The price of SPX has risen 25% in the Longing 24 hours, significantly outperforming major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). This rally pushed SPX to a new all-time high of $1.25 during the early Asian session on Friday.

It has since dropped 4%, but the bullish bias on the tokens remains strong, suggesting further price increases.

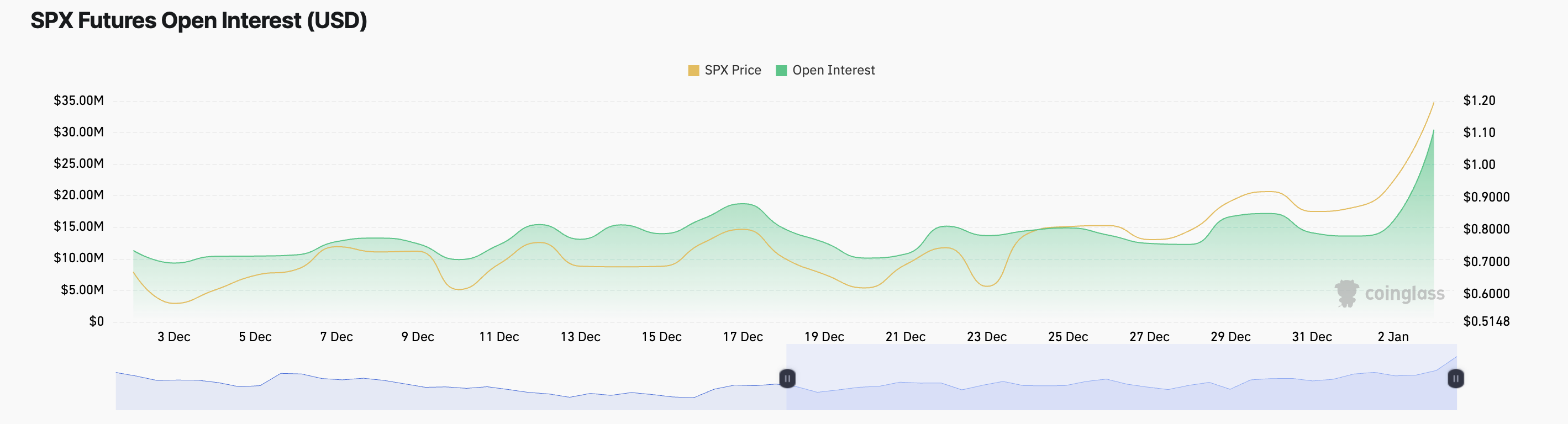

SPX6900 trading volume and open interest both increase

The surge in activity in SPX is reflected in the increase in open interest, which is currently at an all-time high of $30.46 million. According to Coinglass, this is a 90% increase in the Longing 24 hours.

Open interest measures the total number of outstanding derivative contracts, such as futures or options, that have not been settled or expired. An increase in open interest during a price rally indicates that new money is entering the market, suggesting strong participation and confidence in the uptrend. This implies that the rally has momentum and is likely not a Short-term move.

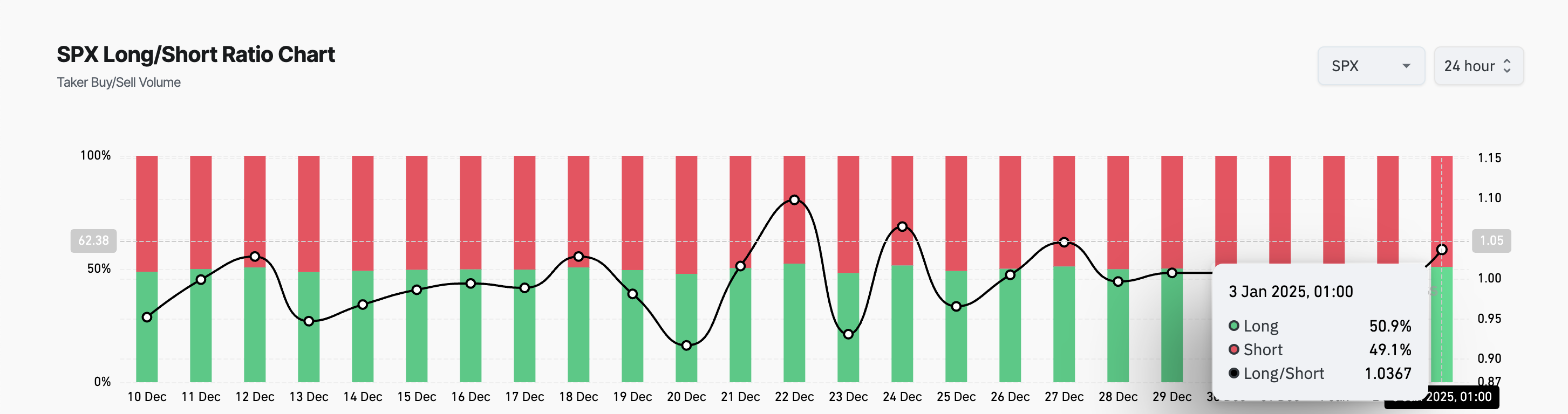

Additionally, the Longing/Short ratio of SPX confirms the bullish bias on altcoins. At the time of writing, this ratio is 1.03.

The Longing/Short ratio of an asset reflects the ratio of Longing (buy) positions to Short (sell) positions in the market, reflecting the sentiment of traders. When the ratio is above 1, as in the case of SPX, it indicates that more traders are taking Longing positions, often suggesting bullish sentiment.

SPX price forecast: Will it surpass the $1.25 all-time high?

The Chaikin Money Flow (CMF) on the daily chart of SPX emphasizes the increase in demand for altcoins. At the time of reporting, this indicator, which measures the flow of money into and out of the asset, is in an uptrend at 0.08.

When an asset's CMF is positive, it indicates that buying pressure is stronger than selling pressure, suggesting a bullish market sentiment. If this bullish sentiment persists, SPX may recover and surpass its all-time high of $1.25.

However, if token holders start selling to realize profits, this bullish outlook could be invalidated. In such a case, the price of SPX could drop to $0.99.