Author: KarenZ, Foresight News

AI agents have long since gone beyond the simple concept of chatbots. Especially at the intersection of Crypto and AI, a new narrative - AI Layer 1 (AI L1) - is quietly emerging.

The "Layer1" here is not a public chain, but refers to the foundational layer of AI technology, covering the basic technology stack and framework of AI agents, and even including AI agent token launch platforms like pump․fun, from which huge value can be captured for their tokens.

ai16z: Launching a Launchpad for Eliza-based agents in Q1

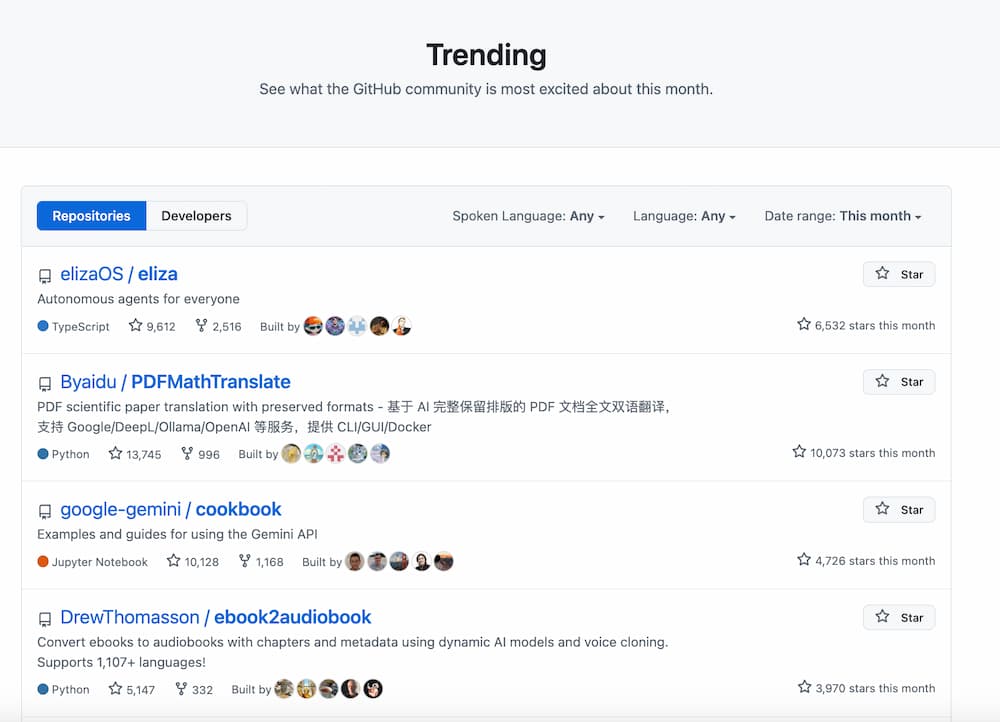

ai16z has become a leader in the AI agent field with its outstanding Eliza agent framework. In the past month, Eliza has performed brilliantly on the GitHub Trending chart, rising to the top of the trend list, adding 6,532 new stars and accumulating a total of 9,600 stars.

However, despite ai16z's great technical success, there is still room for improvement in terms of value capture and accumulation of its token economics model.

To this end, ai16z proposed a plan called "ai16z Token Economics" in December 2024, aiming to transform ai16z into an AI L1 blockchain, launch a Launchpad for Eliza-based agents, make ai16z the base currency for agent-to-agent (A2A) transactions and the "App Store" for agent services, implement node incentives, and establish value capture and accumulation strategies. Through these measures, ai16z aims to build a more comprehensive and robust AI agent ecosystem.

Specifically, the core discussion points of the proposal and the ideas discussed by the Discord community members include:

1. Launching a Launchpad for Eliza-based agent projects in Q1 2025;

2. Making ai16z the base currency for agent-to-agent (A2A) transactions and the "App Store" for agent services. Positioning ai16z as an L1 blockchain for AI;

3. Node incentives;

4. Value capture mechanisms: charging a certain launch fee, requiring holding ai16z to receive allocations at launch, ai16z token staking (to get early access and fee sharing benefits), making ai16z the token for purchasing initial agent products, pairing agent tokens with ai16z liquidity pools.

5. Value accumulation strategies: Buyback and burn mechanism for Launchpad fees (with community user support for reinvesting in Eliza development rather than burning).

5. Providing liquidity mining incentives and locking to stabilize LPs and incentivize long-term liquidity provision.

7. When a new AI project launches its token on the platform, users can trade the token for SOL, with the LP generating a small fee that the platform will collect. The Launchpad may split this fee in two: half used to buyback ai16z tokens from the market, and the other half paired with newly purchased ai16z tokens to create a special liquidity pool to provide additional liquidity for the new project's token.

8. Implementing a community "curation" process, where ai16z partners review projects before launch to maintain quality and consistency with the ai16z brand. This may involve staking and slashing.

9. Treasury diversification: covering major L1 tokens, stablecoins, and selected project tokens to provide liquidity support and incentives for ai16z trading pairs, while avoiding selling agent tokens.

10. No increase in the supply of ai16z tokens.

zerebro: Launching a consumer-oriented AI agent Launchpad

Coincidentally, at the end of last month, zerebro co-founder Jeffy Yu stated that they are building a consumer-oriented agent Launchpad called "Zentients" and providing a value accumulation framework for the ZEREBRO token. Zentients aims to create a seamless UI/UX to launch and develop agents, while channeling value back to the ZEREBRO token. Transaction fees will be used to establish funding pools for specific projects/allocations and strengthen the liquidity of projects or open new trading pairs.

The specific details are as follows (still being finalized):

1. Agents will require ZEREBRO as a creation fee and will be launched based on the ZEREBRO bonding curve and fees.

2. Once the agent token reaches a certain valuation, it will be considered "graduated".

3. The liquidity in the bonding curve will be deposited and locked into a DEX.

4. Thereafter, traders will use ZEREBRO to buy and sell in the liquidity pool.

Of course, zerebro envisions Zentients as a platform compatible with both Web2 and Web3, covering Web2 functionalities such as agent email assistants, coding agents, and financial modeling. zerebro is also exploring the development of a standardized communication layer for agents - "Agent TCP", as well as infrastructure to support multi-agent intelligence. Jeffy Yu also provided an example where one agent can create a tweet, and another agent can critique it and send it back with a revised version for publication.

Furthermore, through collaborations with decentralized providers, zerebro is also building infrastructure to allow users to rent GPUs on Zentients. This means users will be able to directly host their agents, making Zentients not just a launchpad, but also an agent hardware layer. Ultimately, the agents themselves may also take action and rent GPUs for self-training and fine-tuning.

It's worth mentioning that in December 2024, Zerebro also announced a collaboration with ai16z to advance the open-source framework ZerePy. The ai16z team will be among the first external contributors to help develop the ZerePy framework, while the Zerebro team will also contribute to the Eliza framework.

Virtuals: Platform mechanisms drive a self-sustaining economic loop

It is worth noting that the Virtuals Protocol, rooted in the Base ecosystem, is the pioneer in the AI L1 field. Since the launch of its token VIRTUAL on the Binance contract market on December 10, 2024, the price has soared by nearly two times, with a market capitalization exceeding $4 billion.

Looking back to the end of November 2024, the author summarized the potential tokens under the Virtuals AI agent in the article "aixbt Surges 170x, Virtuals AI Agent Potential Tokens Roundup". Since then, the vast majority of the mentioned tokens have shown strong growth momentum. For example, the GAME token has achieved a 12-fold increase, WAI (WAI Combinator) has seen a nearly 17-fold increase, aixbt and VADER have both achieved 4-fold growth, the MUSIC token has also achieved a 3-fold increase, and while the LUNA token's increase was relatively moderate, it still achieved a remarkable 62% rise.

The positioning of the Virtuals Protocol is far more than just an AI agent platform; it is a vibrant ecosystem full of infinite possibilities. Relying on its intuitive and powerful low-code toolkit, users can easily manage the creation and management of AI agents and tokens.

The strong performance of the VIRTUAL token is largely due to Virtuals' token and platform economic system.

First, deploying an agent token requires mandatory staking of 100 VIRTUAL tokens, which are used to establish the liquidity pool for the agent token. Deployers can also purchase a small amount of VIRTUAL to avoid being targeted.

Subsequently, investors provide VIRTUAL tokens. The agent then needs to accumulate a sufficient amount of VIRTUAL in its bonding curve to "graduate" to a fully tradable state, and the liquidity pool will then be deployed to Uniswap.

Equally important is that VIRTUAL serves as the base currency for all AI agent token transactions on the platform, ensuring the token's liquidity and utility. Before purchasing any agent token, users must exchange their USDC, ETH, or other assets for VIRTUAL to make the purchase.

On the proxy economy level, the AI proxies within the Virtuals Protocol ecosystem will charge a 1% transaction fee on all transactions to maintain the costs generated by the proxy execution. Additionally, AI proxies using the inference service will be charged on a per-use basis, with the fees directly deposited into the proxy wallet in the form of VIRTUAL tokens. This sustained demand mechanism makes the proxies high-value, high-efficiency assets within the ecosystem. The income earned will be directly used to buy back and burn the proxy tokens on-chain, further strengthening their deflationary effect. The thriving of the AI proxies within the ecosystem will undoubtedly feed back into the growth of Virtuals Protocol and the VIRTUAL token. According to Dune data, since the launch of the new Virtuals platform on October 16, its cumulative protocol revenue has exceeded $72 million, which is undoubtedly a powerful proof of its strength and potential. Summary: The economic system of the Virtuals platform indeed exhibits a high degree of sophistication and synergy. Through a series of interconnected designs, it not only provides clear economic incentive paths for ecosystem participants, but also constructs a self-sustaining and continuously growing economic loop. This economic system not only lays a solid foundation for the rapid expansion of the platform, but also provides a powerful driving force for the innovation and development of AI proxies. ai16z and zerebro both have the potential to achieve and surpass the success of Virtuals in their respective fields, but this requires them to make the right decisions and execute on token economics, community engagement, technological innovation, and market strategy. In summary, AI L1 is attracting more and more attention with its unique technical charm and economic value. The pioneering projects represented by Virtuals, ai16z, and zerebro are leading the tide of this transformation, building a more complete and robust foundation for the AI proxy ecosystem. These platforms are not only the springboard for project launches, but also the fertile soil for the growth of token value. Although there are currently many criticisms of the implementation details of various AI proxy frameworks in the market, in the world of Web3, the AI proxy that stands out from the rest will have the possibility of winning. Virtuals Protocol ai16z zerebro Uniswap GMX Ren SOL UNI HT AR ONT USDC MX