Original title: The Trillion Dollar Opportunity

Original author: Ryan Barney, Mason Nystrom, partners at Pantera Capital Original translation: 0xjs, Jinse Finance

Stablecoins are a trillion dollar opportunity.

This is not an exaggeration.

While cryptocurrencies are often thought of for volatility, tokens, and liquidity, there is another side of cryptocurrencies that is more quietly carrying the banner of crypto adoption: stablecoins. For the uninitiated, these crypto dollars are pegged 1:1 to an underlying fiat currency, using either an algorithm (less popular) or a reserve (more popular) to maintain the peg.

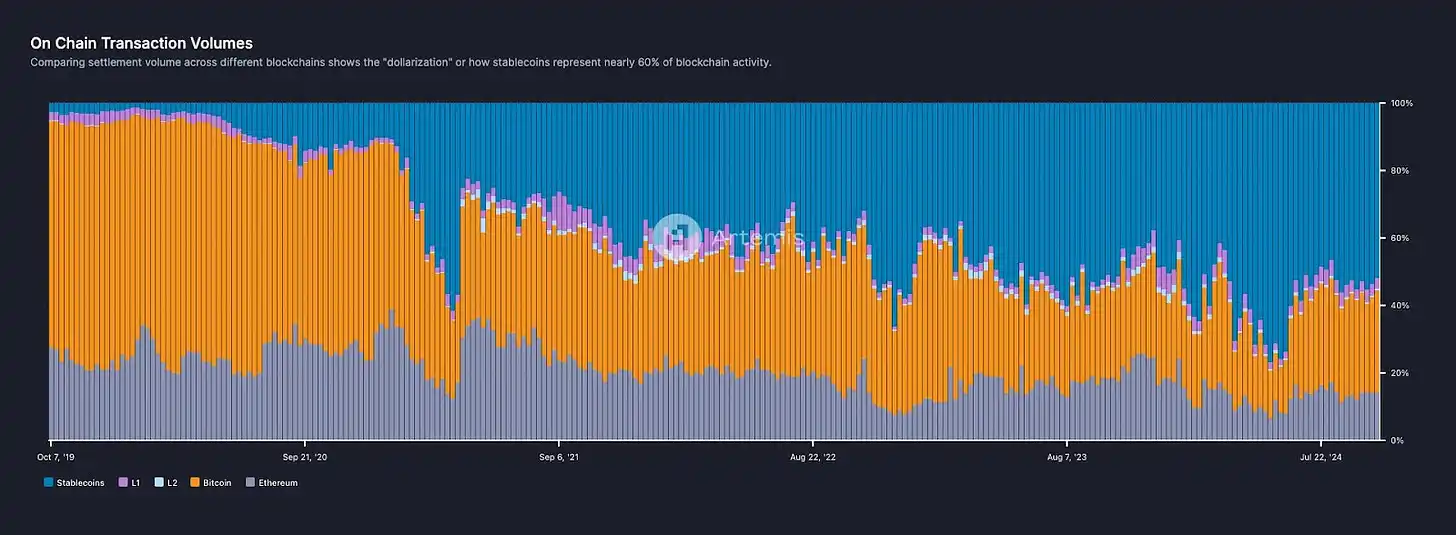

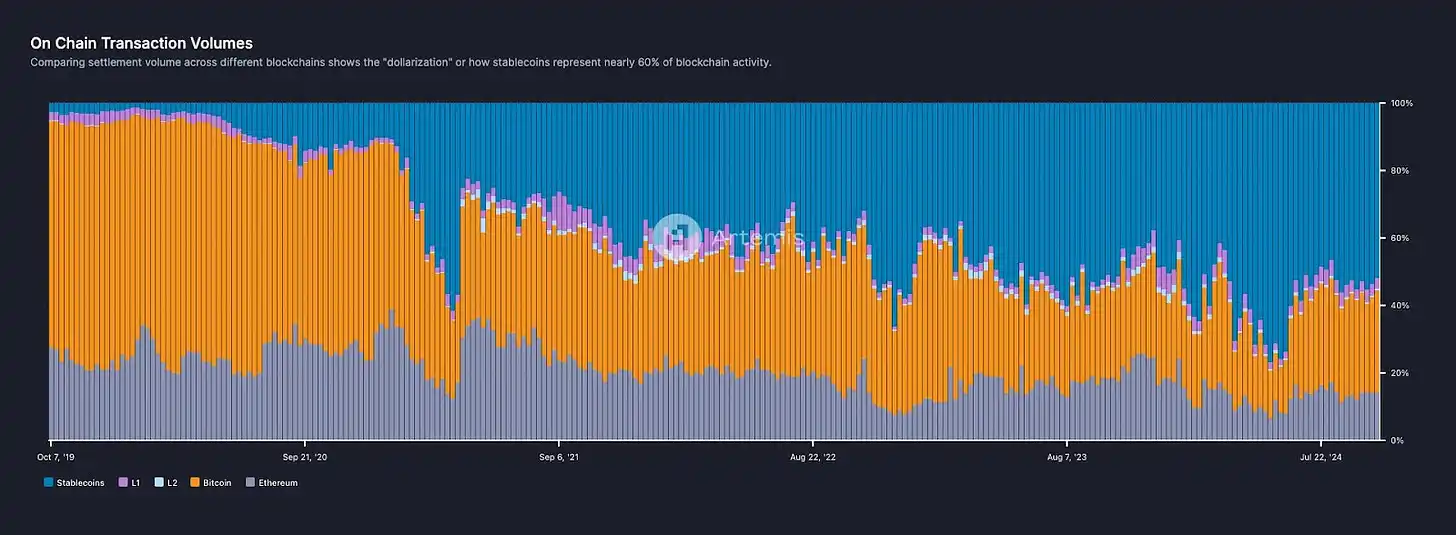

Stablecoins now account for over 50% of blockchain transactions, up from 3% in 2020. Stablecoins are the claim to be the killer app for cryptocurrencies and, unlike many cryptocurrencies, are inherently non-speculative.

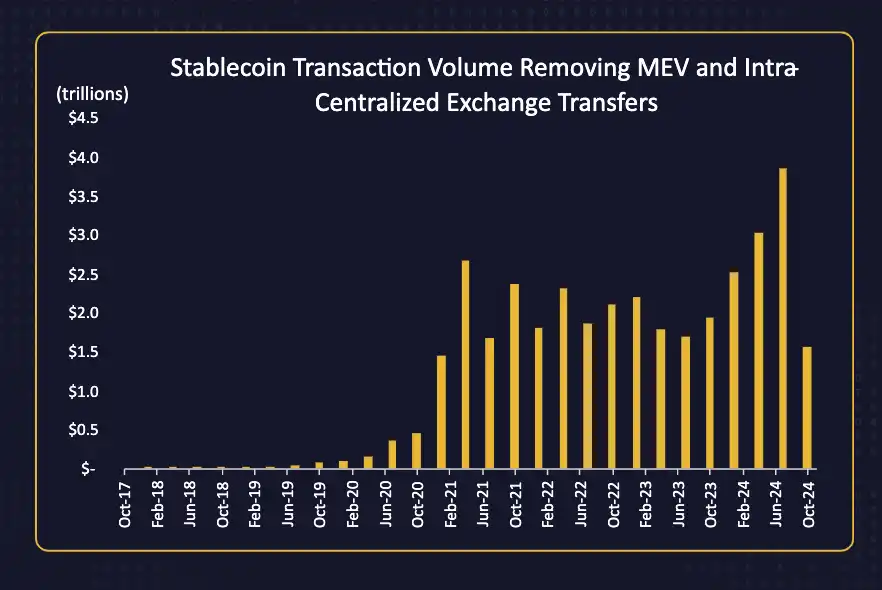

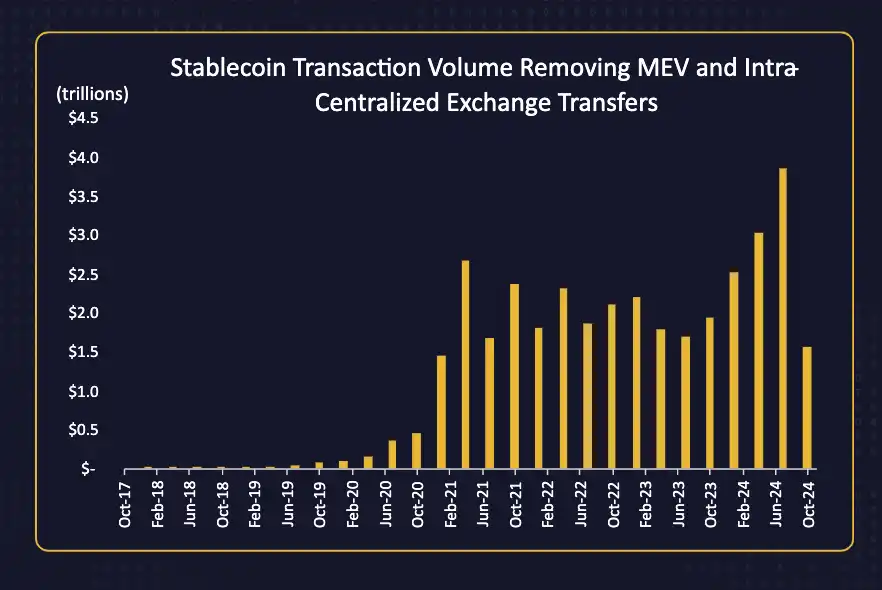

In a short period of time, stablecoins have demonstrated their ability to become one of the transformative innovations in the cryptocurrency space. 2024 was a breakout year for stablecoins, with adjusted trading volume exceeding approximately $5 trillion and transactions exceeding $1 billion across nearly 200 million accounts.

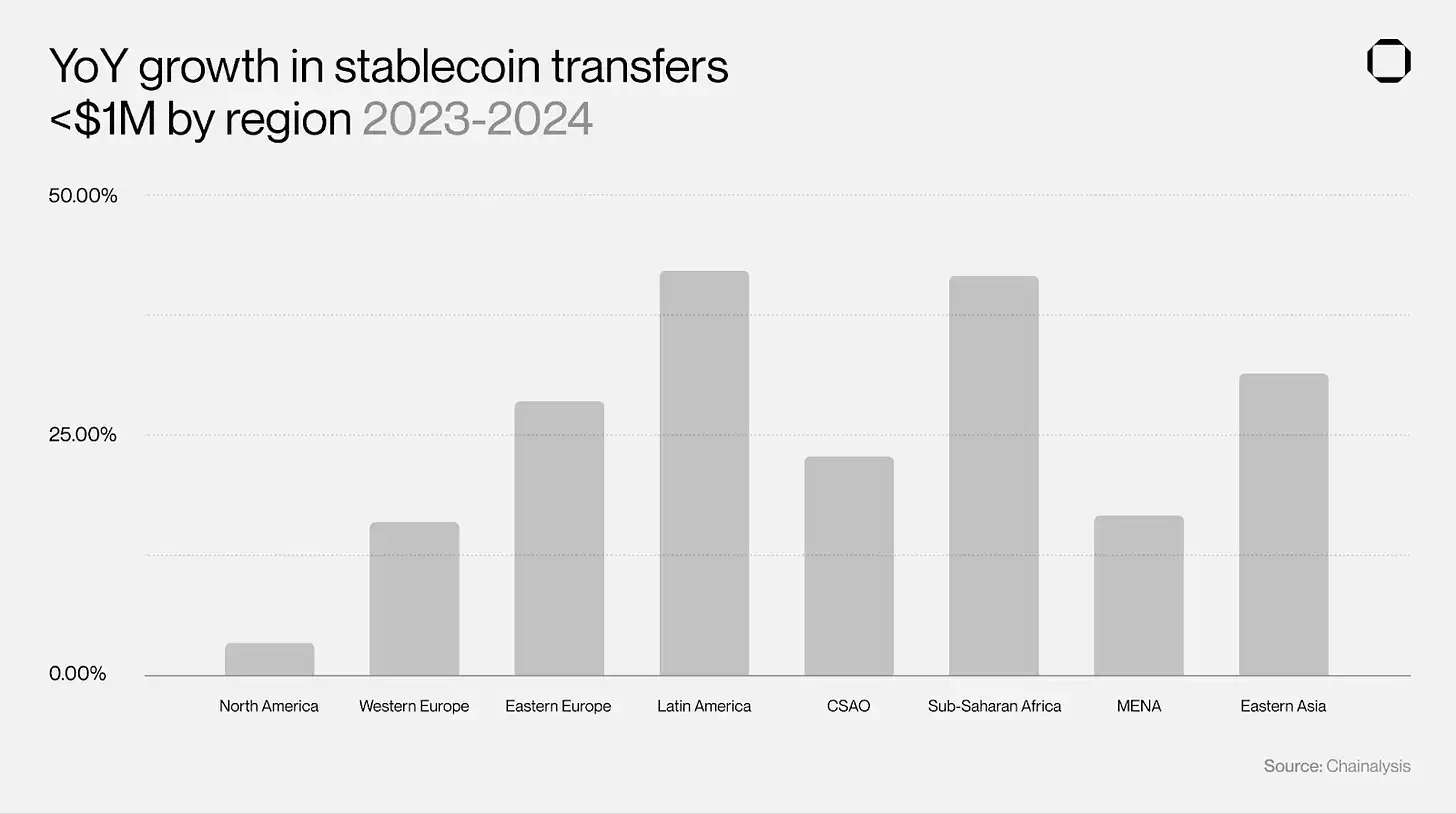

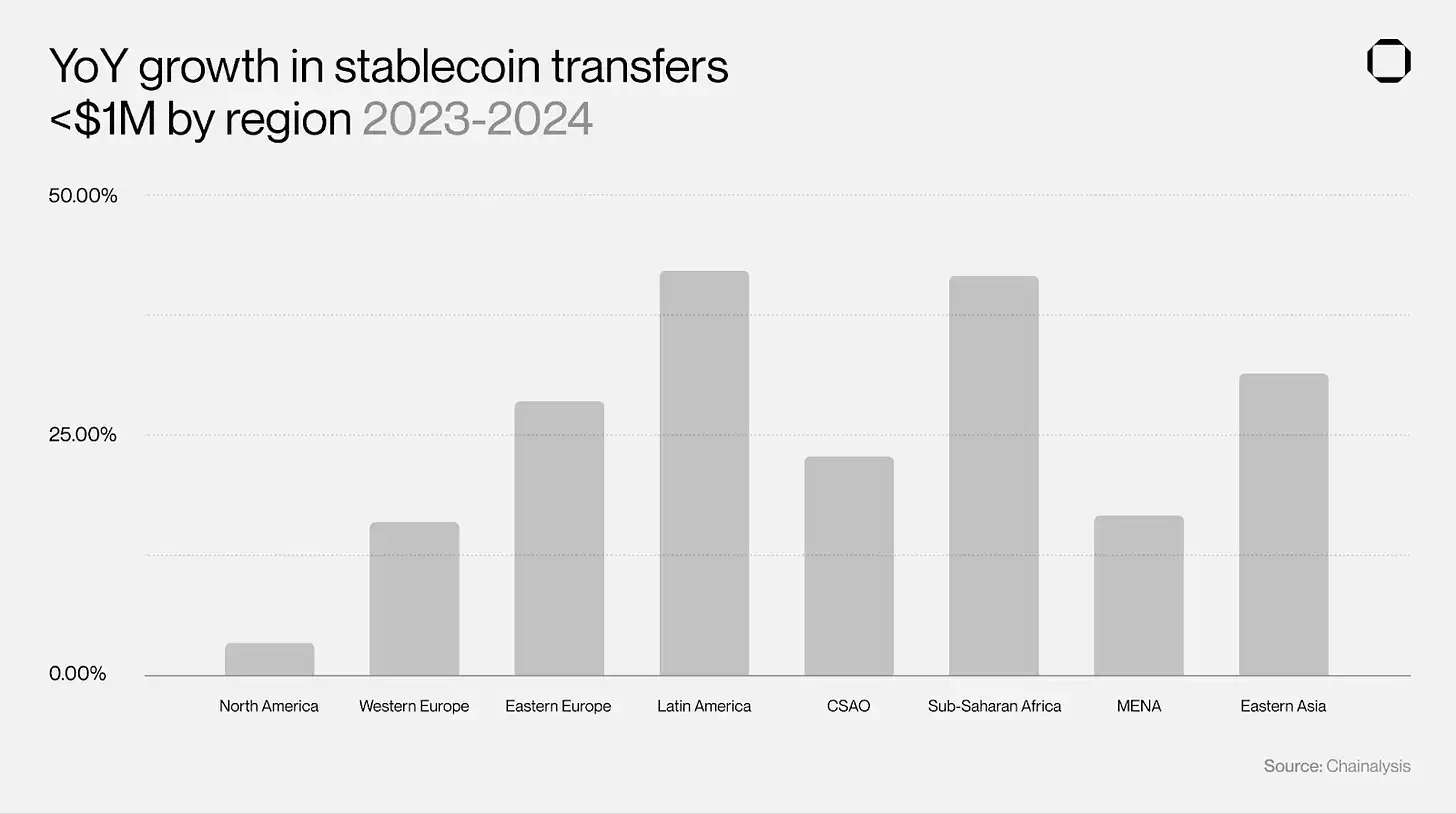

Stablecoins have seen impressive growth in the last crypto bull run, but this time around, their applications extend beyond the DeFi ecosystem. Over the past few years, stablecoins have demonstrated their core value proposition - seamless cross-border payments, initially enabled by access to U.S. dollars. Accordingly, the fastest growing areas for stablecoins are emerging markets, where demand for U.S. dollars is high.

Stablecoins offer a 10x value proposition to traditional payment methods for B2C payments (e.g. remittances) as well as B2B cross-border transactions.

Cryptocurrencies have long been expected to provide a solution to the trillion-dollar cross-border payments market. By 2024, cross-border B2B payments through traditional payment channels will reach approximately $40 trillion (excluding wholesale B2B payments) (Juniper Research). In the consumer payments market, global remittances account for hundreds of billions of dollars in revenue each year. Now, stablecoins provide a means to enable global cross-border remittance payments through crypto channels.

As stablecoin adoption in the B2C and B2B payment sectors accelerates, on-chain stablecoin supply and transaction volume have reached all-time highs.

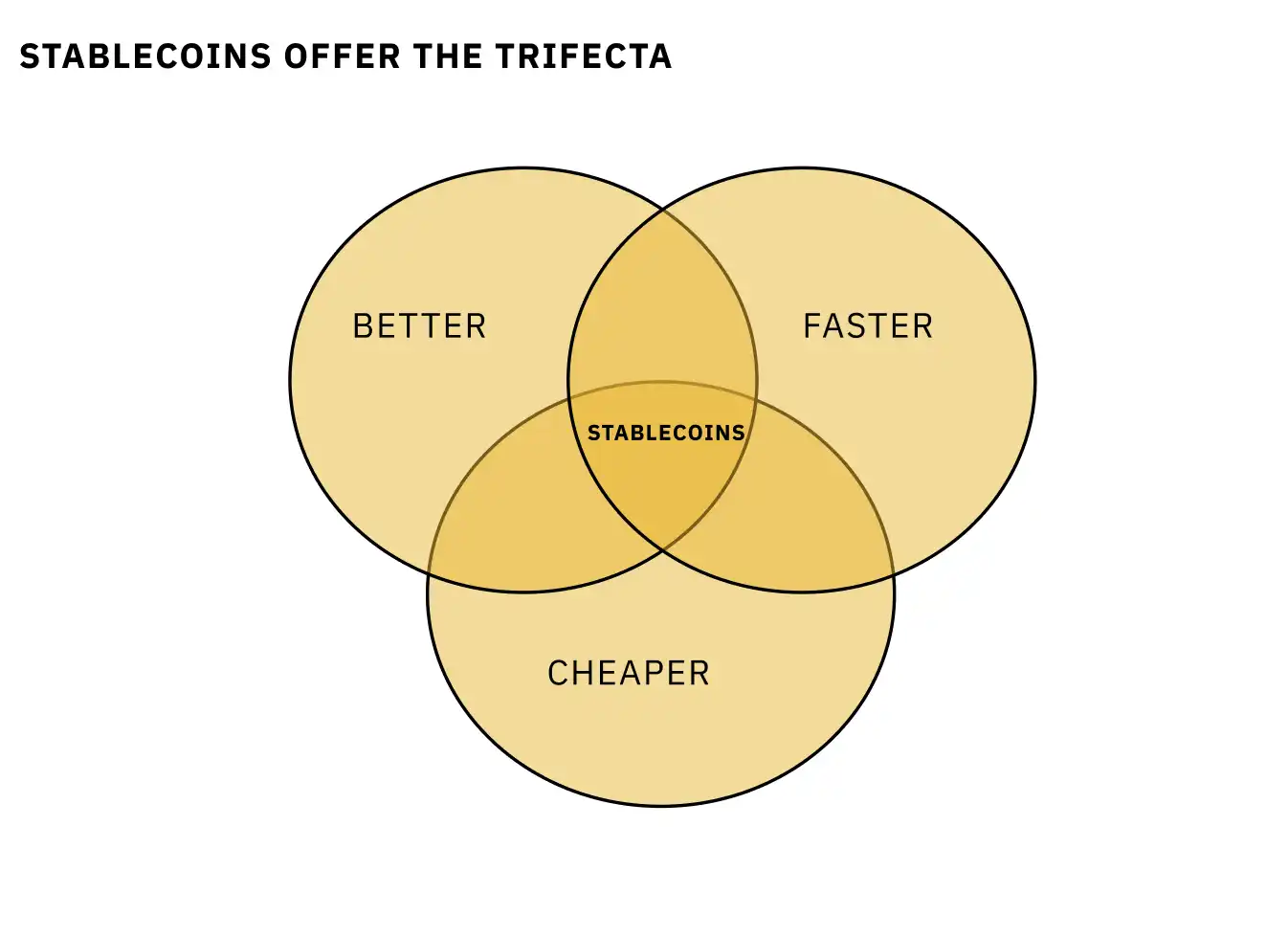

The Stablecoin Trio: Better, Faster, Cheaper

There is an old saying in the business world: Few products can offer the three advantages of "better, faster, and cheaper" at the same time. Generally speaking, products can meet two of the conditions at the same time, but it is impossible to meet all three conditions at the same time. Stablecoins provide a better, faster, and cheaper way to transfer funds globally.

For businesses and consumers, stablecoins offer a value proposition that is 10x greater than traditional dollars.

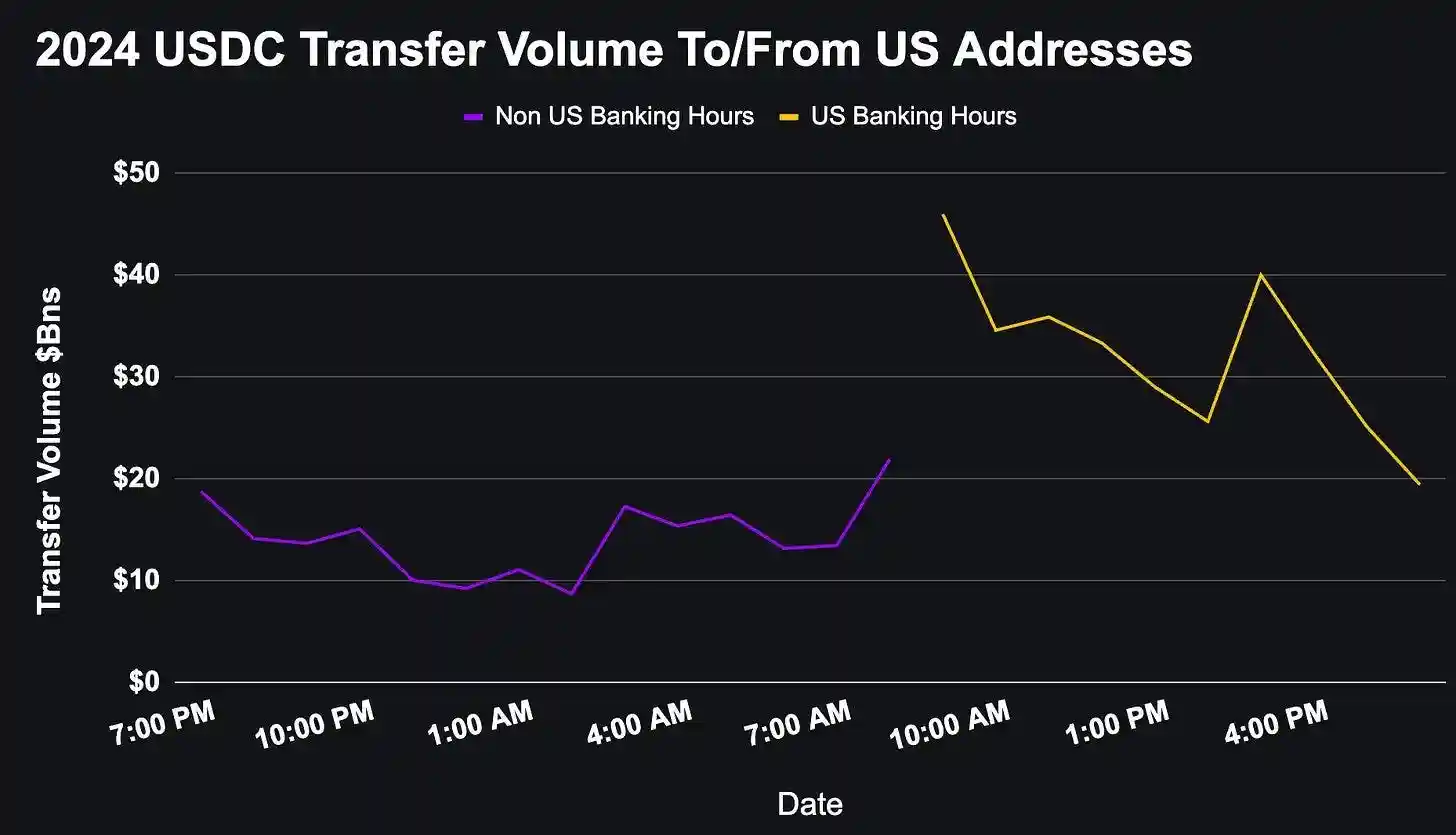

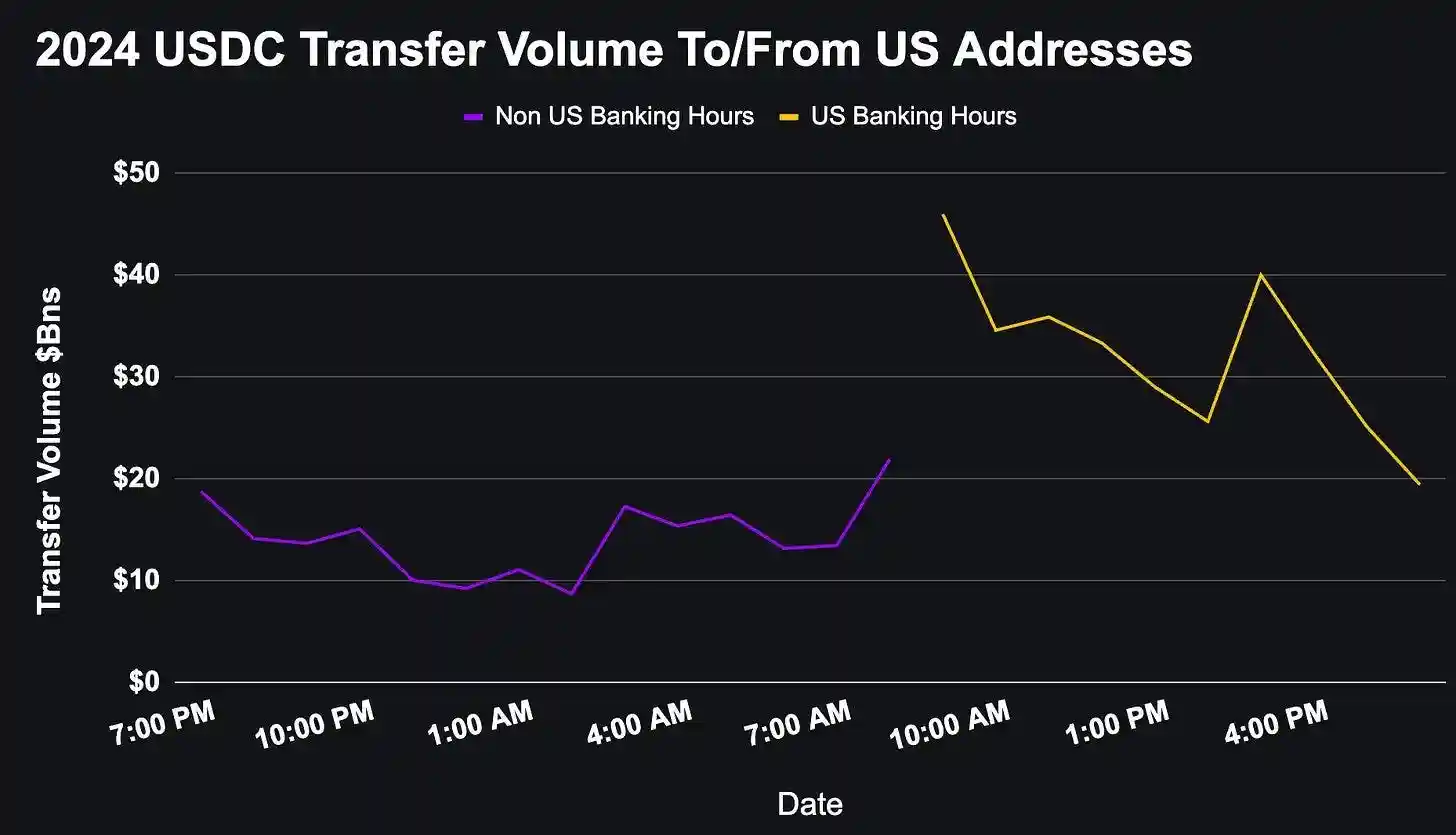

Better: Stablecoins are a more accessible product that is available 24 hours a day, 365 days a year. They can be easily transferred across borders around the world and are programmable, which makes stablecoins a superior product to fiat currencies.

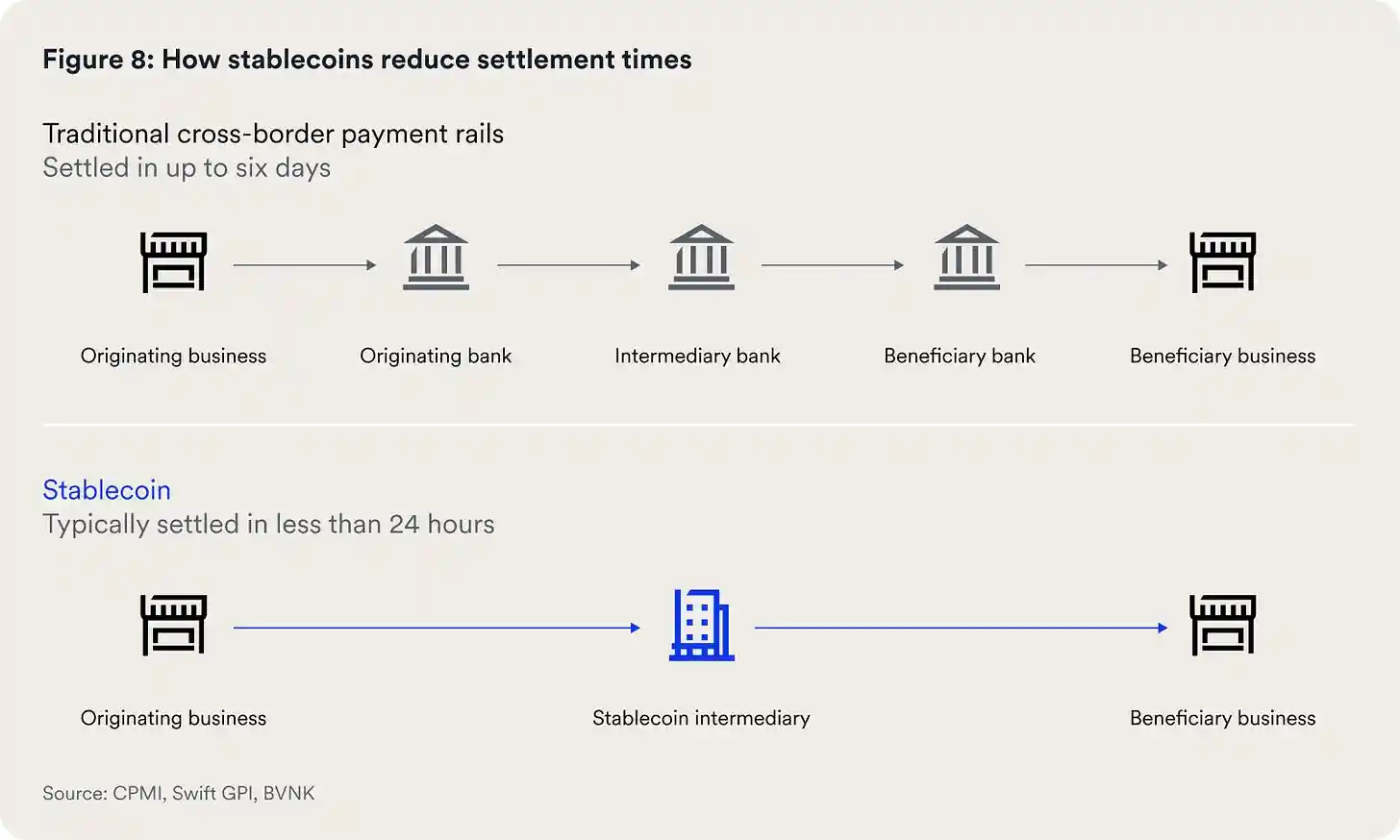

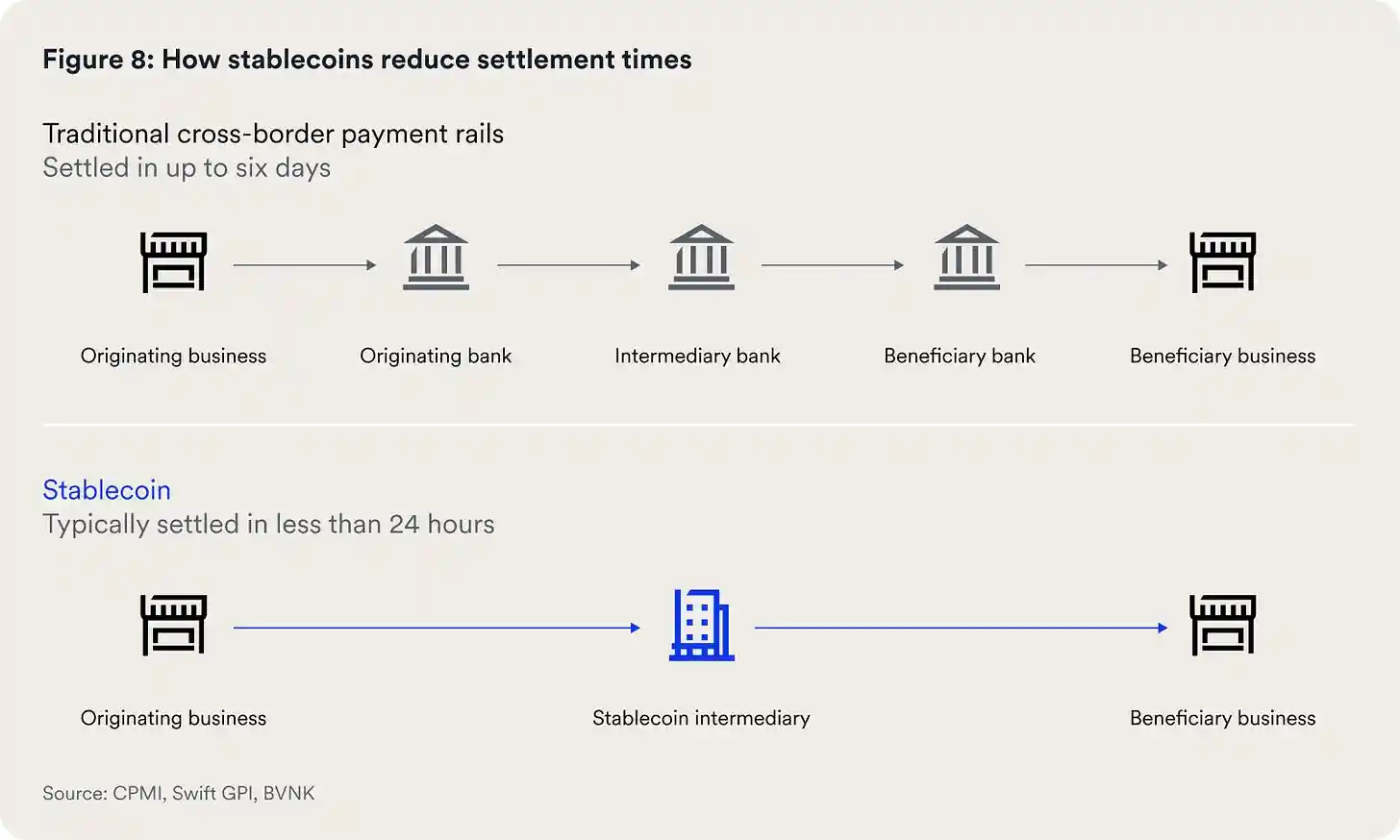

Faster: Stablecoins are undoubtedly faster and can be settled instantly, rather than taking T-minus 2 or T-minus 1 day to settle.

Cheaper: Stablecoins cost less to issue, transfer, and maintain than fiat currencies. In 2023, Stripe facilitated over $1 trillion in payment volume with a fee structure starting at 2.9% plus an additional 30 cents for domestic card transactions. On high-throughput blockchains like Solana or Ethereum L2s like Base, the average stablecoin payment costs less than a penny.

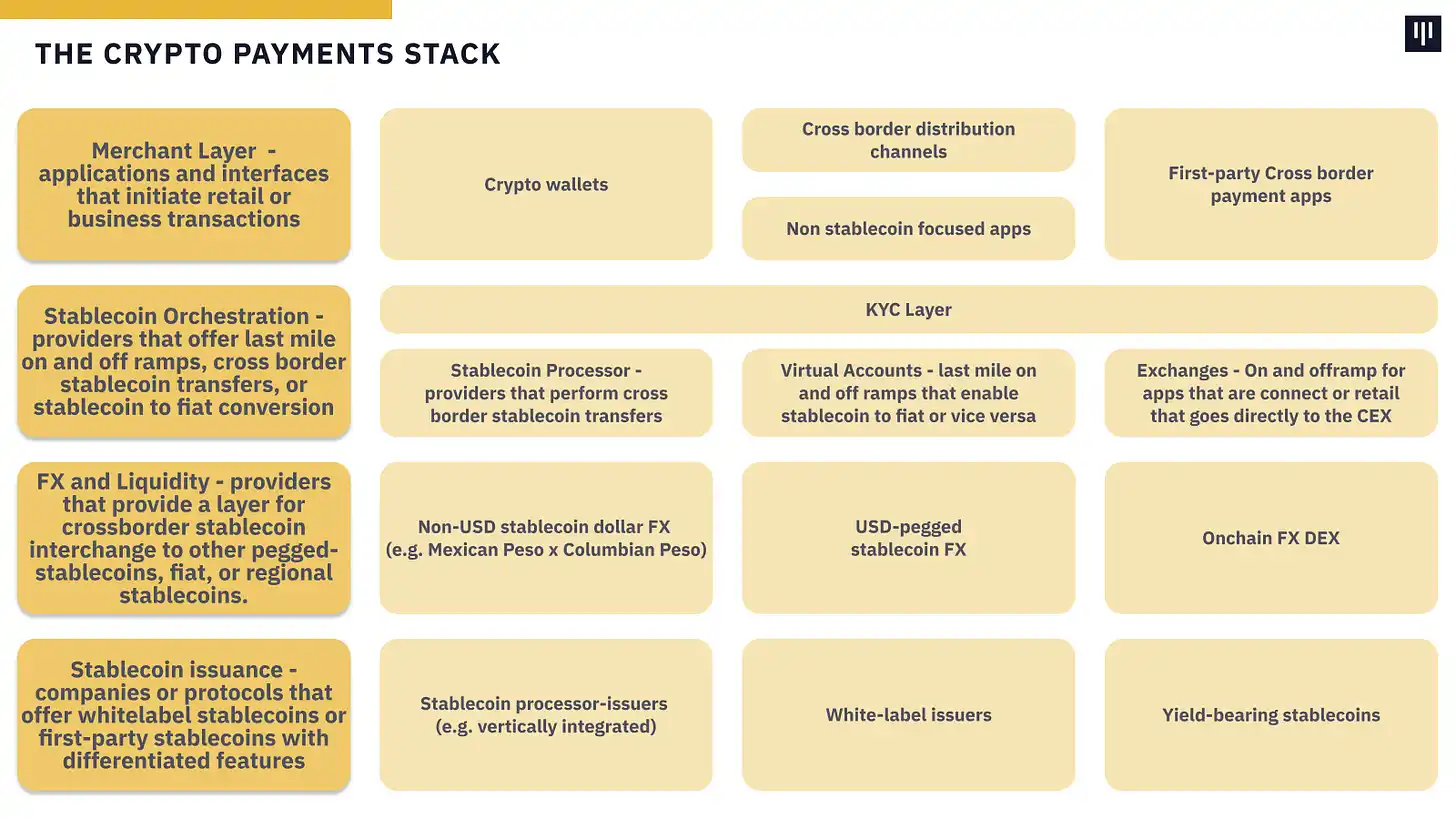

The emerging stablecoin stack

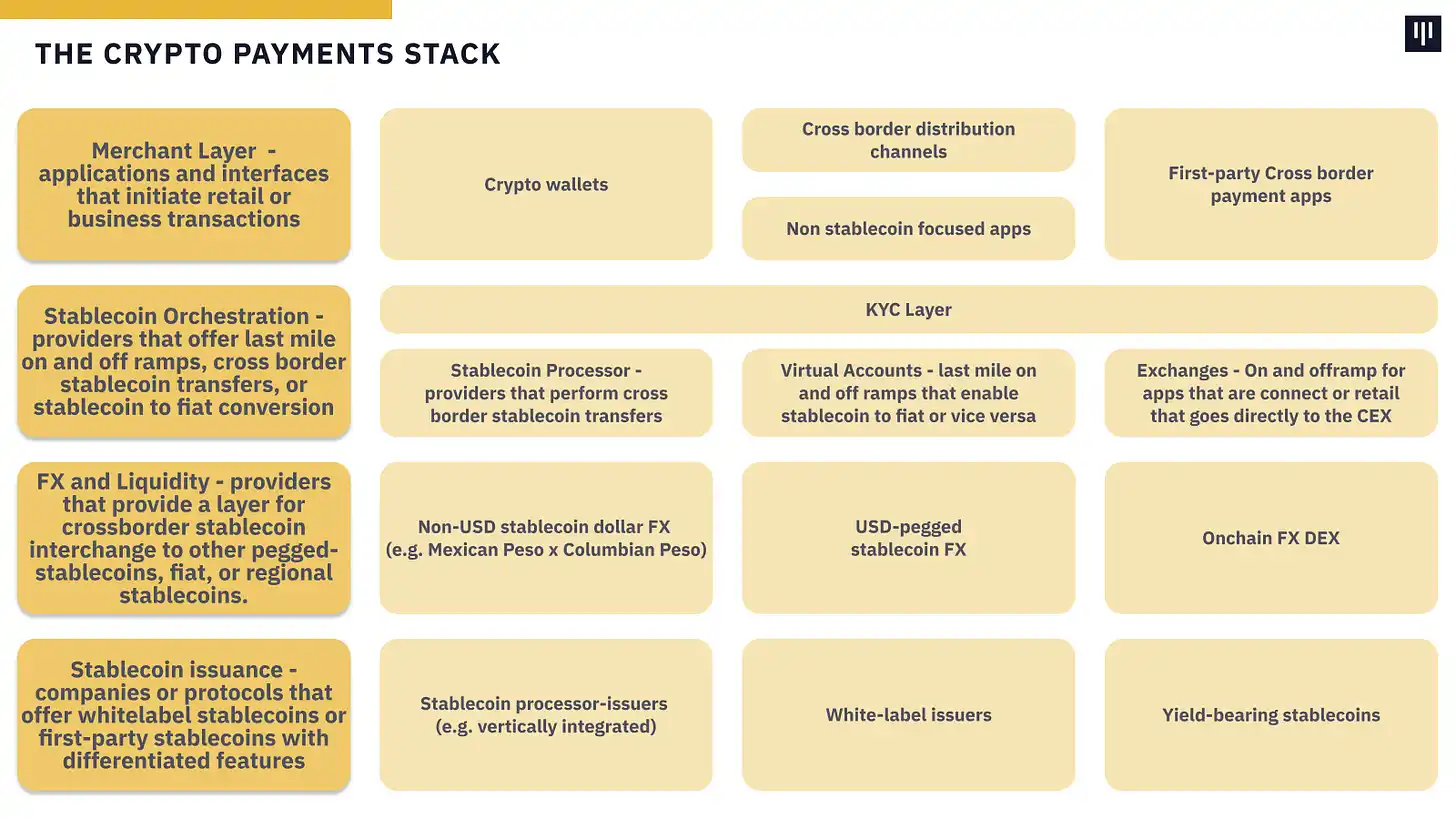

While the stablecoin stack continues to evolve, there are a few new layers that are emerging:

Merchant Layer - Applications and interfaces that initiate retail or commercial transactions

Stablecoin Orchestration — providers that provide last-mile on- and off-ramps, virtual accounts, cross-border stablecoin transfers, or stablecoin-to-fiat currency conversions

FX and Liquidity — Providers that offer cross-border stablecoin exchange with other USD-pegged stablecoins, fiat currencies, or regional stablecoins

Stablecoin issuance - companies or protocols that offer white label stablecoins or first party stablecoins with differentiated features

Similar to how cryptocurrency exchanges have sprung up in various corners of the world to cater to local players, we expect a variety of cryptocurrency cross-border applications and processors to emerge as they cater to specific stablecoin markets.

Just like traditional finance and payments, building moats in each part of the stack is important to expanding business opportunities beyond the initial value proposition. We have considered which moats are defensible and can be expanded over time at each layer:

Merchant Layer - The moat is built by owning the stablecoin flow to the user or business. This provides the opportunity to upsell other services, sell the user flow, and own the end-to-end customer experience. The Robinhood of stablecoins will emerge following a similar strategy.

Stablecoin integration — licenses! Whoever gets the license will get the most reliable, global coverage at the cheapest price. Will it be developer friendly? Look at the Stripe x Bridge acquisition to understand where the moat here is and how it is formed.

FX and Liquidity - Liquidity begets liquidity, and flow begets value. Any participant that can access proprietary liquidity and price it efficiently will outperform new entrants without it. This is why a few large exchanges serve the majority of stablecoin flows on certain major corridors today. We also believe that the transition from OTC FX to exchange-based FX to on-chain FX will facilitate faster payments and transactions at this layer.

Stablecoin issuance - Over time, issuance will become commoditized and will inevitably lead to the launch of dozens of large branded stablecoins (e.g. PYUSD). As the other layers of the stack grow (i.e. merchants, business processes, and liquidity), we expect these layers to have the ability to launch their own stablecoins, whether to capture yield, build their own branded stablecoins, or build proprietary stablecoin liquidity and flow.

The layers will merge over time as the stack is gradually tied together. The merchant layer is best suited to aggregate the other layers of the stack, thereby providing more value to end users, increasing profits and creating more revenue streams. They will have the power to choose which FX transactions they make, which access points they own or rent, and which issuers they use.

Additionally, we expect stablecoin issuance to become increasingly common for large fintechs and e-commerce providers that facilitate large amounts of money movement. The next generation of neobanks and fintechs will be defined by stablecoins. Just this month, we heard that large credit card networks like Visa, banks like JPM, and asset managers like Blackrock are interested in exploring their own stablecoin projects.

Looking Ahead: The Next Decade of Digital Dollars

The tokenization of the U.S. dollar is still in its infancy.

Even as stablecoin MAUs reach all-time highs, we believe adoption will continue as hundreds of millions of people interact with stablecoins over the next decade.

Importantly, even as exchange volumes fluctuate, stablecoin users continue to grow. From bull to bear markets, stablecoins have dominated and expanded their digital influence.

As cryptocurrencies rebuild the financial system from the ground up, stablecoins will also exist and integrate into traditional financial payment networks.

While large companies such as Stripe, Visa, and Paypal have entered the stablecoin market, we see a lot of opportunity for new protocols and companies focused on stablecoins.

Here are some ideas that excite us:

Stablecoin Neobanks - The advent of mobile devices has enabled Neobanks to gain tremendous value. Crypto Neobanks will not only provide first-class payment channels, but will also support the next generation of consumer financial applications that will aggregate payments, transactions, earnings, loans and other core financial services.

On-chain FX - While most stablecoins are currently pegged to the US dollar, we expect more currencies to come on-chain, driving the development of an on-chain FX layer. More immediately, as a large number of yield-bearing stablecoins pegged to the US dollar offer different yields and value propositions, we expect these initial US dollar-pegged stablecoins to require an FX layer.

Telegram Payment Rails – Telegram offers a native payment wallet, but we also see a unique opportunity to build a new payment layer on top of Telegram using new interfaces like the TG applet.

Remittances on crypto rails — Remitly, Wise, Intermex, Ria, MoneyGram, Western Union… all remittance companies, each with hundreds of millions to billions of dollars in annual revenue. Remittance companies charge fixed fees that make sense for low amounts (e.g. $6 for a $60 transaction) or high fees (30-100bps per transaction). Stablecoins reduce the cost of sending remittances globally and make the process seamless.

“Remittance profits are an opportunity for stablecoins.” —Jeff “Stables” Besos

Global Venmo - Building P2P rails to bring Venmo-like functionality to a global scale. Remittances are typically a one-way flow, and this will serve social commerce use cases in a more two-way flow.

Stablecoins support fund management and operations - As the fintech space expands from PayPal payments, it creates multi-billion dollar opportunities in wealth management, personal finance, payroll, corporate spending and expense management, neo-banking, financial accounting and reporting, lending/mortgages, etc. Similarly, stablecoins provide an opportunity to rebuild many of these cumbersome processes with better rails supported by stablecoins. In the short term, fund management and operations deal with complex operations, which makes the value proposition of stablecoins disruptive.

Conclusion

Stablecoins represent a trillion dollar business opportunity. We want to support founders and visionaries who can see the future of stablecoins, independent of the financial system.

Original author: Ryan Barney, Mason Nystrom, partners at Pantera Capital Original translation: 0xjs, Jinse Finance

Stablecoins are a trillion dollar opportunity.

This is not an exaggeration.

While cryptocurrencies are often thought of for volatility, tokens, and liquidity, there is another side of cryptocurrencies that is more quietly carrying the banner of crypto adoption: stablecoins. For the uninitiated, these crypto dollars are pegged 1:1 to an underlying fiat currency, using either an algorithm (less popular) or a reserve (more popular) to maintain the peg.

Stablecoins now account for over 50% of blockchain transactions, up from 3% in 2020. Stablecoins are the claim to be the killer app for cryptocurrencies and, unlike many cryptocurrencies, are inherently non-speculative.

In a short period of time, stablecoins have demonstrated their ability to become one of the transformative innovations in the cryptocurrency space. 2024 was a breakout year for stablecoins, with adjusted trading volume exceeding approximately $5 trillion and transactions exceeding $1 billion across nearly 200 million accounts.

Stablecoins have seen impressive growth in the last crypto bull run, but this time around, their applications extend beyond the DeFi ecosystem. Over the past few years, stablecoins have demonstrated their core value proposition - seamless cross-border payments, initially enabled by access to U.S. dollars. Accordingly, the fastest growing areas for stablecoins are emerging markets, where demand for U.S. dollars is high.

Stablecoins offer a 10x value proposition to traditional payment methods for B2C payments (e.g. remittances) as well as B2B cross-border transactions.

Cryptocurrencies have long been expected to provide a solution to the trillion-dollar cross-border payments market. By 2024, cross-border B2B payments through traditional payment channels will reach approximately $40 trillion (excluding wholesale B2B payments) (Juniper Research). In the consumer payments market, global remittances account for hundreds of billions of dollars in revenue each year. Now, stablecoins provide a means to enable global cross-border remittance payments through crypto channels.

As stablecoin adoption in the B2C and B2B payment sectors accelerates, on-chain stablecoin supply and transaction volume have reached all-time highs.

The Stablecoin Trio: Better, Faster, Cheaper

There is an old saying in the business world: Few products can offer the three advantages of "better, faster, and cheaper" at the same time. Generally speaking, products can meet two of the conditions at the same time, but it is impossible to meet all three conditions at the same time. Stablecoins provide a better, faster, and cheaper way to transfer funds globally.

For businesses and consumers, stablecoins offer a value proposition that is 10x greater than traditional dollars.

Better: Stablecoins are a more accessible product that is available 24 hours a day, 365 days a year. They can be easily transferred across borders around the world and are programmable, which makes stablecoins a superior product to fiat currencies.

Faster: Stablecoins are undoubtedly faster and can be settled instantly, rather than taking T-minus 2 or T-minus 1 day to settle.

(Photo from BVNK report)

Cheaper: Stablecoins cost less to issue, transfer, and maintain than fiat currencies. In 2023, Stripe facilitated over $1 trillion in payment volume with a fee structure starting at 2.9% plus an additional 30 cents for domestic card transactions. On high-throughput blockchains like Solana or Ethereum L2s like Base, the average stablecoin payment costs less than a penny.

The emerging stablecoin stack

While the stablecoin stack continues to evolve, there are a few new layers that are emerging:

Merchant Layer - Applications and interfaces that initiate retail or commercial transactions

Stablecoin Orchestration — providers that provide last-mile on- and off-ramps, virtual accounts, cross-border stablecoin transfers, or stablecoin-to-fiat currency conversions

FX and Liquidity — Providers that offer cross-border stablecoin exchange with other USD-pegged stablecoins, fiat currencies, or regional stablecoins

Stablecoin issuance - companies or protocols that offer white label stablecoins or first party stablecoins with differentiated features

Similar to how cryptocurrency exchanges have sprung up in various corners of the world to cater to local players, we expect a variety of cryptocurrency cross-border applications and processors to emerge as they cater to specific stablecoin markets.

Just like traditional finance and payments, building moats in each part of the stack is important to expanding business opportunities beyond the initial value proposition. We have considered which moats are defensible and can be expanded over time at each layer:

Merchant Layer - The moat is built by owning the stablecoin flow to the user or business. This provides the opportunity to upsell other services, sell the user flow, and own the end-to-end customer experience. The Robinhood of stablecoins will emerge following a similar strategy.

Stablecoin integration — licenses! Whoever gets the license will get the most reliable, global coverage at the cheapest price. Will it be developer friendly? Look at the Stripe x Bridge acquisition to understand where the moat here is and how it is formed.

FX and Liquidity - Liquidity begets liquidity, and flow begets value. Any participant that can access proprietary liquidity and price it efficiently will outperform new entrants without it. This is why a few large exchanges serve the majority of stablecoin flows on certain major corridors today. We also believe that the transition from OTC FX to exchange-based FX to on-chain FX will facilitate faster payments and transactions at this layer.

Stablecoin issuance - Over time, issuance will become commoditized and will inevitably lead to the launch of dozens of large branded stablecoins (e.g. PYUSD). As the other layers of the stack grow (i.e. merchants, business processes, and liquidity), we expect these layers to have the ability to launch their own stablecoins, whether to capture yield, build their own branded stablecoins, or build proprietary stablecoin liquidity and flow.

The layers will merge over time as the stack is gradually tied together. The merchant layer is best suited to aggregate the other layers of the stack, thereby providing more value to end users, increasing profits and creating more revenue streams. They will have the power to choose which FX transactions they make, which access points they own or rent, and which issuers they use.

Additionally, we expect stablecoin issuance to become increasingly common for large fintechs and e-commerce providers that facilitate large amounts of money movement. The next generation of neobanks and fintechs will be defined by stablecoins. Just this month, we heard that large credit card networks like Visa, banks like JPM, and asset managers like Blackrock are interested in exploring their own stablecoin projects.

Looking Ahead: The Next Decade of Digital Dollars

The tokenization of the U.S. dollar is still in its infancy.

Even as stablecoin MAUs reach all-time highs, we believe adoption will continue as hundreds of millions of people interact with stablecoins over the next decade.

Importantly, even as exchange volumes fluctuate, stablecoin users continue to grow. From bull to bear markets, stablecoins have dominated and expanded their digital influence.

As cryptocurrencies rebuild the financial system from the ground up, stablecoins will also exist and integrate into traditional financial payment networks.

While large companies such as Stripe, Visa, and Paypal have entered the stablecoin market, we see a lot of opportunity for new protocols and companies focused on stablecoins.

Here are some ideas that excite us:

Stablecoin Neobanks - The advent of mobile devices has enabled Neobanks to gain tremendous value. Crypto Neobanks will not only provide first-class payment channels, but will also support the next generation of consumer financial applications that will aggregate payments, transactions, earnings, loans and other core financial services.

On-chain FX - While most stablecoins are currently pegged to the US dollar, we expect more currencies to come on-chain, driving the development of an on-chain FX layer. More immediately, as a large number of yield-bearing stablecoins pegged to the US dollar offer different yields and value propositions, we expect these initial US dollar-pegged stablecoins to require an FX layer.

Telegram Payment Rails – Telegram offers a native payment wallet, but we also see a unique opportunity to build a new payment layer on top of Telegram using new interfaces like the TG applet.

Remittances on crypto rails — Remitly, Wise, Intermex, Ria, MoneyGram, Western Union… all remittance companies, each with hundreds of millions to billions of dollars in annual revenue. Remittance companies charge fixed fees that make sense for low amounts (e.g. $6 for a $60 transaction) or high fees (30-100bps per transaction). Stablecoins reduce the cost of sending remittances globally and make the process seamless.

“Remittance profits are an opportunity for stablecoins.” —Jeff “Stables” Besos

Global Venmo - Building P2P rails to bring Venmo-like functionality to a global scale. Remittances are typically a one-way flow, and this will serve social commerce use cases in a more two-way flow.

Stablecoins support fund management and operations - As the fintech space expands from PayPal payments, it creates multi-billion dollar opportunities in wealth management, personal finance, payroll, corporate spending and expense management, neo-banking, financial accounting and reporting, lending/mortgages, etc. Similarly, stablecoins provide an opportunity to rebuild many of these cumbersome processes with better rails supported by stablecoins. In the short term, fund management and operations deal with complex operations, which makes the value proposition of stablecoins disruptive.

Conclusion

Stablecoins represent a trillion dollar business opportunity. We want to support founders and visionaries who can see the future of stablecoins, independent of the financial system.