Due to the rise in US Treasury yields and investors adjusting their expectations for the Federal Reserve's monetary policy, the US dollar index (DXY) hit a new high, and the cryptocurrency market has been correcting for the second consecutive day.

Over the past 24 hours, BTC briefly fell to an intraday low of $92,600, and as of the time of writing, it has rebounded to around $94,400, still down 2.1% over the past 24 hours, while Ethereum fell to around $3,330.

VX: TTZS6308

The minutes of the Federal Reserve meeting released today further indicate that at the meeting to be held at the end of this month, officials are generally willing to keep interest rates unchanged. The market has therefore adjusted its expectations for the Federal Reserve's future monetary policy, and risk assets have come under pressure and declined.

The two-day pullback has led to the liquidation of nearly $1 billion in cryptocurrency leveraged derivative positions, mainly long positions betting on an increase.

This correction in Bitcoin prices reflects the market's adjustment of its previous optimistic expectations for Bitcoin. The previous optimism was mainly based on two assumptions:

First, the Federal Reserve will adopt a more accommodative monetary policy, i.e., actively cutting interest rates;

Second, if Trump is re-elected as US president, it is expected to bring a clearer regulatory framework for the cryptocurrency industry.

However, the current economic data and the Federal Reserve's stance have led the market to doubt the realization of the above two assumptions.

In the absence of new market narratives to drive it, the cryptocurrency market is gradually returning to the logic of the traditional financial market. When interest rates are low, investors usually tend to increase their allocation to risky assets (such as cryptocurrencies and tech stocks) in search of higher returns. However, due to the continued uncertainty around the Trump administration's cryptocurrency policy, market sentiment is relatively cautious, and this uncertainty is expected to persist for some time.

In the short term, Bitcoin prices may therefore enter a period of violent fluctuations.

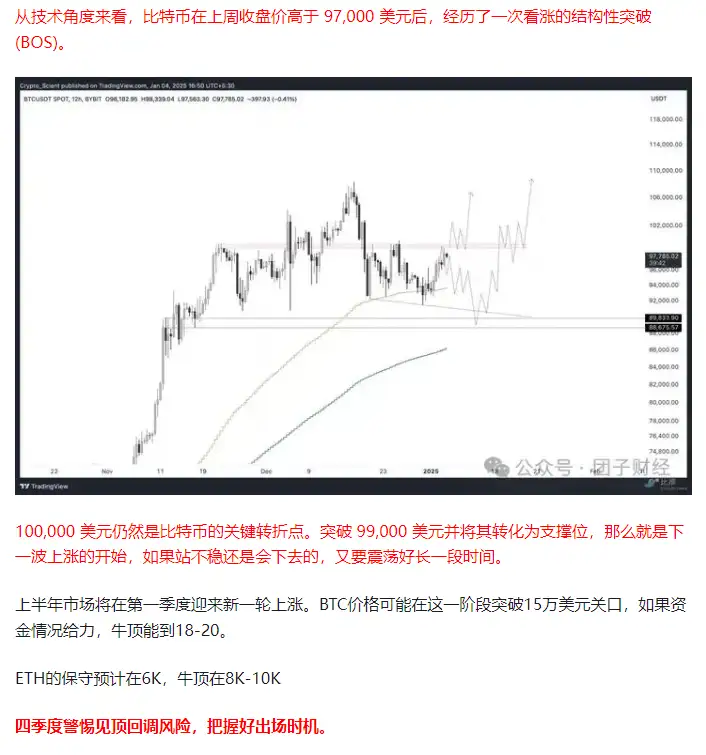

The article published the day before yesterday, "Bitcoin Has Reached 100,000 Again, When Will the Bull Market Start? When to Buy and When to Sell?", also clearly told everyone not to chase the rally for the time being, but to first see whether 100,000 can be stabilized before considering the subsequent moves, of course, the market has also started the expected fluctuations.

How to view Altcoins? What can retail investors still buy?

The open interest of Altcoins in this round of the market has seen an explosive growth, and the growth rate is far faster than that of BTC. Although the large-scale liquidations in December led to a decrease of nearly $10 billion in the size of open interest contracts, the current size of open interest contracts is still about 40% higher than the peak of the bull market in March 2024. This reflects that Altcoins are still the main direction of capital games;

Although the scale of Altcoins has exceeded that of March 2024, and even reached the highest level in nearly 3 years, the peak weighted average funding rate of Altcoins in this round is still far lower than that of March 2024. This indicates that the bullish sentiment in the market is still in a moderate state of fermentation.

Since Bitcoin's market cap dominance has fallen from its peak of 60%, the daily trading volume share of Altcoins (excluding the top 10 by market cap) has remained above 40%, maintaining a dominant position. The reason why the Altcoin market is perceived as sluggish is that the daily trading volume has plummeted from $300 billion to $150 billion, leading to a return to the situation of "too many monks and too little porridge" in the market. In the context of a contraction in trading volume, capital is mainly moving in two directions: one is to concentrate on the coins with strong trend, such as SUI, Aave, XRP, etc.; the other is to gather on popular topics for speculation, such as AI Agent, DeSci, RWA, etc.

Since the market bottomed out on December 20, AI Agent has undoubtedly become the hottest topic in the market. Nearly half of the top gainers are related to AI Agent. The two flagship projects of AI Agent, Ai16z and Virtual, have also become the tokens with the strongest ability to attract capital in December 2024 without any suspense. As capital has already deeply entered this field, the AI Agent market is likely to continue for several months. To seek significant excess returns, it is still necessary to closely follow the market hotspots.

Of course, chasing Ai16z and Virtual at high prices is clearly not the best choice for current participation in the AI Agent market. On the contrary, for conservative investors, the second-tier projects that have already adjusted sufficiently, such as ACT and GOAT, are more likely to generate trading opportunities.

In the operation of Altcoins, the opportunities mainly depend on individual risk preferences and expected returns.

For conservative partners, the platform tokens of leading exchanges still have relatively high safety margins, after all, their current valuations and growth prospects are still very good. At the same time, the pullbacks in the leaders of various sub-sectors also provide good opportunities for position-building, such as UNI, LINK, Aave, and SSV in the DeFi sector.