I. Attention Value - Market Highlights

1. Market Situation

(1) Macroeconomic Environment:

l Cryptocurrency market rebounds on Trump's inauguration expectations, related concept coins surge significantly

As Trump is set to take office in 2025, the cryptocurrency market has seen a significant rebound, with related concept coins generally rising. Among them, TRUMPCOIN surged 469.3% in 24 hours, TRUMP rose 59.6%, FIGHT and MAGA increased 48.2% and 41% respectively. Investors are full of expectations for Trump's commitments to the crypto industry. Trump repeatedly expressed support for the crypto industry during the campaign and gained the support of key figures in the industry.

Sean Farrell, head of digital assets at Fundstrat, pointed out that the first 100 days of Trump's term will be crucial, as this period is often seen as a barometer of the new president's governing efficiency. Although no specific plans have been announced, investor focus includes whether Trump will fulfill his commitment to establish a strategic Bitcoin reserve, and whether crypto regulations will be relaxed.

Bitwise CEO Hunter Horsley mentioned that the Trump administration may relax merger and acquisition regulations, which could accelerate the integration of large tech companies, thereby promoting the development of the cryptocurrency industry. He emphasized that the core idea of cryptocurrencies is distrust of large institutions, and the M&A activities of large enterprises may further highlight the importance of decentralization.

(2) Web3 Field:

l Cryptocurrency market sees new year rebound, Bitcoin and Ethereum make strong comeback, AI concept coins see significant adjustments

The cryptocurrency market has seen a significant rebound in the new year, with Bitcoin rebounding after a nearly 15% drop, currently fluctuating around $99,000, and the market sentiment is bullish, ready to challenge the $100,000 mark again at any time. Ethereum's performance has also been relatively strong, rising more than 18% in the past two weeks, and other Altcoins have also seen a significant rebound. However, AI agent concept coins have seen a significant adjustment after a series of consecutive days of increases. For example, ai16z fell 10.7% in 24 hours, ZAILGO fell 34.2%, SWARMS and ELIZA fell 24.7% and 15.1% respectively.

Key financial events to watch this week include the December FOMC meeting minutes and the December non-farm payroll report released on Friday. The meeting minutes can provide a clear understanding of the Fed officials' views on the US economic outlook and whether they believe the risks of economic growth slowdown are rising. These factors will have a significant impact on future market trends.

2. Hot Events

(1) Macroeconomic Environment:

l Metaplanet plans to increase its Bitcoin holdings to 10,000 by 2025, driving its influence in Japan and globally

Metaplanet CEO Simon Gerovich announced that the company's goal is to increase its Bitcoin holdings to 10,000 by 2025, in order to enhance its influence in the Bitcoin ecosystem in Japan and globally. Currently, Metaplanet holds 1,762 Bitcoins, making it the largest corporate Bitcoin holder in Asia and ranking 15th among listed companies. Gerovich said at MicroStrategy CEO Michael Saylor's Bitcoin New Year's party that if President Trump uses Bitcoin as a strategic reserve, many countries may follow the US's lead. He emphasized that Metaplanet is not just creating a company, but driving a movement around Bitcoin.

(2) Web3 Field:

l Vitalik Buterin reviews the concept of decentralization acceleration, discusses AI safety regulation, the importance of cryptocurrencies in public product financing

Ethereum founder Vitalik Buterin, in his latest long article "d/acc: one year later", reviewed the development of the decentralization acceleration (d/acc) concept he proposed last year, focusing on three key issues: AI safety regulation, the role of cryptocurrencies in d/acc, and public product financing. On AI safety, Buterin proposed two main strategies: first, establishing accountability, setting reasonable legal responsibilities for AI users, deployers and developers; second, establishing a global "soft pause" mechanism at the industrial-grade hardware level to reduce global computing power by 90-99% if necessary. He believes these measures can effectively address the potential risks of AI. Regarding cryptocurrencies, Buterin pointed out their three main connections with d/acc: extension of values, formation of early adopter communities, and complementarity of technologies. He emphasized the contributions of the crypto community in areas such as prediction markets and zero-knowledge proofs, demonstrating the importance of crypto technology in promoting decentralization and democratization. The article also discussed innovative public product financing mechanisms, including quadratic funding, retrospective public product financing, and deep funding, emphasizing the importance of decentralized financing for the development of open-source projects. Buterin believes that a strong public product funding mechanism can promote the popularization of open-source technologies, reduce monopoly risks, and provide stable funding support for d/acc. Although currently facing challenges of rapid technological development and reduced global cooperation, Buterin believes that new tools such as AI and biotechnology provide humanity with the ability to address these challenges. He is full of confidence in the future and looks forward to achieving a safer and freer world through decentralized technologies.

3. Hot Narratives

l Swarms announces major upgrade plan, launches new features to enhance AI agent collaboration and market performance

Here is the English translation of the text, with the specified terms translated as requested:On January 6, Swarms founder Kye Gomez announced a major upgrade plan for the market segment, launching seven core functions, including automated agent deployment, paywall integration, and token payments. Developers can use the Phantom wallet to trade with SWARMS tokens and receive rewards based on quality assessments. Additionally, the new version will introduce one-click cloud deployment API, real-time chat, and data tracking features, aiming to enhance the ecosystem's automation and creator earnings.

The core idea of Swarms is to leverage collective intelligence to solve complex problems through the collaboration of multiple AI agents. This system not only supports seamless integration with external AI services and APIs, but also provides agents with virtually unlimited long-term memory to enhance contextual understanding and allow for customized workflows. Its high reliability and scalability, combined with the ability to automatically optimize language model parameters, enable Swarms to more effectively address complex challenges.

Previously, the SWARMS token market capitalization had surpassed $300 million, setting a new record, but as of January 6, the market capitalization had fallen back to $270 million, a 24.7% drop in 24 hours. Nevertheless, according to on-chain data analyst @ai_9684xtpa's monitoring, the top 1 whale address holding SWARMS has not yet made any sell or transfer operations and still holds 60.129 million SWARMS.

II. Attention Value - Trending Projects

1. Project Introduction

l $hive | AI agent | @HiveSolana

- Narrative: HIVE has built an infrastructure that allows AI agents to deploy tokens based on viral trends. The system monitors Twitter API, TikTok data streams, and Google Trends to analyze popular content on mainstream media and social platforms, and uses the Pump Fun verification framework to deploy tokens, automatically distributing the revenue to HIVE holders.

- Token Allocation: HIVE will randomly acquire 1%-3% of the total token supply, with 50% used for single-sided Raydium CLMM liquidity provision, and the other 50% gradually sold off within 24 hours.

- Earnings Distribution: 40% will be used to buy back and burn HIVE tokens in the market, 40% will be distributed in SOL to the top 250 holders, 10% will support the growth of AI ecosystem projects, and the remaining 10% will go into the treasury to support future deployments.

- Currently, HIVE has successfully deployed its first token, but due to Raydium API limitations, the initial attempt failed, and the development team has fixed this issue.

- HIVE's current peak market capitalization is $12M, and it is currently in a correction phase.

III. Attention Value - Sector Rotation

1. Trending Sectors

Source: Dune, Dot Labs

Source: Dune, Dot Labs

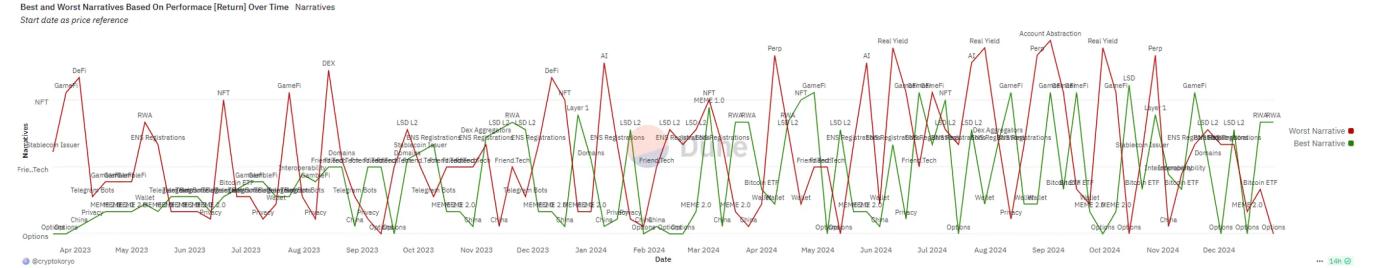

2. Sector Rotation

Source: Dune, Dot Labs