For many investors, 2025 appears to be a very positive year for the Bit market. However, on the first day, Bit (BTC) faced strong selling pressure, raising concerns about whether the leading cryptocurrencies can break through $95,000.

In this analysis, BeInCrypto examines the short-term price outlook for Bit using key indicators.

Bit investors question the sustained uptrend

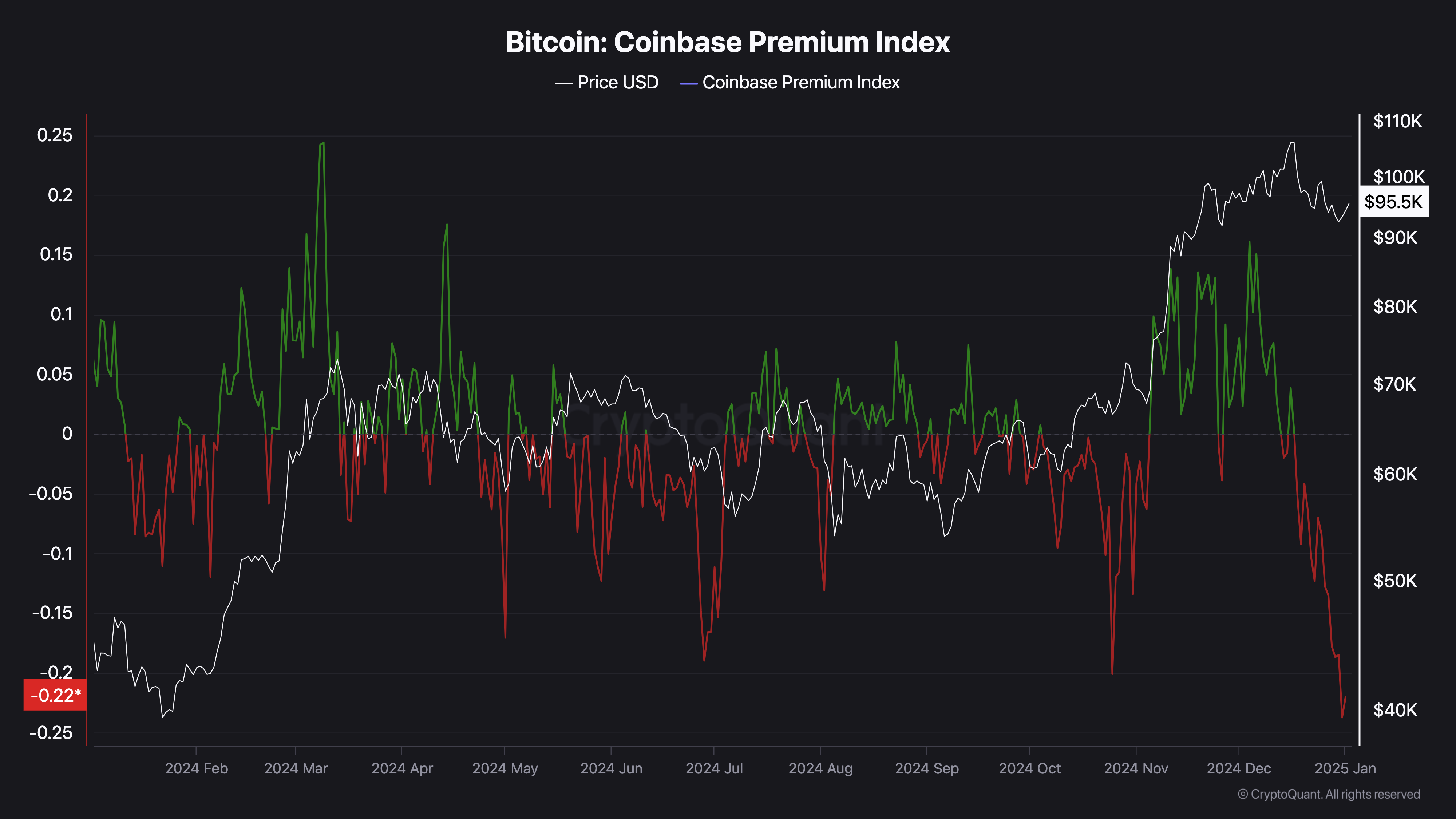

After the US election in November 2024, the Bit Coinbase Premium Index rose to 0.14. The Coinbase Premium Index measures whether there is strong buying pressure among US investors or if they are selling in large quantities.

A high value like in November indicates strong selling pressure. However, at the time of writing, the index has dropped to -0.22, the lowest level in the past 12 months. This significant decline indicates that US Bit investors are selling their assets.

Nevertheless, the Bit price is trading at $96,770 and has risen slightly by 2.31% in the last 24 hours. However, if investors continue to sell BTC, this trend may change, and the cryptocurrency's price may decline.

Given these developments, cryptocurrency analyst Burak Kesmeci mentioned that it may be difficult for the Bit price to rise.

"This trend can create a challenging environment for the short-term price recovery of Bit. Unless there are changes in macroeconomic conditions or new interest from institutional or individual investors." – Burak Kesmeci, cryptocurrency analyst

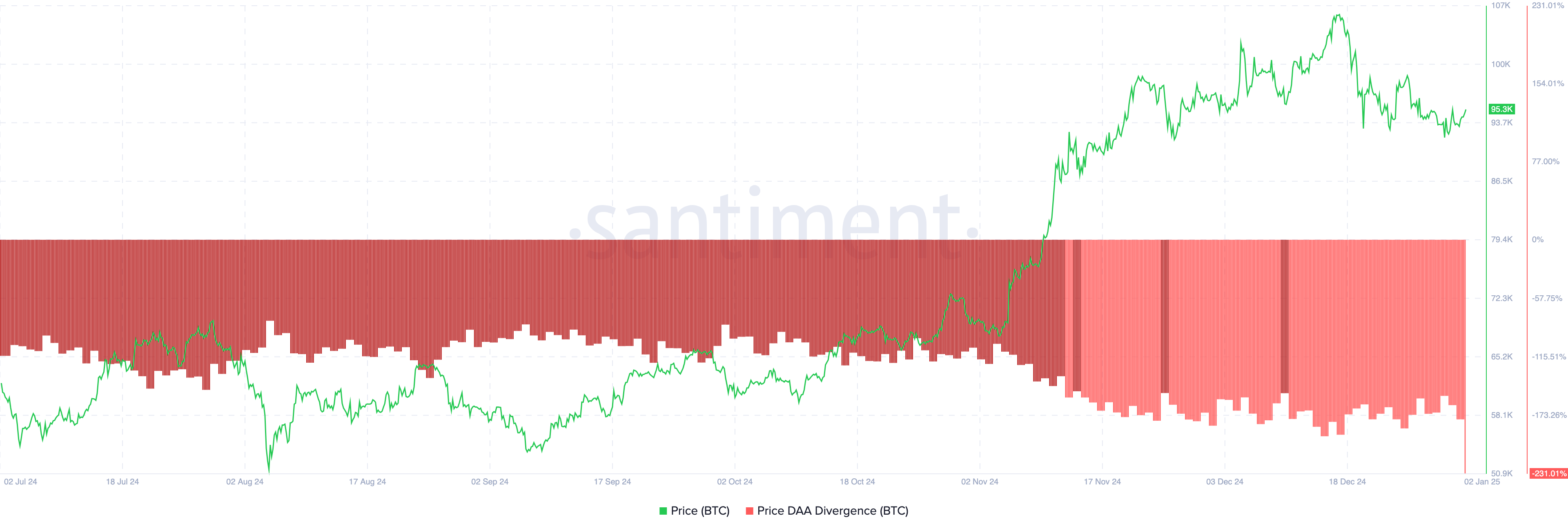

Another indicator supporting this outlook is the price-daily active addresses (DAA) difference. This metric measures the relationship between user engagement on the blockchain and price movements.

A positive value indicates that user engagement has improved, which is positive for the cryptocurrency. Conversely, a negative value indicates that user engagement is decreasing, which is negative.

As shown above, the Bit price DAA difference has dropped by 231%, indicating the latter. If this trend continues, the likelihood of BTC trading below $95,000 may increase.

BTC price forecast: Potential for adjustment below $90,000

Although BTC has recently risen, the exponential moving average (EMA) suggests that the recent uptrend may not be sustained. EMA is a technical indicator that measures the trend direction of prices.

When the EMA is sloping downward, the trend is bearish. However, when the price is above the indicator, the trend is bullish. At the time of writing, the Bit price is below the 20 EMA (blue), suggesting that the cryptocurrency's value may continue to decline.

If the cryptocurrency fails to rise above the 20 EMA and Bit selling pressure increases, the price could drop to $85,851. However, if US investors contribute to the buying pressure on Bit, this trend could change. In that case, the coin's value could rise to $108,398.