Author: 1912212.eth, Foresight News

On January 7, CZ tweeted that "a $100,000 BTC is too boring". If $100,000 is a bit boring, what about a $91,200 BTC? There may only be volatility and unease left. The market once thought the next market trend would continue to rise, but the result was the opposite: BTC has been falling since January 7, and at one point it fell to around $91,200.

Today, the Crypto Fear and Greed Index has dropped to 50, down from 69 yesterday (the weekly average was 74), and the market sentiment has plummeted to the level of last October. The crypto market performance has not started the year as dreamlike as investors expected, but has been ups and downs. Since last December, the coin price has been like a roller coaster, and many market participants, especially Altcoin holders, have been exhausted by the small rallies and sharp declines.

The data does not lie. According to Coinglass data, as BTC has continued to decline recently, the current mainstream CEX and DEX funding rates indicate that the market is generally bearish. Under the dual decline of market sentiment and coin prices, how do the big shots view the subsequent market trend?

Real Vision Co-founder: The market is entering the "Banana Singularity" zone, and after consolidation, there will be an Altcoin season

Raoul Pal, co-founder and CEO of Real Vision, said that the crypto market is entering the "Banana Singularity" zone, or the "everything is going up" period. (The "Banana Zone" is a term coined by Raoul Pal to describe a period of sharp price increases.)

Raoul Pal said that the market is still in the Banana Zone, and the first stage of this bull market was the breakthrough in November last year. There will then be a period of consolidation similar to the 2016/2017 cycle, which will not last too long. The next stage of the "Banana Zone" is the "Banana Singularity", which is an "everything will go up, followed by a larger consolidation" Altcoin season.

CryptoQuant CEO: The Altcoin market is in a zero-sum PvP game, and only a few projects can survive

Ki Young Ju, CEO of CryptoQuant, said on his social platform that "the Altcoin market is currently in a zero-sum PvP (player-vs-player) game. Although BTC's market cap has doubled, the total market cap of Altcoins is still lower than the previous all-time high, just rotating within the market, without new capital inflows. Only a few Altcoins with strong application scenarios and narratives can survive."

Trader Eugene: BTC, ETH and SOL are facing the loss of key support levels, and the market is starting to show panic

Trader Eugene Ng Ah Sio posted on social media that "this is when most people start to panic, for the following reasons:

· BTC, ETH and SOL are retesting the December 5th range lows, and the market is starting to accept the fact that these support levels may not hold.

· The next support level for BTC is at $85,000, which is very far away.

· People's psychological dependence on the "January bull market" is starting to weaken, and most people realize that the assets they hold have gone through a complete cycle of ups and downs, and they are starting to suffer losses, only to find that not only have they completely given back their profits, but they also find that they no longer like the coins they hold as much when the market has fallen sharply."

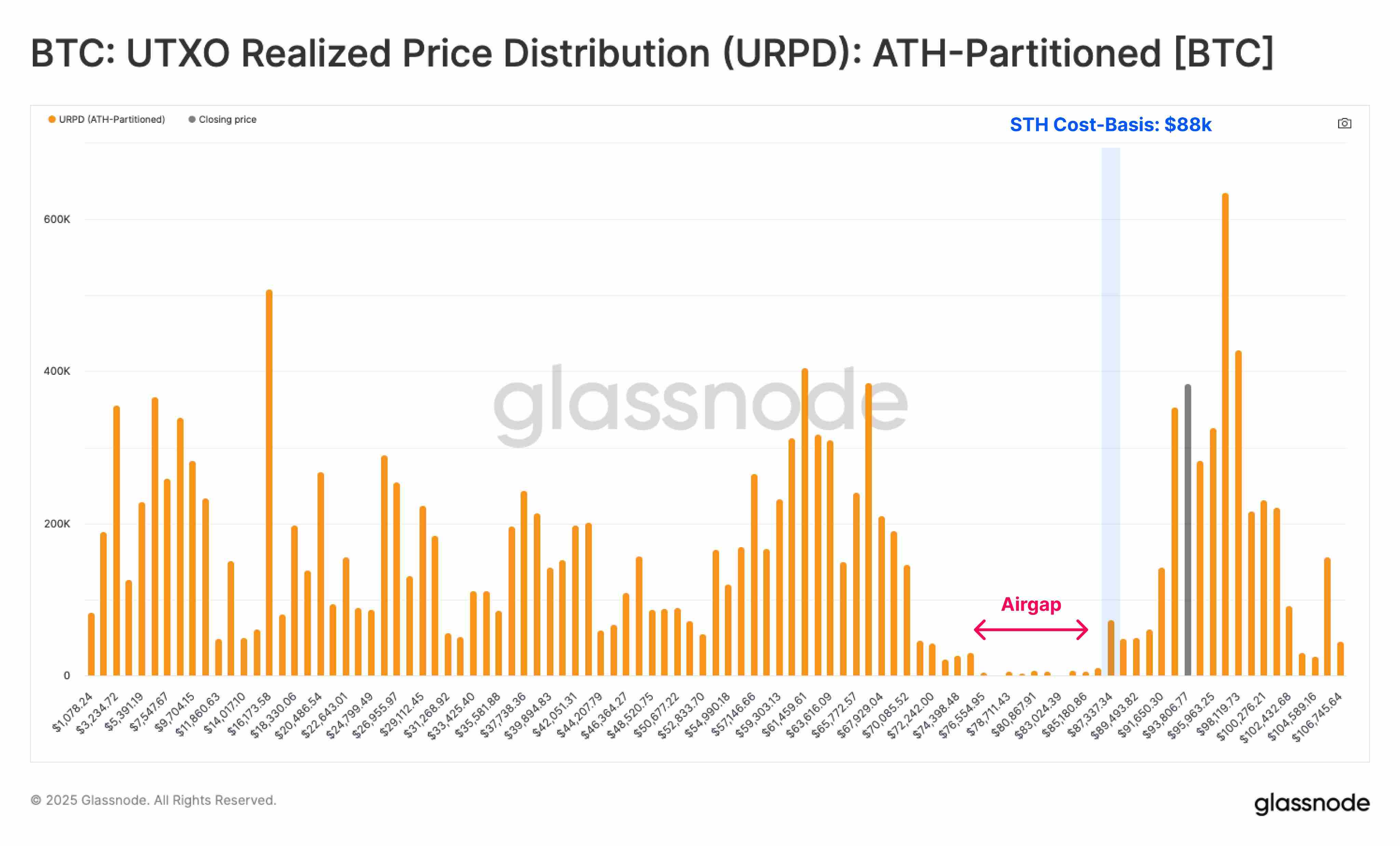

Glassnode: If BTC falls below $88,000, it may lead to further declines

Glassnode wrote: "The short-term holder cost basis ($88,000) is still a key level for assessing the momentum of BTC prices. Using the URPD metric, it can be found that the trading volume below the short-term holder cost basis is relatively low, indicating that if it breaks below this level, it may lead to further downward trends."

Trader TraderS: BTC will consolidate in the short term, and the non-farm payroll data this Friday needs to be closely watched

Twitter KOL trader TraderS tweeted that in the short term, $92,750 may be the short-term low (or the next low), and BTC will fluctuate between $92,000 and $102,000 recently, and if the upper and lower limits are widened a bit, it will be between $88,000 and $108,000. Before Trump's inauguration on 1.20, the time cycle and sentiment may still have time and a desire to touch $100,000 or even the previous high. If so, most positions will be cleared and wait to see the actual performance after the inauguration of Trump. If there is no opportunity before January 20, it may have to wait for the small spring from the Lunar New Year to mid-March according to the occult tradition. The big non-farm payroll on Friday night may be the most important reference data to set the upward and downward tone, and needs to be closely watched.

Crypto KOL Ansem: The market will enter a sideways consolidation, but there are still opportunities on-chain

Crypto KOL Ansem wrote that the current basic view is that August to December is the Altcoin season, with the first round of the AI token mini-bubble occurring from October to December. He expects the market to enter a relatively long period of sideways consolidation until investors generally believe the bull market is over. During this period, some on-chain projects will perform well, and there will also be many new projects worth participating in.

Trader Kruge: The market is overly pessimistic, the Fed's rate cut cycle has not ended, and new highs are still expected

Well-known trader Kruge tweeted a long post expressing his views on the market situation: People are now too bearish. I think it's a matter of time frame. Most crypto natives are already exhausted, and many have even been traumatized. Under normal circumstances, this sentiment could actually form a top. But this time, traditional finance (Tradfi) is buying BTC (not just Saylor alone). They don't care about the trauma of crypto natives.

So ask yourself: Has the stock market top been reached? That's the key. ETFs should ensure the correlation continues. To answer this question, you also need to ask another question: Has the Fed's rate cut cycle ended? I don't think so. We just heard the Fed announce a temporary pause in rate hikes, which has basically been digested by the market. It's temporary, not permanent. Look at what the Fed officials are saying, they still advocate further rate cuts. And the market has almost only priced in one rate cut for 2025. Three months ago, that number was 7.

Kruge also said: The market narrative will soon change again, no longer focusing on hawkish Fed and long-term rate selloffs. Trump will also be on stage soon. At the same time, given the gloomy economic data and chart performance we've just received, I wouldn't be surprised if the BTC price enters the $80,000 range. But in my view, this is just temporary noise that requires short-term risk management. I do believe traders will be more aggressive in selling when BTC price exceeds $100,000, in order to slow the pace of the rise, especially before it reaches $105,000. I also think macrofactors will become important again. I don't expect "easy money" days anymore. But I still expect BTC to hit new highs. We still have a long way to go this year.