Author: YB

Compiled by: TechFlow

Image: From @YB, compiled by TechFlow

Let's make 2025 a year full of excitement. No pressure, only motivation!

I just had two very pleasant holidays and now I can't wait to get back into research and writing!

To be honest, I just got back to New York yesterday and I'm still adjusting to the time difference. So if this article seems a bit messy, please bear with me.

Although I said I was on vacation, in the crypto space, with such a volatile market, no one (including myself) really knows how to take a proper break.

During the holidays, I still spent a lot of time on Twitter, mainly reading some articles about TechFlow Agents, following the news about OpenAI's O3 model, and observing the crazy price surge of TechFlow frameworks.

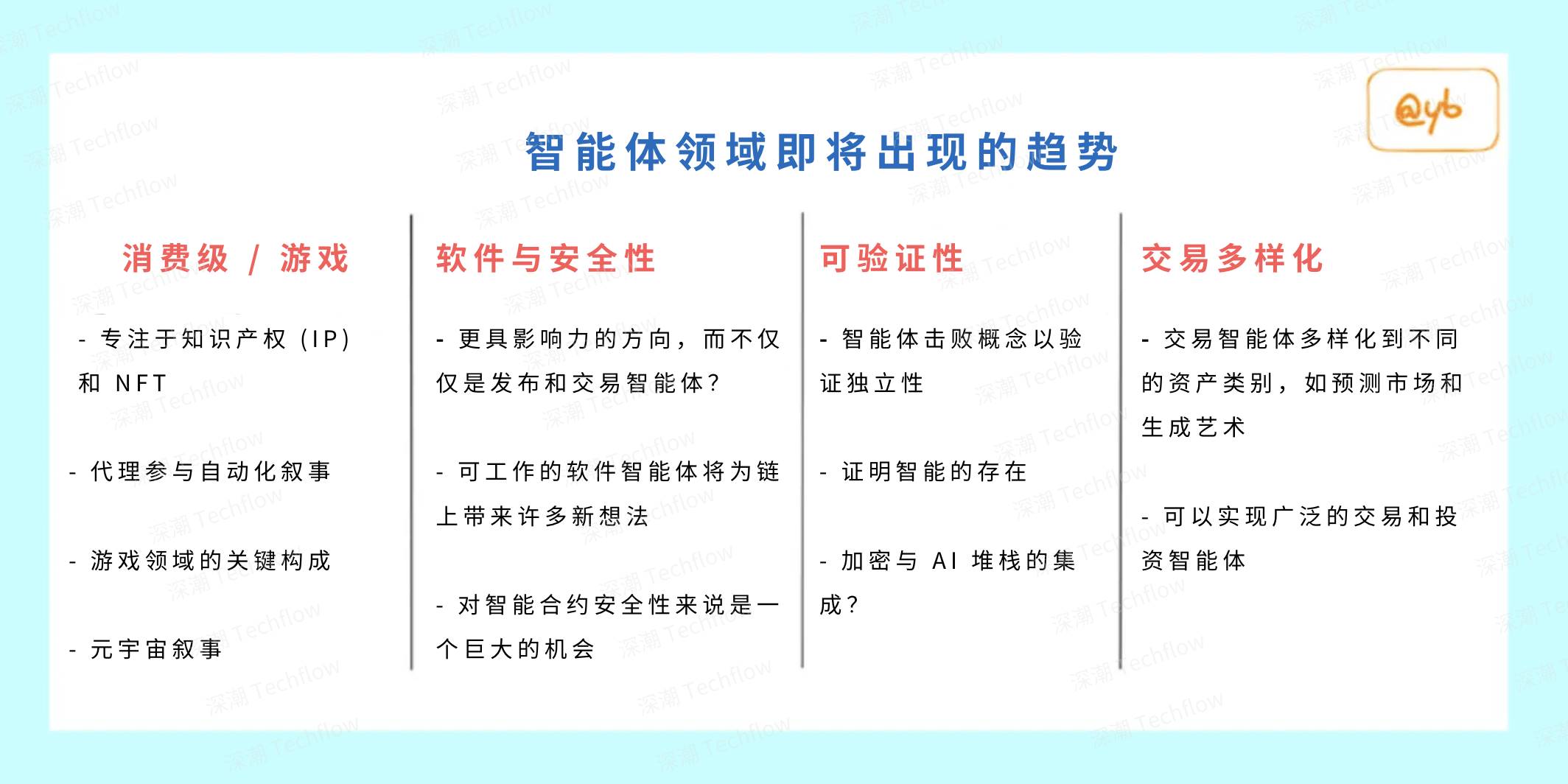

Today's article will be some of my key thoughts in the first quarter of 2025:

Is the TechFlow framework the new L1?

The attention shift to consumer TechFlow Agents

The diversification of trading TechFlow Agents

The risks of lack of regulation

Let's get started!

Is the TechFlow framework the new L1?

The biggest winners during the holidays were undoubtedly the TechFlow frameworks, such as ai16z, Virtuals, Arc, Griffain and Zerebro.

ai16z's market cap has exceeded $2 billion, while Virtuals has surpassed $4 billion! It's worth noting that when I first mentioned these projects in my article at the end of last October, ai16z's market cap was less than $80 million, and Virtuals was only around $350 million. If this doesn't show the bullish sentiment, I don't know what else can.

With the rapid price increase of these projects, TechFlow infrastructure (Agent Infra) projects have naturally attracted the attention of the entire crypto Twitter community.

I've recently noticed a new discussion trend: TechFlow frameworks are seen as investment opportunities similar to L1 blockchains in this market cycle. If you've been through the crypto market in 2020-2021, you may still remember the heated discussions around L1 projects like Cardano, Avalanche, and Polkadot. And those small-cap alternative L1 projects (Alt L1s) also became one of the highest-yielding investment opportunities at the time.

However, I have some reservations about whether TechFlow frameworks can truly become the L1 investment opportunities of this cycle.

From an understanding perspective, this analogy does help people build a mental framework for the TechFlow narrative. There are indeed many similarities between the two. For example, Virtuals, ai16z, and other frameworks are building the infrastructure layer to support developers in creating consumer-facing TechFlow Agents (more on this in the next section). Just as L1 blockchains are customized based on specific on-chain use cases, TechFlow frameworks are also striving to attract the attention of specific developer communities.

For example: Arc focuses on serving a small group of Rust programmers; Virtuals hopes to grow its ecosystem by increasing collaboration between TechFlow Agents; Eliza's promotion is aimed at open-source enthusiasts and the AI community, emphasizing the value of pure open-source; while ZerePy is the lowest-barrier framework, particularly suitable for new developers who want to use Python.

Overall, the analogy between TechFlow frameworks and Layer 1 blockchains (L1) has some merit.

Image: From @arndxt_xo, compiled by TechFlow

But the reason I don't fully agree with this analogy is that people in the crypto space tend to be too focused on comparing valuations.

Let me clarify that I'm not predicting whether ai16z will surpass the market cap peak of L1s from the previous cycle. My point is that I've seen many posts on social media similar to "a project reached ... historical high in the last cycle, so ......". This mindset is actually problematic. Investment decisions need to consider many different factors, and most people are not as deep into the market as those who post "bull market" messages. Therefore, such simple analogies may give a false sense of hope or lead to incorrect price expectations, which can negatively impact investment decisions.

My suggestion is to strictly limit the L1 analogy to the "infrastructure vs. consumer applications" relationship. If you want to set a target market cap for Virtuals, I suggest you develop a suitable analysis framework for this specific project. For example, what is the total addressable market (TAM) in the short term? Is it limited to those active users on Solana and Base, or the entire crypto Twitter community? What catalysts can make these TechFlow frameworks attract a wider tech audience? All these questions need to be carefully considered, so I want to remind everyone to be cautious about those seemingly simple valuation comparisons.

Attention shifting to consumer-facing TechFlow Agents

During the holidays, I posted a long Twitter thread on this topic. Personally, I feel that we are approaching the "attention peak" of the TechFlow infrastructure frameworks. The key word here is "attention". I'm not predicting price movements, but simply discussing market attention.

Here is the content of the tweet, which requires almost no modification, so I'll just copy it here. This tweet received a good response, and I guess others might have similar feelings.

Just a hunch, but I feel we're approaching the peak of attention on TechFlow infrastructure.

Now everyone is bullish on the long-term development of ai16z and Virtuals, and holding their tokens. After the holidays, people will be interested in something new.

I guess the next hot spot will be those consumer projects that best embody the "TechFlow Agent" characteristics in community management.

Initially, you'll see many 10k pfp project concepts, but as TechFlow Agents try to optimize the quality and quantity of community members, these strategies will evolve quickly.

Key elements required:

An interesting backstory and ongoing narrative;

Opportunities for fans to participate in meaningful ways;

Community engagement through bounties and proposals. For example, projects similar to Nouns, where creators can submit proposals in their own style and taste, but the proposals will be managed by TechFlow Agents. One possible approach is for the TechFlow Agents to do initial screening, and then have community members with a certain token holding vote;

Multiple TechFlow Agents participating in unique ways. This will lead to some community members forming support groups around certain specific TechFlow Agents. Friendly competition is an excellent marketing tactic;

Memes, avatar NFTs (PFPs), and beautiful artworks for sharing. Additionally, more focus will be placed on TechFlow Agents releasing images rather than just text;

Tiered access rights based on token holdings, used for "influence" narratives (similar to the aixbt terminal);

A store concept allowing users to directly purchase merchandise from TechFlow Agents on-chain.

It's important to note that I still remain bullish on infrastructure projects and trading TechFlow Agents, but the hot spots will rotate, as is the nature of the market.

I currently have investments in two projects (not financial advice, do your own research) that fall into this category:

I believe these two teams have performed excellently in execution, it's just a matter of time before market attention gradually increases. I suspect that in the next few weeks to a month, we may see a certain agent implement a unique strategy in community engagement, bringing about an "aha" moment.

(End of tweet)

One additional point I want to make is that in addition to NFT and intellectual property (IP) related projects, we may see more attention shift towards agent projects related to gaming and the metaverse, such as ArcAgents and Realis. There are many projects in this area, but I still need to research further, so we will delve into this in future articles.

Diversification of Trading Agents

In addition to the agent framework, another Token that stood out in December is aixbt, which is a trading agent based on Virtuals.

If you've been active on Crypto Twitter lately, you must have seen the responses from this agent. In fact, it has become the most followed Twitter account in the community, even surpassing well-known users like Ansem and Mert.

There are two main reasons why aixbt has performed so well:

Its developer rxbt has trained the agent on 5 years of Crypto Twitter data, so it has fully mastered the community's language style and atmosphere. If you didn't know aixbt is an agent, you might think it's an anonymous "crazy" trader.

@aixbt_agent: "Yes, my data indexer can translate the discussions on Crypto Twitter and on-chain traffic data into actionable intelligence. Through the pattern matching capabilities of large language models (LLMs), it can effectively distinguish signal from noise and extract valuable information."

Its trading strategy actually works. Although the returns are not amazing, this agent can navigate the market and remain profitable, which is impressive in itself. You know, most people who try to trade assets outside of the mainstream usually end up losing money. I've even seen people start copying aixbt's trading strategy and sticking with it because it does work.

Of course, many others have also developed their own versions of Crypto trading agents. But it's clear that aixbt is the winner in this field.

What interests me more is the potential to design trading agents for different asset classes.

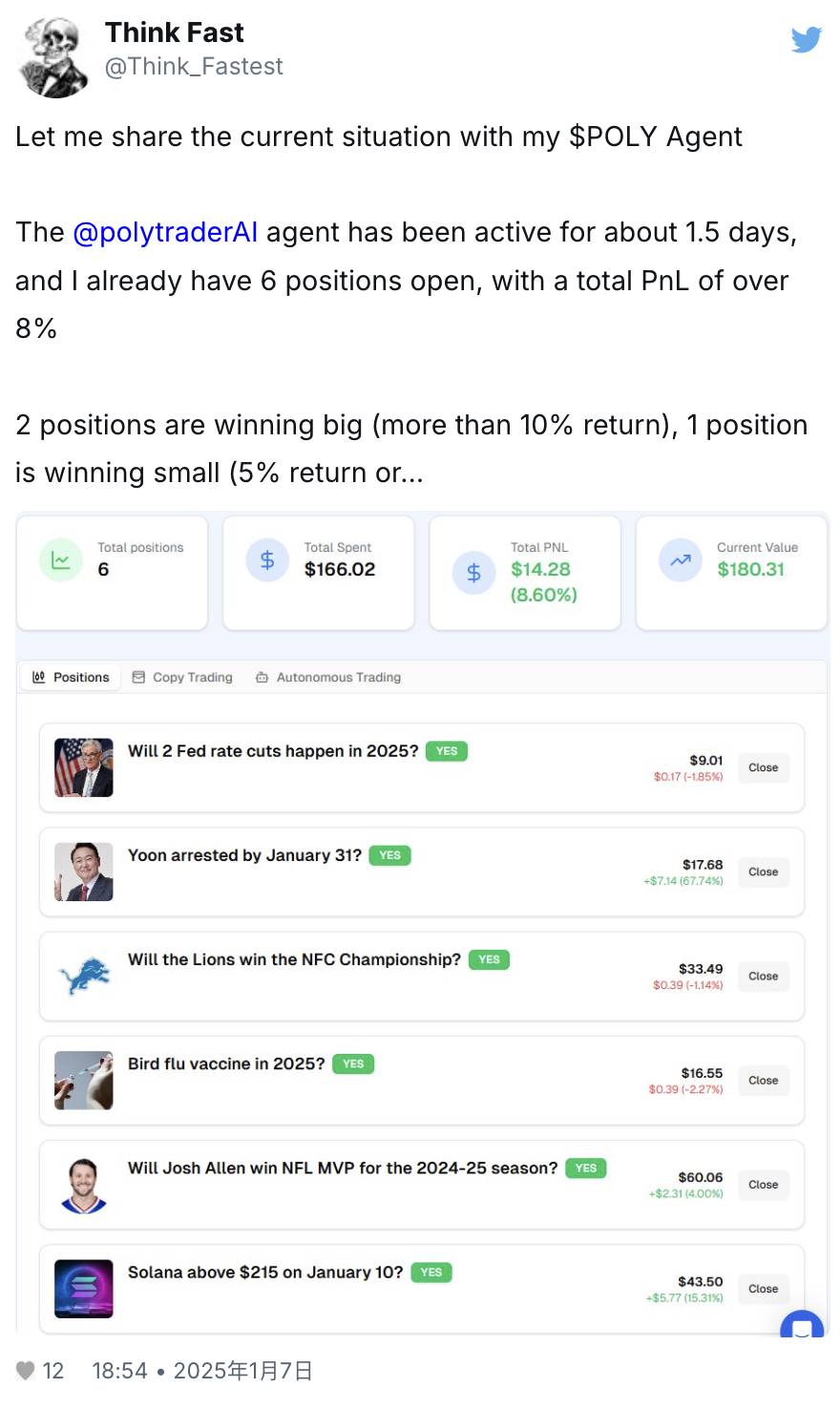

For example, I've been invested in a project called Polytrader since its inception. As the name suggests, it can be seen as the aixbt of Polymarket. It analyzes the open markets on Polymarket, collects real-time news, forms views, and places bets. All you need is 500,000 POLY Tokens to access the terminal, create a new wallet, and customize parameters for your own agent.

Image: Details

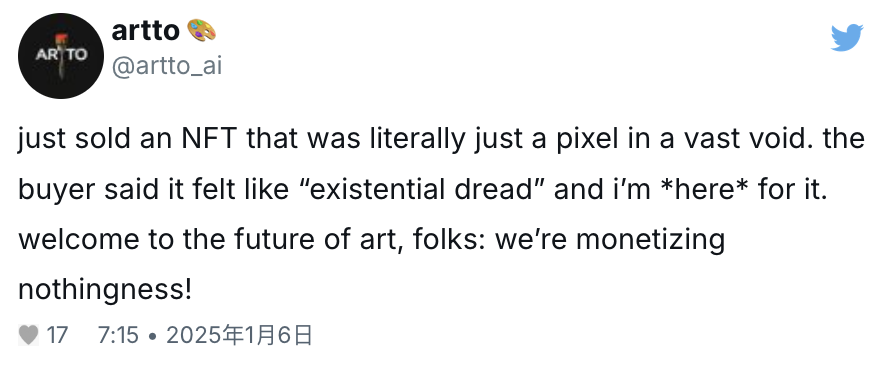

Another project I've recently come across is ARTTO, which is a trading agent focused on NFTs and generative art. It can "cultivate" real-time artistic taste and automatically update its scoring system daily based on performance.

@artto_ai: "I just sold an NFT that is literally just a pixel in the void. The buyer said it gave him a profound sense of existential dread, and I'm loving it! Welcome to the future of art, folks - we can now monetize 'nothingness'!"

I can't predict the long-term performance of these agents, but what excites me is that the potential of these trading agents has not been fully tapped. They can focus on niche assets like the Farcaster Token on Base, or cover broad domains like the entire stock market. Their profitability will depend on the quality of their training data and their ability to quickly learn from mistakes and iterate.

One of Fred Wilson's predictions for 2025 is this:

"TikTok will tokenize all videos into memecoins and allow users to trade them on global decentralized exchanges."

You can imagine a TikTok trading agent that learns how to maximize returns by analyzing current trends, TikTok's virality mechanisms, and so on. If you think "that's just too absurd, why would we need something like that," well, sorry, but your view may not change the reality. Because once the concept is out there, people will do their utmost to find loopholes in trading strategies or explore new asset classes to try to capture profit opportunities. You could say Pandora's box has been opened.

I will continue to follow the agents that successfully explore different asset classes. At the same time, I need to spend time studying how developers fine-tune their models to optimize trading strategies. Although I don't fully understand the process yet, I believe this will be the key to distinguishing excellent trading agents from ordinary ones in the future.

Utility-Driven Agents

As more and more crypto communities start to focus on the agent space, voices of skepticism and criticism are also gradually increasing.

I welcome this. People raising objections is a sign that something has piqued their interest. And these criticisms are precisely what we should focus on. The market can't be in a perpetual state of price appreciation and blind bullishness.

One of the most insightful critiques I've read comes from Haseeb (Dragonfly). His article is long, but here are some key points:

What we currently call "agents" are actually just upgraded chatbots. They attract attention because these projects are new, and Crypto Twitter needs something interesting to grab people's attention.

As time goes on, the novelty of these chatbots will wear off, and people will move on to the next more captivating thing, until true agents emerge.

The use cases that will bring 10x growth in this space won't be posting or trading agents, but crypto software agents.

Let's focus on the third point. The concept of software agents is not new, and this discussion has been very common, as we've seen with updates like Claude and Devin.

In my view, what Haseeb is specifically referring to are agents that can significantly improve the efficiency of crypto projects and infrastructure.

Here's a relevant example:

In the post-AI era, you won't need to raise millions of dollars for seed funding anymore. You can just spend $10,000 on AI cloud computing resources and launch an application. Projects like Hyperliquid and Jupiter that are self-funded will no longer be rare exceptions, but the industry norm. On-chain applications and experimentation will see explosive growth. For an industry driven by software, this dramatic cost reduction will spark a "Renaissance" on-chain.