Author: TechFlow

The AI theme continues to dominate the market, with $a16z, $zerebro, and $griffain all joining Binance contracts, the framework narrative $arc and $Swarms rising steadily, with over 10-fold gains in a week, and various AI Agents emerging one after another. In short, the current AI theme can be described as - completely crazy.

In addition to the soaring prices of various tokens, the practicality of AI is also constantly evolving. Many AI projects are starting to target the DeFi sector, allowing AI to execute complex DeFi operations, and the concept of DeFAI is frequently mentioned.

As Twitter user 0xJeff mentioned in his new article "DeFAI is the New DeFi", "DeFAI is becoming the future of DeFi." The DeFAI trend has emerged, so what is DeFAI all about? And which DeFAI concept projects are worth paying attention to?

TechFlow Note: AI Agent market has high timeliness, token prices fluctuate violently, and there is a high degree of risk. Investors should fully assess the risks and participate cautiously. This article is only based on market hotspots for information sharing, and the author and platform do not guarantee the completeness and accuracy of the content, and this article does not provide any investment advice.

What is DeFAI?

Although DeFi has already become one of the cornerstone concepts of the crypto world, when it comes to specific operations, DeFi still has a certain threshold for ordinary people to enter.

To experience the various conveniences brought by DeFi, an ordinary user needs to learn: find the right project platform, learn to set up various wallets, distinguish between different L1+L2, prevent phishing scams, etc. Relatively speaking, DeFi operations are still too complex.

The emergence of DeFAI has changed this situation to a certain extent.

By definition, DeFAI is "AI+DeFi", using AI to simplify the complex DeFi operation threshold, allowing more people to participate in DeFi in a simpler way, and using DeFi services to manage assets as conveniently as chatting with GPT.

DeFAI Concept, What Projects Are There?

The DeFAI concept is simple and easy to understand, and the first batch of DeFAI concept projects have also begun to emerge. They are currently mainly concentrated in three areas:

Abstraction layer

Autonomous trading AI agents

AI-driven dApps

Abstraction Layer - Simplifying Interaction Operations

The abstraction layer is essentially a user-friendly interaction interface that covers the complex operations of DeFi. Just like driving a car, users don't need to understand the working principle of the engine, as long as they know how to drive.

Before DeFAI, DeFi had already made some simple abstraction layer attempts, such as Uniswap using the abstract cross-chain intent standard ERC-7683 to optimize the cross-chain path. But these solutions still require users to have a certain understanding of DeFi knowledge.

The abstraction layer in the DeFAI era has gone a step further, allowing users to express their investment intentions directly in natural language. For example, directly telling the AI Agent: "I want to invest in ETH, $100 per week", and the system will automatically handle all the complex on-chain operations.

The abstraction layer products currently receiving the most attention in the market are Griffain, Orbit, and Neur. Their common point is that they all try to allow users to complete DeFi operations through chatting, but their focus is different. Griffain is a versatile product, Orbit focuses on cross-chain, and Neur is deeply cultivating the Solana ecosystem.

Griffain

Token contract address:

KENJSUYLASHUMfHyy5o4Hp2FdNqZg1AsUPhfH2kYvEP

Griffain (@griffaindotcom) is an early-issued AI Agent in the DeFAI sector.

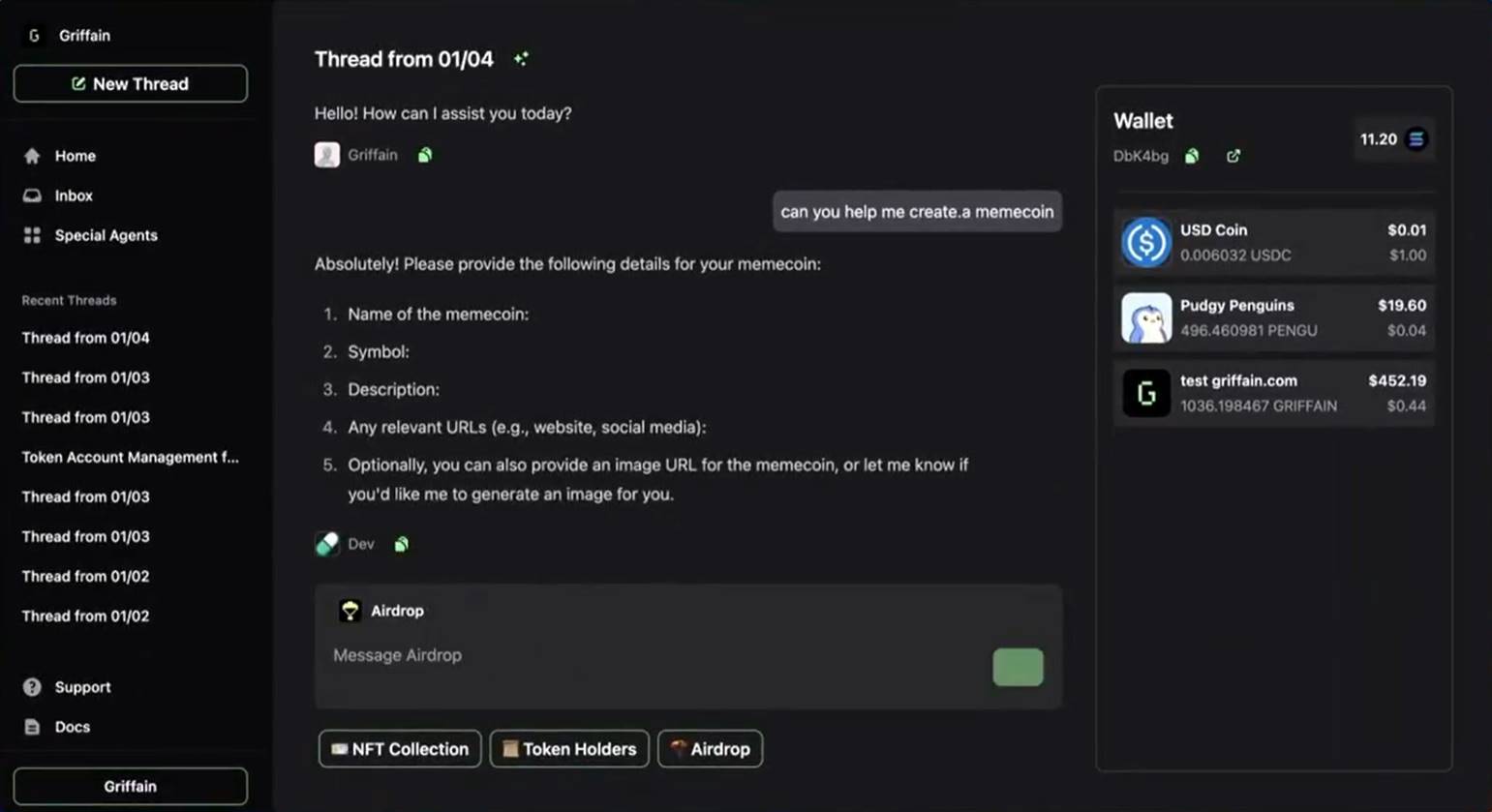

Griffain is divided into two main categories: personal agents and specialized agents. Personal agents are AI Agents created and controlled by users themselves, and users can customize instructions and continuously update the agent's memory. These agents can not only execute on-chain operations, but also perform information retrieval, and plan to support task delegation to other specialized agents in the future.

The specialized agents, on the other hand, are professional AI agents built by Griffain. Currently, they have launched multiple specialized agents including Baxus, Blink, Onchain, Holiday, Sniper, and Flipper, each with specific professional functions.

Griffain currently uses an invitation-only system. Users need to hold an early access pass or Griffain's Saga Genesis token to obtain access rights, and then they can create their own AI agents and access Griffain's specialized agent network.

Orbit

Token contract address:

GekTNfm84QfyP2GdAHZ5AgACBRd69aNmgA5FDhZupump

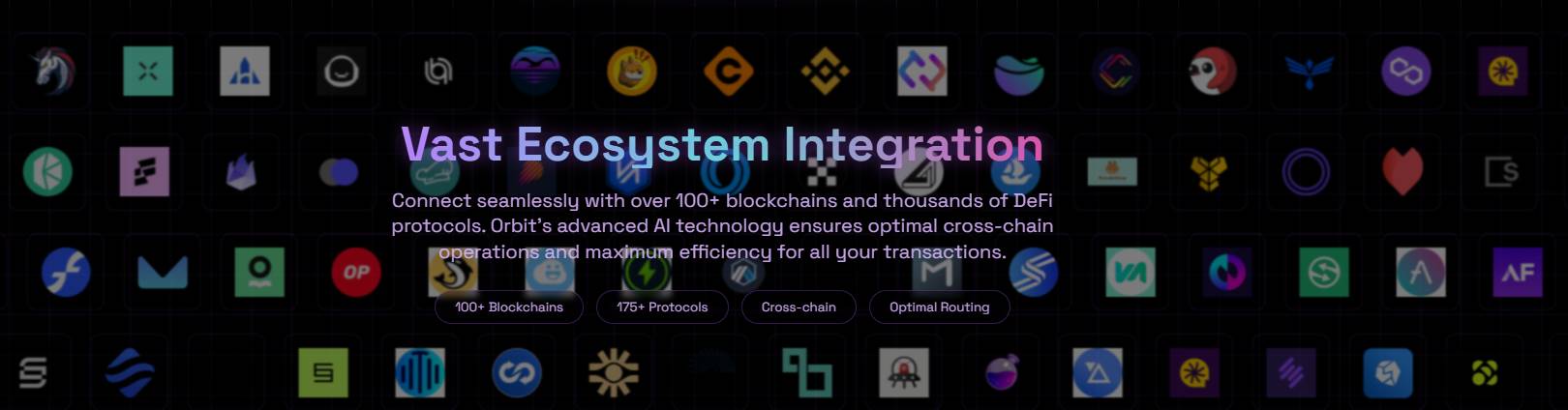

Orbit (@orbitcryptoai) is an AI-driven DeFi assistant platform, with the core goal of simplifying the user's interaction experience with DeFi. Orbit has currently integrated with more than 100 blockchain networks and over 175 protocols, and uses AI technology to improve the efficiency of cross-chain operations. The platform's functions cover cross-chain betting and asset bridging, staking and yield farming strategy optimization, lending protocol access, and comprehensive investment portfolio management tools, allowing users to operate on 116 chains.

Neur

Token contract address:

3N2ETvNpPNAxhcaXgkhKoY1yDnQfs41Wnxsx5qNJpump

Neur (@neur_sh) is a smart assistant in the Solana ecosystem, using an open-source full-stack architecture supported by the Solana Agent Kit. The platform provides an intelligent agent system that supports natural language interaction, and has integrated with major Solana protocols such as Jupiter and Magic Eden. Core functions include smart wallet management, NFT collection analysis, real-time market tracking, and more, simplifying user interaction with DeFi and NFTs through AI-driven interfaces.

Slate

Slate (@slate_ceo) is a project still in the early stage of the DeFAI field, and its core feature is automation. According to user feedback, Slate's automation capabilities perform well in the execution of complex trading strategies, and this automation capability is implemented by drawing on well-known technologies in the industry, such as Chainlink's automation service concept, providing users with a secure and cost-effective solution.

Slate has not yet issued a token, and is still focusing more on product development.

AI Wayfinder

Wayfinder (@AIWayfinder) is an AI full-chain tool that allows users' autonomous AI Agents to navigate safely and effectively within and between the blockchain ecosystem and applications, while independently transacting their assets through a dedicated Web3 wallet.

Autonomous Trading AI Agents

Unlike traditional trading bots that can only execute pre-set programs, the new generation of AI trading agents have much stronger capabilities: they can extract information from complex environments, perform contextual reasoning, learn patterns, and execute operations beyond the original programming...

The AI trading agent field is also shifting from its early entertainment nature (such as Altcoin betting) to practical profit-making tools. But the key issue is: how to verify that an "agent" is truly AI, and not just an ordinary bot or human-operated.

To solve this problem, the industry has introduced two important infrastructures:

Trusted Execution Environment (TEE): Ensure that the agent runs in a secure, tamper-proof environment

Transparent Execution Verification Framework: Use technologies like zero-knowledge proofs to ensure computation is trustworthy

As autonomous agents are about to manage large amounts of funds, these verification mechanisms become particularly important. Users need to clearly understand how the agent manages risks and ensure the safety of their funds.

Although this field is still in its early stages, multiple projects are exploring these key technologies:

Almanak

Here is the English translation of the text, with the specified translations applied:Almanak (@Almanak__) Almanak is a platform focused on democratizing quantitative trading, with the core goal of enabling anyone to create and use AI trading agents to generate returns. The platform's key advantage lies in its unique simulator, which combines agent-based modeling and blockchain-driven Monte Carlo simulation to provide a high-precision forecasting environment for financial strategies.

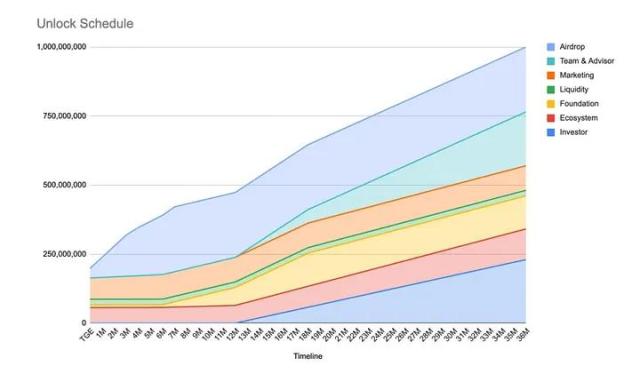

The platform conducts strategy testing and optimization through the simulator, and an execution engine is responsible for strategy deployment and monitoring. Almanak incentivizes ecosystem participants through tokens, with a particular focus on rewarding strategy contributors.

Cod3x

Cod3x (@Cod3xOrg) is a DeFAI ecosystem built by the Byte Mason team (developers of Fantom and Sonic Labs). Its core highlight is the provision of a no-code building tool, allowing users to easily create trading agents. Users can set trading strategies, personality traits, and even tweeting styles for their agents.

The platform integrates a rich set of APIs and strategy libraries, and collaborates with Allora Network to leverage its advanced machine learning price prediction models to enhance the effectiveness of trading strategies. This enables users to access any data set and develop financial strategies within minutes. The platform's flagship agent, Big Tony, is based on the Allora model and performs trading operations on mainstream cryptocurrencies, demonstrating the practical application of AI-driven trading.

Axal & Gekko Agent

Token contract address:

0xf7b0dd0B642a6ccc2fc4d8FfE2BfFb0caC8C43C8

Axal (@getaxal) is an innovative AI trading platform, with its flagship product Autopilot supporting users in creating custom trading agents. The project was founded in 2023, focusing on the development of AI agent infrastructure, responsible for agent source management, competitive auctions, and payment processing. Users can set up auto-rebalancing strategies, yield farming conditions, and create custom token portfolios through Autopilot, such as automatically liquidating when the investment portfolio drops below a certain price.

Axal recently partnered with Agora Finance to further expand its capabilities in automated trading strategies, from rebalancing to creating custom token indices.

Gekko Agent (@Gekko_Agent) is an AI agent launched by AXAL through Virtuals.io. Its main function is to share crypto market information and trading-related content, adopting a 1980s Wall Street trader-style communication on social media.

ASYM

Token contract address:

KENJSUYLASHUMfHyy5o4Hp2FdNqZg1AsUPhfH2kYvEP

ASYM Agents (@ASYM41b07) are described as the "cheat code" for MEME trading, able to analyze large data sets from the blockchain and social media to predict MEME coin trends. (Primarily monitoring and trading tokens on the Pumpfun platform.)

The project's core functionality is divided into two parts: a prediction system, where ASYM uses a set of machine learning models to predict short-term price movements of tokens and execute corresponding trading strategies based on these predictions; and social interaction, where the project has set up an interactive bot on the X platform, building on the a16z framework, to engage with users.

Based on the current development status, ASYM's website is not frequently updated, and its main activities on the X platform are the publication of market analyses similar to @aixbt_agent. The project regularly posts updates through bot accounts, including data on the accuracy of its prediction models and development progress.

Project Plutus

Token contract address:

76PsEyML7UV9uiBDWMdG3itRRuupDuRs6nNpjNBpump

Project Plutus (@ProjectPlutus_) is an AI trading agent project deployed on the Solana blockchain, with its token PPCoin issued through the Pumpfun platform. The project's core goal is to help users maximize returns while freeing them from the tedious chart analysis and complex financial operations.

Project Plutus believes that providing research and analysis alone, like @aixbt_agent, is not enough, and the system needs to have autonomous trading capabilities. Therefore, the project has designed an integrated system that combines analysis and trading: it can perform market research like aixbt, and execute autonomous trades through a funded wallet, allowing users to invest and withdraw funds (AUM). The system's main functions include automated strategy execution, portfolio management optimization, and trade completion based on users' financial goals.

The project is developing more features, such as enabling the Agent to evaluate the code quality of projects on Github, to expand the analysis dimensions. In terms of token application, users holding more than 5,000,000 PPCoins can unlock more advanced analysis functions, a mechanism similar to the token staking model on Cookie platform, providing actual utility for the token.

AI-driven DApps

AI-driven DApps represent a promising direction in the DeFAI field. These complete decentralized applications integrate AI or AI Agents to enhance functionality, automation, and user experience. Although this sub-sector is still in its early stages, some ecosystems and projects have already started to emerge.

Mode Network

Token contract address:

0x084382d1cc4f4dfd1769b1cc1ac2a9b1f8365e90

Mode Network (@modenetwork) is one of the most active ecosystems in this field, designed as a second-layer network to attract high-tech AI x DeFi developers. Several teams are currently developing cutting-edge AI-driven applications on Mode:

ARMA (by Giza Tech)

ARMA (@0xARMAgeddon) is an emerging AI-driven yield optimization project in the Mode Network ecosystem, developed by Giza Tech (@gizatechxyz). The project focuses on automated USDC asset management, and is a core application in the Mode Network AI Agent App Store. ARMA operates in a self-custodial mode, using smart contracts to ensure user control over assets. Its core function is to continuously monitor the yields of various lending protocols on Mode Network and automatically rebalance funds at appropriate times.

Modius

Modius is an autonomous agent supported by Autonolas (Olas) @autonolas, used to manage Balancer liquidity pools. The multi-agent autonomous system was launched on the Mode Network in 2024. Modius has joined the Mode Network AI agent ecosystem, including ARMA, to drive the development of DeFi automation.

Amplifi Lending Agents

Amplifi Lending Agents, developed by Amplifi.Fi (@Amplifi_Fi), utilize AI algorithms to analyze market data and automatically adjust investment strategies, providing optimized yield solutions for users. The core functions include smart asset allocation, risk management, and yield rate optimization, helping users achieve better investment returns in the DeFi market through automation. Amplifi Lending Agents are also integrated with Ironclad Finance, enabling automatic asset swapping, lending on Ironclad, and yield maximization through auto-rebalancing.

HeyAnonai

Token contract address:

9McvH6w97oewLmPxqQEoHUAv3u5iYMyQ9AeZZhguYf1T

HeyAnonai (@HeyAnonai) can automatically execute cross-chain bridging, token swapping, staking, and other complex operations, while real-time aggregating and analyzing project data from multiple channels such as Twitter, Discord, and GitHub. Through natural language processing technology, HeyAnon helps users quickly obtain information on price changes, community sentiment, and development dynamics, improving the efficiency of DeFi investment decisions.

Recently, @danielesesta has attracted widespread attention through HeyAnonai's (@HeyAnonai) DeFAI theory. He announced that HeyAnon is developing the following:

An abstraction layer as a DeFi interface

A DeFi agent for autonomous trade execution

A research and communication agent for acquiring, filtering, and interpreting relevant data