1/12 December summary 🧵

Many metrics reached new all-time highs.

Total adjusted on-chain volume decreased by 5.9% to $670B (BTC: -5.4%, ETH -6.9%):

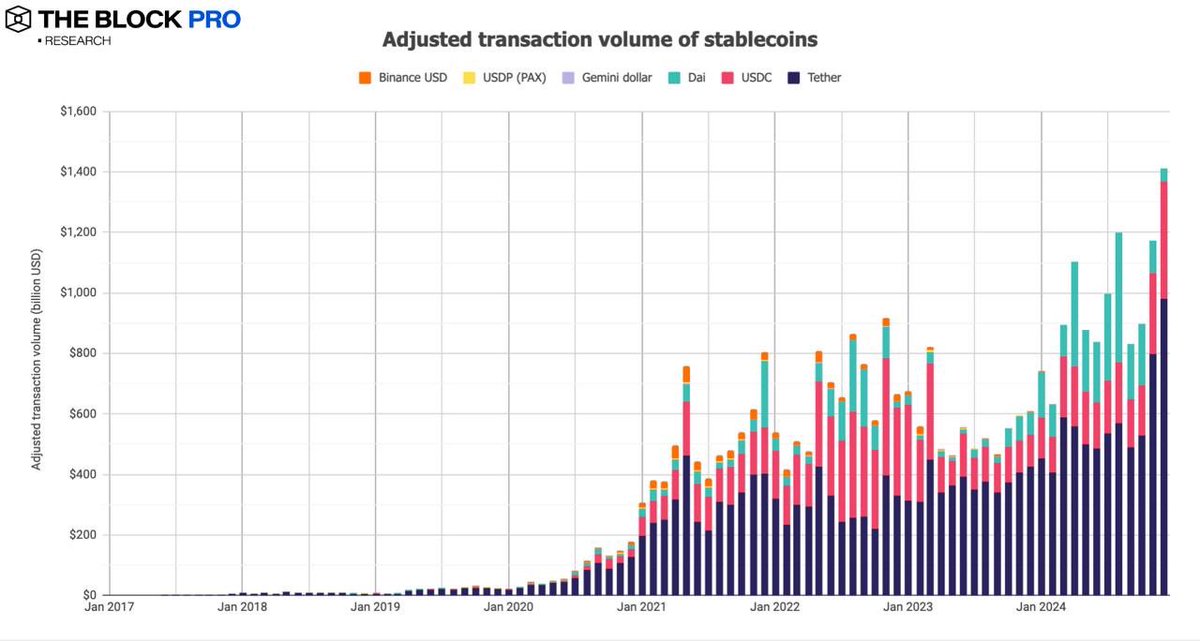

2/12 Adjusted transaction volume of stablecoins increased by 20.3% to a new ATH of $1.41T; Issued supply increased by 1.7% to a new ATH of $170B, with USDT at 79.2% and USDC at 18.3% respective market share:

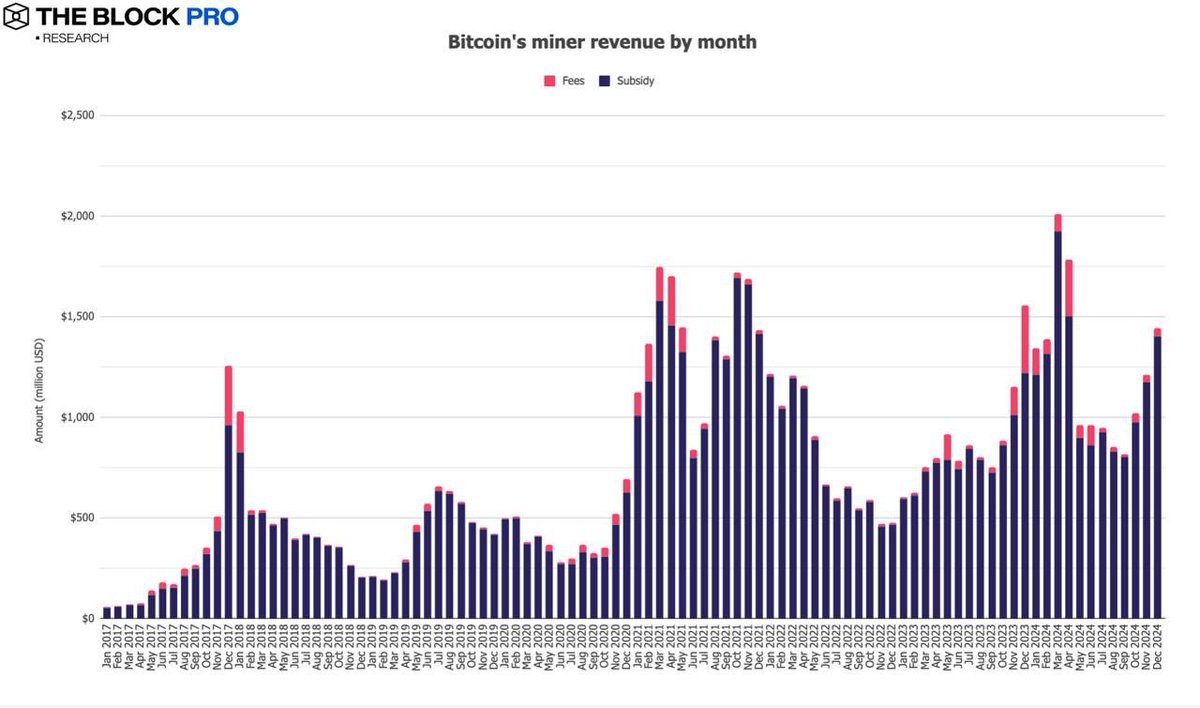

3/12 BTC miner revenue increased by 18.9% to $1.44B, while ETH staker revenue increased by 30.2% to $342M:

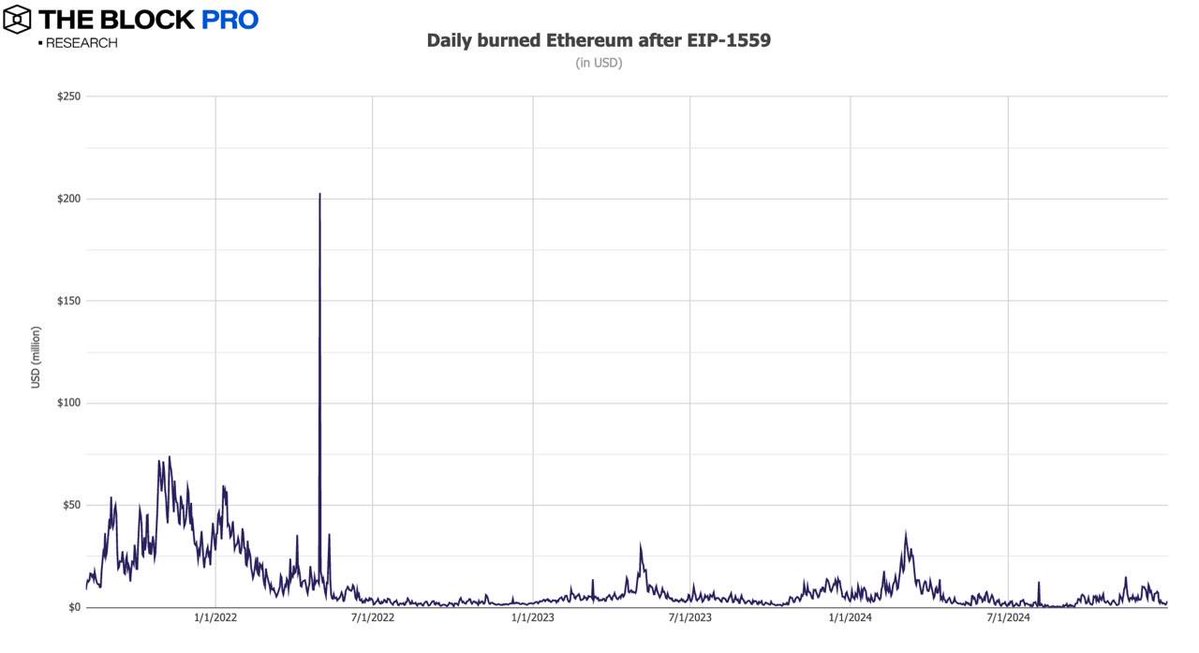

4/12 A total of 47,064 ETH, equivalent to $174.4M, was burned. Since the implementation of EIP-1559 in early August 2021, a total of 4.53M ETH, equivalent to $12.8B, has been burned:

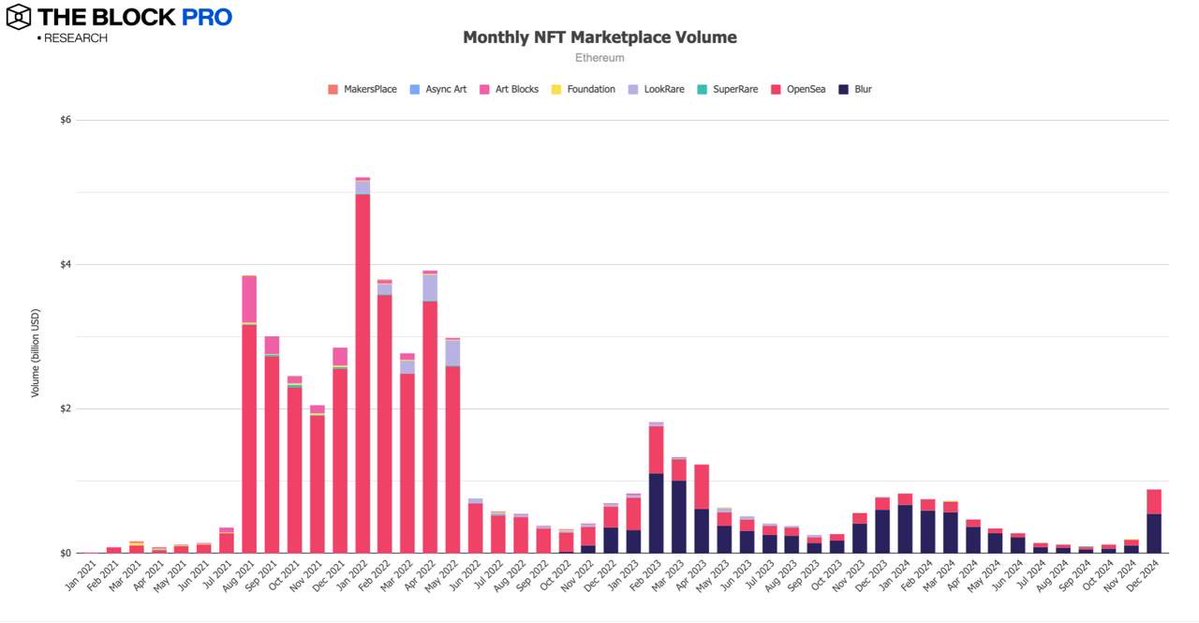

5/12 Monthly NFT marketplace volume on Ethereum increased by 350.7% to $884.8M. This was mainly due to Pudgy Penguins token launch and OpenSea's token teaser:

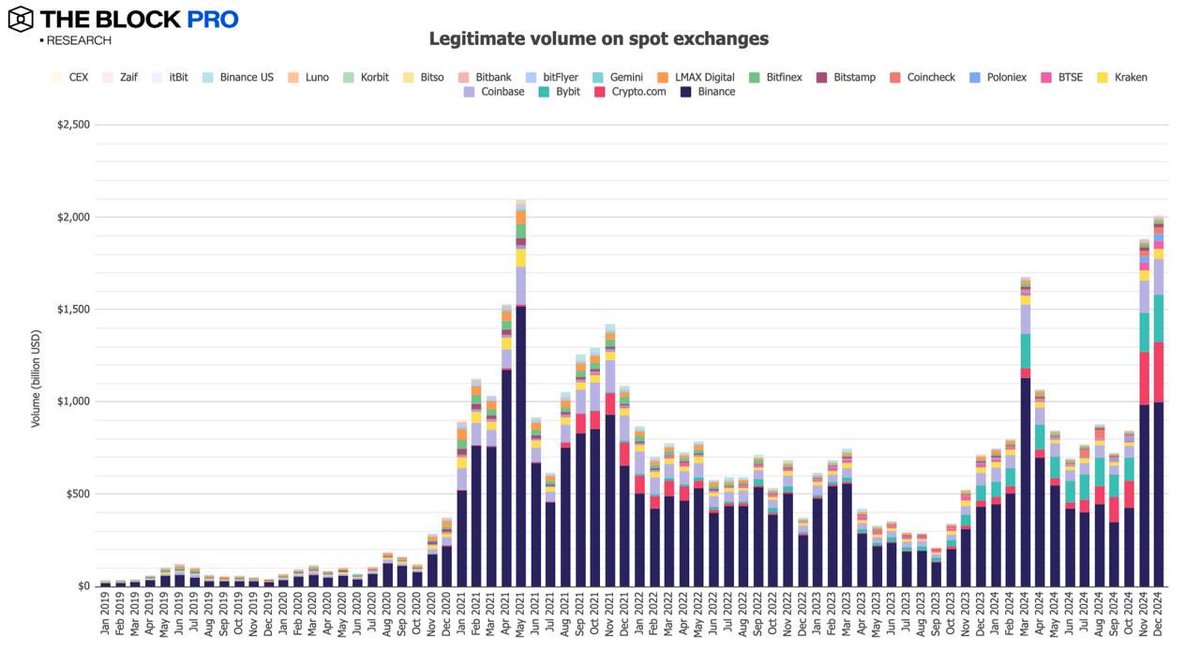

6/12 Legitimate CEX spot volume increased by 6.8% to $2.01T:

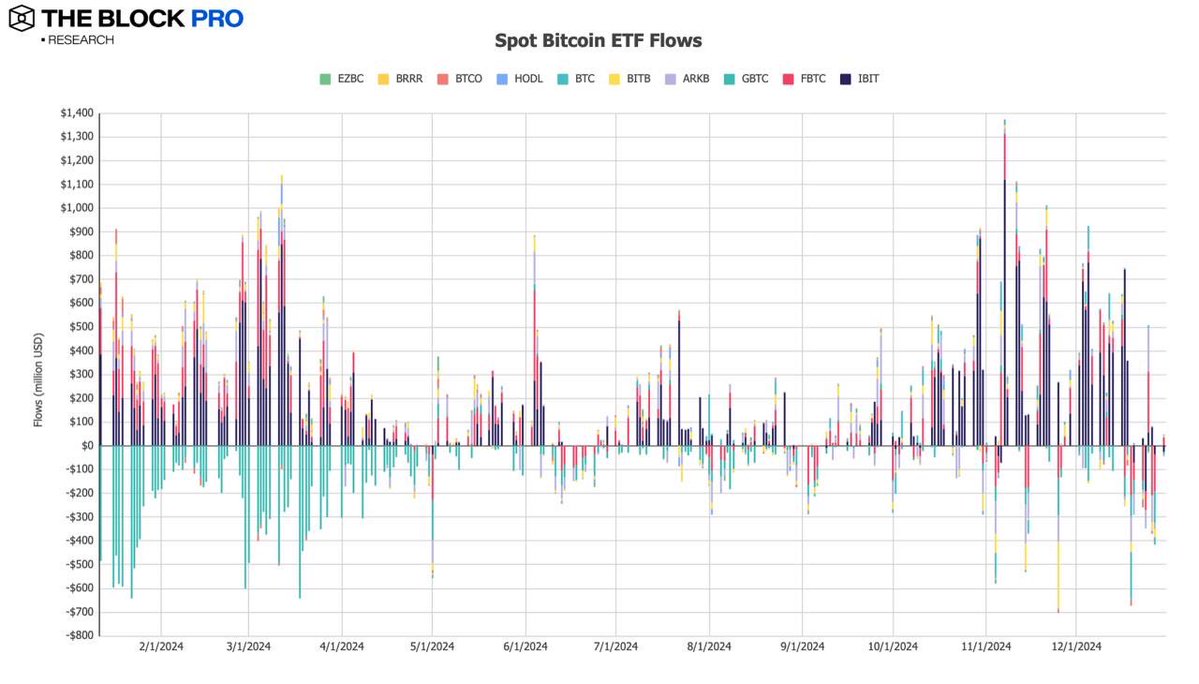

7/12 Monthly net flows of all BTC spot ETFs came in at positive $4.6B:

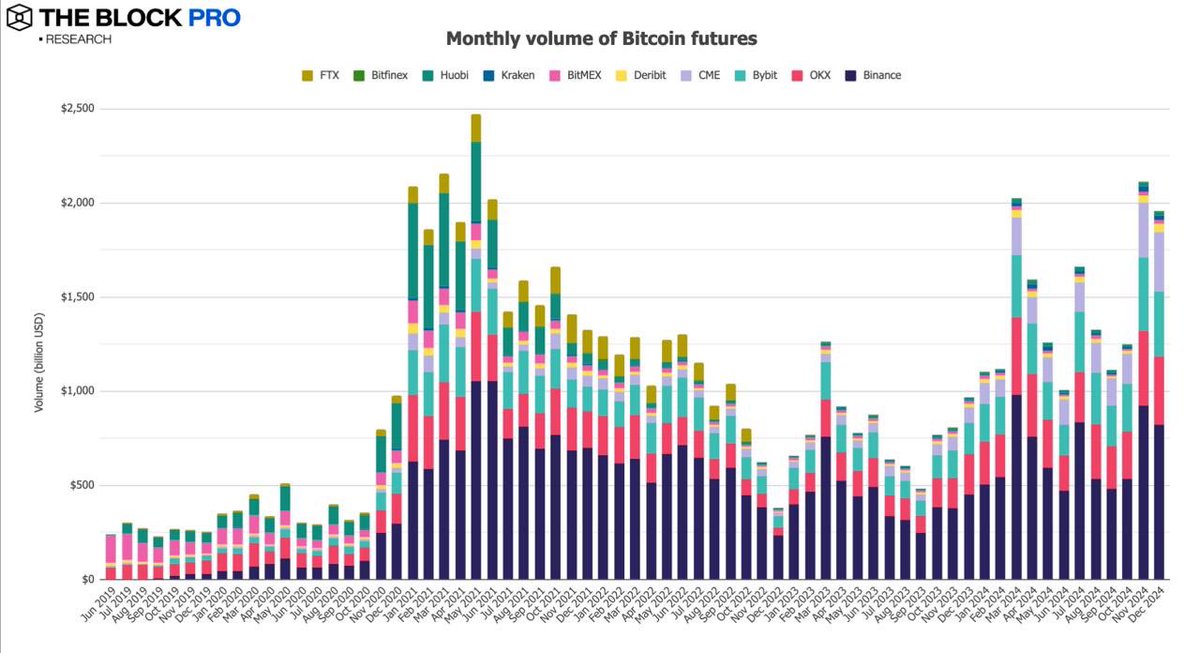

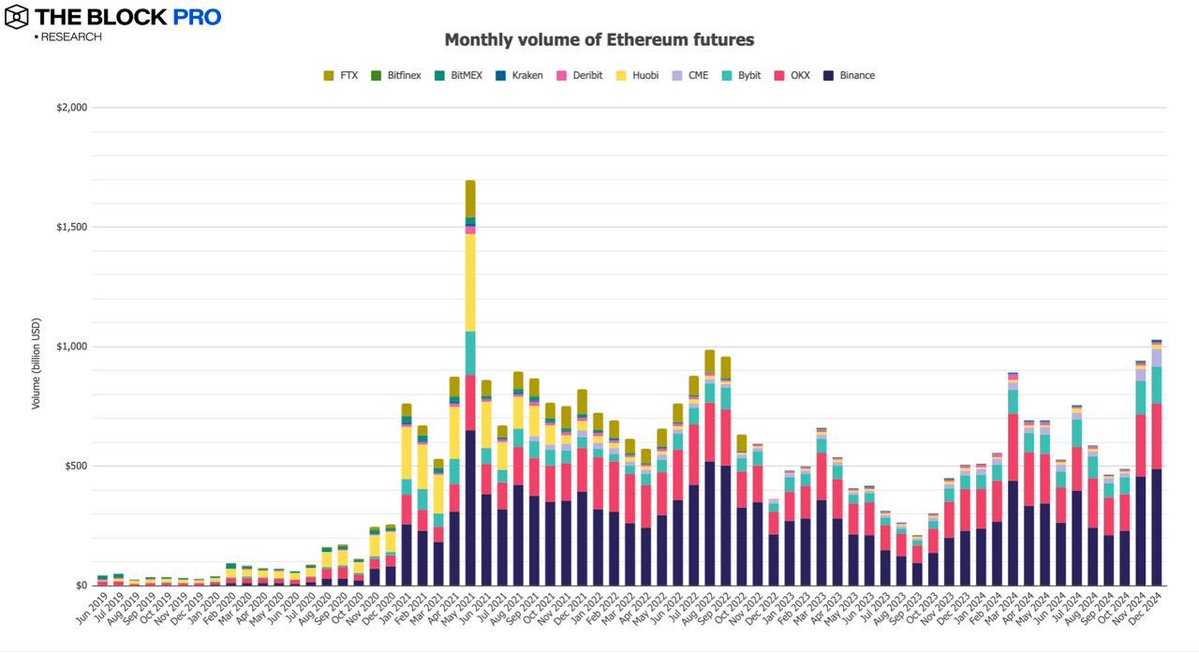

8/12 Futures: Open interest: BTC: -9.4%, ETH new ATH: +0.5%; Trading volume: BTC monthly futures volume decreased by 7.4% to $1.96T (ETH +9.6%):

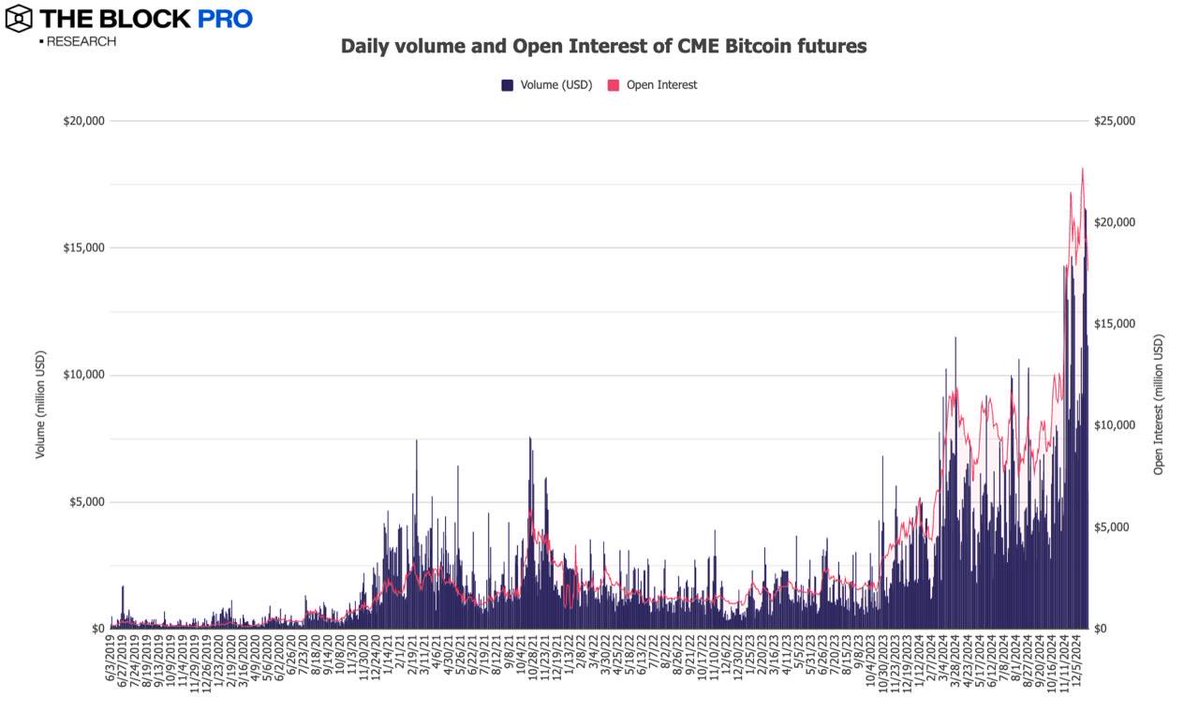

9/12 CME's open interest of Bitcoin futures decreased by 12.4% $17.6B (daily avg volume new ATH +3.1% to $10.14B):

10/12 ETH futures monthly volume increased by 9.6% to $1.03T:

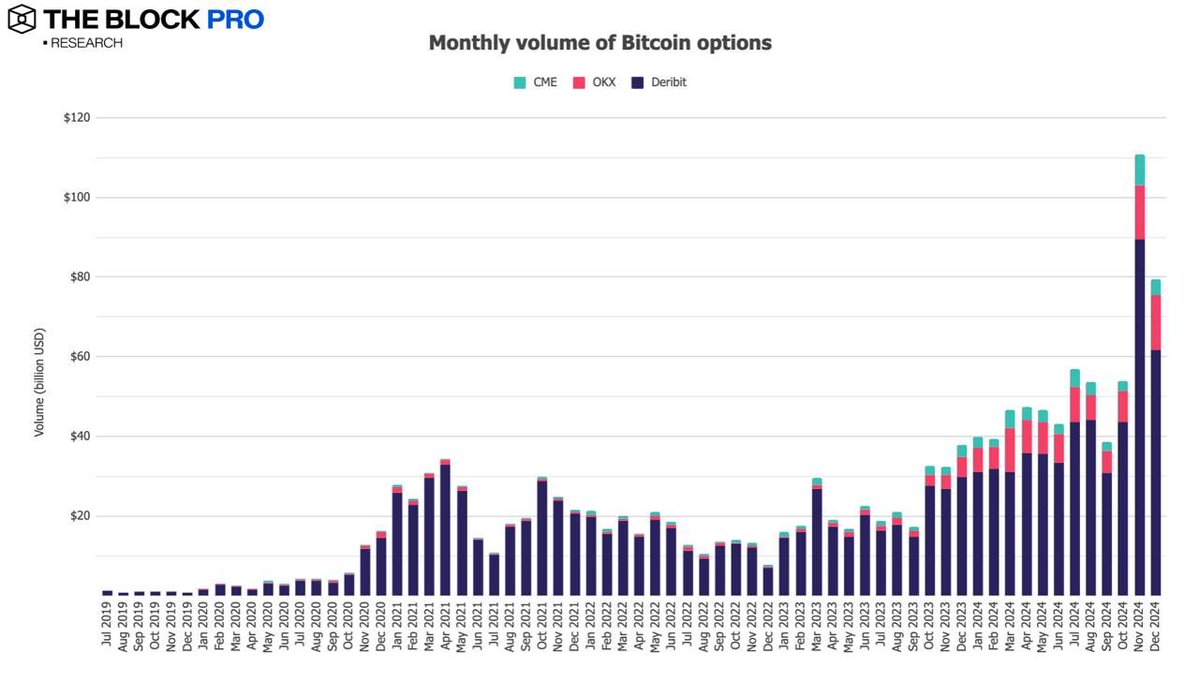

11/12 Options: Open interest: BTC: -36%, ETH: -30.2%. BTC monthly options volume decreased by 28.4% to $79.5B (ETH: +5.6% to $23.1B):

12/12 As always you can find many of these metrics, and other live metrics, on our Data Dashboard:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content