Preface

In 2025, the Crypto industry continues to move towards the future that the market commonly expects. Looking back on the past from the hopeful present, it is impossible not to sigh that 2024 was a year of profound transformation for Crypto. This is reflected not only in the "crypto bull market" brought about by the approval of the Bitcoin spot ETF, which represents a systemic breakthrough, but also in the fundamental change in the attitude of traditional financial institutions towards crypto technology, which is directly reflected in market sentiment and prices. Moreover, the successful election of Trump, who is friendly to crypto at the end of the year, has also injected a strong stimulant into the market.

Among this wave of transformation, the most eye-catching is the move of BlackRock, the world's largest asset management company, in the crypto field. Its main investment, the on-chain money market fund BlackRock USD Institutional Digital Liquidity Fund (BUIDL Fund), has exceeded $530 million in scale, and its business footprint has also expanded to networks such as Aptos and Arbitrum. The integration of DeFi and RWA is gradually becoming an undeniable trend.

Recently, BlackRock has also been continuously carrying out new practices based on this trend: the BUIDL Fund has reached a tripartite cooperation with the digital securities platform Securitize and the DeFi infrastructure layer Elixir, launching the deUSD RWA Institutional Program, to build a bridge for over $1 billion in institutional-level RWA assets to the DeFi ecosystem.

Thanks for reading TechFlow! Subscribe for free to receive new posts and support my work.

As the link between BlackRock and the DeFi world, Elixir is not just an "asset tokenization platform", but a complete infrastructure layer. Its core product deUSD not only needs to solve the on-chain liquidity problem of institutional-level assets, but also needs to explore a new path of innovation co-existence between TradFi and DeFi while ensuring asset security. Perhaps this attempt will pave a new viable path for DeFi.

This article will delve into BlackRock's new moves and the key role played by Elixir as the infrastructure layer in this connection, exploring the new direction of DeFi under the current market trends, and presenting to readers the innovative path for traditional financial institutional-level assets to enter the DeFi track.

Institutional Involvement in DeFi, How Does the deUSD RWA Work?

Of course, it's not just BlackRock, the asset management giant, that is involved in the deUSD RWA Institutional Program. The framework also supports Hamilton Lane's SCOPE Fund and other assets. Major institutions have already actively extended an olive branch, so how to fully realize on-chain liquidity while ensuring asset security is the key focus of this collaboration, and Elixir and Securitize have cleverly addressed these collaboration priorities through an innovative technical architecture.

Dual-Track Parallel: Perfect Combination of Yield and Liquidity

Through the unique dual-layer architecture design of the deUSD RWA Institutional Program, it cleverly connects the permissioned environment of traditional finance and the permissionless ecosystem of DeFi.

Permissioned Environment: The Starting Point of Asset Tokenization

In the first layer, the BUIDL and SCOPE Funds tokenize the traditional financial assets through Securitize's "sToken" technology. This process is based on the ERC-4626 standard, converting traditional financial assets into $sBUIDL and $sSCOPE tokens. Securitize's permissioned environment ensures that the entire tokenization process complies with regulatory requirements, providing the necessary compliance assurance for institutional participants.

Permissionless Environment: Extension of DeFi Innovation

The tokenized assets enter Elixir's permissionless environment, which is the second layer of the entire solution. Here, $sBUIDL and $sSCOPE holders can simultaneously:

Use their tokens to mint deUSD, gaining liquidity in the DeFi ecosystem

Continue to enjoy the stable returns from the underlying assets (such as US short-term Treasuries)

Participate in a wider range of DeFi applications without affecting their original yield rights

The brilliance of this dual-layer architecture lies in the complete risk isolation:

It is clear that Elixir has already incorporated risk isolation as a core consideration in the design of deUSD RWA. The standardized interface of the ERC-4626 vault provides a unified standard paradigm for asset valuation and risk monitoring. Through the precise decoupling mechanism of yield rights and liquidity, the original assets (such as the Treasury bond yields of BUIDL) and the DeFi interaction layer are completely separated. Smart contracts ensure the independence of yield rights, so that even if there is volatility in the DeFi end, it will not affect the security of the underlying RWA assets.

Separation of yield rights and liquidity: The original yield flow remains unchanged at the Securitize layer

Separation of environments: The permissioned environment ensures compliance, and the permissionless environment provides space for DeFi to thrive

Separation of risks: Even if there is volatility in the DeFi end, it will not affect the security of the underlying RWA assets

Elixir, Favored by BlackRock, How Does It Support the Entire Chain?

Elixir's gaining the favor of a traditional finance giant like BlackRock is no coincidence.

In its deep collaboration with BlackRock and Securitize, Elixir has demonstrated its mature institutional-level service capabilities. The project team is composed of seasoned practitioners from top investment banks such as Goldman Sachs and Morgan Stanley, with a deep understanding of the business needs and compliance requirements of traditional financial institutions.

With its deep accumulation in the DeFi infrastructure field, Elixir has smoothly provided comprehensive asset management lifecycle support for institutions. From being the "DeFi liquidity aggregator" to becoming the "one-stop RWA liquidity solution provider", this bridge connecting TradFi and DeFi can be said to be quite solid.

Building Institutional-Grade Infrastructure

For institutional users entering DeFi, not only do they need to meet the strict requirements of traditional financial institutions for security and compliance, but they also need to ensure that the system has sufficient scalability and interoperability. Based on an in-depth understanding of institutional needs, Elixir has built a complete solution.

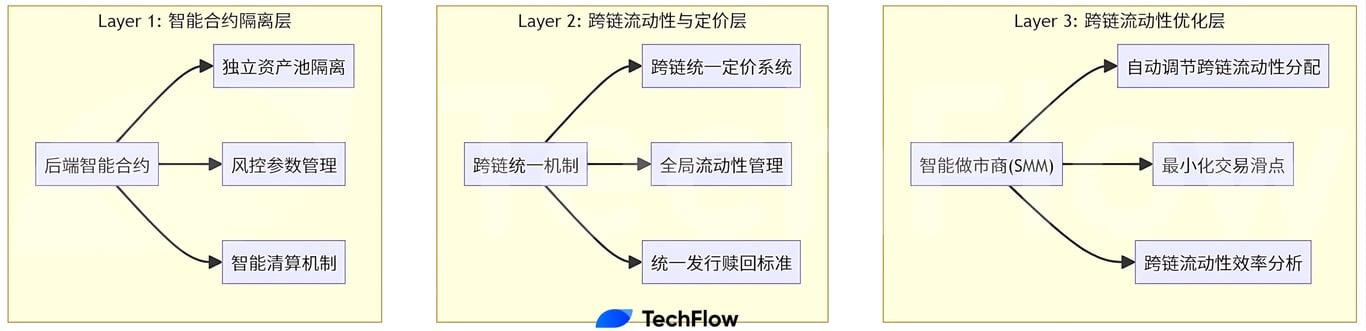

The Three-Layer Security Architecture of deUSD

The first layer is the asset isolation layer, where smart contracts achieve complete isolation of institutional assets, and each institution's asset pool has independent risk control parameters and liquidation trigger mechanisms, ensuring that a risk event in a single institution will not affect the stability of the entire system.

The second layer is the cross-chain liquidity and pricing layer, where deUSD realizes a unified issuance and redemption mechanism across chains, so that regardless of where the underlying assets are, they can maintain unified pricing and liquidity management.

The third layer is the cross-chain liquidity optimization layer, where the smart market maker (SMM) algorithm automatically adjusts the liquidity distribution of deUSD on different chains, ensuring minimal slippage during cross-chain transfers. This innovation has enabled deUSD to achieve over $800 million in stable trading volume in the past three months.

Cross-Chain Interoperability Architecture

Here is the English translation of the text, with the specified translations applied:At the same time, in order to support the future access of more institutions, as an industry veteran, Elixir has leveraged its own resources accumulated in the cross-chain field. Currently, it has been launched on mainstream networks such as the ETH mainnet, Arbitrum, Avalanche, and Sei, and may integrate ecosystems such as Movement, Optimism, and Polygon in the future, realizing liquidity interconnection through a unified cross-chain bridge interface. This ensures that institutions have both cross-chain choice and capital interoperability efficiency.

Through deeply optimized technical implementation, Elixir has successfully established a secure, reliable, and efficient institutional-level RWA infrastructure. However, the innovative value of the technical architecture must ultimately be reflected through application scenarios. After a detailed analysis of the core asset deUSD in this collaboration, we can easily find that the design concept of this system is in line with the current situation faced by institutional-level users in the DeFi field. From asset management to ecosystem collaboration, from single-chain deployment to cross-chain integration, deUSD is interpreting what "institutional-level" DeFi infrastructure is with its unique technical advantages.

The Noteworthy Synthetic Asset deUSD

If Elixir's technical architecture is the skeleton of the entire project system, then deUSD is the heart that pumps blood into the entire system. As the core asset of the entire system, the specific design of deUSD itself is already "stable" enough.

deUSD is a synthetic US dollar with yield attributes, supported by Elixir Network. Its core innovation lies in establishing a delta-neutral position through stETH collateral and ETH perpetual contract short, while also obtaining yield through the USDS government bond protocol of MakerDAO.

Compared to traditional synthetic assets, deUSD has three significant advantages:

Fully decentralized

A powerful validator network is the core of the Elixir protocol. The Elixir validator network is composed of more than 13,000 independent nodes distributed globally, with each node participating in transaction verification and consensus mechanisms. The decentralized validator network has no single point of control, ensuring that the protocol is free from any form of centralized intervention, and guaranteeing the transparency and security of the protocol.

Innovative risk management

Anyone can mint deUSD by collateralizing stETH, and each stETH collateralized will be used to short an equivalent amount of ETH in the market, and the short position can also capture the positive funding rate to bring additional revenue to deUSD.

When the funding rate is negative, deUSD will dynamically adjust its asset composition ratio based on the balance of the OCF (over-collateralization fund used to support the value of deUSD) to maintain price stability.

Ecosystem integration

Combining Elixir's high-quality resource integration, deUSD abstracts the products and exchanges of different public chains into a single yield asset, reducing the complexity of operations between different blockchains and exchanges for deUSD holders, allowing them to manage assets more conveniently, converting more institutions and individuals into potential liquidity providers. deUSD is like a ticket in the Elixir collaboration ecosystem, and users only need to use deUSD to participate in staking interactions on multiple platforms or even multiple chains, realizing multi-chain demands through Elixir.

Unlike many stablecoins, deUSD, as a synthetic US dollar, does not maintain stability through a 1:1 US dollar reserve or centralized issuance, but rather through innovative financial engineering and decentralized mechanisms. This design not only provides higher capital efficiency, but also makes this integration of TradFi and DeFi more "Crypto Native".

DeFi Collaboration to Absorb Liquidity

BlackRock's "old money entering the market" action has already quite representatively demonstrated the practicality of deUSD - security and yield combined, bringing the "one fish, two knives" experience loved by on-chain players to the financial old-timers who are eager to try new things.

And in the DeFi ecosystem where it is already adept, deUSD has an even richer space to play.

Through deep integration with mainstream DeFi protocols, deUSD has built a comprehensive liquidity supply system for institutional users. With the support of liquidity optimization, institutions can participate in more complex DeFi strategies while ensuring asset security, achieving better yield performance.

Take Curve, the liquidity center of deUSD, as an example:

Curve can deeply absorb the large amount of institutional-level liquidity from the RWA assets on the deUSD side - users can deploy the four main liquidity pools of deUSD/USDC, deUSD/USDT, deUSD/DAI and deUSD/FRAX in the Curve deUSD Pool, and LP users can enjoy the additional stacking rewards of Curve & Elixir Apothecary while earning trading fee revenue: Elixir provides up to 5 times the Elixir Potions revenue for the basic liquidity providers on Curve, and staking LP tokens can also earn 10 times the point rewards. This provides extra treatment for liquidity in the RWA direction, capturing the layered returns of DeFi.

Elixir vs Ethena: Two Paths of Institutional-level DeFi

Coincidentally, as the track heats up, Ethena has also collaborated with Securitize to launch the stablecoin USDtb, which is also supported by the BlackRock BUIDL fund. Being both institutional-level DeFi, will Ethena's solution and Elixir "collide"?

It is found that although Elixir and Ethena are both heading in the direction of TradFi+DeFi, they are taking different paths, and there are some differences between them:

Different Track Selection

Ethena: Focusing on the Stablecoin Track

Ethena has chosen a relatively focused development path. The project uses BlackRock's BUIDL as the core supporting asset to launch the stablecoin product USDtb. This model has the following characteristics:

Supported by a single asset

The operating model is relatively simple and the risk is controllable

Elixir: Building a Complete Ecosystem

In comparison, Elixir has adopted a more comprehensive and systematic solution:

Building a complete RWA-DeFi infrastructure

Supporting diversified financial product innovation

Constructing an open ecosystem

Technical Architecture

From the perspective of technical implementation, the two projects have adopted different architectural designs.

Ethena's Technical Route:

Adopts a direct asset-backed model

The minting and redemption mechanism is relatively simple

Focuses on the security and reliability of stablecoins

Elixir's Technical Solution:

Builds a multi-level asset management system

Realizes cross-chain asset interconnection

Supports the innovation and expansion of complex financial products

Market Positioning

Ethena positions itself as an institutional-level stablecoin issuer, emphasizing:

Simple and straightforward products

High security

Elixir positions itself as an RWA-DeFi infrastructure provider, emphasizing:

The completeness of the ecosystem

The scalability of products

The diversity of institutional services

The different development paths of the two projects provide new perspectives for the market to think about the development of institutional-level DeFi. Whether to take the path of specialization or platformization needs to be determined based on the project's own advantages and market demand. The key is how to balance innovation and practicality while ensuring security.

Conclusion

BlackRock's latest move is not just a simple attempt at asset tokenization, but a starting point for the deep integration of TradFi and DeFi. Through the technological innovation of Elixir and the compliant infrastructure of Securitize, we see a mature institutional-level infrastructure that reasonably balances asset security and compliance, while also releasing the innovative vitality unique to crypto, proving that DeFi is not just a self-enclosed circle in the crypto realm.

From the BUIDL fund to the deUSD RWA institutional plan, to the deep integration with DeFi projects like Curve, this innovation path clearly demonstrates the feasibility of combining institutional assets and crypto assets, and the two different development paths of Elixir and Ethena also provide valuable reference samples for the entire industry.

Undoubtedly, as more traditional financial giants like BlackRock enter the market, the demand and development of institutional-level DeFi will enter the fast lane, and the concept of RWA will no longer be just a simple concept hype. Whether it can maintain the native characteristics of crypto while meeting the strict requirements of institutional-level users will become a new assessment standard for projects in this cycle, and Elixir's practice undoubtedly provides a promising development model for the market.

TechFlow is a community-driven deep content platform dedicated to providing valuable information and thoughtful perspectives.

Community:

Public account: TechFlow

Subscription channel: https://t.me/TechFlowDaily

Telegram: https://t.me/TechFlowPost

Twitter: @TechFlowPost

Join WeChat group, add assistant WeChat: blocktheworld

Donate to TechFlow to receive blessings and permanent records

ETH: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A

BSC: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A