

From the approval of Bitcoin spot ETF to the favorable policies triggered by Trump’s victory

From the unexpected attempt to fund science with MEME coins to the rapid rise of AI-Agent technology

Each event highlights the vitality and unpredictability of the crypto industry. 2024 is not only an adventure for crypto assets, but also a reshaping of the market and technology landscape.

What about 2025? On this treacherous road, we are facing more unknown possibilities. Will the crypto industry continue to soar in the new year? Or will it enter a more rational and standardized stage? Can Bitcoin and Ethereum dominate again in the new narrative? Is the flywheel effect of AI-Agent strong enough? These suspense have already made global investors and technology developers full of expectations.

Next, we will start from the top ten trends and look forward to the blueprint of the crypto market in 2025. From Bitcoin reserves to public chain competition, from the exponential growth of DeFi to the recovery of NFT, this forecast report attempts to clear the fog for you and give you a glimpse of future possibilities. This is not only an exploration of the unknown, but also a profound interpretation of the future direction of the industry.

1. Bitcoin: Consolidating its status as a global reserve asset

In 2025, Bitcoin will enter a new phase of wider adoption and market recognition. From breaking new highs in price to taking a place in the balance sheets of countries and companies, to the further development of its ecosystem, Bitcoin is continuing to lead the core narrative of the cryptocurrency market with multi-dimensional growth.

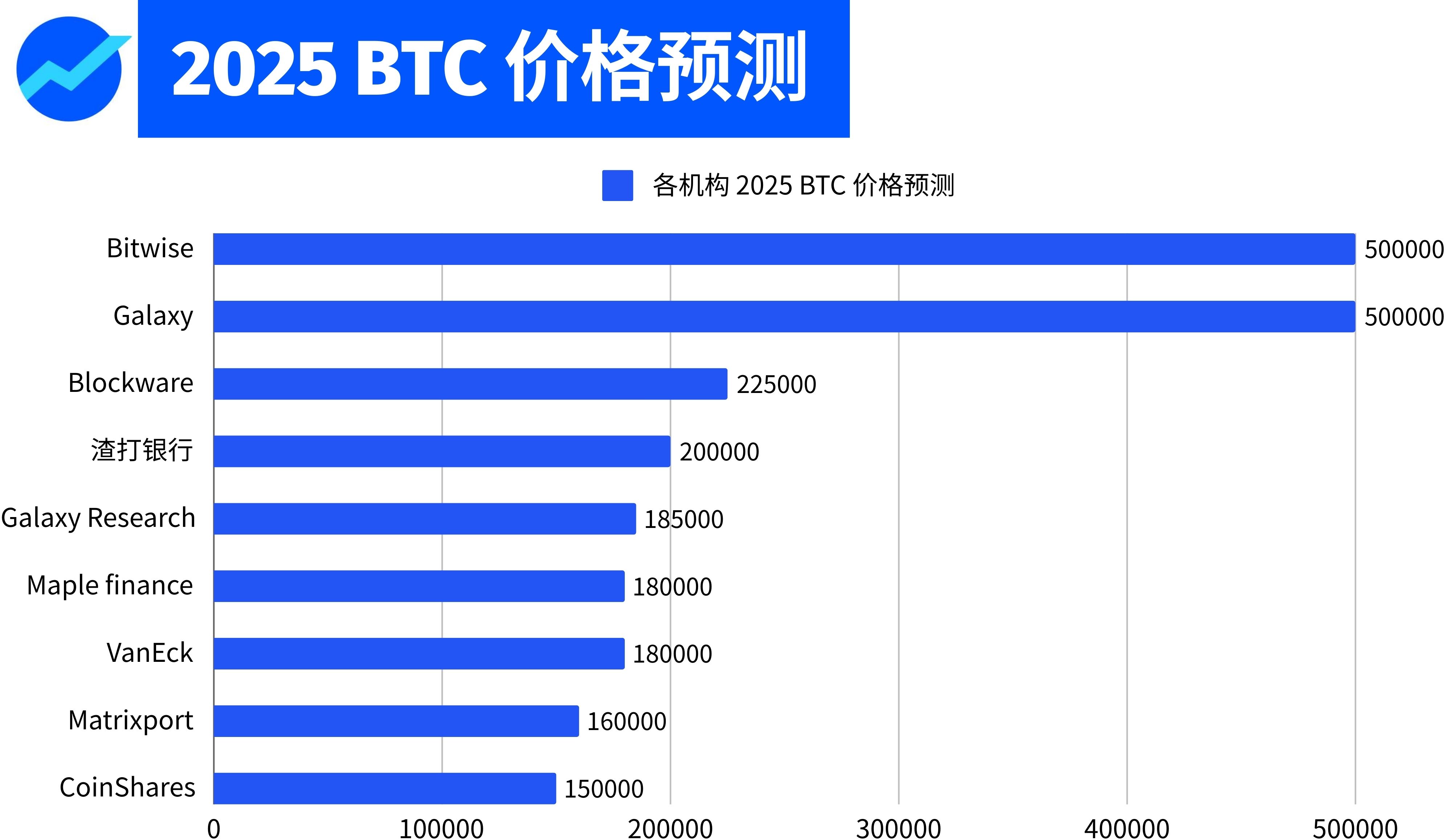

Price: Strong expectations for a bull market

According to Blockware Solutions' forecast, the price of Bitcoin will exceed $150,000 in the middle of 2025 and reach $225,000 by the end of the year in the basic scenario, and may even reach $400,000 in the optimistic scenario. In addition, Carol Alexander, a professor of finance at the University of Sussex, also believes that Bitcoin will reach $150,000 in the summer of 2025 and may further challenge the high of $200,000. The key to these forecasts lies in the continuation of the Federal Reserve's loose monetary policy and the long-term impact of Bitcoin's supply scarcity.

Countries and companies: adoption is accelerating significantly

Galaxy Research predicts that by 2025, at least five countries and five Nasdaq 100 companies will officially announce the inclusion of Bitcoin in their balance sheets or sovereign wealth funds. The asset management scale (AUM) of US spot Bitcoin ETFs is expected to exceed US$250 billion, and traditional institutional investors such as pension funds have also begun to include Bitcoin in their portfolios, further consolidating its status as a reserve asset. Non-aligned countries and countries with large sovereign wealth funds, especially Middle Eastern economies, see Bitcoin as a key tool for diversifying trade settlement; at the same time, companies represented by MicroStrategy are expected to further increase their Bitcoin holdings in 2025, continuing to drive market adoption.

Ecosystem: Dual-wheel drive of DeFi and protocol upgrade

Bitcoin's ecological development will usher in an important milestone in 2025, with decentralized finance (DeFi) and protocol innovation becoming two key driving forces. Blockware Solutions predicts that the total valuation of the Bitcoin DeFi market will double to $30 billion. Bitcoin's L2 network (such as Lightning and Babylon) will further expand usage scenarios and provide stronger support for DeFi protocols. At the same time, Bitcoin core developers may reach a consensus on protocol upgrades (such as BIP 119 and BIP 347) in 2025 to enhance the functionality and scalability of the Bitcoin network. Although the upgrade activation will take more time, its long-term impact will undoubtedly further consolidate the ecological foundation of Bitcoin.

In 2025, Bitcoin will steadily consolidate its position in global assets with continued price increases, accelerated adoption by countries and enterprises, and diversified development of the ecosystem, and write a new chapter of "digital gold".

2. Ethereum: Growing Demand and Revival

2024: Weak performance

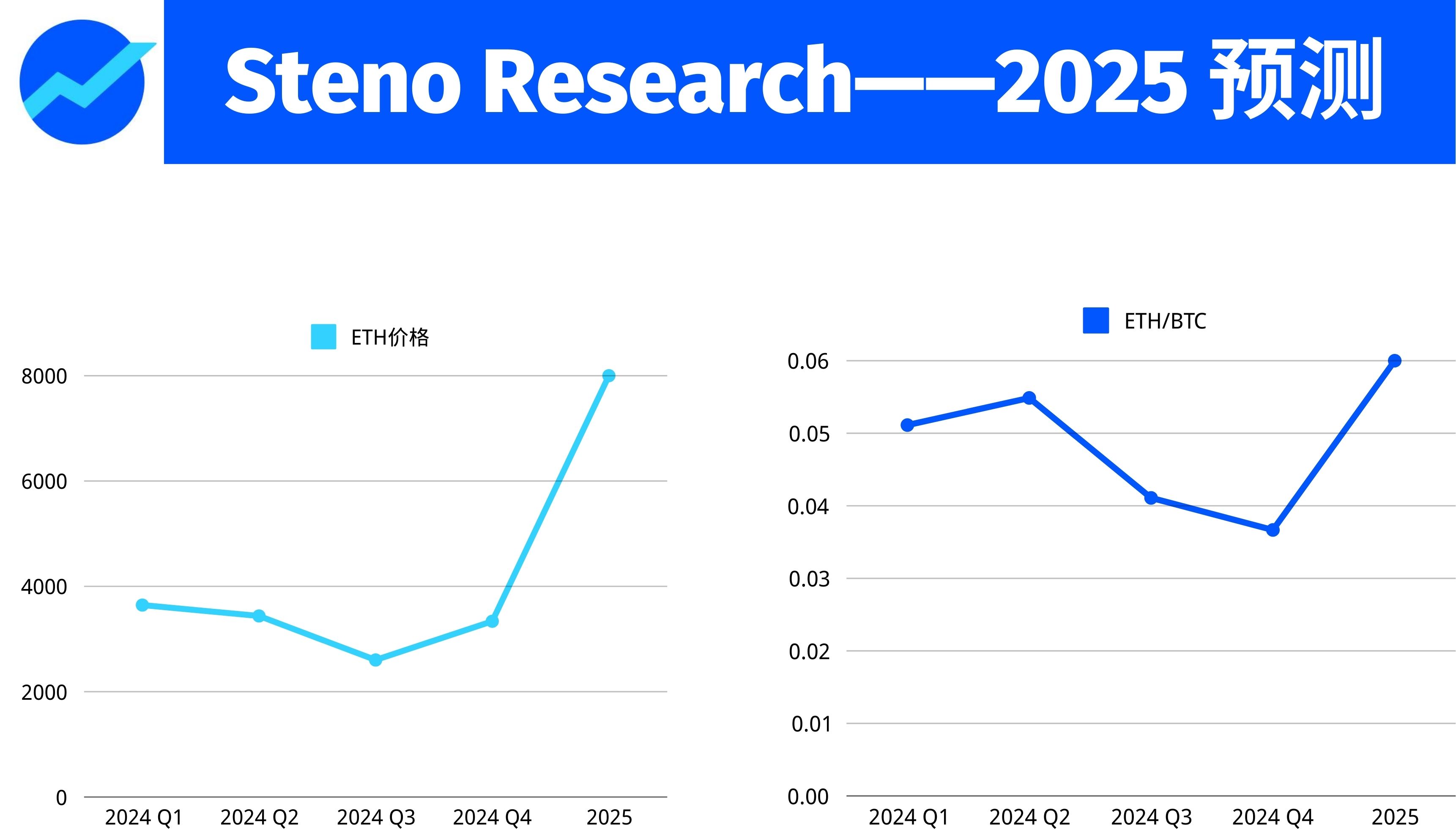

In 2024, Ethereum failed to rise as strongly as the market expected. Although the performance of the Layer 2 network has improved after the Dencun upgrade, the diversion of mainnet revenue, the continued increase in the pledge rate, and the net outflow in the early stage of the ETF have put pressure on the price of Ethereum. According to market data, the ETH/BTC ratio fell to 0.0357 in 2024, a new low since the merger and upgrade of Proof of Stake (PoS). In addition, the Ethereum Foundation sold a large amount of ETH in the context of market instability, triggering a crisis of confidence among investors. In sharp contrast to Bitcoin's repeated record highs driven by favorable policies, Ethereum's price performance was slightly weak throughout the year.

2025: A chance for a breakthrough

Entering 2025, Ethereum is expected to usher in a critical moment from weakness to rebound. Steno Research predicts that the price of ETH will exceed $8,000 by the end of the year, doubling its growth, and the ETH/BTC ratio will rebound to above 0.06. Key factors driving this rebound include a clearer regulatory environment, continued growth in staking demand, and active development of the ecosystem.

Staking Demand and Institutional Adoption

Ethereum's staking rate is expected to exceed 50% in 2025. As the US government may relax regulatory restrictions on staking and DeFi, the popularity of spot Ethereum ETFs will further promote institutional adoption. According to a report by Farside Investors, the inflow of Ethereum spot ETFs in 2025 may exceed US$50 billion, significantly enhancing market liquidity. At the same time, innovative solutions such as re-staking protocols (such as EigenLayer) will inject more capital into the Ethereum ecosystem and enhance the overall value of the network.

Active Ecosystem: The Rise of DeFi and Layer 2

DeFi and Layer 2 networks will become the two major growth engines of the Ethereum ecosystem in 2025. Steno Research predicts that the total locked value (TVL) of Ethereum decentralized applications will exceed $300 billion, setting a new record. For the first time, the economic activity of the Layer 2 network will exceed the total fee share of all other Alt L1 networks, and Rollup technology solutions such as Arbitrum and Optimism will make new breakthroughs in technology and user experience. In addition, the recovery of the NFT market and the gradual market fit between games and financial applications based on Ethereum will further expand the use scenarios of Ethereum.

3. Public chain structure: new and old factions generally rise in competition

Ethereum L2: Expanding the Ecosystem

Ethereum's Layer 2 (L2) solution will continue to consolidate its core position in the public chain ecosystem in 2025. L2 networks such as Base, Arbitrum, and Optimism have achieved explosive growth due to the maturity of Rollup technology. According to forecasts, Base's total asset lock-in (TVL) will exceed US$40 billion in 2025, accounting for a significant proportion of Ethereum's total L2 TVL.

As an L2 chain supported by Coinbase, Base has attracted a large number of application developers with its strong distribution capabilities, and its ecological expansion speed is remarkable. At the same time, Arbitrum and Optimism continue to lead in user experience and cost efficiency with technological innovations (such as Stylus virtual machine and Blob market optimization parameters). It is expected that in 2025, the overall transaction fees of the L2 network will exceed the sum of all other emerging public chains, consolidating its dominant position in the multi-chain landscape.

New public chains: Base, Solana, Sui and HyperLiquid compete against each other

The competition landscape of new public chains in 2025 is extremely fierce. Base, Solana, Sui and HyperLiquid each focus on different fields, attracting a large number of users and developers.

Base: An emerging ecosystem driven by AI

In 2025, Base will not only be an important platform for DeFi and NFT, but will also gradually become the leading chain for AI proxy and AI branch applications. Its efficient Rollup architecture and Coinbase's support make it stand out in the field of AI and blockchain technology integration and become the preferred platform for developers.

Solana: High Performance and Institutionalization

Solana's technical advantage lies in its high throughput and low latency. The upcoming Firedancer client aims to achieve 100,000 TPS per second, greatly enhancing its ability to attract complex applications. In addition, Solana has further consolidated its institutional ecological positioning by adjusting its issuance policy to reduce inflation and applying for ETFs. Its goal is not only to lead in performance, but also to provide developers with a stable and low-cost application development environment.

Sui: User experience and simplified development

As an emerging public chain, Sui has attracted a large number of developers with its Move language and modular architecture that focuses on improving development efficiency. At the same time, its low-threshold user experience and optimized network performance make it a popular choice for consumer applications.

HyperLiquid: A Pioneer in High-Performance and Customized Chains

HyperLiquid, an application chain launched based on Tendermint consensus, has reached a TVL of $20 billion in just 8 months, and continues to improve its consensus mechanism to further enhance performance. HyperLiquid's customized Layer 1 design makes it stand out in the market segment, especially in meeting the needs of high-frequency trading and derivatives.

Price performance: Bullishly driven rise

With the continuous expansion of the ecosystem and the involvement of institutional funds, the price performance of public chains will show significant differentiation in 2025:

Base: With a TVL of $40 billion and the rise of AI-driven applications, the Base token is expected to double in value.

Solana: With the end of unlocking pressure and potential approval of ETF, its price may exceed $1,000, corresponding to a market value of $485.9 billion.

Sui and HyperLiquid: As representatives of emerging public chains, their prices are expected to achieve high growth in 2025 due to their technological innovation and differentiated positioning, and gradually become an important supplement to the mainstream ecology.

4. A new era led by AI Agents: from on-chain activities to real-world applications

AI Agents: A paradigm shift centered on “intention”

Illia Polosukhin, co-founder of NEAR, predicts that Web3 will see a major shift centered on “intent” in 2025. This shift will greatly expand the possibilities for users and developers, while empowering AI Agents to act and trade autonomously on Web2 and Web3. This view marks a fundamental change in the way the Internet interacts, and also lays the foundation for the diversity of on-chain activities.

Autonomous Actions on the Chain: From Experimentation to Large-Scale Applications

According to Cara Wu, partner of a16z, AI Agents will become autonomous participants on the blockchain, making the transition from experimental exploration to practical application. AI Agents have played an important role in social media in 2024, and some agents have even begun to manage their own crypto wallets. As the virtual world gradually merges with the physical world, intelligent entities like Truth Terminal have managed and allocated resources through blockchain and tried to complete transactions autonomously. This extension of capabilities may prompt AI Agents to become core participants in the Decentralized Physical Infrastructure Network (DePIN).

Diversified on-chain activities and economic ecology

According to VanEck data, the number of on-chain AI Agents is expected to exceed 1 million in 2025, and the total revenue of these agents has reached 8.7 million US dollars in just 5 weeks. These agents are not only used for DeFi optimization and financial strategies, but are also widely used in social media, games, and consumer interaction. For example, the Virtuals protocol provides users with tools to create on-chain AI Agents without a technical background, and the emergence of a large number of agents is driving the diversification of the on-chain economy.

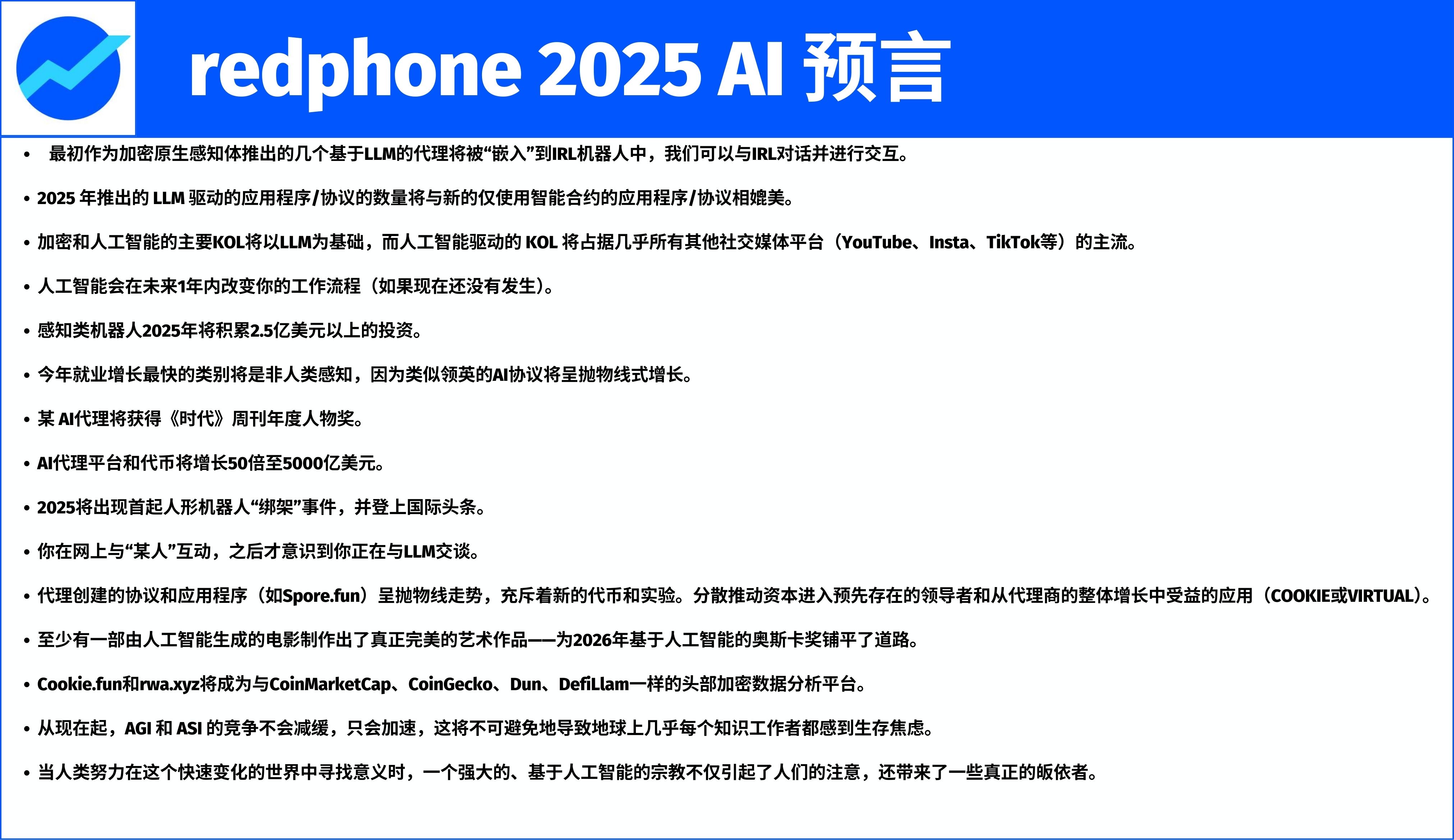

Social Popularization and Innovative Applications of AI Agents

Redphone, a well-known commentator in the crypto space, predicts that AI Agents will become ubiquitous and revolutionize many fields. He believes:

AI Agents will become major “Key Opinion Leaders” (KOLs), active on social platforms such as YouTube, Instagram, and TikTok. With the evolution of Large Language Models (LLMs), users may interact with AI Agents online without being aware of their non-human identity.

An AI agent might even be named Time magazine’s “Person of the Year,” highlighting its influence in society.

Breakthrough in finance: AI-driven autonomous robots are expected to make their mark in investment management, managing portfolios of more than $250 million.

Career transformation: Career categories related to non-human intelligent agents will become the fastest growing areas. At the same time, a decentralized AI protocol similar to LinkedIn may quickly emerge to provide a new interaction model for professional social networking.

Acceleration of the decentralization trend

With the surge in protocols and applications for creating intelligent agents, tools such as spore.fun are empowering ordinary users to develop on-chain AI Agents. This decentralization trend has driven the emergence of a large number of new tokens and experiments, and capital flows are also accelerating into related projects (such as COOKIE and VIRTUAL). Redphone also predicts that in 2025, AI-created movies will shift from "technical demonstrations" to true artistic breakthroughs, paving the way for AI to win an Oscar.

The rise of AI Agents not only demonstrates unprecedented innovative vitality in on-chain activities, but also gradually penetrates into all levels of society. This wave of change will undoubtedly change the relationship between humans and technology in the coming years and drive society towards a more intelligent future.

5. Meme Evolution: From Fun to Function and Science

Meme coin has always occupied an irreplaceable position in the crypto market with its unique cultural influence and community-driven nature. Messari predicted in "The Crypto Theses 2025" that although the market value of Meme coin only accounts for 3% of the top 300 cryptocurrencies (excluding stablecoins), its trading volume has remained at 6%-7%, and even soared to 11% at one point. This phenomenon shows that Meme coin is still a long-term hot spot in the crypto market, attracting widespread attention. However, the core narrative of Meme coin is gradually shifting from a pure speculative tool to a functional asset, opening up a profound cultural and technological evolution.

Meme's total market value: sprinting from 20 billion to 100 billion US dollars

Meme coin ecosystem KOL Murad Mahmudov proposed the concept of "Meme coin super cycle", believing that Meme coin is not only a speculative product in the crypto world, but also the best entry point for users to enter this field. He wrote on the X platform: "Next year, the best Meme coin may still increase by 50-200 times, but investors must hold the best Meme coins instead of frequently jumping into new coins." He further predicted that the total market value of the best performing Meme coins in this cycle will sprint to 20 billion to 100 billion US dollars. This view reflects the huge potential and importance of Meme coins in the future market.

The Rise of Functional Meme Coins: From Fun to Science

As the market matures, Meme coins are evolving from fun assets to functional tokens. The MV Global report points out that decentralized science (DeSci) is opening up new application scenarios through its combination with functional Meme coins. Tokens such as Rifampicin and Urolithin A launched by platforms such as Pump.Science not only provide funding for experiments, but also provide transparent profit mechanisms for token holders by updating research results in real time. These innovations have given Meme coins unprecedented possibilities in the field of scientific research funding.

MV Global predicts that by 2025, at least 10 projects on the Pump.Science platform will have a market value of over $100 million, demonstrating the potential of Meme Coin in scientific research funding and real-world applications.

AI Fusion: Driving the Intelligent Evolution of Meme Coin

The addition of AI technology has injected new vitality into Meme Coin. Through personalized AI agents, dynamic interactive platforms, and trend prediction tools, the community participation and dissemination of Meme Coin have been significantly improved. For example, tokenization tools supported by AI technology not only realize community shared ownership, but also promote the integration of Meme Coin in DeFi, NFT, and scientific research.

This intelligent evolutionary path enables Meme coin to transcend simple cultural expression and become a bridge between technology and finance, further consolidating its core position in the Web3 ecosystem.

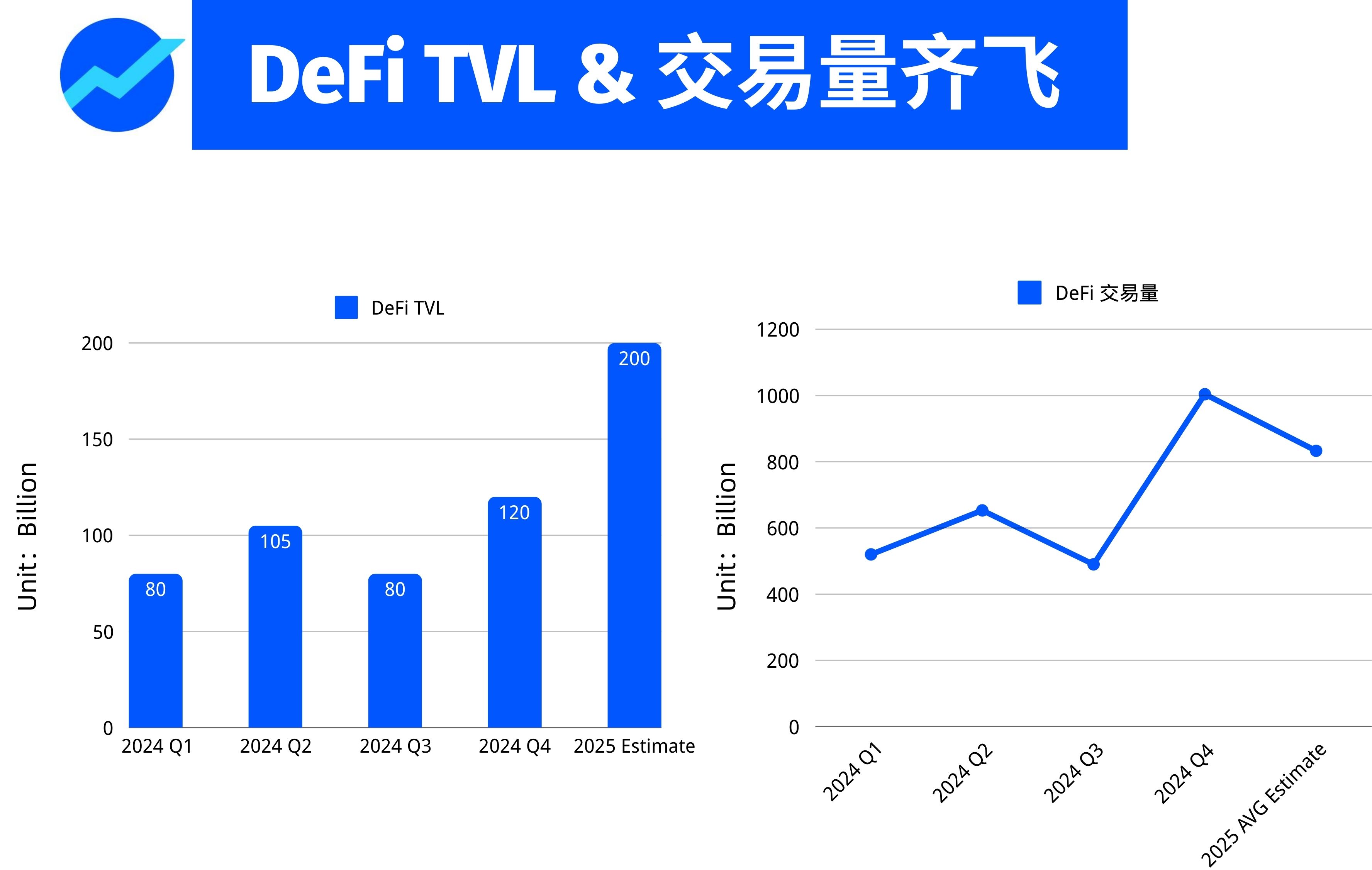

6. DeFi exponential growth

2025 will be a critical node in the development of decentralized finance (DeFi). The full influx of institutional funds, the tokenization of real-world assets (RWA), the rise of decentralized exchanges (DEX), and a clearer regulatory framework will jointly promote DeFi to become a core component of global finance.

DEX transaction volume will exceed $4 trillion in 2025

The rise of decentralized exchanges (DEX) will be another major growth engine for DeFi. VanEck predicts that by 2025, DEX trading volume will reach $4 trillion, accounting for 20% of the spot trading volume of centralized exchanges (CEX). This marks the maturity of decentralized finance in terms of trading infrastructure.

This trend is driven by Layer 2 expansion solutions (L2) and more efficient transaction technologies. For example, Ethereum's low-cost Rollup technology provided by EIP-4844 has reduced transaction costs to less than 1 cent, while the average daily transaction volume has increased to 30 million. With this technical support, protocols such as Uniswap and Aave are also exploring revenue distribution models to further attract capital and users by paying protocol revenue to token holders.

RWA tokenization leads DeFi TVL to exceed $200 billion

As the tokenization of real-world assets accelerates, DeFi's total locked value (TVL) is expected to rebound to more than $200 billion in 2025. VanEck emphasized that this growth stems from the deep integration of traditional finance (TradFi) and DeFi, such as the tokenization of bonds, real estate and other high-value assets. Through tokenization, RWA not only injects new liquidity, but also provides global investors with a more efficient way to allocate assets.

The tokenized fund BUIDL launched by BlackRock has become a model of this trend, and more institutions are introducing high-value assets into the blockchain. For example, the VTAP platform launched by Visa will start a pilot in 2025. These innovations will bring DeFi closer to the mainstream financial market.

Influx of institutional funds and clearer regulation

Coinbase pointed out that institutional investors will fully enter DeFi in 2025, driving exponential growth in the market size. This trend is due to a clearer regulatory framework, including the establishment of stablecoin rules and the clarification of securities classification. Alvin Kan, COO of Bitget Wallet, emphasized that traditional financial institutions are taking advantage of DeFi tools such as automated liquidity pools and smart contracts and integrating them into existing businesses.

Christopher Waller, a member of the Federal Reserve Board, proposed that distributed ledger technology (DLT) and smart contracts can significantly improve the efficiency of financial services, and DeFi will become a powerful supplement to centralized finance (CeFi). With the improvement of the regulatory environment, the possibility of legalizing revenue sharing of DeFi protocols will also be greatly improved, attracting more TradFi investors.

DeFi’s AI-driven and new application scenarios

In 2025, the development of DeFi will also be deeply integrated with AI technology. For example, Frax Finance is developing autonomous smart contracts to launch fully decentralized AI agents. This innovation not only improves the intelligence level of decentralized applications (dApps), but also opens up new application scenarios for DeFi. In the future, the combination of AI agents and DeFi will completely change the way users interact with financial instruments.

In 2025, DeFi will no longer be just a decentralized financial experiment, but an expanding financial ecosystem. The tokenization of RWA, the rapid development of DEX, the inflow of institutional funds, and technological innovation will jointly promote DeFi to become an important part of the new financial order in the future.

7. Stablecoins explode

As the regulatory environment becomes clearer and the technology matures, the growth potential of the stablecoin market will reach an unprecedented level in 2025. It is expected that by 2025, the market value of stablecoins will exceed US$300 billion, becoming an indispensable part of the crypto market.

Enterprise adoption and cross-border payments will lead to explosive growth in stablecoin transactions

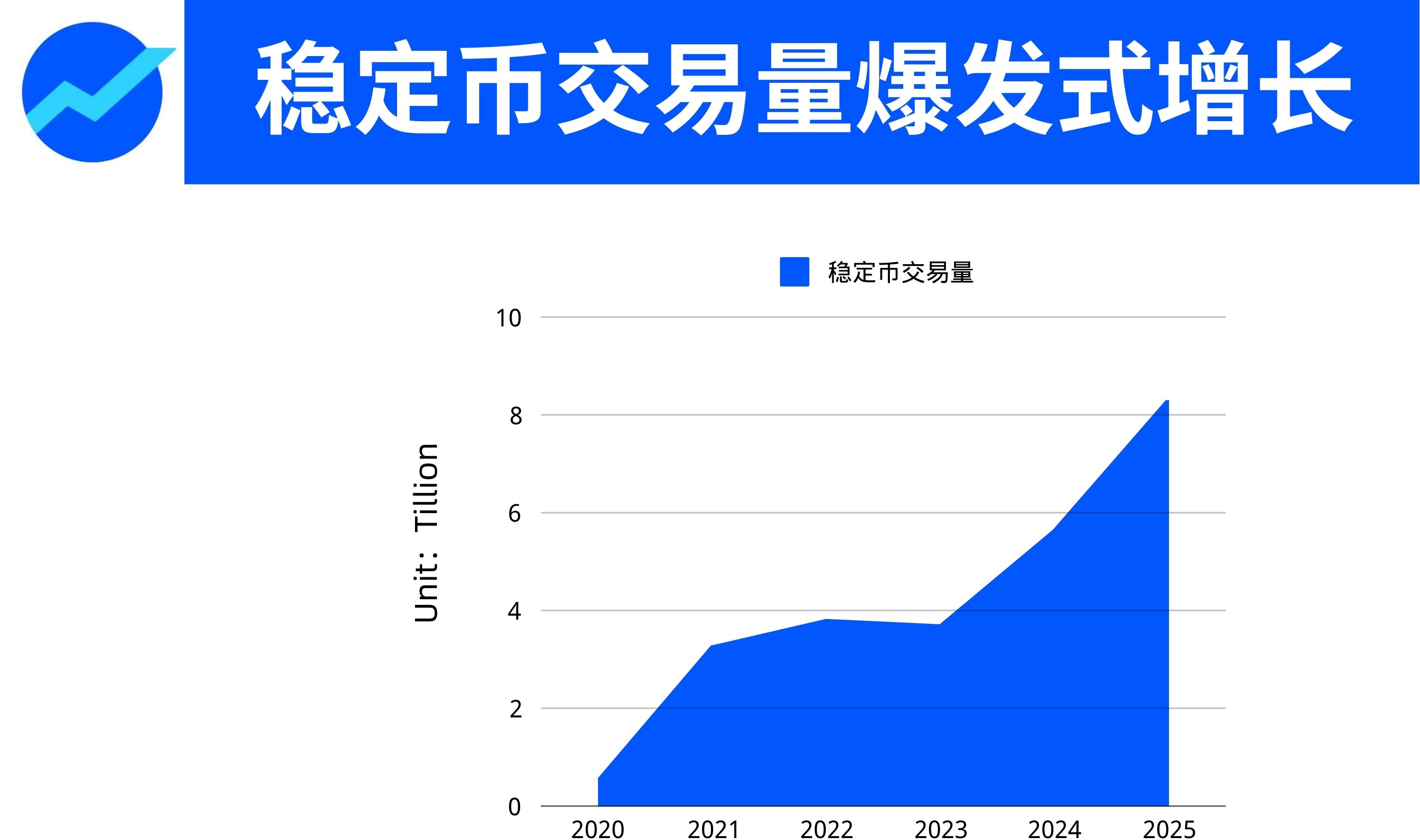

In 2024, the transaction volume of stablecoins has reached nearly 27.1 trillion US dollars, nearly three times that of 2023.

The adoption of stablecoins will usher in a leap in the field of global corporate payments, especially in cross-border payments, where USDC and USDT will become common payment tools. Bitwise analysts predict that stablecoins will fully enter the corporate payment system in 2025 and become an important tool for cross-border payments. With Stripe's acquisition of infrastructure companies such as Bridge, stablecoins are becoming the cornerstone of financial technology, greatly promoting the evolution of the international payment system.

According to Coinbase's forecast, stablecoin transaction volume is expected to reach $8.3 trillion in 2025, almost equivalent to Visa's annual payment volume. This growth will serve as a catalyst for stablecoins to become a core tool for global payments, and the use of stablecoins will grow exponentially.

Stablecoin 2.0 and the rise of new models

In 2025, stablecoin 2.0 will emerge. These new stablecoins will not only stabilize the value of the currency, but will also attract more users and institutional investors through new models such as revenue sharing and tokenized assets. Ceteris, head of research at Delphi Digital, pointed out that "stablecoin 2.0" will likely disrupt the existing market by attracting a distribution mechanism for the income of users or token holders. In addition, as the income-generating characteristics of stablecoins continue to develop, new stablecoins such as PayPal USD will become an important part of the market, providing investors with more income opportunities.

Progressive Optimization of the Regulatory Environment

As the regulatory framework gradually improves, especially the progress of the United States and the European Union in the regulation of stablecoins, stablecoins will usher in a clearer regulatory environment in 2025. The PwC report pointed out that the US government is expected to introduce a regulatory framework for stablecoins in 2025, providing legal support for financial institutions to issue their own stablecoins. The implementation of this framework will not only bring more trust to the stablecoin market, but also encourage more traditional financial institutions to participate in the issuance and circulation of stablecoins, accelerating their global popularity.

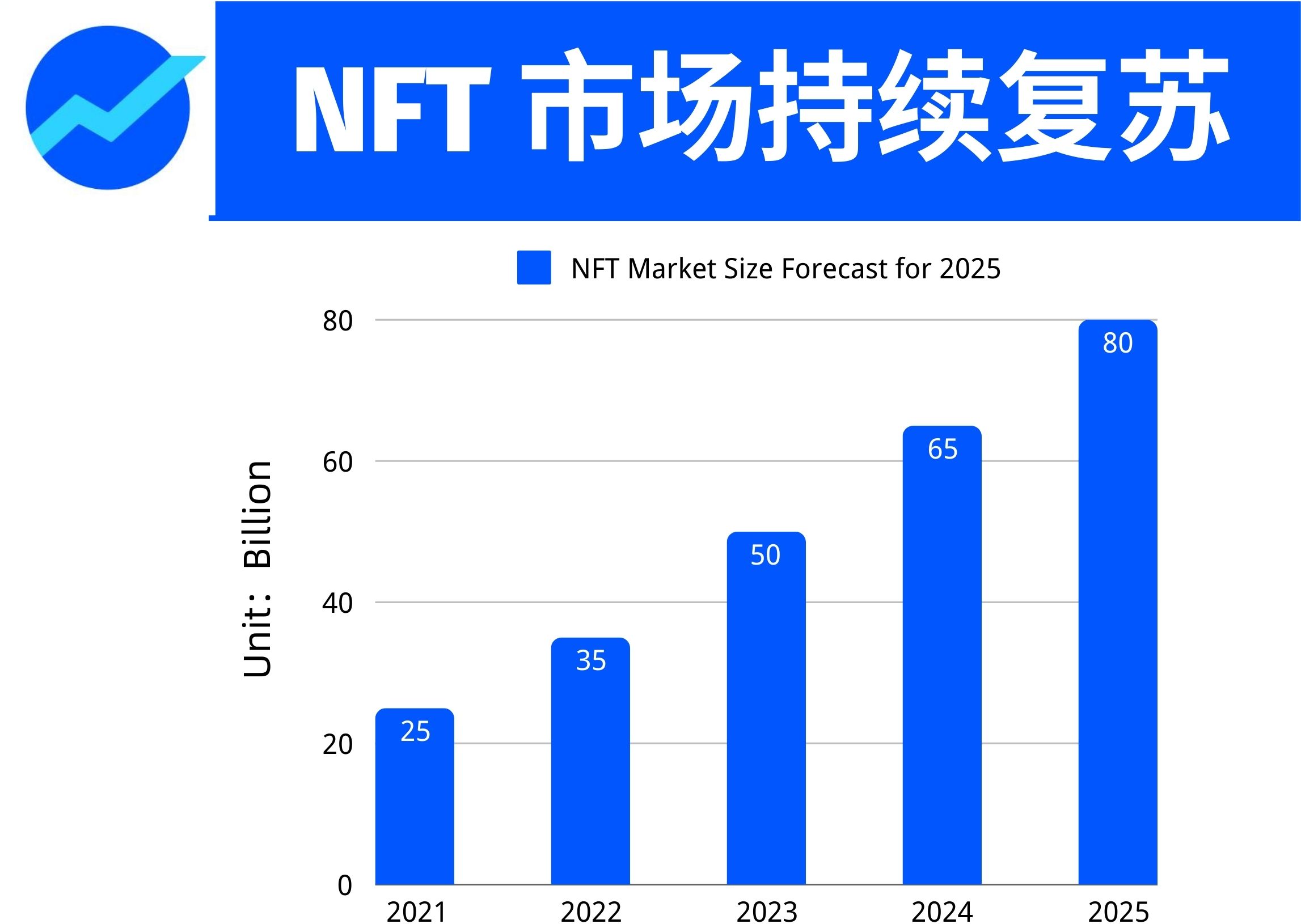

8. NFT market recovery: wealth effect and reshaping of cultural values

In 2025, the NFT market showed strong signs of recovery, with trading volume and cultural value advancing hand in hand, gradually getting rid of the bear market of the previous two years. VanEck predicts that NFT market transaction volume will reach US$30 billion this year. Although lower than the peak in 2021, it has reflected the market recovery and enhanced sustainability.

The driving force of major platforms and top projects

In early November, NFT weekly trading volume exceeded $100 million for the first time since May, and reached $172 million in early December. Galaxy Research pointed out that this rebound was mainly due to the increase in activities of the top 25 NFT collections by market value. The market share of mainstream platforms such as OpenSea and Blur reached 60% and 27% respectively, further consolidating market participation.

Projects such as Pudgy Penguins performed particularly well, and the expected launch of its ecosystem token also injected momentum into the growth of trading volume. Similarly, top projects such as Bored Ape Yacht Club (BAYC) and CryptoPunks have a core position in the recovery process with strong community stickiness and cultural identity.

The Wealth Effect and the Rise of Generative Art

VanEck pointed out that the recovery of the NFT market is closely related to the wealth effect of the late cycle of cryptocurrency. Top collectibles, such as CryptoPunks and Fidenzas, are consolidating their status as social identifiers in the crypto space, becoming symbols of scarcity and cultural value. In particular, generative art, with its on-chain provenance and scarcity, has an irreplaceable advantage in the high-end digital art market.

Early generative art works represented by Artblocks are expected to become important beneficiaries in the recovery due to their historical significance and artistic value. The long-term value of these works also benefits from the younger generation's increased acceptance of digital assets and preference for cultural collections.

Coin Issuance Model and Market Innovation

The innovation of the NFT market is not limited to the rebound in trading volume. The project's coin issuance model has become a new highlight. For example, Pudgy Penguins' PENGU token features a combination of memes and functions, and its upcoming token has injected new expectations into the market. These changes show that the value of NFT is gradually shifting from pure speculation to an asset class with lasting cultural significance and practicality. With the platform stickiness and user growth, the application prospects of NFT are becoming increasingly diversified.

The recovery of the NFT market is not only an increase in trading volume, but also a comprehensive reshaping of asset value and cultural identity. Driven by the wealth effect and generative art, top projects represented by CryptoPunks and Pudgy Penguins are consolidating their position in digital culture. This trend will continue to deepen in 2025, injecting new vitality and possibilities into the entire Web3 ecosystem.

9. The 2025 airdrop myth continues - luxury financing projects that are about to issue coins

Rootdata released the RootData List 2024 in November 2024, among which the Top 50 projects (without token issuance) are worth paying attention to in 2025. HyperLiquid and Movement, which issued tokens after the list was released, have already used airdrops to further prove the value of this list.

According to RootData statistics, the projects on the list have demonstrated strong financing and track potential, becoming a focus worthy of attention in 2025.

Project financing features:

The projects on the list performed well in terms of financing, with a median financing amount of US$25.71 million and an average financing round of 2. Among them, 7 projects have a valuation of US$1 billion or more, reflecting the huge development potential of these projects. In addition, 4 projects have not publicly disclosed financing data, which has also added a lot of mystery to the market.

Track Features:

The projects in the list cover 26 tracks, mainly in the fields of modularization, DeFi, infrastructure and artificial intelligence (AI). Although the GameFi, CeFi and NFT tracks have faced a certain degree of innovation stagnation in the past four quarters, RootData still selected several innovative representative projects from them, highlighting the potential and value in these fields.

As these high-financing, high-potential projects gradually issue tokens, a new wave of investment will come in 2025. Whether in terms of technological innovation, market demand, or financing scale, these projects have the conditions to become market leaders and deserve close attention from investors.

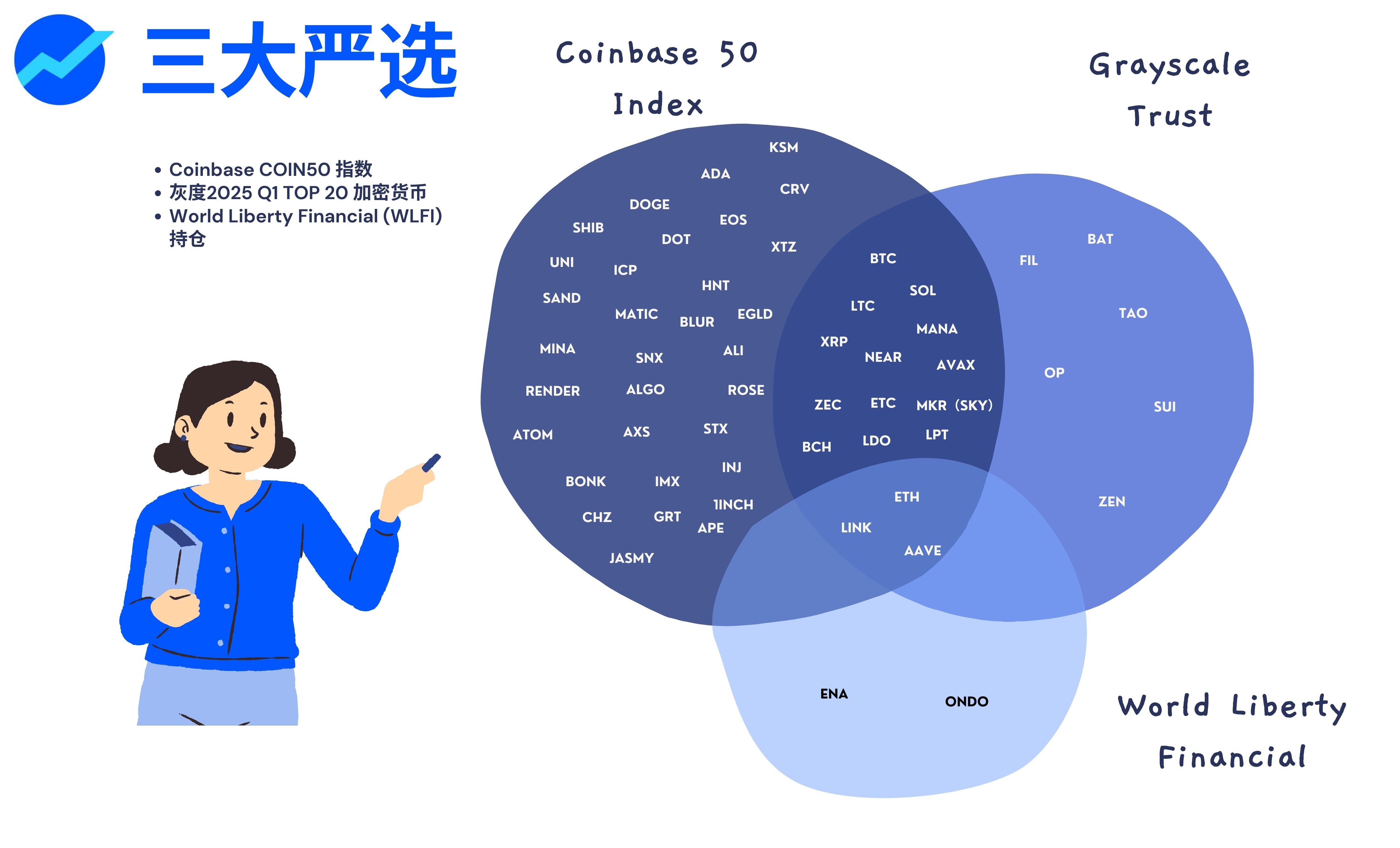

10. 2025 coin selection strategy: three strict selections first

As the crypto market develops, several important projects will show great potential in 2025. Here are three carefully selected portfolios worth paying attention to.

Grayscale 2025 Q1 TOP 20 Cryptocurrencies

Grayscale, a crypto asset management company, recently updated its list of the top 20 cryptocurrencies in the first quarter of 2025. These tokens are considered to have significant growth potential. Grayscale analyzes hundreds of digital assets every quarter and screens out a series of assets with the greatest growth prospects. Based on an in-depth analysis of market trends, the top 20 tokens in the first quarter of 2025 include: BTC, ETH, SOL, LINK, SUI, UNI, HYPE, AAVE, TAO, ENA, etc.

Grayscale said key areas of focus include:

Cryptocurrencies that benefit from the US election results, especially DeFi and staking;

the convergence of artificial intelligence and AI agents;

Further development of the Solana ecosystem.

The booming development of these fields will drive the growth of related tokens and become an important driving force of the market.

Coinbase COIN50 Index: Tracking the Mainstream Assets in the Crypto Market

The COIN50 index launched by Coinbase covers the top 50 digital assets on the trading platform that meet basic inclusion criteria and can be traded as perpetual futures with up to 20x leverage. This index is rebalanced quarterly to reflect the latest market trends and ensure compliance with Coinbase's strict legal and compliance requirements. The launch of the COIN50 index aims to provide investors with a benchmark for market performance, ensuring that they can make timely investment decisions based on market changes. The index covers approximately 80% of the crypto market, making it a reliable tool for investors to track the performance of crypto assets.

World Liberty Financial (WLFI) Positions

World Liberty Financial (WLFI) was officially launched in September 2023. As a decentralized finance (DeFi) platform, one of the characteristics of WLFI is its connection with the Trump family, and its slogan is "Be Defiant", which has a strong Trump personal value. Trump was appointed as the "Chief Crypto Advocate" of WLFI, while his children Donald Trump Jr., Eric Trump and Barron Trump served as "ambassadors".

Although WLFI has a close relationship with the Trump family, its operation and management are independent, and the Trump family does not participate in the direct management of the platform. The $WLFI token issued by the WLFI platform has a certain influence in the market, and in its cooperation agreement, the Trump family is entitled to 75% of the net agreement income through the service agreement. The launch of this project highlights the influence of the Trump family in the crypto market and also reveals its legal independence.

Although the $WLFI token of the WLFI platform has no political connection with Trump, the emergence of this project has attracted widespread attention in the market, especially in the context of the combination of politics and finance, and may become a force that cannot be ignored in the crypto market in 2025.

Among them, the three companies’ common holdings are: ETH, AAVE, and LINK, which represent: the largest on-chain ecosystem, the largest loan, and the largest oracle, respectively. They are the easiest to understand and the most promising targets in traditional finance.

Conclusion: Towards 2025, riding the wind and waves

2024 is destined to be a memorable year in the history of cryptocurrency. The price of Bitcoin has reached a record high. Although Ethereum has experienced fluctuations, it remains tenacious. New public chains such as Solana and Base have also stood out in the fiercely competitive market. The breakthroughs of DeFi and AI-Agent have brought a new wave of technology, and the recovery of the NFT market has added vitality to digital culture. These changes not only depict the past of the crypto industry, but also outline a future full of potential for us.

Entering 2025, the crypto market will continue to move forward in the midst of magnificent innovation. Bitcoin's position as a global reserve asset is becoming more and more solid, and Ethereum is expected to break through the current bottleneck. The competition between Layer 2 technology and emerging public chains will promote the further prosperity of the ecosystem. At the same time, the rise of AI-Agent and the deep integration of DeFi with real-world assets indicate that a more decentralized and intelligent new financial order is quietly taking shape. The evolution of Meme coins and NFTs also marks the deep intersection of culture and technology. They will not only be financial tools, but also key elements in social, entertainment, and science.

Although the future is full of unknowns and challenges, the innovation and progress of the cryptocurrency industry are always exciting. From technology to applications, from finance to culture, 2025 will be an important turning point in the crypto world. Industry participants, investors, and technology developers will all strive to advance in this new era and push the crypto world towards a more mature and diversified future.

Let us welcome 2025 together and witness how this digital revolution continues to deepen and create a more intelligent and decentralized global financial and technological landscape.