Author: He Yi Article Compilation: Block

Venture capitalist Marc Andreessen appeared on the Joe Rogan podcast and made some explosive statements, claiming that there is a systemic "de-banking" targeting politically disfavored companies and individuals, especially in the crypto industry. At the beginning of the video, he pointed out that the Consumer Financial Protection Bureau (CFPB) led by Elizabeth Warren is the culprit behind crypto startups losing their banking services. However, some critics argue that not only has this "de-banking" not occurred, but the CFPB's actual goal is to end this phenomenon.

The issue is that there are several different problems that need to be discussed here. First, what is Marc Andreessen complaining about, and are his concerns justified? Secondly, what role (if any) has the CFPB played in the de-banking process - is it the instigator or the restrainer?

Many on the left do not understand the crypto industry and the widespread Longing on the right about de-banking, and therefore are confused or disbelieving about Marc's statements and Elon's retweets on social media platform X. First, I think it's worth reading Marc and Joe's full conversation, as many people are reacting based on snippets, when it is actually an in-depth commentary with many independent viewpoints. Let's dive in.

What is Marc Andreessen complaining about?

Marc raised several clear and interconnected points in the program. He first criticizes the CFPB, arguing that it is an almost unaccountable "independent" federal agency that can "terrorize financial institutions, prevent new competition, and those new startups trying to compete with the big banks."

He then mentions de-banking as a specific harm, defining it as "when you as an individual or your company are completely excluded from the banking system." Marc points out that this phenomenon occurs through banks acting as proxy agents (similar to how the government does through Big Tech), but in an indirect way that shields the government from direct accountability.

According to Marc, de-banking "has been happening to every single crypto entrepreneur for the last four years. It's also been happening to a lot of fintech entrepreneurs, and anyone trying to start any new banking services, because they (the government) are trying to protect the big banks." In addition, Marc also mentioned some politically disfavored businesses - legal marijuana, escort services, and gun shops and manufacturers during the Obama administration. This was called "Operation Choke Point," initiated by the Obama administration's Department of Justice. And "Choke Point 2.0" (named by the crypto industry) targets the government's "political enemies" and those "unwelcome tech startups." Marc added, "This has had a huge impact on the tech sector. We've had about 30 founders go bankrupt in the last four years."

The victims "basically include every single crypto founder, every single crypto startup, either had their personal banking services canceled and were forced out of the industry, or their company had their banking services canceled and couldn't operate, or they were sued by the SEC, or threatened with charges."

Marc also mentioned that he has learned of some people losing their banking services due to "holding the wrong political views or making unacceptable statements."

In summary, Marc made the following claims:

De-banking means individuals or companies being deprived of banking services, either because your industry is politically disfavored or because you hold different political views

The CFPB at least bears partial responsibility, as do other unnamed federal agencies

This is achieved by outsourcing financial suppression to banks, shielding the government from direct accountability

The main victims of de-banking during the Obama administration were politically disfavored but legal industries - marijuana companies, adult businesses, gun shops and manufacturers

Crypto companies and entrepreneurs, as well as fintech companies, are the main victims of de-banking during the Biden administration. Conservatives are sometimes also de-banked solely for their political views

30 tech founders in the a16z portfolio have encountered de-banking

We will evaluate these points at the end of the article.

What do the critics say about Marc Andreessen's statements?

I'm simplifying the issue, but left-wing liberals are upset with Marc Andreessen's comments because they feel he is using the narrative of de-banking to serve his own purposes (supporting crypto and fintech), while ignoring more "legitimate" victims of de-banking - for example, Palestinians being kicked off Gofundme for providing funds to Gaza. As for the mainstream left, they typically support de-banking their political enemies outright, and so they prefer to ignore the whole thing.

But there is a segment of the left that is at least ideologically consistent, who are skeptical of corporate and state power over speech and finance. (Now that the right has regained control of some tech platforms and state power, this group may be growing). They have been opposing de-banking. They recognize that while right-wing dissenters are the primary victims of de-banking (like Kanye, Alex Jones, Nick Fuentes, etc.), the left would also be vulnerable if the situation were reversed. Their definition of de-banking is more narrow: "De-banking, or as some financial institutions prefer to call it, de-risking, refers to banks severing ties with clients perceived as politically incorrect, extreme, dangerous or out of bounds." (Excerpt from this TFP article). Upa Subramanya in this article mentions that banks have the power to completely destroy someone's financial life if they are deemed a reputational risk, regardless of whether they are left or right-wing individuals - Melania Trump, Mike Lindell, Trump himself, Christian charities, January 6th participants, Muslim crowdfunding organizations and charities, etc.

However, many on the left still remain critical or confused about Andreessen's statements, particularly regarding the CFPB. Here are a few examples:

Lee Fang: The CFPB has strongly opposed de-banking, so why is Andreessen saying this? Where is the evidence? One thing not mentioned in this long piece is that the CFPB has investigated Andreessen-backed startups for alleged fraud, not political speech. De-banking has come from the FBI and DHS, not the CFPB.

Lee Fang: De-banking is indeed a big problem. We've seen anti-vaccine truckers lose bank accounts for protesting, pro-Palestine organizations lose Venmo access, etc. But now, predatory lenders and fraudsters are conflating consumer protection with "de-banking" to call for deregulation.

Jarod Facundo: I really don't understand what @pmarca is talking about, because just a few months ago, in a FedSoc event, CFPB Director Chopra warned the audience that Wall Street is engaging in "de-banking," but provided no explanation.

Jon Schweppe: I agree with @dorajfacundo. I have no idea what @pmarca is talking about. The CFPB has been leading the charge against discriminatory de-banking. What is this even supposed to mean?

Here is the English translation of the text, with the specified terms translated as instructed:Ryan Grim: The CFPB has issued a lawful good rule targeting banks' cancellation of users' banking services based on political views. Yes, a populist left-wing CFPB official has stood up to defend the rights of conservatives. Now, venture capitalists and Musk dislike the CFPB for other reasons, and they are lying, stirring up emotions, and weakening the CFPB's power.

Overall, this group is hostile to cryptocurrencies and fintech, and does not believe that companies in these industries are "debanked" victims, at least not morally equivalent to crowdfunding platforms that remit funds to the Gaza Strip. From the perspective of left-wing liberals, cryptocurrency practitioners are "reaping what they sow." They believe that cryptocurrency practitioners issue tokens, commit fraud, and engage in fraud, and therefore they should be despised by banks. "If cryptocurrency founders are debanked, that is a problem of bank regulation, not our fight."

Furthermore, according to these critics, Musk's mistake is to blame the Consumer Financial Protection Bureau. They tell us that the CFPB is an institution that cracks down on "debanking." Musk is simply dissatisfied with the Consumer Financial Protection Bureau because he has invested in fintech platforms, and the Consumer Financial Protection Bureau is responsible for ensuring that they do not defraud customers.

Since Musk appeared on the Rogan program, dozens of tech and cryptocurrency founders have publicly recounted their experiences of being unilaterally deprived of bank access. Many in the cryptocurrency industry see a glimmer of hope at the end of the tunnel and believe that the bank regulatory authorities' unconstitutional attacks on the cryptocurrency field through banks are nearing an end. The call for an investigation into "Operation Choke Point 2.0" is growing louder and louder. So who is right? Anderson or his critics? Is the CFPB really guilty? Is debanking really as serious as Musk says? Let's start by investigating the CFPB.

What is the CFPB?

The Consumer Financial Protection Bureau (CFPB) is an "independent" agency established in 2011 by the Dodd-Frank Act after the financial crisis. It has broad powers and is authorized to oversee banks, credit card companies, fintech companies, payday lenders, debt collectors, and student loan companies. As an independent agency, its funding comes from outside Congress (and therefore is not subject to congressional funding review). The president cannot easily dismiss the director, it can directly issue rules, and it can bring enforcement and legal actions in its own name. It has considerable power. The CFPB was essentially established at the exclusive request of Senator Elizabeth Warren.

The CFPB is often the target of attacks by conservatives and liberals, as it is another federal agency and is essentially unaccountable. It was established by Elizabeth Warren, who is often the target of right-wing attacks, with the aim of effectively harassing fintech companies and banks. Of course, most of these companies are already subject to strict regulation. Banks must be supervised by state or federal (OCC) authorities, and if they are public companies, they are also accountable to the Federal Deposit Insurance Corporation (FDIC), the Federal Reserve, and the Securities and Exchange Commission. Credit unions, mortgage lenders, and others have their own regulators. Federal financial regulation was not seriously lacking before the CFPB was established. The United States has more financial regulatory agencies than any other country in the world. Therefore, it is understandable that conservatives would question why Elizabeth Warren, seemingly out of a spirit of revenge, was able to obtain such a dedicated agency that she can arbitrarily use to harass her political opponents.

Now let's talk about the CFPB's responsibilities.

As for the functions of the Consumer Financial Protection Bureau (CFPB), it does have some specific provisions, often opposing discrimination in bank access. Specifically, the Equal Credit Opportunity Act (ECOA) and the "Unfair, Deceptive, or Abusive Acts or Practices" (UDAAP) section of the Dodd-Frank Act are the relevant legal frameworks. ECOA prohibits discrimination based on certain protected categories, including race, color, religion, national origin, sex, marital status, age, or receipt of public assistance.

Regarding the "Operation Choke Point" issue mentioned by Mark Anderson, these provisions do not apply. According to the law, "cryptocurrency entrepreneurs" or "conservatives" are not protected categories. Therefore, this part of the CFPB's function has not, in theory, been involved in the issue we are discussing: the targeted suppression of certain unwelcome industries for political reasons. Furthermore, this provision applies to credit access, not general banking services.

The UDAAP section of the Dodd-Frank Act is another regulation that may be related to debanking. It gives the CFPB broad powers to pursue what they consider to be unfair, fraudulent, or abusive behavior. Their massive settlement with Wells Fargo falls under UDAAP. In theory, if the CFPB were to take action against debanking, they should do so under UDAAP. But so far, it has been a lot of thunder and little rain, and they have not taken any substantive action.

What is the CFPB doing?

Recently, the CFPB has finally finalized a rule that brings digital wallets and payment apps under its regulatory scope, making them more like banks. This rule requires large digital payment apps, such as Cash App, PayPal, Apple Pay, and Google Wallet, to provide transparent explanations for account closures. They specifically mentioned "debanking" in the rule release. Remember, this rule does not apply to banks, but to "large tech companies" or p2p payment apps. In any case, as of now, this rule has not been actually implemented, so we still need to observe its specific implementation in the real world.

Will this rule suppress things like "Operation Choke Point 2.0"? Highly unlikely. First, it covers the behavior of tech companies, not banks. Second, Choke Point-style behavior is not a discretionary choice at the bank level, but the result of federal regulatory agencies suppressing the entire industry through banks. For example, if the CFPB notices that cryptocurrency startups are being systematically cut off from banking services, they would have to fight the Federal Deposit Insurance Corporation (FDIC), the Federal Reserve, and the Office of the Comptroller of the Currency (OCC) (ultimately the White House) to stop this practice. Given Elizabeth Warren's firm anti-cryptocurrency sentiment, one can't help but wonder if the CFPB will do so. More importantly, the Choke Point problem is related to banking regulatory agencies going beyond legal boundaries to cancel banking services for an entire industry. This has nothing to do with individual bank misconduct (banks are just helplessly executing the orders of regulatory agencies).

Under UDAAP, in theory, the CFPB could review systematic account closure behavior targeting a particular industry (such as cryptocurrency). But the recent development of this payment app rule does not apply to banks, and some critics of Mark Anderson cite this rule to show the CFPB's stance against debanking. And the CFPB has remained silent on debanking in its actual enforcement actions so far.

What are the CFPB's main enforcement actions?

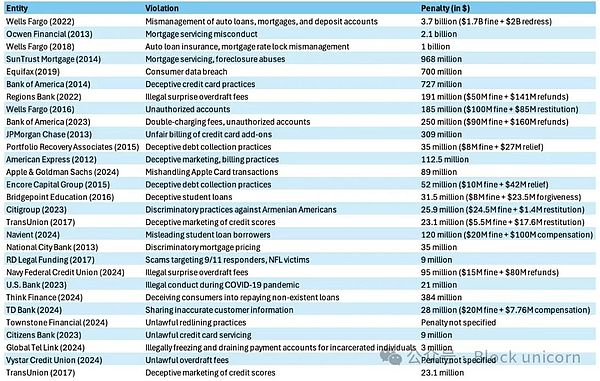

I could not find any CFPB settlement cases related to "debanking." Here are the 30 largest CFPB settlement cases by amount:

The closest or most relevant case I could find is the 2023 case against Citibank, which revealed their discrimination against Armenian-American applicants in credit card applications. (The bank claimed this was due to a higher fraud rate in the Armenian-American community in California, mainly due to fraud groups.) Citibank paid a $25.9 million fine for this.

In 2020, the CFPB found that Townestone Financial prevented African-Americans from applying for mortgages in its marketing. The company paid a $105,000 fine.

Here is the English translation of the text, with the terms in <> retained as is: In US law, nationality and race are both considered protected classes, so these two cases are not purely political red lines, as critics of the decentralization of cryptocurrencies have complained. Furthermore, I reviewed the 50 most recent CFPB settlement cases since March 2016, and none of them involved arbitrary deprivation of the right to use banking services. Of the most recent 50 cases, 15 involved UDAAP violations (such as the infamous Wells Fargo case), 8 involved fair lending violations, 5 involved student loan servicing, 5 involved inaccurate credit reporting, 5 involved mortgage servicing, 4 involved auto loan discrimination, and 3 involved unlawful overdraft practices. Debanking: none. What substantive content does Mark have regarding the criticism of companies and conservatives being debanked? At this point, there is no real ambiguity. I have documented in detail the phenomenon known as "Operation Choke Point 2.0", where the Biden administration has revived the financial redlining practices started by the Obama administration around 2013. At that time, Obama's DOJ launched "Operation Choke Point", an official DOJ program aimed at choking off banking services to politically disfavored industries like payday lending, cannabis, adult entertainment, and gun manufacturers. Iain Murray's article "Choking Point: What It Is and Why It Matters" discusses this well. Under Marty Gruenberg's leadership, Obama's FDIC used implied threats and pressure to convince banks to "de-risk" companies in over a dozen industries. Conservatives objected, and members led by Rep. Luetkemeyer exposed the practice. Critics argued it was unconstitutional, as it involved secret regulatory pressure rather than official rulemaking or legislation. In 2014, a DOJ memo on the practice was leaked, and the House Oversight and Government Reform Committee issued a damning staff memo on the practice. The FDIC issued new guidance to banks encouraging case-by-case risk assessment rather than industry-wide redlining. In August 2017, Trump's DOJ formally ended the practice. In 2020, Trump's Comptroller Brian Brooks issued a "Fair Access" rule aimed at ending debanking based on reputational risk. However, in May 2021, Biden's Acting Comptroller Michael Hsu rescinded that rule. In early 2023, after the FTX collapse, crypto industry participants like myself noticed similar choking strategies being used against crypto founders and companies. In March 2023, I published "Operation Choke Point 2.0 Is Underway, and Crypto Is in the Crosshairs", followed by another article in May detailing new findings. Specifically, I found that the FDIC and other financial regulators have secretly capped crypto-related companies' bank deposits at 15%. Furthermore, I believe that due to the government's anti-crypto sentiment, the crypto-focused Silvergate and Signature banks were unfairly forced into bankruptcy or closure. Since then, crypto companies have struggled to obtain banking services - despite there being no official public regulation restricting banks' crypto business, and no relevant legislation. The law firm Cooper and Kirk has again alleged that Choke Point 2.0 is unconstitutional. Recently, as the crypto industry remains constrained by this secret regulation, I have re-examined the practice and found new evidence that Silvergate Bank was executed, rather than naturally failing. Today, crypto-focused banks still maintain a 15% deposit cap, choking the industry's development. Every US crypto entrepreneur has been impacted - I can demonstrate that around 80 of our portfolio companies have encountered this. My firm Castle Island (a regular VC fund that only deals in fiat) has also experienced partial bank account closures. After Mark's appearance on the Rogan show, many crypto executives also shared their perspectives. David Marcus explained how Facebook's Libra project was killed by Janet Yellen. Kraken CEO Jesse Powell, Joey Krug, Gemini CEO Cameron Winklevoss, Visa's Terry Angelos, and Coinfund's Jake Brukhman shared their stories. Caitlin Long has long opposed Choke Point 2.0, even founding her own bank Custodia, which had its master account revoked by the Fed. Critics may not sympathize with the crypto industry, but the fact is this is a fully legal industry being suppressed by the secret letters and innuendo of banking regulators. As a result, the US has mounted a broad assault on crypto banking, not through the democratic process of legislation or rulemaking, but entirely through administrative action. Outside of crypto, similar actions against fintech are also quietly underway. According to research by Klaros Group, since the start of 2023, a quarter of FDIC enforcement actions have targeted banks partnering with fintech companies (versus only 1.8% of banks partnering with fintech). As an investor in fintech, I can attest that finding banking partners for fintech companies has become a massive challenge, on par with the difficulties crypto companies face in obtaining banking services. The Wall Street Journal has criticized the FDIC actions as unconstitutional, saying the agency is "effectively rulemaking while bypassing the notice and public comment period required by the Administrative Procedure Act". As for Anderson's comments about conservatives being debanked, we have ample anecdotal evidence that this is occurring. Melania Trump mentioned in her recent memoir that she was debanked. The right-wing speech platform Gab.ai also encountered the same. In 2021, JPMorgan Chase closed General Michael Flynn's bank account, citing reputational risk. In 2020, Bank of America terminated the account of the Christian non-profit Timothy II International, and in 2023 froze the account of Christian missionary Lance Wallnau. In the UK, Nigel Farage was debanked by Coutts/NatWest, sparking a minor scandal. These are just a few examples among many. Under current law, US banks can close accounts for any reason without explanation. So in substance, Anderson is correct. Why are critics trying to limit the discussion of "debanking"? The common thread among the critics is that Anderson has somehow leveraged the term "debanking" to advance his own economic agenda. Writer Lee Fang states: "The issue of debanking is very serious. We've seen anti-vaccine truckers lose bank accounts for protesting, pro-Palestinian organizations lose Venmo access, etc. But now predatory lenders and scammers are conflating consumer protection with 'debanking' to call for deregulation." The Axios author implies Anderson is concerned about the CFPB because his firm invests in questionable new banks like Synapse, which collapsed earlier this year. This becomes a common theme in the comments - that Anderson only cares about "debanking" because he wants to deregulate the crypto and fintech industries and escape the CFPB's attempts to protect consumers.Here is the English translation of the text, with the specified terms translated as instructed:This sounds very real, so it resonates with many on the left who are unwilling to believe the government would unlawfully deprive an entire industry of banking services. Unfortunately, this is indeed true for them. The Obama administration did develop a strategy of using banking regulation to unconstitutionally target industries like gun manufacturing and payday lending. The Biden administration has further refined these strategies and very effectively applied them to the cryptocurrency space. They are now going after fintech companies by harassing their partner banks. These things have indeed happened, and in both cases, they represent the broad (and unconstitutional) overreach of executive power, which will now be exposed and reversed under Trump's leadership.

Whether writers like Fang believe the Biden administration's strategy of debanking crypto companies alleviates his own moral qualms about the unbanked, it is irrelevant. It happened, it is debanking, and it is illegal. And whether Mark has some economic motive in criticizing the CFPB is also not that important. (I checked, and the CFPB has not taken any enforcement action against a16z's investment companies to date). Banking regulators (Mark did mention multiple agencies, not just the CFPB) have indeed used the highly regulated financial system to achieve political ends. The motives of the messenger are irrelevant. The key is whether federal agencies have dangerously abused executive power and gone far beyond their remit to harass legitimate industries. And they have indeed done so.

Ruling on Anderson's Allegations

So, based on a comprehensive analysis, let's assess Mark's remarks at the Rogan conference:

Debanking means an individual or company being deprived of banking services, either because your industry is politically disfavored or because you hold different political views

In my view, this is an accurate description. Being "debanked" does not differ based on whether the victim is sympathetic in your eyes.

The CFPB bears at least some responsibility, as do various other unnamed federal agencies

The CFPB does have a habit of harassing fintech companies and banks, and it may not have needed to exist. But based on our understanding of Operation Choke Point 2.0, they do not bear primary responsibility. More directly involved are the FDIC, OCC, and the Federal Reserve, with coordination from the Biden administration. Contrary to what the critics say, the CFPB is not really a mitigating force, as they have not brought any cases related to "debanking" so far, although they have recently voiced some concerns.

The way debanking works is by outsourcing financial suppression to banks, so the government doesn't have to bear direct responsibility

This is an accurate description. Just as using big tech companies to de-platform dissenters is an effective way to financially suppress the enemies of the regime without too much scrutiny, using banks or fintech platforms to kick out tech founders is a way to do so.

Under Obama, the main victims of debanking were legitimate but disfavored industries - cannabis companies, adult stores, gun shops, and gun manufacturers

This is an accurate description of how Operation Choke Point (the official DOJ program under Obama) operated. It actually started with payday lending, but Mark did not mention that.

Under Biden, cryptocurrency companies and entrepreneurs, as well as fintech firms, have been the main victims of debanking. Conservatives are also sometimes debanked for their political views

These statements are all true, although we have more evidence that the coordinated crackdown on cryptocurrencies has been more severe than the anti-fintech movement (though we know the FDIC is going after fintech companies by taking enforcement actions against their partner banks). Regarding the debanking of conservatives, we have ample anecdotal evidence that this is happening, but no current evidence of explicit internal bank policies. It seems to be done on a case-by-case basis, citing "reputational risk" as the reason. Ultimately, banks are completely opaque, and they don't need to provide reasons for their de-risking decisions.

30 tech founders in a16z's portfolio have been debanked

It is possible, and very likely. a16z is a highly active crypto investment firm, and virtually every domestic crypto startup has faced banking issues at some point.

Where did Mark go wrong?

Where did Mark go wrong?

He overstated the role of the CFPB, as their sister regulatory agencies, the FDIC, OCC, and the Federal Reserve, bear greater responsibility for the recent crackdown on cryptocurrencies and fintech companies. However, he did point out that other unnamed "agencies" are the driving force behind debanking (though he did not mention the FDIC, OCC, or Federal Reserve). Additionally, on the CFPB front, Elizabeth Warren was the founder of the agency and is the primary responsible party for Operation Choke Point (especially under the Biden administration, where her appointee to the National Economic Council, Bharat Ramamurti, has led the effort). So I can understand Mark's disproportionate attribution of responsibility to the CFPB.

His discussion of politically exposed persons (PEPs) was somewhat oversimplified. Being classified as a PEP does not automatically result in the loss of banking services, but it typically means facing more due diligence. Mark may have been referring to the Nigel Farage/Coutts/Natwest incident, where Nigel was considered a PEP, and this was indeed a factor in Coutts canceling his banking services.

Overall, Mark is right, and the critics are wrong. The CFPB has not yet become any kind of powerful anti-debanking force. Debanking is real, and it clearly applies to the crypto and fintech space, and with the coming Republican control and investigations, more evidence will come to light.