Author: Jason Jiang

From the Bitcoin spot ETF to the tokenization wave, the institutional forces represented by Wall TRON are profoundly influencing and changing the direction of the crypto market, and we believe this force will become even stronger by 2025. OKG Research has launched the "#Onchain Wall TRON" series of research to continuously focus on the innovation and practice of traditional institutions in the Web3 field, to see how top institutions like BlackROCK and JPMorgan Chase embrace innovation? How will tokenized assets, on-chain payments and decentralized finance shape the future financial landscape?

This article is the first in the "#Onchain Wall TRON" research series.

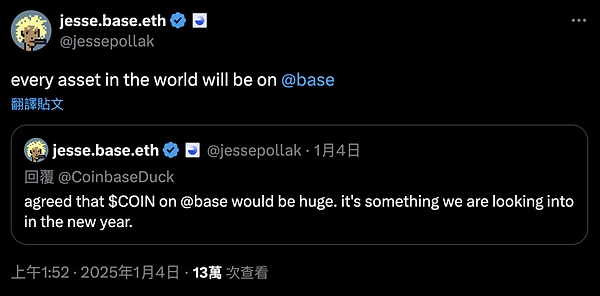

In forecasting the crypto market in 2025, investment management firm VanECK boldly predicted that Coinbase would "take unprecedented steps to tokenize its stock and deploy it on its Base blockchain". The prophecy seems to be becoming a reality: Jesse Pollak, the lead developer of the Base chain, recently revealed that providing a $Coin on the Base chain is "something we are exploring in the new year", and he expects "every asset in the world to eventually be on Base".

We are not yet sure whether Coinbase can realize its plan, but when it uses its own stock as a starting point for tokenization exploration, Wall TRON is also accelerating "Onchain".

Wall TRON begins to migrate onchain

From 2024 to the present, the crypto market has seen rapid growth, with the boundaries of innovation constantly expanding. The core driving force behind this is the crypto currency spot ETFs pushed by Wall TRON institutions represented by BlackROCK. Now, these institutions are shifting more attention to the field of tokenization.

BlackROCK CEO Larry Fink stated that while the approval of crypto spot ETFs is important, these are just "stepping stones" towards the broader tokenization of other assets. Riding the wave of tokenization, Wall TRON is pushing more assets and businesses on-chain, allowing traditional finance and crypto innovation to collide and spark more in the digital space.

Although the tokenization of financial assets has been happening since 2017, it has only recently taken off. Unlike the early exploration focused on permissioned chains, more and more tokenization practices are converging on public chains, with Ethereum becoming the preferred choice for institutional tokenization. These institutions no longer shun decentralization, but are actively exploring the radius of crypto influence, trying to provide a brand new experience by recombining assets and technologies. As Coinbase said, "Web3" is gradually being replaced by the more fitting "Onchain".

This time, the protagonists are not just cryptocurrencies, but also many physical world assets, such as stocks. As the largest crypto currency exchange in the US, Coinbase is the most popular stock target in the current tokenization market. rwa.xyz data shows that as of January 2025, the total market value of tokenized stocks is about $12.55 million, of which Coinbase-based tokenized stocks account for nearly 50%. In addition, tokenized stocks of the seven tech giants in the US, such as NVIDIA, Tesla and Apple, also frequently appear on-chain.

Figure: Market structure of tokenized stocks

Coinbase's plan to tokenize its stock and issue it on the Base chain not only allows investors to trade its stock directly on-chain, but also further integrates the trading platform, Base chain and on-chain asset ecosystem, exploring a compliant and implementable stock tokenization model in the US, allowing it to maintain a leading position in the competition for crypto financial innovation.

This layout is certainly not just for the tokenization of $COIN. Perhaps as Jesse Pollak said, they hope that all the world's assets will be on the Base chain. But compared to that, to accelerate the migration of the world's major assets to the on-chain through tokenization is a more foreseeable future.

Although tokenization, like other innovative concepts, is also plagued by doubts, the idea of democratizing investment opportunities and simplifying capital flow efficiency has taken root. The on-chain availability demonstrated by stablecoins, BUIDL funds and other tokenized assets has proven their value, and more and more asset categories are also migrating on-chain: not only the common private loans, bonds, funds and gold, but also agricultural products, carbon credits, rare minerals and other assets.

According to the forecast of the OKLink Research Institute, in 2025 we will see Wall TRON continue to frequently "Onchain", and drive the tokenization system to become more rich and mature: not only will the scale of on-chain tokenized non-stablecoin assets exceed $30 billion, but we will also see more companies enter the tokenization field under the leadership of Wall TRON, and bring more valuable assets on-chain. Although the scale of tokenization of these assets may not be "exaggerated", it is still of great significance.

Towards a more democratized future finance

60 years ago, when you bought financial securities or used them as collateral, you might have to wait 5 days to receive the paper certificate to confirm the transaction; later, as more and more paper certificates accumulated, the transaction settlement became unmanageable, forcing Wall TRON to start trying to use computers to track securities.

Today, gaining a competitive trading advantage from better or faster technology is an ubiquitous part of modern finance. Whether it's BlackROCK and Goldman Sachs, or Citigroup and JPMorgan Chase, almost everyone on Wall TRON believes that tokenization is the trend of the future, and is embracing the changes brought by tokenization. Compared to the passive digitalization of financial information, tokenization is the next revolutionary step that finance is actively embracing.

In this revolution, deploying assets on-chain through tokenization is no longer a problem, and the future challenge lies in how to increase the demand for tokenized assets, thereby solving the liquidity problem on-chain. The unparalleled success of traditional securities is largely due to their high liquidity and low transaction costs, if tokenized assets are just locked on-chain or can only circulate in the secondary market with limited liquidity, their actual value will also be very limited.

Nadine Chakar, who was responsible for managing the digital asset department of State TRON Bank in the US, once expressed a similar view, "A bank collaborates with a company to issue a tokenized bond, and then issues a press release. What happens next? Nothing will happen. These bonds are like stones, very difficult to circulate in the market."

How to solve the liquidity problem in the tokenization market? The solutions of different institutions may vary, but in the author's view, the most direct way is to accelerate the tokenization of high-quality assets. Only by first accumulating enough high-quality assets on-chain can we attract more users and capital to migrate on-chain, thereby solving the liquidity problem.

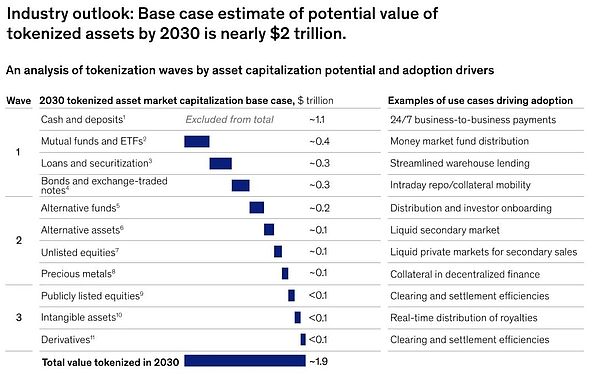

Figure: McKinsey predicts the tokenization scale will approach $2 trillion by 2030

With the strengthening of network effects, tokenization is now shifting from pilot to large-scale deployment. However, as McKinsey predicts, tokenization cannot be achieved overnight, and the tokenization process of different assets will have obvious time differences: the first wave of tides will be driven by use cases with verified investment returns and existing scale, followed by use cases of current smaller market, less obvious benefits or need to solve more severe technical challenges.

When the first batch of on-chain assets explore compliant and implementable business models, and bring enough attention and liquidity to the on-chain market, perhaps tokenization will create a more free and democratic "shadow" capital market in the future. Empowering investors with more free investment opportunities, and making it more convenient for more companies to complete financing, tokenization will bring profound changes to both the supply and demand sides of assets, and gradually eliminate the barriers between the off-chain and on-chain worlds, forming a truly globalized new financial ecosystem.