The overall tone of the market in December 2024 was undoubtedly one of adjustment. Although Bitcoin's maximum decline from its high was only 15%, many Altcoins have already halved, and some Altcoins have even completely erased all the gains of the current bull market. According to CoinMarketCap data, the median of the top 100 cryptocurrencies' maximum decline in this adjustment was 44%. Such a severe decline has only occurred in the crashes of 5.19 and 3.12 in the past five years. Therefore, this adjustment has also dealt a heavy blow to the Altcoin market. So, is there still a chance for the Altcoin market?

On this issue, the author's view is very clear: the Altcoin market has not ended.

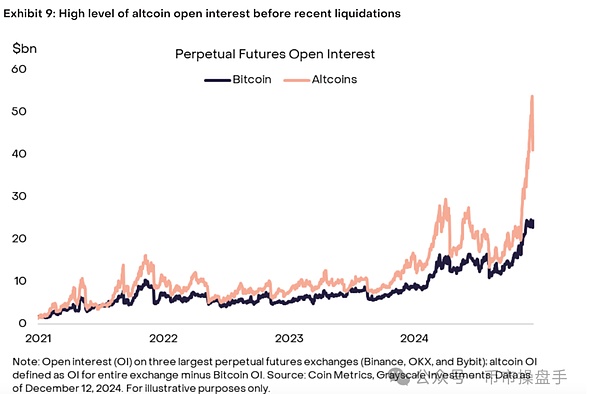

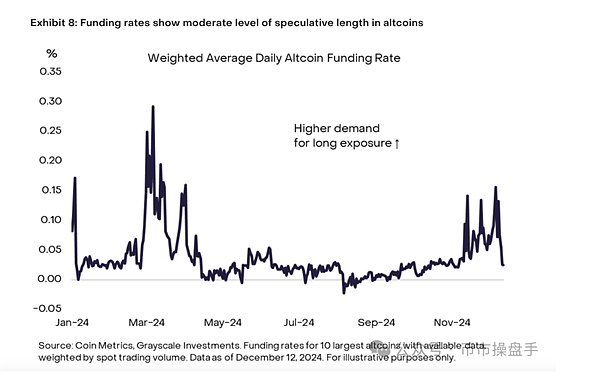

First, from the trading perspective, the trend of capital flowing into Altcoins is already very obvious, mainly manifested in the following two aspects: 1. The holdings of Altcoins in this round of the market have experienced an explosive growth, and the growth rate is far ahead of Bitcoin. Although the large-scale liquidation in December led to a decrease of nearly $10 billion in the size of open interest contracts, the current size of open interest contracts is still about 40% higher than the peak of the bull market in March 2024. This reflects that Altcoins are still the main direction of capital games; 2. Although the scale of Altcoins has exceeded that of March 2024, and even reached the highest level in nearly 3 years, the peak of the weighted average funding rate of Altcoins in this round is still far lower than that of March 2024. This indicates that the bullish sentiment in the market is still in a moderate state of fermentation.

Secondly, in terms of policy, although Trump's plan to include Bitcoin in the national reserve faces major challenges, the possibility of him seeking benefits for his family and political allies is still very high. In the past month, the DeFi protocol created by the Trump family has made large purchases of tokens such as , , , and . These investments are mainly betting on two major positive factors: one is that Trump nominated crypto-friendly Paul S. Atkins as the SEC chairman, which will help remove the pledge restrictions on Ethereum ETF; the other is that Trump nominated asset tokenization supporter David Sacks as the White House crypto chief, who will be responsible for drafting the legal framework for cryptocurrencies, providing legal support for the advancement of asset tokenization.

In addition, during Trump's campaign, Musk and the founder of also provided financial and resource support for him. Therefore, the outside world generally expects that after Trump's election, will have the opportunity to become the next approved crypto ETF project, and the legal dispute between and the SEC will also be resolved soon. In summary, as a series of policy benefits are gradually implemented, new trading opportunities in the crypto market will also emerge.

In fact, since Bitcoin's market cap dominance has fallen from its peak, the daily trading volume share of Altcoins (excluding the top 10 by market cap) has been maintained above 40%, always in a dominant position. Investors feel that the Altcoin market is sluggish because the daily trading volume has plummeted from $300 billion to $150 billion, leading to a situation of "too many monks and too little porridge" in the market again. Under the market conditions of reduced trading volume, capital is mainly moving in two directions: one is to concentrate on the coins with strong trend, such as , , and ; the other is to gather on popular topics for speculation, such as AI Agent, DeSci, and RWA.

Since the market bottomed out on December 20, AI Agent has undoubtedly become the hottest topic in the market. The most typical phenomenon is that more than half of the top 10 coins on the CoinMarketCap gainers list are related to AI Agent. The two star projects of AI Agent, and Virtual, have also become one of the tokens with the strongest ability to attract capital in December 2024. As capital has already deeply entered this field, the AI Agent market is likely to continue for several months. For investors, in order to obtain considerable excess returns, they still need to closely follow the market hotspots. However, the author does not believe that chasing high prices of and Virtual is the best choice for currently participating in AI Agent. On the contrary, the second-tier projects that have been sufficiently adjusted, such as , , and , are more likely to nurture trading opportunities.

In the operation of Altcoins, what kind of trading opportunities investors focus on mainly depends on their risk preferences and expected returns.

For conservative investors, the author believes that the platform tokens of leading exchanges still have relatively high safety margins, as their current valuations and growth potential are still very good. At the same time, the pullbacks of the leaders in most sub-sectors also provide good opportunities for position-building, such as , , and in the DeFi sector.

For speculators who are passionate about sentiment games, AI Agent and RWA are undoubtedly directions with higher odds. The logic of the former has been analyzed before, and the latter has shown signs of accelerating progress after Trump's victory. First, the appointment of the White House crypto chief Sacks provides strong support for asset tokenization; secondly, institutions such as BlackRock, Franklin Templeton, , and are all deploying asset tokenization. As mentioned in the joint article by 's policy chief Brian Quintenz, regulatory chief Michele Korver, and general counsel Miles Jennings, the channels for constructive engagement with regulatory and legislative authorities have now been opened. As the regulatory framework becomes clearer, it has become possible for project parties to explore blockchain services and token issuance.