Although there are signs of a shortage of market liquidity during the holiday period, it is a fact that Bitcoin is about to rise.

VX: TTZS6308

Bitcoin is currently down more than 10% from the record high of $108,300 recorded on December 17. Data shows that the trading price has been below $100,000 since December 19.

Although the momentum is slow, Bitcoin may rise to $105,000 in January.

As investors seek to allocate capital across various asset classes, the Bitcoin market is expected to experience range-bound volatility. By the end of January, Bitcoin may fluctuate between $95,000 and $110,000.

Trump's inauguration on January 20 may become an important catalyst for the cryptocurrency sector. Many investors expect the incoming administration to enact more favorable cryptocurrency regulations and improve the US economic policy.

However, Trump's inauguration may not immediately lead to a price increase:

The entire market is waiting for Trump's term to bring more clarity to cryptocurrency policy, but I don't think the inauguration is a bullish event, but rather a prerequisite for paving the least resistant path for the US cryptocurrency market.

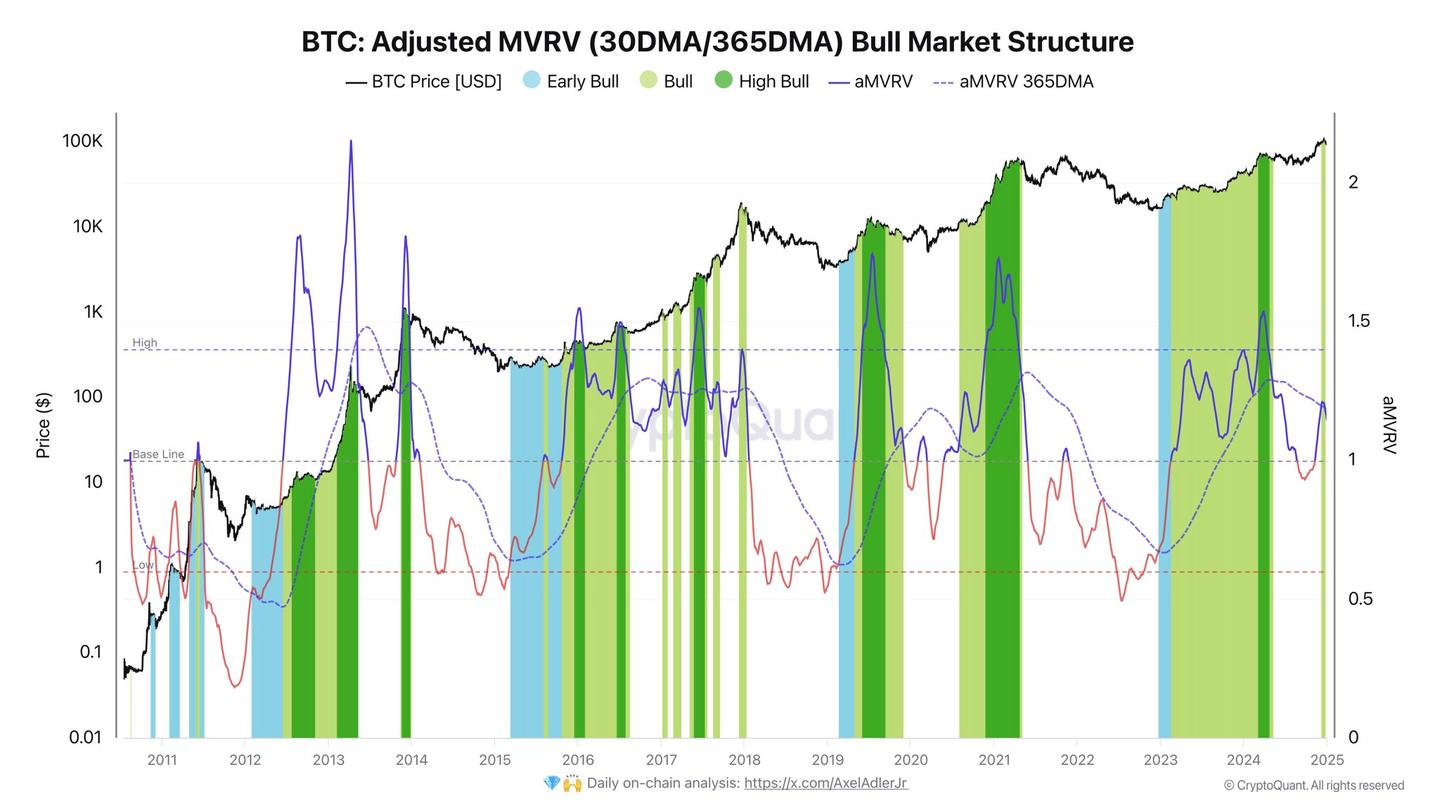

Bitcoin may reach a peak of $200,000 by 2025, and the record growth of the US Bitcoin spot ETF, with assets under management approaching $110 billion, further strengthens this forecast.

Recovery Requires Increased Trading Volume

Although Bitcoin's development trajectory is optimistic, it is still affected by the shortage of holiday liquidity. To recover to six-digit levels, Bitcoin still needs to accumulate more trading volume.

Although the current momentum is strong, there is still a lack of trading volume.

Bitcoin's daily trading volume on January 3 exceeded $66.7 million, down 91% from the $743 million trading volume when it first broke through the $100,000 mark on December 5.

Due to the expected improvement in US government financial policy, investors' risk appetite is constantly increasing, and the outlook for 2025 remains optimistic, with a forecast price range of $150,000 to $200,000.

Which tracks will explode in 2025?

The first is the AI sector, where most of the current AI is still a meme concept without any outstanding large projects, and a hot spot that runs through the whole year will definitely have a project that breaks out to create a wealth effect.

The second is the DEFI sector, which is an indispensable infrastructure for the bull market. Especially after Trump takes office, the current more compliant development is extremely beneficial for the development of DEFI, especially some projects with self-revenue capabilities, such as AAVE and UNI, and the continuous buying of DEFI sector coins by the Trump family is an extremely favorable proof.

Next is the RWA sector, where institutions like BlackRock are accelerating their layout, which provides a new way of liquidation for traditional assets, allowing illiquid assets to be arbitraged or liquidated quickly. The influx of funds brought by ETFs has fully demonstrated the interest of external capital in the cryptocurrency market. Once the trend of RWA explodes, the amount of capital is unimaginable. Compliance and practicality will be the main theme of this bull market.

The market will usher in a new round of upward trend in the first quarter of the year. BTC price may break through the $150,000 mark during this stage, and if the capital situation is strong, the bull top may reach $18-20,000.

The conservative estimate for ETH is $6,000, and the bull top is $8,000-$10,000.

Be alert to the risk of a top reversal in the fourth quarter and grasp the right timing to exit.