The price of Ethereum (ETH) has risen 6% last week, building momentum for a sharp rise to the $4,000 level. The recent formation of a golden cross and the current RSI of 63.6 indicate the possibility of continued upside.

Additionally, whale accumulation has resumed, and the number of wallets holding over 1,000 ETH has rebounded after a brief decline in early January. As ETH remains near key support and resistance levels, its ability to maintain the upward momentum will determine whether the rally can continue or if it will experience a correction.

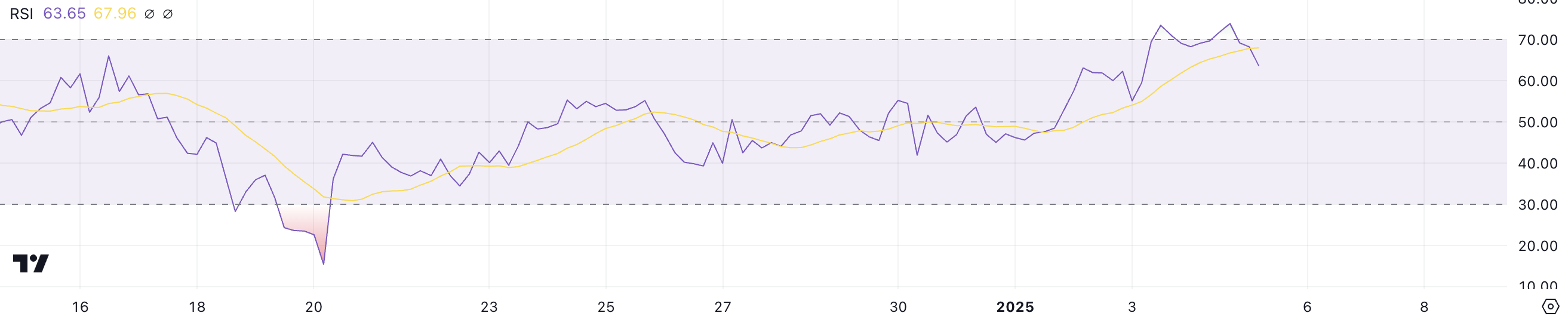

ETH RSI Pulls Back from 70

The Relative Strength Index (RSI) for Ethereum is currently at 63.6, briefly exceeding the overbought threshold of 70 between January 3 and January 4. The RSI measures the speed and magnitude of price movements, providing insights into market momentum.

Readings above 70 indicate an overbought condition and suggest the possibility of a correction, while values below 30 signal an oversold state and potential price recovery. The fact that ETH's current RSI is below 70 indicates that buying pressure has eased, but the upward momentum is still intact.

At 63.6, the RSI for ETH suggests a short-term neutral to bullish outlook. The pullback from overbought levels may indicate that the asset is experiencing some correction as traders take profits, or that the market is undergoing a minor adjustment.

However, the RSI remains above 50, emphasizing sustained buying interest. If the RSI rises back to 70, ETH could see renewed upward momentum, but if it falls below 50, the upward momentum may weaken, potentially leading to a broader price correction.

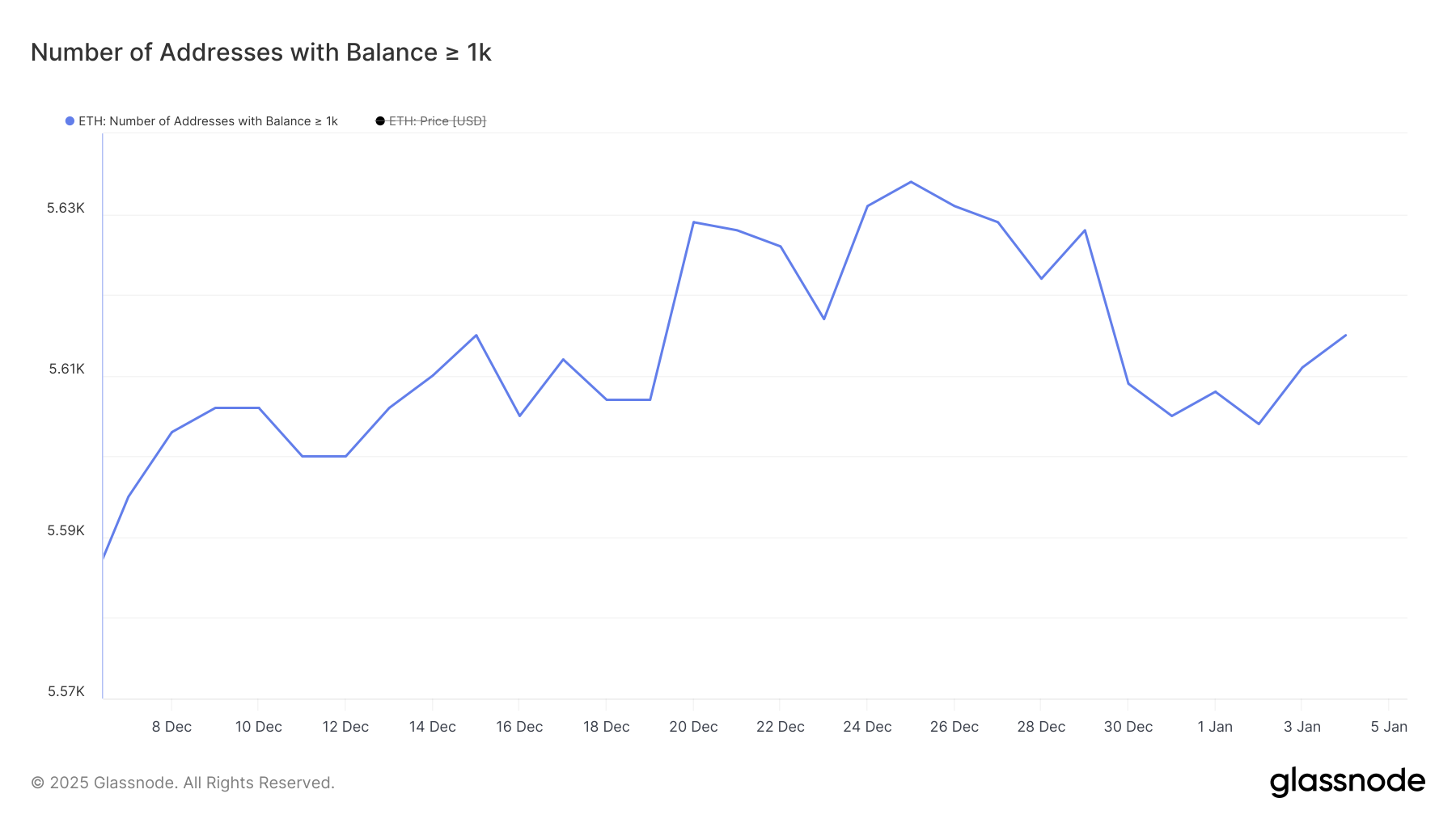

Ethereum Whales Accumulating Again

The number of Ethereum whales holding over 1,000 ETH reached a one-month high of 5,634 on December 25, before declining to 5,604 by January 2. Tracking whale activity is important as these large holders can significantly influence market trends.

Increased whale accumulation indicates growing confidence in the asset and can drive price increases, while a decrease may signal reduced interest or selling pressure.

After reaching 5,604 on January 2, the number of whales has started to increase again, currently standing at 5,615. This rebound in whale activity suggests renewed interest from large investors, which could provide short-term support for the ETH price.

If the upward trend in whale accumulation continues, it may indicate increased market confidence and buying pressure, potentially fueling further price appreciation. Conversely, a decrease in whale activity could signal hesitation among major investors, potentially putting a strain on the ETH momentum.

ETH Price Prediction: Must Hold $3,543 Support

Ethereum's price recently formed a golden cross on January 4, a bullish signal where the short-term EMA (moving average) crosses above the long-term EMA. While ETH price has not yet seen a significant surge following this formation, the technical setup suggests potential upward momentum.

If the uptrend is reinforced by the RSI levels and renewed whale activity, ETH price could test the $3,827 resistance. Breaching this level would open the door for further gains, with the next target potentially at $3,987.

However, the $3,543 support is crucial for ETH to maintain its current uptrend. A failure to hold this support could increase selling pressure on ETH, potentially reversing the momentum. In such a scenario, ETH could retest the key support areas of $3,300, $3,200, and $3,096.