Brief Overview

Key Events: This week will see the release of several important data, such as US non-farm payrolls, Eurozone inflation rate, and the FOMC meeting minutes, which are crucial for the sentiment in the crypto market.

Central Bank Dynamics: Inflation and labor market data will directly impact the policy decisions of the ECB and the Fed, which could lead to violent fluctuations in crypto prices.

Global Perspective: Geopolitical risks, regulatory policy changes, and energy price volatility make the market more complex, with Elon Musk's X-Money plan and the potential impact of China's GDP growth particularly worth noting.

As the second week of 2025 approaches, a series of important economic data will be released. These data will not only have a broad impact on the global market, but are also crucial for the rapidly developing crypto market. From the trend of inflation to the latest dynamics in the job market, these indicators will provide key clues for us to interpret market trends, liquidity changes, and central bank policies.

Why is the second week so important for crypto traders?

As the new year just began, the market's attention to inflation, employment data, and central bank decisions continues to heat up. For crypto traders, the focus remains on how macroeconomic changes affect the price trends of digital assets in a volatile environment.

Review of the First Week

The first week of 2025 provided us with some preliminary signals of global economic trends:

China: The manufacturing PMI released by the National Bureau of Statistics fell slightly to 50.1, indicating that the economic recovery is still facing challenges despite continued policy support.

Germany: The unemployment rate has risen slightly, highlighting the pressures facing Europe's largest economy.

US: The ISM manufacturing PMI rose to 49.3, suggesting that the US manufacturing sector may be stabilizing after consecutive months of decline.

These data set a cautiously optimistic tone for the start of the new year. Traders are closely monitoring the upcoming data releases and policy dynamics to formulate more precise investment strategies.

Table of Contents

Overview of Important Economic Data from January 6 to January 10

Macroeconomic Drivers: Inflation, Consumer Behavior, and Labor Market Resilience

Central Bank Policies and Their Impact on the Crypto Market

US Non-Farm Payrolls

Eurozone Inflation Rate

FOMC Meeting Minutes

US ISM Services PMI

Focus on Key Economic Indicators

Flexible Response to Changes in Market Sentiment

Wise Management of Volatility Risks

Global Risks and Opportunities

Geopolitical Risks: How They Affect the Market

X-Money Plan and the Future of Bit

Regulatory Dynamics and the Rise of Central Bank Digital Currencies (CBDCs)

Energy Price Volatility and Its Impact on Crypto Mining

Highlights of the Week

This week will see the release of several important economic data, which may have a significant impact on market trends. For crypto traders, understanding these trends in advance is key to formulating trading strategies.

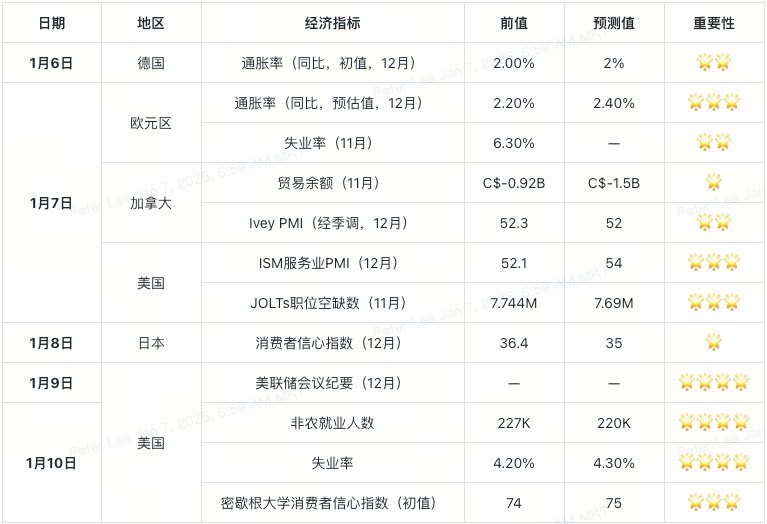

Overview of Important Economic Data from January 6 to January 10

Here are some key data to watch this week and their potential market impact:

Macroeconomic Drivers

Inflation: A Key Factor for Central Bank Decisions

Europe: German and Eurozone inflation data will provide important clues for the ECB's future monetary policy. If inflation remains high, it may trigger more tightening measures, which could affect the market's risk appetite and the crypto market.

US: Producer Price Index (PPI) and core inflation data will determine market expectations for the Fed's next policy move. If inflation slows, it may encourage more investment in risk assets, including cryptocurrencies.

Consumer Spending and Confidence

US: The ISM Services PMI and the University of Michigan Consumer Sentiment Index are important indicators for assessing economic resilience and consumer spending capacity. If the data performs strongly, it may mean the economy remains stable, but it could also reduce the likelihood of the Fed easing policy. For the crypto market, this could be both an opportunity and a challenge.

Labor Market Dynamics

The non-farm payrolls data to be released this Friday is a global market focus. If the data falls short of expectations, it may indicate a cooling labor market, which could increase the likelihood of the Fed shifting to a more accommodative policy, providing a boost to the crypto market.

Central Bank Signals

FOMC Meeting Minutes (Thursday): The minutes will provide detailed information on the internal discussions at the Fed's December meeting, and traders will look for signals regarding rate cuts or policy shifts. If the content leans dovish, the crypto market may receive a boost; conversely, hawkish rhetoric could dampen market enthusiasm.

European Central Bank: Inflationary pressures in the Eurozone remain a major challenge for market confidence. If there are further signs of tightening, it may impact the trading activity of euro-denominated stablecoins and related crypto assets.

In-Depth Data Analysis

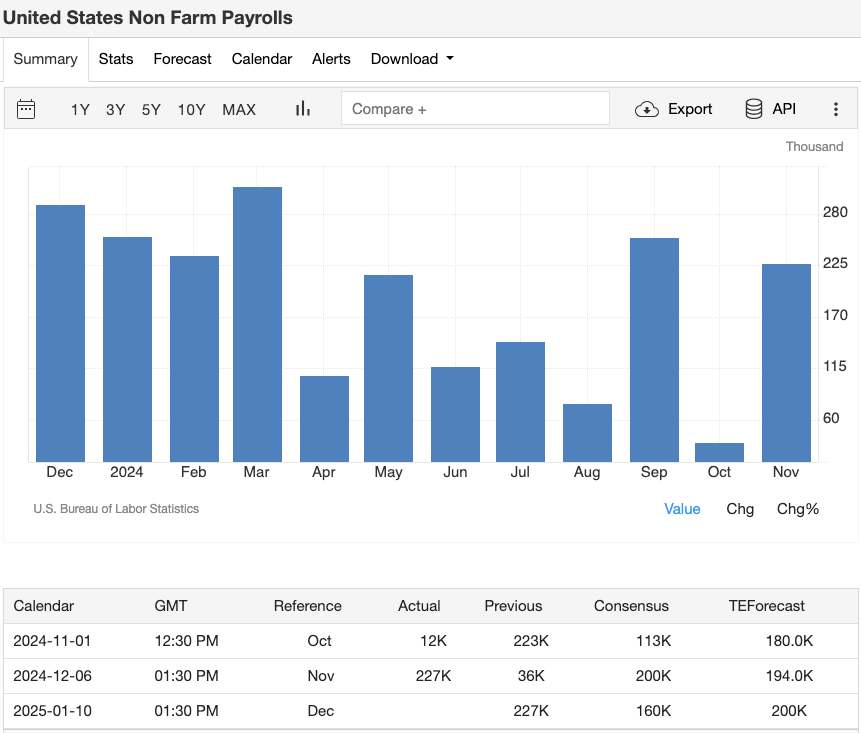

US Non-Farm Payrolls (January 10, Friday)

Why It's Important: As a core indicator of the health of the US economy, the performance of non-farm payrolls directly impacts the market. Strong data typically boosts the US dollar and weakens the performance of risk assets (including cryptocurrencies); conversely, if the data falls short of expectations, it may lead investors to bet on the Fed easing policy, which could benefit the crypto market.

Forecast: The expected increase in non-farm employment is 220,000 (previous 227,000).

Potential Impact: If the data exceeds expectations, the market may experience a temporary correction; while a result below expectations could stimulate a rebound in cryptocurrency prices, especially if investors expect the Fed to adopt a more accommodative policy.

Image Credit: Trading Economics

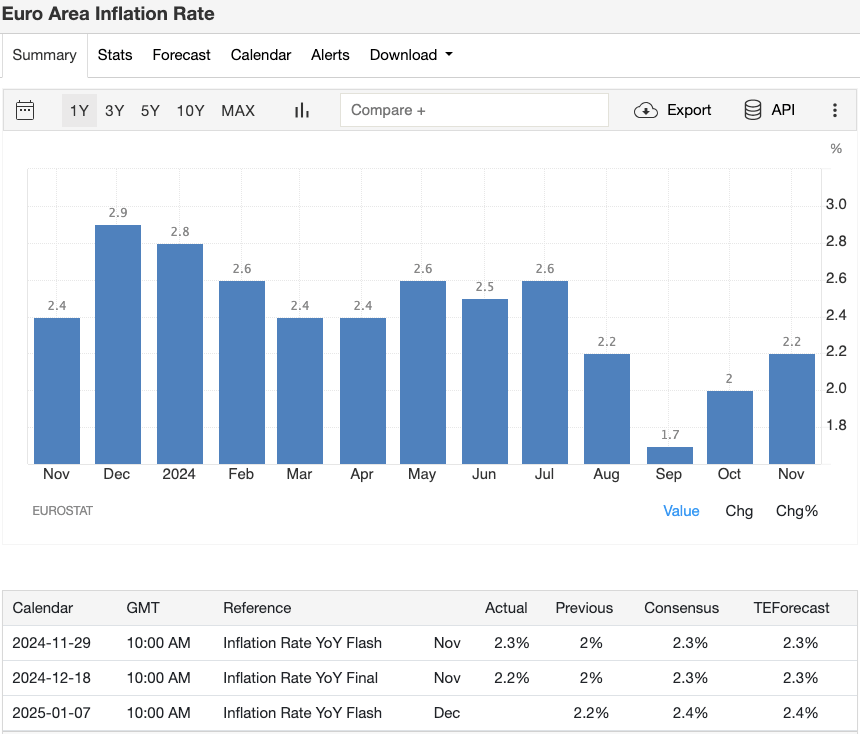

Eurozone Inflation Rate (January 7, Tuesday)

Why It's Important: Inflation data is an important reference for the ECB's policy decisions. High inflation usually means that tightening policies will continue, while a slowdown in inflation may lead the market to expect a policy shift towards easing.

Forecast: Year-over-year increase of 2.4% (previous 2.2%).

Potential Impact: If the data exceeds expectations, the market may become more cautious about risk assets (including euro-denominated stablecoins and crypto assets); if inflation is lower than expected, it may release more risk appetite, providing a boost to the crypto market.

Image Credit: Trading Economics

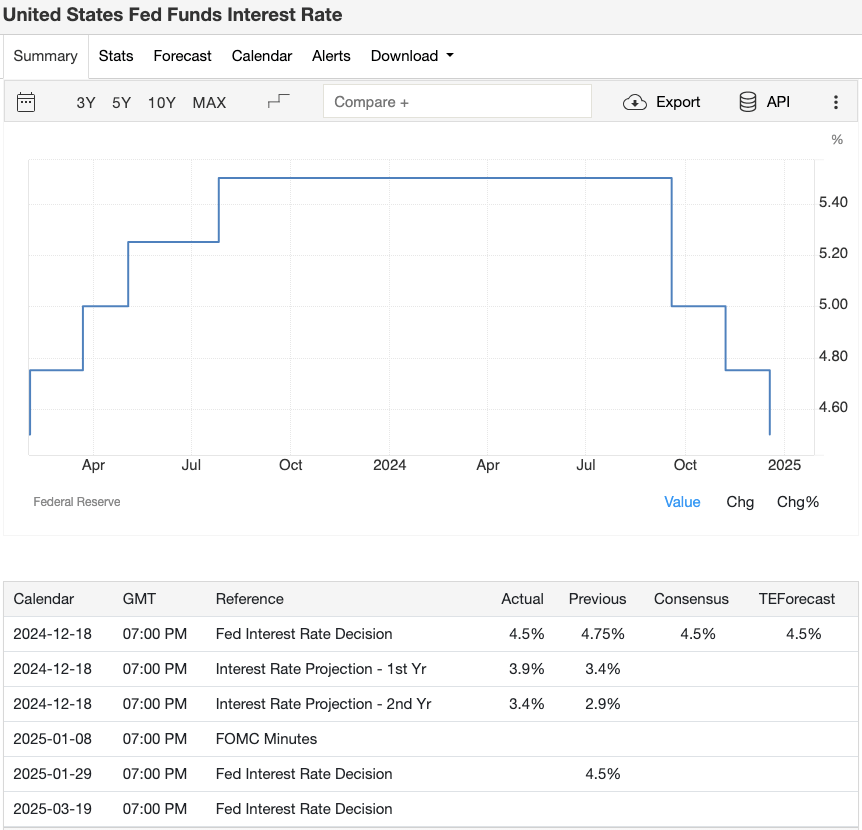

FOMC Meeting Minutes (January 9, Thursday)

Why It's Important: The meeting minutes will provide details on the Fed's internal policy discussions in December, which is an important window for observing the direction of monetary policy in 2025.

Potential Impact: A dovish signal may increase market expectations of rate cuts by the Fed, thereby boosting crypto market sentiment; hawkish content, on the other hand, may make investors more cautious and depress the prices of risk assets.

Image Credit: Trading Economics

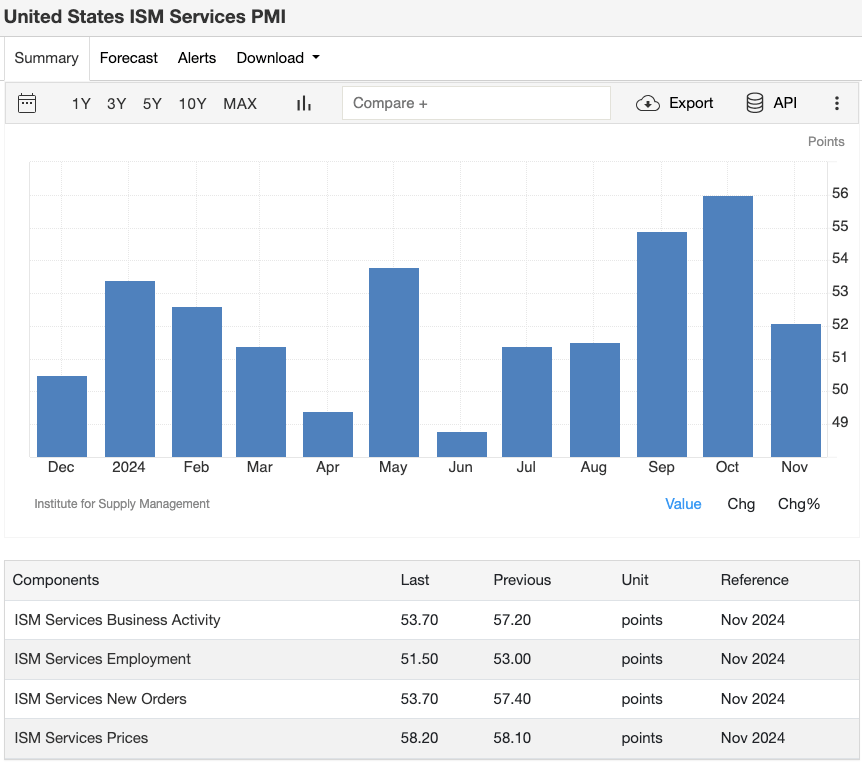

US ISM Services PMI (Tuesday, January 7)

Why it's important: The data reflects the overall health of the US service sector, and is also an important indicator for assessing economic resilience.

Forecast: 54.0 (previous 52.1).

Potential impact: If the data is strong, it may strengthen market confidence in the stability of the US economy, but this may also reduce the likelihood of the Fed easing policy, putting some pressure on the crypto market. Conversely, data below expectations may stimulate more risk appetite, providing support for crypto asset prices.

Image Credit: Trading Economics

Trader Strategy Guide

Focus on key economic data

This week's US non-farm payroll data and ISM services PMI are of paramount importance. These data not only reveal the labor market and economic vitality, but will also directly affect the price trend of the crypto market.

Don't overlook the Eurozone's inflation data, as it may affect the policy direction of the ECB and indirectly impact crypto assets and stablecoins related to the Euro.

Respond flexibly to market sentiment

As the Fed's meeting minutes and Eurozone economic data are released, market sentiment may fluctuate rapidly. Hawkish signals may put pressure on risk assets, while dovish signals may stimulate a rise in cryptocurrency prices.

Stay sharp and adjust your strategy in a timely manner to cope with the volatility caused by policy expectations or data performance.

Manage market volatility wisely

High-impact events (such as non-farm data and Fed meeting minutes) often exacerbate market volatility. At these critical time points, you can use stop-loss orders or appropriate hedging to protect your positions and reduce risk exposure.

Ensure sufficient liquidity before and after major data releases, so that you can flexibly adjust your trading plan when the market is experiencing violent fluctuations.

Global Risks and Opportunities

Geopolitical risks and their market impact

Geopolitical tensions remain a potential risk that cannot be ignored in the crypto market.

US: After Trump took office, the market expected the US to have a more friendly attitude towards cryptocurrencies, which may further mainstream crypto assets.

China: In contrast, China has banned private ownership of Bitcoin, and is instead focusing on promoting the digital renminbi. This vastly different policy direction may exacerbate market uncertainty and volatility.

Global hotspots: The continued escalation of the Ukraine situation and conflicts in the Middle East also add risks to the market. Although Bitcoin is sometimes seen as a safe-haven asset, its correlation with traditional financial assets is weakening this characteristic.

Image Credit: CSO Online

X-Money Plan and the Future of Bit

Elon Musk's X-Money plan is expected to be a major breakthrough in the payment field.

Disrupt the payment landscape: According to the information disclosed, X-Money will deeply integrate cryptocurrency functions, which may fundamentally change traditional payment methods.

Opportunities for Bit: As the price of Bitcoin gradually approaches $100,000, the market has high expectations for Musk's plan, believing that this may attract more institutions to participate and accelerate the global adoption of Bitcoin.

Image Credit: Tekedia

Regulatory Policies and CBDC (Central Bank Digital Currency) Development

The global regulatory environment for cryptocurrencies is changing rapidly:

UK: The Financial Conduct Authority (FCA) plans to introduce stricter crypto regulations by 2026, which may have long-term implications for the market.

Morocco: It is formulating new cryptocurrency laws and exploring the launch of its own central bank digital currency (CBDC).

Bank of England: The decision on a digital pound is still in the observation stage, which may affect the competitive landscape between cryptocurrencies and CBDCs.

Image Credit: Bitcoinist

Energy Prices and Crypto Mining Costs

Fluctuations in energy prices directly affect Bitcoin mining activities:

High costs suppress production: If energy prices remain high, miners may slow down production, which could affect network computing power and the supply of Bitcoin.

Low costs promote expansion: If energy prices fall, miners may expand their production scale, increasing the supply of Bitcoin in the market.

Environmental pressure: As global attention to sustainable development increases, the mining industry is facing greater environmental pressure. Especially as Musk emphasizes energy efficiency in the X-Money plan, this may have a significant impact on future mining methods.

Energy prices not only affect miners, but also influence investors' expectations of Bitcoin, bringing new variables to market trends.

Image Credit: Dreamstime

Week 3 and Future Outlook

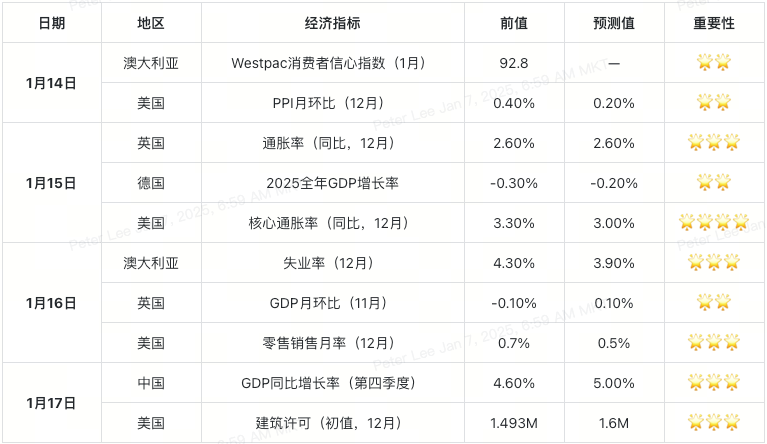

Upcoming Data and Trends

In Week 3, a number of important economic data will be released, including consumer confidence, inflation rate and GDP growth. In addition, US retail sales data will also be published this week, providing an important reference for consumption trends.

Key Indicators to Watch (January 13 - January 17)

China's GDP Growth

Why it's important: China's GDP growth was 4.6% in the third quarter, indicating challenges in the real estate market and domestic demand. The forecast for the fourth quarter is 5.0%, which will reveal whether policy stimulus is starting to take effect. If the data is strong, it may boost global market confidence and inject more funds into crypto assets related to the Asian market.

US Core Inflation Rate

Why it's important: The core inflation rate in November was 3.3%, indicating that inflationary pressures still exist. The forecast for December is 3.0%, which will directly affect market expectations of Fed policy. If the data is lower than expected, it may drive the prices of risk assets (including cryptocurrencies) to rise.

US Retail Sales Data

Why it's important: The retail sales data for December is expected to be released in the middle of this week. These data will reflect holiday consumption performance, directly affecting the market's assessment of economic resilience. Strong consumption data may indicate a robust economy, but may also reduce expectations of the Fed easing policy, leading to a complex reaction in the crypto market.